Key Insights

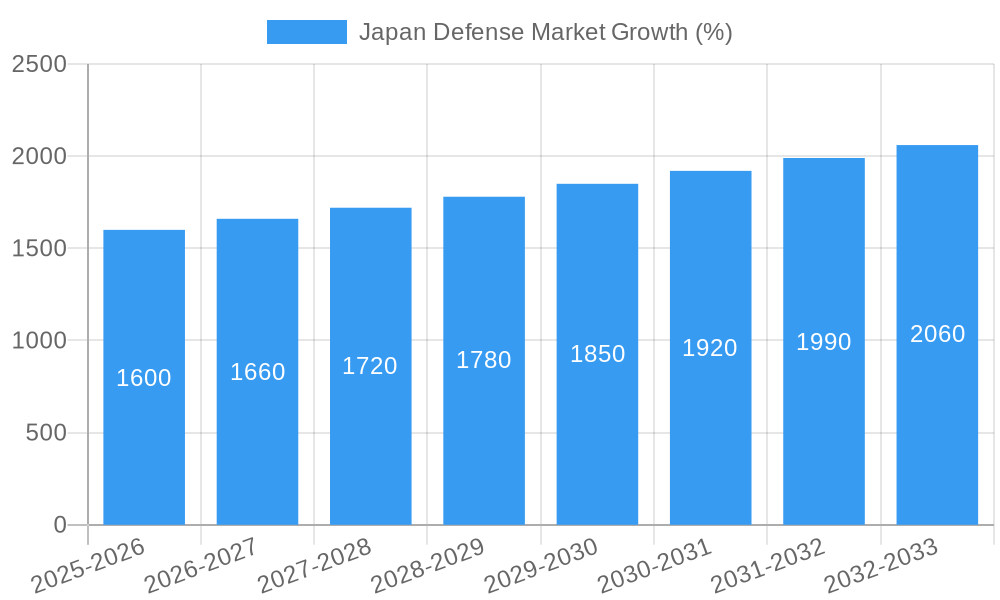

The Japan defense market, valued at ¥48.10 billion in 2025, is projected to experience steady growth, driven by escalating geopolitical tensions in the Asia-Pacific region and a renewed focus on bolstering national security. The compound annual growth rate (CAGR) of 3.40% from 2025 to 2033 indicates a consistent expansion, largely fueled by increased government spending on modernization of its armed forces and technological advancements in defense systems. Key growth drivers include the modernization of existing weapon systems, the development of next-generation technologies such as artificial intelligence and autonomous systems in defense applications, and a growing demand for enhanced cybersecurity and C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) capabilities. Significant investments in personnel training and protection programs further contribute to market growth. While certain economic factors could potentially act as restraints, the overall market outlook remains positive, underpinned by strong government commitment to defense spending and technological innovation.

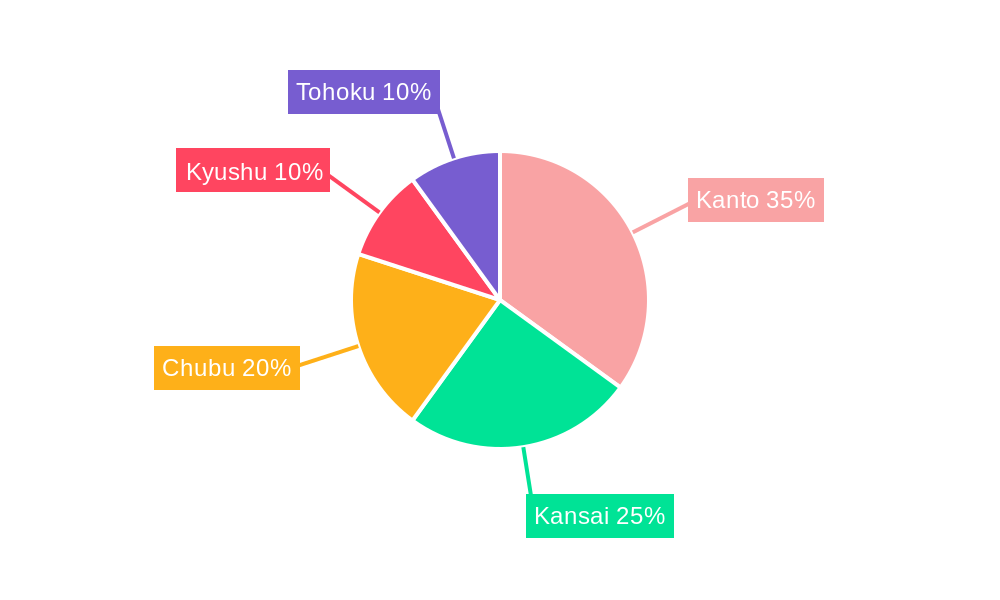

The market is segmented into several key areas: Armed Forces (Air Force, Army, Navy), and by equipment type (Personnel Training and Protection, C4ISR and EW (Electronic Warfare), Vehicles, Weapons and Ammunition). Major players such as Thales, Lockheed Martin, and Northrop Grumman, alongside significant Japanese companies like Mitsubishi Heavy Industries and Kawasaki Heavy Industries, dominate the market landscape. Regional variations in market activity are expected, with Kanto, Kansai, and Chubu regions likely to exhibit the highest demand due to their concentration of military bases and defense-related industries. The forecast period (2025-2033) presents significant opportunities for both domestic and international defense contractors, particularly those specializing in advanced technologies and integrated systems.

Japan Defense Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Japan Defense Market, encompassing market size, growth forecasts, key players, and significant industry milestones from 2019 to 2033. Leveraging extensive data and expert insights, this report is an indispensable resource for industry professionals, investors, and policymakers seeking a deep understanding of this rapidly evolving market. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period covers 2019-2024.

Japan Defense Market Market Structure & Competitive Landscape

The Japan defense market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. While precise concentration ratios are unavailable publicly (xx), the presence of large multinational corporations like Lockheed Martin, Boeing, and Thales alongside substantial domestic players such as Mitsubishi Heavy Industries and Kawasaki Heavy Industries indicates a complex competitive landscape. Innovation is a key driver, fueled by technological advancements in areas like C4ISR, hypersonic weapons, and next-generation fighter aircraft. Stringent regulatory frameworks, including export controls and defense procurement processes, significantly impact market dynamics. Product substitution is limited due to the specialized nature of defense equipment; however, ongoing technological advancements continuously challenge the status quo. The end-user segmentation comprises the Air Force, Army, and Navy, with varying procurement priorities across these segments. M&A activity in the sector has been moderate (xx deals per year on average in the historical period), primarily focused on enhancing technological capabilities and expanding market reach. This trend is projected to continue as companies seek strategic partnerships to navigate complex procurement processes and remain competitive.

Japan Defense Market Market Trends & Opportunities

The Japan Defense Market exhibits robust growth, driven by escalating geopolitical tensions and increasing defense budgets. The market size reached an estimated USD xx Billion in 2025, exhibiting a CAGR of xx% during the historical period (2019-2024). This upward trajectory is expected to continue throughout the forecast period (2025-2033), with the market size projected to reach USD xx Billion by 2033, fueled by continuous technological advancements and increasing government investments. Market penetration of advanced technologies such as AI, autonomous systems, and hypersonic weapons is currently limited (xx%), but significant growth is anticipated over the next decade. Consumer preferences in the defense sector are defined by high-performance, reliable equipment that meets stringent operational standards and complies with national security requirements. The competitive dynamics are shaped by a mix of global and domestic companies, with both entities vying for a slice of the lucrative market. International collaboration is increasingly prominent, evident in co-development projects like the next-generation fighter jet endeavor involving Japan, UK, and Italy.

Dominant Markets & Segments in Japan Defense Market

While precise market share data by region is unavailable (xx), the domestic market within Japan is undeniably the most dominant segment. Growth drivers within this market include:

- Increased Defense Budget Allocation: Significant increases in government spending on defense modernization and capacity building have fueled market expansion.

- Technological Advancements: Japan’s commitment to technological innovation in defense systems creates substantial demand.

- Geopolitical Factors: Growing regional security concerns and the need to bolster national defense capabilities are key catalysts.

Across defense segments, Weapons and Ammunition, and C4ISR & EW consistently represent the largest segments, primarily due to the high technological sophistication and associated costs. The Air Force and Navy are anticipated to be the leading consumers of advanced weaponry and sophisticated communication systems, followed by the Army. Personnel Training and Protection, while essential, typically represents a smaller segment compared to the others.

Japan Defense Market Product Analysis

The Japanese defense market exhibits a preference for advanced and technologically superior products, particularly those incorporating AI, automation, and advanced materials. This demand pushes innovation across all segments—from sophisticated weapons systems and integrated communication networks to advanced training simulators and protective equipment. Competitive advantages are increasingly derived from technological leadership, robust supply chains, and strong partnerships that facilitate collaborative development and technology transfer. A strong emphasis on interoperability with allied nations’ systems also enhances the competitive edge.

Key Drivers, Barriers & Challenges in Japan Defense Market

Key Drivers: Government policies emphasizing defense modernization and increased budgetary allocation are major drivers. Technological advancements in areas like AI and hypersonic weapons are also creating significant opportunities. Growing geopolitical tensions in the region further contribute to heightened demand.

Key Challenges: Complex regulatory hurdles, including stringent procurement processes and export controls, can delay project timelines and increase costs. Supply chain vulnerabilities represent a significant risk, particularly concerning reliance on foreign components and technologies. Intense competition from established global players presents a continual challenge for domestic companies.

Growth Drivers in the Japan Defense Market Market

The market's growth is significantly propelled by escalating defense budgets, driven by increasing geopolitical uncertainties. Technological innovation, specifically in areas like AI, hypersonic weaponry, and autonomous systems, fosters demand for cutting-edge defense solutions. Furthermore, governmental initiatives supporting domestic defense industries and strategic partnerships with international defense corporations fuel market expansion.

Challenges Impacting Japan Defense Market Growth

Significant challenges include intricate regulatory hurdles and procurement procedures that often extend project timelines. Supply chain vulnerabilities, potentially stemming from global instability and reliance on foreign technologies, also pose considerable risk. Lastly, intense competition from both domestic and international players adds pressure to maintain competitiveness and profitability.

Key Players Shaping the Japan Defense Market Market

- THALES

- Subaru Corporation

- ShinMaywa Industries Ltd

- Lockheed Martin Corporation

- Toshiba Corporation

- The Japan Steel Works Ltd

- RTX Corporation

- Komatsu Ltd

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Northrop Grumman Corporation

- The Boeing Company

- Mitsubishi Heavy Industries Ltd

Significant Japan Defense Market Industry Milestones

- October 2022: The US approved the sale of 32 Standard Missile 6 Block I missiles and MK 21 vertical launch systems to Japan (USD 450 Million). RTX Corporation to provide training and support.

- April 2023: Japan's Defense Ministry signed a USD 3 Billion contract with Mitsubishi Heavy Industries Ltd. for long-range missile development and mass production (deployment by 2026).

- May 2023: Japan and the UAE signed a defense equipment and technology transfer agreement, facilitating joint research, development, and production. This coincides with Japan's next-generation fighter jet project with the UK and Italy.

Future Outlook for Japan Defense Market Market

The Japan Defense Market is poised for continued strong growth, driven by sustained governmental investments in defense modernization and technological advancements. Strategic partnerships and collaborative projects with international allies will further stimulate innovation and market expansion. The growing emphasis on advanced technologies, particularly in areas like AI and hypersonic weapons, presents significant opportunities for market players. Overall, the market is set for robust expansion throughout the forecast period, driven by strong technological drivers, significant government spending, and escalating geopolitical concerns.

Japan Defense Market Segmentation

-

1. Armed Forces

- 1.1. Air Force

- 1.2. Army

- 1.3. Navy

-

2. Type

- 2.1. Personnel Training and Protection

- 2.2. C4ISR and EW

- 2.3. Vehicles

- 2.4. Weapons and Ammunition

Japan Defense Market Segmentation By Geography

- 1. Japan

Japan Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Air Force Segment Projected to Show the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Defense Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 5.1.1. Air Force

- 5.1.2. Army

- 5.1.3. Navy

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Personnel Training and Protection

- 5.2.2. C4ISR and EW

- 5.2.3. Vehicles

- 5.2.4. Weapons and Ammunition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6. Kanto Japan Defense Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Defense Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Defense Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Defense Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Defense Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 THALES

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Subaru Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ShinMaywa Industries Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Toshiba Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Japan Steel Works Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Komatsu Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAE Systems plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kawasaki Heavy Industries Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Boeing Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mitsubishi Heavy Industries Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 THALES

List of Figures

- Figure 1: Japan Defense Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Defense Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Defense Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 3: Japan Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Japan Defense Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 12: Japan Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Japan Defense Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Defense Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Japan Defense Market?

Key companies in the market include THALES, Subaru Corporation, ShinMaywa Industries Ltd, Lockheed Martin Corporation, Toshiba Corporation, The Japan Steel Works Ltd, RTX Corporation, Komatsu Ltd, BAE Systems plc, Kawasaki Heavy Industries Ltd, Northrop Grumman Corporation, The Boeing Company, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Japan Defense Market?

The market segments include Armed Forces, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.10 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Air Force Segment Projected to Show the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: Japan's Defense Ministry signed a contract worth USD 3 billion with Mitsubishi Heavy Industries Ltd. to develop and mass-produce long-range missiles for deployment by 2026. The contracts include advanced versions of Mitsubishi's Type 12 missiles for surface, sea, and air launches, as well as a hypersonic ballistic missile for the defense of remote islands.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Defense Market?

To stay informed about further developments, trends, and reports in the Japan Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence