Key Insights

The Iranian wind power industry, currently experiencing robust growth, presents a compelling investment opportunity. With a compound annual growth rate (CAGR) exceeding 7% from 2019-2033, the market is projected to reach significant value within the next decade. This expansion is driven by several key factors: Iran's substantial wind energy potential, particularly in the northern and southern regions, government initiatives promoting renewable energy adoption to diversify energy sources and reduce reliance on fossil fuels, and increasing private sector investment attracted by favorable policies and long-term power purchase agreements. The residential sector is expected to witness considerable growth, fueled by decreasing solar panel costs and increasing environmental awareness among consumers. While the industrial and utility sectors will also contribute significantly, the commercial segment may show slower initial growth due to higher upfront investment requirements. Natural gas currently holds the largest share of the fuel mix, but the industry is anticipated to see a gradual shift toward wind power, driven by its sustainability and long-term cost-effectiveness. Major players like MAPNA Group, Siemens Gamesa, Vestas, and General Electric are actively participating, indicating the market's maturity and attractiveness. However, challenges remain, including the need for grid infrastructure upgrades to accommodate intermittent wind power and potential regulatory hurdles. Despite these constraints, the Iranian wind power market's strong fundamentals and growth trajectory point to a bright future.

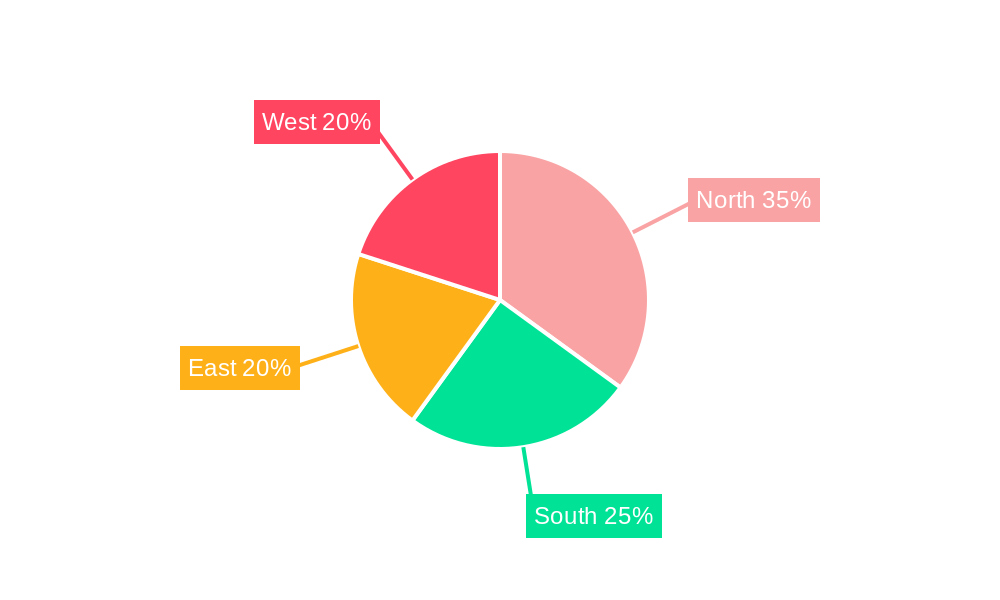

The forecast period of 2025-2033 will likely see the most significant expansion, building upon the foundation laid in the historical period (2019-2024). Based on the provided CAGR of >7%, we can anticipate a substantial increase in installed capacity and market value. The segmentation by fuel type (Natural Gas, Coal, Oil, Other) reveals the ongoing transition, with "Other Fuel Types" likely representing the increasing share of wind power generation. Regional variations within Iran (North, South, East, West) will likely reflect differences in wind resource availability and investment levels. While precise figures for market size are not available, the substantial growth rate indicates significant expansion and highlights the strategic importance of wind power in Iran’s energy mix.

Iran Wind Power Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Iranian wind power industry, offering invaluable insights for investors, industry professionals, and policymakers. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages robust data and expert analysis to illuminate market trends, opportunities, and challenges. The report covers key players like MAPNA Group, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, MahTaab Group, and General Electric Company, and examines market segments across residential, commercial, and industrial & utilities applications.

Iran Wind Power Industry Market Structure & Competitive Landscape

This section analyzes the competitive intensity and structure of Iran's wind power market. We delve into market concentration, assessing the market share held by key players and calculating concentration ratios to understand the level of competition. The report examines innovation drivers, including technological advancements and R&D activities, and their impact on market dynamics. Regulatory impacts, including government policies and incentives, are scrutinized, along with an analysis of substitute products and their potential to disrupt the market. The report also explores end-user segmentation, focusing on the specific needs and preferences of residential, commercial, and industrial & utilities consumers. Finally, we examine M&A trends, quantifying the volume of mergers and acquisitions in the industry and analyzing their impact on market consolidation and competition. The xx Million USD invested in M&A activities during the historical period (2019-2024) indicates a dynamic market landscape.

- Market Concentration: Analysis of concentration ratios (e.g., CR4, CR8) to determine market dominance.

- Innovation Drivers: Assessment of technological advancements and R&D investments.

- Regulatory Impacts: Examination of government policies, incentives, and regulations.

- Product Substitutes: Analysis of alternative energy sources and their competitive threat.

- End-User Segmentation: Detailed breakdown of market demand across residential, commercial, and industrial & utilities sectors.

- M&A Trends: Quantitative and qualitative analysis of merger and acquisition activity.

Iran Wind Power Industry Market Trends & Opportunities

This section provides a comprehensive overview of the Iranian wind power market's growth trajectory. We analyze historical data (2019-2024) and project future growth (2025-2033), providing a clear picture of market size evolution. Technological shifts, particularly the adoption of advanced wind turbine technologies and smart grid integration, are examined. We analyze consumer preferences and their influence on market demand, considering factors such as cost-effectiveness, environmental concerns, and reliability. Competitive dynamics are assessed, focusing on the strategies employed by key players and the impact of new entrants. Key performance indicators, such as Compound Annual Growth Rate (CAGR) and market penetration rates, are included to provide quantifiable insights into market growth. We project a market size of xx Million USD by 2033, with a CAGR of xx% during the forecast period.

Dominant Markets & Segments in Iran Wind Power Industry

This section identifies the leading regions, countries, and market segments within the Iranian wind power industry. We provide in-depth analysis of the dominant segment(s), considering factors like infrastructure development, government policies, and economic conditions. We highlight key growth drivers and challenges associated with each segment, offering strategic insights for businesses operating in or considering entry into the market. The Industrial & Utilities segment is projected to be the dominant application segment, fueled by the government's initiative to increase renewable energy capacity.

- Key Growth Drivers:

- Government incentives and supportive policies.

- Expanding grid infrastructure.

- Increasing demand for clean energy.

- Technological advancements in wind turbine technology.

- Market Dominance Analysis: In-depth assessment of leading segments, including regional and application-based breakdowns.

Iran Wind Power Industry Product Analysis

This section offers a concise overview of the product landscape in Iran's wind power industry. We summarize key product innovations, focusing on advancements in wind turbine technology and their impact on efficiency and cost-effectiveness. We also discuss product applications across various sectors and analyze the competitive advantages offered by different products in the market. The focus is on technological advancements leading to increased energy efficiency and reduced costs, enhancing market appeal.

Key Drivers, Barriers & Challenges in Iran Wind Power Industry

This section identifies the key factors driving and hindering growth within the Iranian wind power industry.

Key Drivers:

- Government initiatives to increase renewable energy capacity.

- Example: The January 2022 MoU targeting 10 GW of additional renewable capacity within four years.

- Falling costs of wind energy technology.

- Growing environmental awareness and the need to reduce carbon emissions.

Challenges and Restraints:

- Economic sanctions and their impact on investment and technology acquisition.

- Regulatory complexities and bureaucratic hurdles.

- Grid infrastructure limitations in certain regions.

- Potential supply chain disruptions due to geopolitical factors. This could impact the availability of critical components and materials, potentially delaying project timelines and increasing costs by an estimated xx%.

Growth Drivers in the Iran Wind Power Industry Market

This section re-emphasizes the key drivers identified earlier, highlighting the synergistic effect of government policies, technological advancements, and economic factors in driving market growth. The focus remains on the positive forces shaping the market's trajectory.

Challenges Impacting Iran Wind Power Industry Growth

This section reiterates the challenges outlined previously, emphasizing the need for addressing regulatory complexities, supply chain vulnerabilities, and geopolitical uncertainties to unlock the full potential of the Iranian wind power market.

Key Players Shaping the Iran Wind Power Industry Market

- MAPNA Group

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

- MahTaab Group

- General Electric Company

Significant Iran Wind Power Industry Industry Milestones

- November 2022: The Iranian government increased guaranteed purchase prices for private sector solar and wind power generation by 20-60%, significantly boosting investment incentives. This was announced via a new Ministry of Energy directive and press releases from SATBA. Small-scale solar power tariffs also rose by 20%, reaching 6 cents/kWh.

- January 2022: A Memorandum of Understanding (MoU) was signed between Iran's Ministry of Energy and SATBA to install an additional 10 GW of renewable energy capacity within four years, aiming for a total of 30 GW.

Future Outlook for Iran Wind Power Industry Market

The Iranian wind power market presents substantial growth potential driven by government support, technological advancements, and the increasing demand for clean energy. Strategic investments in infrastructure development, coupled with continued policy reforms to streamline regulatory processes, will be crucial in unlocking the industry's full potential. The market is poised for significant expansion, driven by both domestic demand and potential for regional export opportunities.

Iran Wind Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Iran Wind Power Industry Segmentation By Geography

- 1. Iran

Iran Wind Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption

- 3.4. Market Trends

- 3.4.1. Onshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Wind Power Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 MAPNA Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Siemens Gamesa Renewable Energy SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Vestas Wind Systems AS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MahTaab Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Electric Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 MAPNA Group

List of Figures

- Figure 1: Iran Wind Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Wind Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Wind Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Wind Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Iran Wind Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Iran Wind Power Industry Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Iran Wind Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Iran Wind Power Industry Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Iran Wind Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Iran Wind Power Industry Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Iran Wind Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Iran Wind Power Industry Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Iran Wind Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Iran Wind Power Industry Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Iran Wind Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Iran Wind Power Industry Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 15: Iran Wind Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Iran Wind Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 17: North Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: North Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 19: South Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 21: East Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: East Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 23: West Iran Wind Power Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: West Iran Wind Power Industry Volume (Gigawatt) Forecast, by Application 2019 & 2032

- Table 25: Iran Wind Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 26: Iran Wind Power Industry Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 27: Iran Wind Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 28: Iran Wind Power Industry Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 29: Iran Wind Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Iran Wind Power Industry Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 31: Iran Wind Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 32: Iran Wind Power Industry Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 33: Iran Wind Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 34: Iran Wind Power Industry Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 35: Iran Wind Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Iran Wind Power Industry Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Wind Power Industry?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Iran Wind Power Industry?

Key companies in the market include MAPNA Group, Siemens Gamesa Renewable Energy SA, Vestas Wind Systems AS, MahTaab Group, General Electric Company.

3. What are the main segments of the Iran Wind Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Costs and Increasing Efficiencies of Solar PV Panels 4.; Supportive Government Policies Towards Solar.

6. What are the notable trends driving market growth?

Onshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Alternative Clean Energy Sources and Increasing Natural Gas Consumption.

8. Can you provide examples of recent developments in the market?

In November 2022, the Iranian government increased private companies' guaranteed purchase prices for solar and wind power generated by 20-60% compared to 2021. Iran's Ministry of Energy announced a new directive to raise tariffs (for private sector producers) to encourage investment. The Ministry's new portal cited the press release issued by the state-run Renewable Energy and Energy Efficiency Organization (SATBA). The Ministry also noted that the latest prices for generating electricity from small-scale solar power stations (with less than 20-kilowatt capacity) have risen by 20% per kilowatt, reaching 6 cents/kWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Wind Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Wind Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Wind Power Industry?

To stay informed about further developments, trends, and reports in the Iran Wind Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence