Key Insights

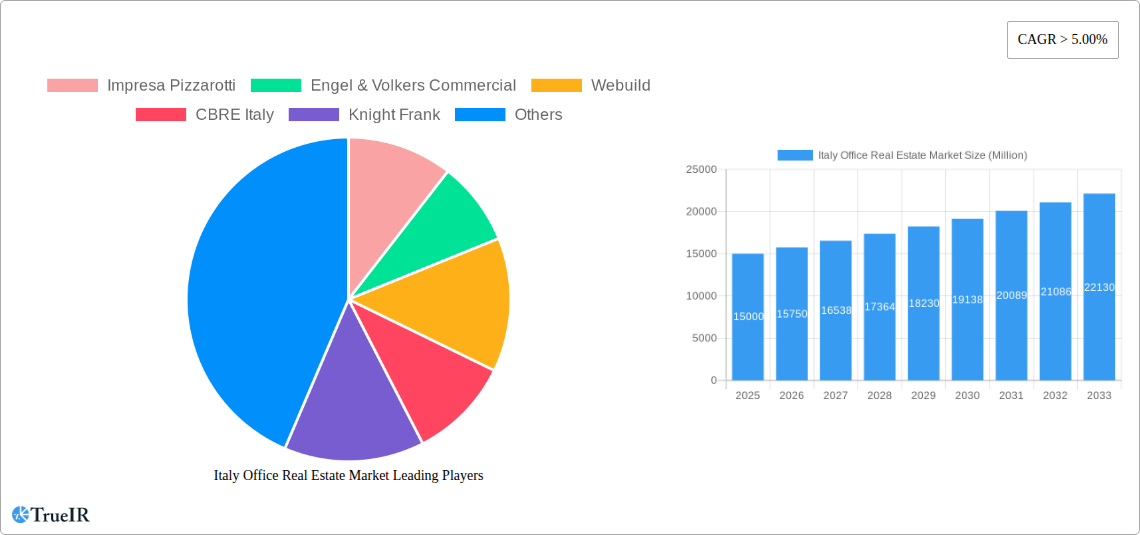

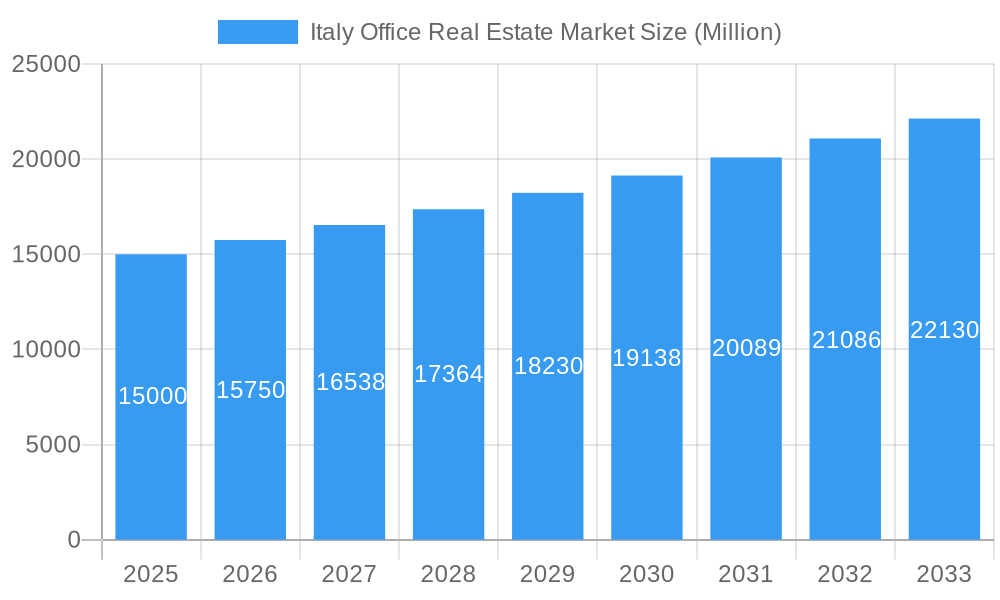

The Italian office real estate market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 5.29% from 2025 to 2033. This robust growth is underpinned by several key drivers. The thriving technology sector and escalating foreign investment are stimulating demand for contemporary, high-caliber office spaces, especially in prominent urban centers such as Milan and Rome. Concurrently, the evolving landscape of flexible work and co-working solutions is prompting landlords to adapt their offerings. Additionally, governmental endeavors in urban renewal and infrastructure enhancement are indirectly fortifying the sector by improving accessibility and appeal of vital business districts. Geographically, Rome, Milan, and Naples spearhead market performance in absorption and rental yields, reflecting their established commercial environments. However, economic volatility and the lasting influence of remote work present ongoing challenges. Furthermore, the scarcity of prime-located properties continues to pose a constraint on growth. Leading market participants, including Impresa Pizzarotti, Webuild, CBRE Italy, and Savills plc, are actively shaping the trajectory of Italy's office real estate sector.

Italy Office Real Estate Market Market Size (In Billion)

The competitive arena features a diverse array of domestic and international entities, each implementing distinct strategies to secure market share. While major developers concentrate on large-scale projects, smaller firms address specialized space requirements. A growing tenant preference for sustainable and technologically advanced office buildings is evident, necessitating developer investment in both property upgrades and the integration of eco-friendly features in new constructions. This sustainability trend is anticipated to accelerate, driven by environmental consciousness and tenant demand. Continued Italian economic growth and ongoing urban revitalization initiatives are critical determinants of the market's sustained success.

Italy Office Real Estate Market Company Market Share

Italy Office Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides a detailed analysis of the Italy office real estate market, encompassing historical data (2019-2024), current market conditions (Base Year 2025), and future projections (2025-2033). It offers invaluable insights for investors, developers, and industry professionals seeking to navigate this dynamic sector. The report leverages extensive market research and data analysis to deliver a clear understanding of market trends, key players, investment opportunities, and challenges. With a focus on key cities like Rome, Milan, Naples, and Turin, this report is a crucial resource for strategic decision-making.

Italy Office Real Estate Market Structure & Competitive Landscape

The Italian office real estate market exhibits a moderately concentrated structure, with several large national and international players vying for market share. Concentration ratios, while not precisely quantifiable without specific data on market revenue distribution, suggest a landscape where a handful of dominant firms hold significant power, though many smaller players exist, particularly at regional levels. Innovation is driven by technological advancements such as smart building technologies and the increasing adoption of flexible workspace solutions. Regulatory impacts, including building codes and environmental regulations, significantly influence development costs and timelines. Product substitutes, such as co-working spaces and remote work arrangements, present ongoing challenges to traditional office leasing models. End-user segmentation varies significantly across cities and sectors, ranging from finance and technology to government and public administration. M&A activity (Mergers & Acquisitions) in the period 2019-2024 exhibited xx Million EUR in volume, indicating a moderate level of consolidation, driven primarily by large international firms acquiring smaller local players to expand market presence. Significant factors shaping the landscape include the increasing adoption of sustainable building practices, driven both by environmental regulations and corporate sustainability initiatives, and the evolving preferences of tenants, who are demanding increasingly sophisticated and flexible office spaces.

Italy Office Real Estate Market Market Trends & Opportunities

The Italian office real estate market demonstrates steady, albeit uneven, growth. The CAGR (Compound Annual Growth Rate) for the period 2019-2024 is estimated to be xx%, with variations across major cities. Milan, being a major financial and fashion hub, consistently outpaces other regions. The market size in 2025 is projected to reach xx Million EUR, with an anticipated growth of xx% annually from 2025 to 2033. Technological shifts, including the adoption of smart building technologies and the rise of remote working, are reshaping office space demand. Consumer preferences are shifting towards flexible, sustainable, and amenity-rich workspaces, impacting design and lease terms. Competitive dynamics are intensifying as traditional players navigate the emergence of flexible workspace providers and new technologies. Market penetration of smart building features remains relatively low, but is expected to increase significantly over the forecast period, driven by increased demand for efficient and sustainable building operations. This trend presents significant opportunities for businesses offering cutting-edge technologies and services. Further opportunities lie in meeting the rising demand for high-quality sustainable office spaces in prime locations, particularly in major cities like Milan and Rome.

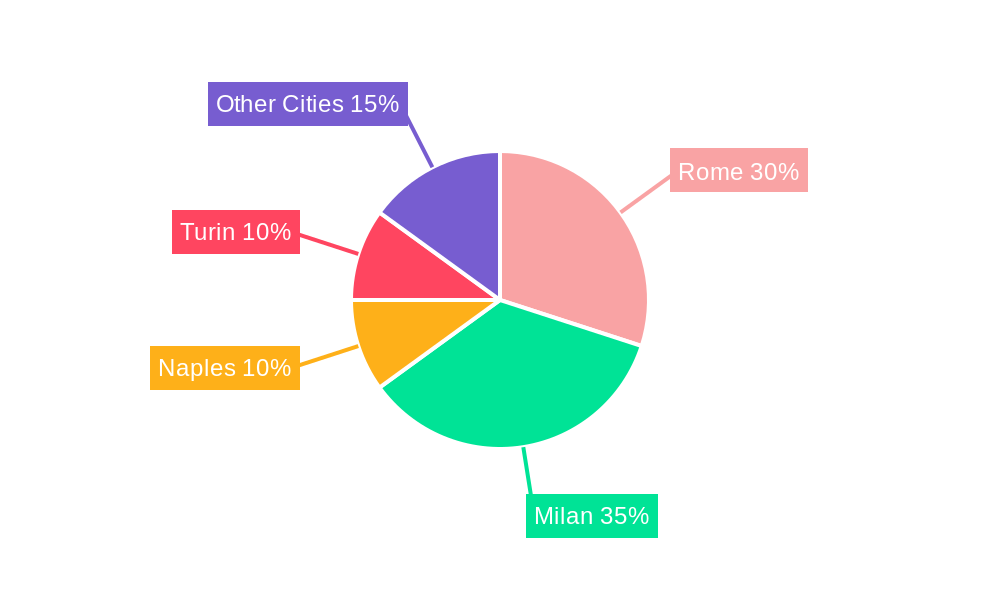

Dominant Markets & Segments in Italy Office Real Estate Market

Milan undeniably dominates the Italian office real estate market, driven by a robust economy, a thriving financial sector, and significant foreign investment. Rome, while possessing a distinct character, showcases consistent growth, albeit at a slower pace than Milan. Naples and Turin, while important regional hubs, maintain smaller market shares relative to Milan and Rome. "Other Cities" represent a diversified market with variable growth trajectories, often influenced by specific local economic developments.

Milan's Dominance:

- Strong financial sector and multinational presence.

- Significant infrastructure investments, including public transportation upgrades.

- Attractive lifestyle and high quality of life.

- Government support for urban regeneration projects.

- Proactive city planning to address office space needs.

Rome, although experiencing slower growth compared to Milan, still represents a significant market, driven by government activities, tourism, and a diverse range of businesses. Naples and Turin benefit from their status as regional centers, but face stronger competition from Milan. The "Other Cities" segment reflects the heterogeneous nature of the Italian office market beyond the major metropolitan areas. Growth in these areas is generally tied to specific local industries and developments, making regional analysis crucial for a complete understanding of this market segment.

Italy Office Real Estate Market Product Analysis

The Italian office real estate market showcases a broad spectrum of office products, ranging from traditional Class A buildings to modern, flexible workspaces. Technological advancements such as smart building technologies, including energy-efficient systems and integrated security, are enhancing the appeal and value of office properties. This evolution in product offerings is driving heightened competition, with developers focusing on innovative designs and sustainable practices to attract and retain tenants. The market is increasingly responsive to tenant demands for flexible lease terms and amenities, including co-working spaces, fitness centers, and outdoor areas.

Key Drivers, Barriers & Challenges in Italy Office Real Estate Market

Key Drivers:

- Increased foreign investment

- Growing demand for modern, sustainable office spaces

- Government initiatives to revitalize urban areas

- Expansion of the technology sector in major cities

Challenges:

- Economic volatility and potential interest rate increases.

- Bureaucratic complexities and lengthy permitting processes.

- Competition from flexible workspace providers.

- Supply chain constraints impacting construction timelines and costs. (Estimated impact: xx% increase in construction costs)

Growth Drivers in the Italy Office Real Estate Market

The Italian office real estate market's growth is primarily fueled by a combination of factors. Foreign direct investment, particularly in Milan, contributes significantly to demand. The increasing adoption of sustainable building practices aligns with both environmental regulations and corporate social responsibility objectives, driving demand for energy-efficient and environmentally friendly office spaces. Government initiatives focused on urban regeneration projects and improvements in public infrastructure further stimulate growth. Lastly, the expansion of the technology sector in major cities fuels demand for modern and flexible office spaces.

Challenges Impacting Italy Office Real Estate Market Growth

Several factors pose challenges to the Italian office real estate market's growth. Bureaucratic complexities and lengthy permitting processes can delay projects and increase development costs. Competition from flexible workspace providers is intensifying, requiring traditional landlords to adapt and innovate. Supply chain issues, particularly in the construction sector, can lead to cost overruns and project delays. Moreover, economic uncertainty and interest rate fluctuations introduce an element of risk. The combined impact of these challenges necessitates careful planning and risk management for developers and investors.

Key Players Shaping the Italy Office Real Estate Market

- Impresa Pizzarotti

- Engel & Volkers Commercial

- Webuild

- CBRE Italy

- Knight Frank

- Rizzani de Eccher

- Savills plc

- Astaldi

- JLL Italy

Significant Italy Office Real Estate Market Industry Milestones

- November 2022: Macquarie Asset Management's EUR 119 Million (USD 126 Million) purchase of a major Milan office building highlights continued investor confidence in the market.

- February 2022: BC Partners and Kervis Group's acquisition of an office building in Milan's Porta Romana further demonstrates investor optimism in the Milanese office market.

Future Outlook for Italy Office Real Estate Market

The Italian office real estate market is poised for continued growth, driven by ongoing foreign investment, the expansion of the technology sector, and the increasing demand for sustainable and flexible office spaces. Strategic opportunities exist for developers focusing on innovative designs, smart building technologies, and prime locations within major cities. The market's future trajectory will be influenced by broader economic conditions, regulatory changes, and the evolving preferences of tenants. However, the underlying demand for high-quality office space in key Italian cities is expected to support continued growth throughout the forecast period.

Italy Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Rome

- 1.2. Milan

- 1.3. Naples

- 1.4. Turin

- 1.5. Other Cities

Italy Office Real Estate Market Segmentation By Geography

- 1. Italy

Italy Office Real Estate Market Regional Market Share

Geographic Coverage of Italy Office Real Estate Market

Italy Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Occupier and Investment Focus in Milan

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Rome

- 5.1.2. Milan

- 5.1.3. Naples

- 5.1.4. Turin

- 5.1.5. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Impresa Pizzarotti

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Engel & Volkers Commercial

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Webuild

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CBRE Italy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Knight Frank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rizzani de Eccher

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Savills plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Astaldi

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JLL Italy

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Impresa Pizzarotti

List of Figures

- Figure 1: Italy Office Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Office Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 2: Italy Office Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Italy Office Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 4: Italy Office Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Office Real Estate Market?

The projected CAGR is approximately 5.29%.

2. Which companies are prominent players in the Italy Office Real Estate Market?

Key companies in the market include Impresa Pizzarotti, Engel & Volkers Commercial, Webuild, CBRE Italy, Knight Frank, Rizzani de Eccher, Savills plc, Astaldi, JLL Italy.

3. What are the main segments of the Italy Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Occupier and Investment Focus in Milan.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

November 2022 - A major Milan office building was purchased by Macquarie Asset Management through an Italian real estate fund for roughly EUR 119 million (USD 126 Million). It has been an active participant in the Italian real estate market for a number of years, and it has now added this historic house to its portfolio of properties in the region. One of the most desirable gateway cities in Europe is Milan, with many opportunities to find higher-quality apartments with strong demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Italy Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence