Key Insights

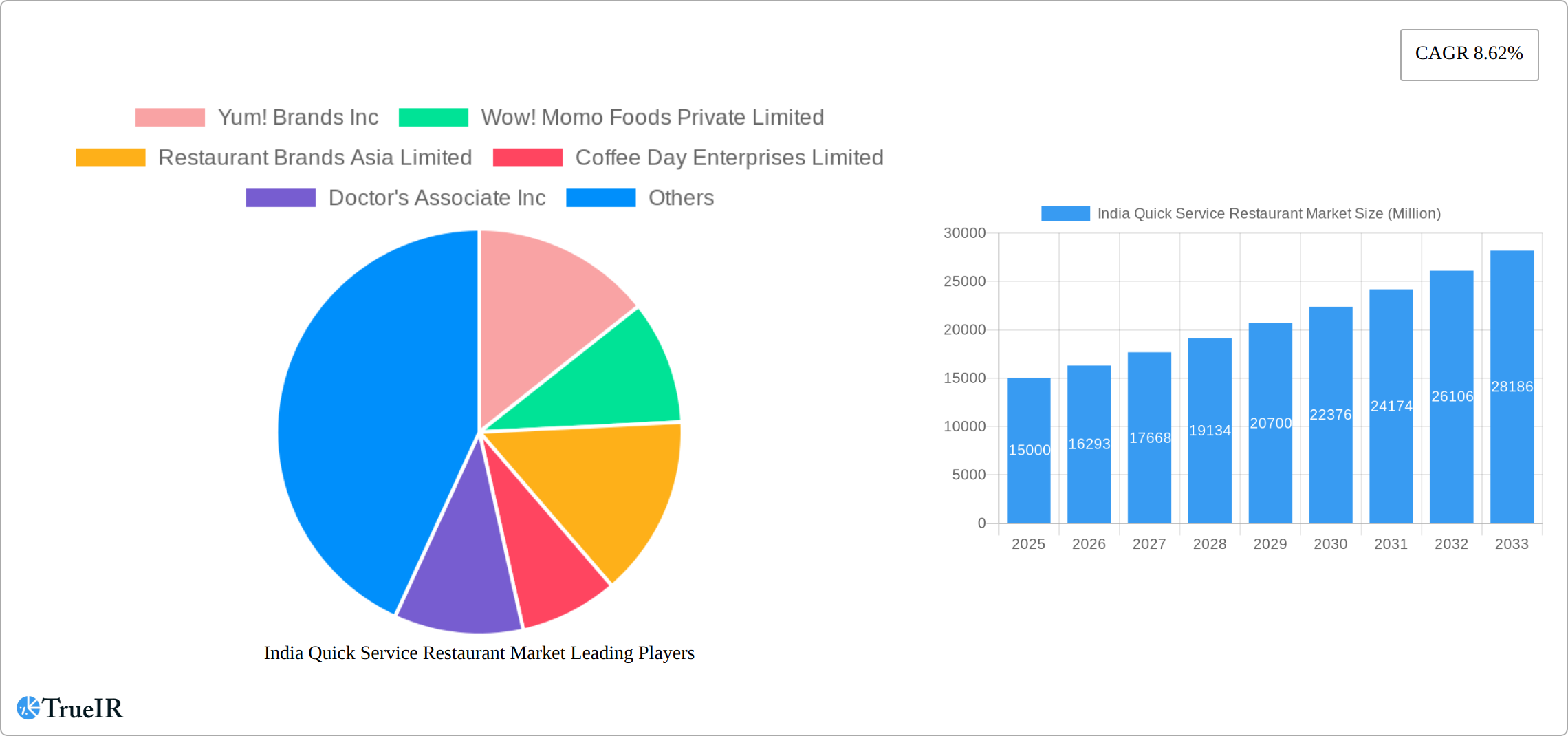

The Indian Quick Service Restaurant (QSR) market is experiencing robust growth, driven by rising disposable incomes, urbanization, changing lifestyles, and a burgeoning young population with a preference for convenience and diverse culinary options. The market, currently estimated at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and study period), is projected to maintain a strong Compound Annual Growth Rate (CAGR) of 8.62% from 2025 to 2033. This growth is fueled by several key trends, including the increasing popularity of international cuisines adapted to local palates (e.g., customized pizzas and burgers), the expansion of home delivery and online ordering platforms, and the rise of specialized QSR chains catering to specific dietary preferences and health consciousness. The segment of chained outlets holds significant market share, benefiting from brand recognition, standardized quality, and efficient operations. However, the independent outlets segment also continues to thrive, particularly in smaller cities and towns offering local flavors and cost-effective options. Geographic distribution shows significant potential across all regions – North, South, East, and West India – with varying degrees of penetration based on regional tastes and economic development. Competition is intense, with established players like Jubilant FoodWorks, McDonald's, and Yum! Brands vying for market dominance alongside rapidly growing homegrown brands such as Wow! Momo and Coffee Day Enterprises.

The QSR market in India is segmented by cuisine type (bakeries, burgers, ice cream, meat-based cuisines, pizza, and others), outlet type (chained and independent), and location (leisure, lodging, retail, standalone, and travel). The dominance of specific cuisines varies regionally. For instance, South India might show higher preference for South Indian snacks within QSR while North India showcases a greater adoption of North Indian and international fast food. The increasing focus on health and hygiene is creating opportunities for QSR chains offering healthier options and transparent sourcing practices. Challenges include rising input costs, increasing competition, and maintaining consistent service quality across outlets. Despite these challenges, the long-term outlook for the Indian QSR market remains highly optimistic, fueled by ongoing economic growth and the evolving preferences of Indian consumers. Future growth will likely be shaped by technological advancements (e.g., improved delivery systems, AI-powered ordering) and strategic collaborations between established and emerging players.

India Quick Service Restaurant (QSR) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the dynamic India Quick Service Restaurant market, covering the period from 2019 to 2033. It offers in-depth insights into market size, segmentation, competitive landscape, key players, growth drivers, challenges, and future outlook. Leveraging extensive data and industry expertise, this report is an essential resource for investors, industry professionals, and anyone seeking to understand the complexities and opportunities within this rapidly expanding market. The report uses 2025 as its base year and forecasts market trends until 2033.

India Quick Service Restaurant Market Market Structure & Competitive Landscape

The Indian QSR market is a dynamic blend of established international chains and rapidly expanding domestic players. While a few large players command significant market share, creating a moderately concentrated market, a multitude of smaller independent outlets contribute substantially to the overall volume. This results in a highly fragmented market across diverse cuisines and outlet formats. Continuous innovation is paramount, driven by evolving consumer preferences and technological advancements in food preparation, delivery, and customer engagement. Stringent regulatory oversight, particularly concerning food safety and hygiene standards, significantly shapes market practices. Consumers also consider readily available substitutes like home-cooked meals and street food, influencing overall market demand. The market demonstrates substantial end-user segmentation based on demographics, income levels, and lifestyle preferences. The sector witnesses robust M&A activity, fueled by strategic acquisitions and private equity investments, steadily driving market consolidation. Recent significant acquisitions, such as the Subway deal, exemplify this trend. We project a xx% concentration ratio for the top 5 players by 2025, anticipating approximately xx M&A transactions throughout the forecast period (2025-2033).

- Market Concentration: Moderate, with a balance of large chains and independent players fostering competition.

- Innovation Drivers: Technological advancements in food tech, evolving consumer tastes, and personalized experiences.

- Regulatory Impacts: Stringent food safety regulations, licensing requirements, and hygiene standards.

- Product Substitutes: Home-cooked meals, street food, and other readily available convenient options.

- End-User Segmentation: Highly diverse, encompassing various demographics, income levels, and lifestyle preferences, requiring targeted strategies.

- M&A Trends: Significant increase in strategic acquisitions and private equity investments, leading to market consolidation and reshaping the competitive landscape.

India Quick Service Restaurant Market Market Trends & Opportunities

The Indian QSR market exhibits robust growth, fueled by several key factors: rising disposable incomes, rapid urbanization, evolving lifestyles, and the explosive growth of online food delivery platforms. The market is projected to reach xx Million USD by 2025, showcasing a CAGR of xx% during the forecast period (2025-2033). This expansion is further accelerated by technological advancements, including the rise of cloud kitchens, AI-driven order management systems, and personalized customer experiences. Consumer preferences are shifting towards healthier choices, customized meals, and seamless, convenient ordering. The competitive landscape remains fiercely contested, with established players facing pressure from both emerging domestic brands and international entrants. While market penetration is high in urban areas, substantial growth opportunities exist in less-penetrated rural regions.

Dominant Markets & Segments in India Quick Service Restaurant Market

The Indian QSR market exhibits strong growth across various segments. The Burger segment dominates the cuisine category, while Chained Outlets represent a significant portion of the overall outlet type market. The Retail location type shows the highest potential, driven by increasing foot traffic in malls and high-street locations.

Key Growth Drivers (Cuisine):

- Burger: High consumer preference, widespread availability, diverse offerings.

- Pizza: Growing popularity, particularly amongst younger demographics.

- Other QSR Cuisines: Regional and ethnic food offerings expanding rapidly.

Key Growth Drivers (Outlet):

- Chained Outlets: Brand recognition, standardized quality, and efficient operations.

- Independent Outlets: Localized menus, flexibility, and competitive pricing.

Key Growth Drivers (Location):

- Retail: High foot traffic, convenient accessibility.

- Standalone: Greater flexibility in location and operations.

India Quick Service Restaurant Market Product Analysis

Product innovation within the Indian QSR market is driven by the need to cater to diverse consumer preferences and adapt to evolving dietary trends. Technological advancements, such as automated cooking equipment and online ordering systems, are enhancing efficiency and customer experience. The focus is on providing value-for-money offerings, with customized meal options and convenient delivery services becoming increasingly important. Competitive advantages are achieved through brand building, menu innovation, operational excellence, and strategic partnerships with food delivery platforms.

Key Drivers, Barriers & Challenges in India Quick Service Restaurant Market

Key Drivers: The market's upward trajectory is propelled by rising disposable incomes, increased urbanization, evolving lifestyles, and significant technological advancements in food technology and delivery infrastructure. Supportive government initiatives aimed at boosting the food processing sector and favorable policies further contribute to market expansion.

Key Challenges: The industry faces significant hurdles, including intense competition, volatile raw material prices, strict food safety regulations, and the consistent challenge of maintaining uniform quality across numerous outlets. Supply chain disruptions can severely impact operational efficiency and profitability. Furthermore, adapting to diverse regional tastes and consumer demands necessitates substantial investments in research and development, as well as targeted marketing strategies.

Growth Drivers in the India Quick Service Restaurant Market Market

The market's expansion is propelled by a confluence of factors: rising disposable incomes, rapid urbanization, evolving consumer preferences toward convenience and variety, and technological advancements facilitating online ordering and delivery. Government initiatives promoting the food processing sector also play a vital role.

Challenges Impacting India Quick Service Restaurant Market Growth

The growth of the Indian QSR market faces several key challenges: fierce competition from both established and emerging players, escalating input costs, ensuring consistent quality across multiple outlets, navigating stringent regulatory compliance, and adapting to dynamic and evolving consumer preferences. Furthermore, supply chain vulnerabilities can lead to significant operational inefficiencies and negatively impact profitability, requiring robust supply chain management strategies.

Key Players Shaping the India Quick Service Restaurant Market Market

- Yum! Brands Inc

- Wow! Momo Foods Private Limited

- Restaurant Brands Asia Limited

- Coffee Day Enterprises Limited

- Doctor's Associate Inc

- Jubilant FoodWorks Limited

- McDonald's Corporation

- Tata Starbucks Private Limited

- Graviss Foods Private Limited

Significant India Quick Service Restaurant Market Industry Milestones

- January 2023: Jubilant Foodworks announced plans to open 250 Domino's stores in India within 12-18 months, involving a INR 900 crore investment.

- January 2023: Popeyes launched the new Shrimp Roll to its seafood menu.

- August 2023: Subway was acquired by Roark Capital for USD 8.95 billion, contingent on achieving specific cash flow milestones.

Future Outlook for India Quick Service Restaurant Market Market

The Indian QSR market is poised for continued, sustained growth, driven by favorable demographic shifts, increasing disposable incomes, and ongoing technological innovation. Strategic investments in innovation, menu diversification to cater to evolving tastes, and a strong focus on enhancing the overall customer experience will be critical for achieving long-term success. The market presents lucrative opportunities for both established players and new entrants seeking to capitalize on the immense potential of the Indian consumer market. The market is projected to reach xx Million USD by 2033.

India Quick Service Restaurant Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

India Quick Service Restaurant Market Segmentation By Geography

- 1. India

India Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Fast-delivery options along with hygienic food and the essence of brand loyalty boost the sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North India India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Yum! Brands Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wow! Momo Foods Private Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Restaurant Brands Asia Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Coffee Day Enterprises Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Doctor's Associate Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Jubilant FoodWorks Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 McDonald's Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tata Starbucks Private Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Graviss Foods Private Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Yum! Brands Inc

List of Figures

- Figure 1: India Quick Service Restaurant Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Quick Service Restaurant Market Share (%) by Company 2024

List of Tables

- Table 1: India Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: India Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: India Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: India Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 12: India Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 13: India Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: India Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Quick Service Restaurant Market?

The projected CAGR is approximately 8.62%.

2. Which companies are prominent players in the India Quick Service Restaurant Market?

Key companies in the market include Yum! Brands Inc, Wow! Momo Foods Private Limited, Restaurant Brands Asia Limited, Coffee Day Enterprises Limited, Doctor's Associate Inc, Jubilant FoodWorks Limited, McDonald's Corporation, Tata Starbucks Private Limited, Graviss Foods Private Limited.

3. What are the main segments of the India Quick Service Restaurant Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Fast-delivery options along with hygienic food and the essence of brand loyalty boost the sales.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

August 2023: Subway was acquired by private equity firm Roark Capital for USD 8.95 billion. To fully receive the amount, Subway needs to achieve certain cash flow milestones within a period of two or more years after the deal is completed.January 2023: Jubilant Foodworks announced its near-medium-term outlook. The company plans to open 250 stores for Domino's in India in the next 12-18 months with a capital investment of INR 900 crore.January 2023: Popeyes introduced the new Shrimp Roll to its seafood menu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the India Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence