Key Insights

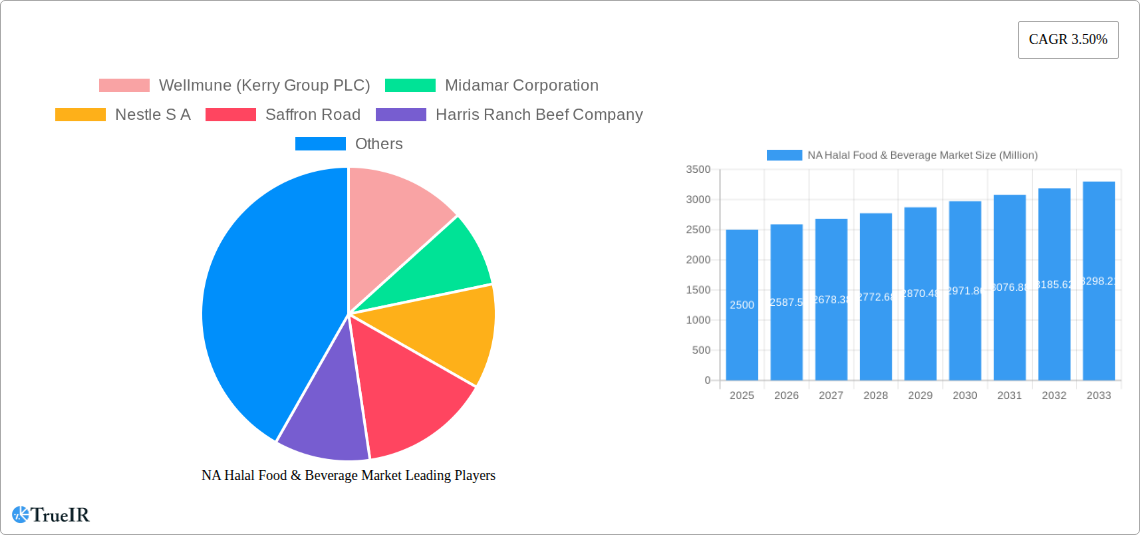

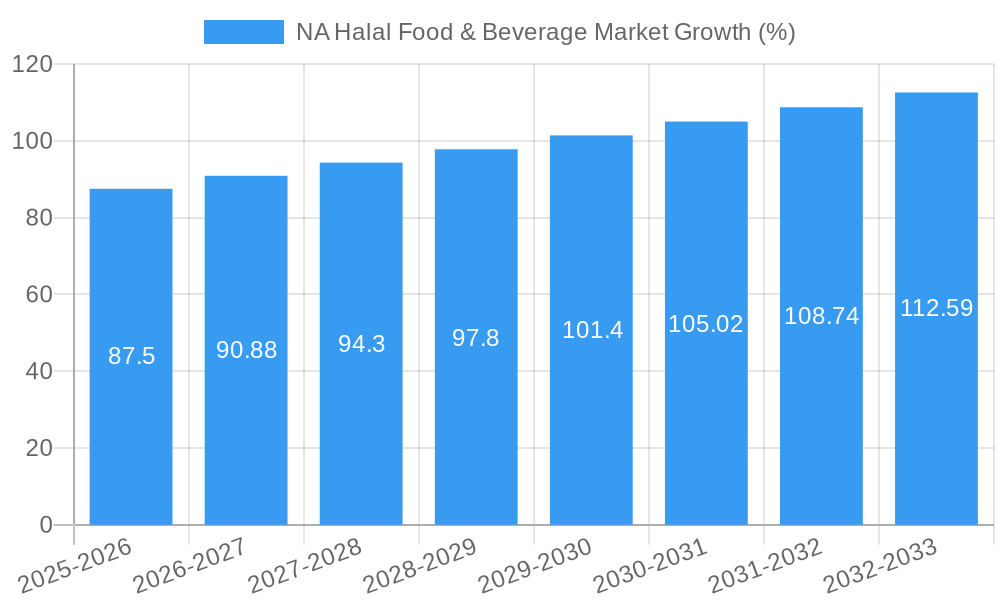

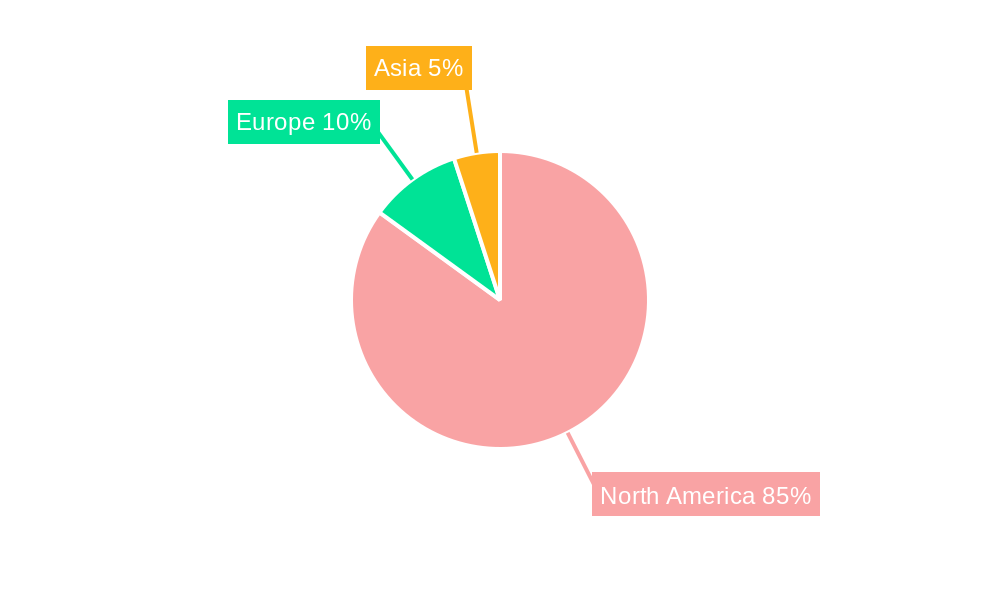

The North American Halal food and beverage market presents a significant growth opportunity, driven by the expanding Muslim population and increasing consumer awareness of halal certification. With a current market size estimated at $XX million in 2025 (assuming a reasonable market size based on global halal food market data and North America's population demographics), the market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033. Key drivers include rising disposable incomes, increasing demand for ethically sourced and healthier food options, and the growing popularity of diverse cuisines. The market is segmented by product type (Halal food, Halal beverages, Halal supplements) and distribution channel (supermarkets/hypermarkets, convenience/grocery stores, specialty stores, online retailers). Supermarkets and hypermarkets currently hold the largest market share, but online channels are experiencing rapid growth, reflecting evolving consumer purchasing habits. Competitive landscape analysis reveals a mix of established multinational corporations like Nestle and Cargill alongside smaller, specialized halal food producers. Strategic partnerships, product innovation (e.g., plant-based halal options), and expansion into new distribution channels will be crucial for success in this dynamic market.

The market’s growth trajectory is influenced by several factors. While increasing consumer awareness of halal certification and its implications for product quality and ethical sourcing acts as a major catalyst, potential restraints include the challenges of maintaining stringent halal certification standards across the entire supply chain and managing consumer perception around halal products. Successfully navigating these challenges will require robust supply chain management, transparent communication, and a commitment to quality. The strong growth potential is further underpinned by the increasing demand for convenience and ready-to-eat halal food options, particularly among younger demographics. This translates into opportunities for innovation in product development and marketing strategies that effectively target specific consumer segments. The United States, as the largest market within North America, is expected to dominate the regional market share, followed by Canada and Mexico.

NA Halal Food & Beverage Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the North American Halal Food & Beverage market, offering invaluable insights for businesses, investors, and industry stakeholders. With a focus on market size, growth drivers, competitive landscape, and future trends, this report is an essential resource for navigating this rapidly expanding sector. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

NA Halal Food & Beverage Market Market Structure & Competitive Landscape

The North American Halal food and beverage market exhibits a moderately consolidated structure, with several large multinational corporations and a significant number of smaller, regional players competing for market share. The market concentration ratio (CR4) is estimated at xx%, indicating a moderately competitive landscape. Key innovation drivers include increasing consumer demand for healthier, ethically sourced products, coupled with technological advancements in food processing and packaging to maintain halal certification integrity. Stringent regulatory frameworks regarding halal certification and labeling significantly influence market operations, while the emergence of plant-based halal alternatives presents a notable shift. Product substitutes such as conventional meat and beverages compete with halal offerings, especially in price-sensitive segments.

End-user segmentation is primarily driven by demographic factors, including the growing Muslim population and the increasing adoption of halal products by non-Muslim consumers seeking healthier and ethically sourced options. Mergers and acquisitions (M&A) activity in the sector has been moderate in recent years, with a focus on expanding product portfolios and geographical reach. The volume of M&A transactions between 2019 and 2024 is estimated at xx deals, with an average deal size of xx Million. Further consolidation is expected, particularly among larger players looking to establish a stronger presence in the market.

NA Halal Food & Beverage Market Market Trends & Opportunities

The NA Halal Food & Beverage market is experiencing significant growth fueled by several key trends. The market size is projected to reach xx Million by 2033, demonstrating considerable expansion from its value of xx Million in 2024. This robust growth is driven by a rising Muslim population in North America, along with increased awareness among non-Muslim consumers about halal food's health and ethical aspects. Technological advancements in food processing and packaging maintain halal integrity and expand product offerings, influencing consumer preferences toward more convenient and diverse options. Changing consumer preferences are shifting towards healthier, more sustainable, and ethically produced food options, leading to greater demand for halal certified products beyond the traditionally defined consumer base. The competitive dynamics are shaped by both established players and emerging brands vying for market share, leading to product diversification and innovative marketing strategies. This includes significant investment in digital marketing and targeted outreach to diverse communities. Market penetration rates are increasing, especially in urban areas with large Muslim populations and in regions with high multicultural exposure. The CAGR for the forecast period (2025-2033) is projected at xx%.

Dominant Markets & Segments in NA Halal Food & Beverage Market

While the entire North American market is showing growth, specific regions and segments stand out. The most dominant region is currently the xx, followed by xx. Growth drivers for these regions include several factors:

- Growing Muslim population: A significant increase in the Muslim population in these regions directly translates to increased demand for halal-certified products.

- Multiculturalism and acceptance: Increased acceptance of diverse culinary traditions within these areas enhances the marketability of halal products.

- Government policies and initiatives: Supportive regulatory environments and government incentives for halal-certified food production further fuel market expansion.

- Retail infrastructure: Well-established retail networks effectively distribute halal products to diverse demographics.

Within product types, Halal Food currently commands the largest market share, followed by Halal Beverages and Halal Supplements. Supermarkets/Hypermarkets represent the dominant distribution channel, owing to their widespread reach and the increasing availability of halal-certified products on their shelves. However, the growth of specialty stores catering specifically to halal products and online retailers is also showing remarkable potential.

NA Halal Food & Beverage Market Product Analysis

Product innovation in the NA Halal Food & Beverage market focuses on enhancing product quality, expanding product variety, and improving convenience. Technological advancements include improved processing techniques, innovative packaging solutions (that extend shelf life and maintain halal integrity), and the development of plant-based halal alternatives. These innovations cater to diverse consumer preferences, enhancing market fit and driving stronger brand loyalty. This market sees continuous expansion of ready-to-eat meals, snacks, and beverages certified as halal, reflecting the growing demand for convenient options.

Key Drivers, Barriers & Challenges in NA Halal Food & Beverage Market

Key Drivers: The market is driven by increasing consumer awareness of halal food’s health benefits and ethical production standards, supported by robust growth in the Muslim population and rising disposable incomes. The emergence of novel technological advancements in food processing and packaging, aimed at ensuring halal certification and improving product quality, also significantly influences the growth. Favorable government policies and initiatives also positively impact market expansion.

Key Challenges: Challenges include the complexities of obtaining and maintaining halal certification, particularly for smaller businesses. Supply chain inefficiencies, especially in sourcing raw materials and ensuring consistent quality control, pose a significant hurdle. Competition from conventional food products and the pricing pressure in the market create a challenging environment.

Growth Drivers in the NA Halal Food & Beverage Market Market

Technological advancements are a key driver. Developments in packaging technology, for instance, enhance product shelf life and maintain quality, critical for halal food products. Economic growth boosts consumer spending power, making it easier to afford premium halal options. Finally, governmental policies providing incentives for halal-certified food production aid market growth.

Challenges Impacting NA Halal Food & Beverage Market Growth

Significant challenges include the stringent regulatory environment surrounding halal certification, which adds complexity to product launches and can be costly for smaller businesses. Supply chain disruptions can create production delays and impact product quality and availability. Finally, intense competition among established and emerging players puts pressure on profit margins and necessitates continual innovation.

Key Players Shaping the NA Halal Food & Beverage Market Market

- Wellmune (Kerry Group PLC)

- Midamar Corporation

- Nestle S.A.

- Saffron Road

- Harris Ranch Beef Company

- American Foods Group LLC

- Prima Quality Food Industries Sdn Bhd

- Cresent Foods

- Cargill Inc

- Pampanga's Best Inc

- Noor Pharmaceuticals LLC

- BRF SA

Significant NA Halal Food & Beverage Market Industry Milestones

- May 2021: Health Mother and Health Baby Organization launched a halal-certified UNIMMAP MMS in the US.

- November 2021: Cresent Foods partnered with Costco, Walmart, and Kroger.

- January 2022: Cresent Foods launched halal products in H.E.B Stores across Houston.

Future Outlook for NA Halal Food & Beverage Market Market

The future of the NA Halal Food & Beverage market looks promising, driven by sustained growth in the Muslim population, increased consumer awareness, and ongoing innovation in product development and distribution. Strategic opportunities exist in expanding into underserved markets, developing innovative product lines to cater to changing consumer preferences, and strengthening supply chain partnerships to enhance efficiency and resilience. The market's potential for significant growth remains substantial.

NA Halal Food & Beverage Market Segmentation

-

1. Product Type

-

1.1. Halal Food

- 1.1.1. Meat

- 1.1.2. Bakery

- 1.1.3. Dairy

- 1.1.4. Confectionery

- 1.1.5. Other Halal Foods

- 1.2. Halal Beverages

- 1.3. Halal Supplements

-

1.1. Halal Food

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/ Grocery Stores

- 2.3. Specialty Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

NA Halal Food & Beverage Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

NA Halal Food & Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Concern for Quality Drinking Water; Strategic Investment by the Key Players

- 3.3. Market Restrains

- 3.3.1. Need for Stringent Regulatory Landscape

- 3.4. Market Trends

- 3.4.1. Halal Certification Attracting a New Consumer Base

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Halal Food & Beverage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Halal Food

- 5.1.1.1. Meat

- 5.1.1.2. Bakery

- 5.1.1.3. Dairy

- 5.1.1.4. Confectionery

- 5.1.1.5. Other Halal Foods

- 5.1.2. Halal Beverages

- 5.1.3. Halal Supplements

- 5.1.1. Halal Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/ Grocery Stores

- 5.2.3. Specialty Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States NA Halal Food & Beverage Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Halal Food

- 6.1.1.1. Meat

- 6.1.1.2. Bakery

- 6.1.1.3. Dairy

- 6.1.1.4. Confectionery

- 6.1.1.5. Other Halal Foods

- 6.1.2. Halal Beverages

- 6.1.3. Halal Supplements

- 6.1.1. Halal Food

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience/ Grocery Stores

- 6.2.3. Specialty Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada NA Halal Food & Beverage Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Halal Food

- 7.1.1.1. Meat

- 7.1.1.2. Bakery

- 7.1.1.3. Dairy

- 7.1.1.4. Confectionery

- 7.1.1.5. Other Halal Foods

- 7.1.2. Halal Beverages

- 7.1.3. Halal Supplements

- 7.1.1. Halal Food

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience/ Grocery Stores

- 7.2.3. Specialty Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico NA Halal Food & Beverage Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Halal Food

- 8.1.1.1. Meat

- 8.1.1.2. Bakery

- 8.1.1.3. Dairy

- 8.1.1.4. Confectionery

- 8.1.1.5. Other Halal Foods

- 8.1.2. Halal Beverages

- 8.1.3. Halal Supplements

- 8.1.1. Halal Food

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience/ Grocery Stores

- 8.2.3. Specialty Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America NA Halal Food & Beverage Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Halal Food

- 9.1.1.1. Meat

- 9.1.1.2. Bakery

- 9.1.1.3. Dairy

- 9.1.1.4. Confectionery

- 9.1.1.5. Other Halal Foods

- 9.1.2. Halal Beverages

- 9.1.3. Halal Supplements

- 9.1.1. Halal Food

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience/ Grocery Stores

- 9.2.3. Specialty Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States NA Halal Food & Beverage Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada NA Halal Food & Beverage Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico NA Halal Food & Beverage Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Wellmune (Kerry Group PLC)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Midamar Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nestle S A

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Saffron Road

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Harris Ranch Beef Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 American Foods Group LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Prima Quality Food Industries Sdn Bhd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Cresent Foods

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Cargill Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pampanga's Best Inc *List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Noor Pharmaceuticals LLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 BRF SA

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Wellmune (Kerry Group PLC)

List of Figures

- Figure 1: Global NA Halal Food & Beverage Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America NA Halal Food & Beverage Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America NA Halal Food & Beverage Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: United States NA Halal Food & Beverage Market Revenue (Million), by Product Type 2024 & 2032

- Figure 5: United States NA Halal Food & Beverage Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: United States NA Halal Food & Beverage Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: United States NA Halal Food & Beverage Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: United States NA Halal Food & Beverage Market Revenue (Million), by Geography 2024 & 2032

- Figure 9: United States NA Halal Food & Beverage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 10: United States NA Halal Food & Beverage Market Revenue (Million), by Country 2024 & 2032

- Figure 11: United States NA Halal Food & Beverage Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Canada NA Halal Food & Beverage Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: Canada NA Halal Food & Beverage Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: Canada NA Halal Food & Beverage Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: Canada NA Halal Food & Beverage Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: Canada NA Halal Food & Beverage Market Revenue (Million), by Geography 2024 & 2032

- Figure 17: Canada NA Halal Food & Beverage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 18: Canada NA Halal Food & Beverage Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Canada NA Halal Food & Beverage Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Mexico NA Halal Food & Beverage Market Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Mexico NA Halal Food & Beverage Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Mexico NA Halal Food & Beverage Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Mexico NA Halal Food & Beverage Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Mexico NA Halal Food & Beverage Market Revenue (Million), by Geography 2024 & 2032

- Figure 25: Mexico NA Halal Food & Beverage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 26: Mexico NA Halal Food & Beverage Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Mexico NA Halal Food & Beverage Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of North America NA Halal Food & Beverage Market Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Rest of North America NA Halal Food & Beverage Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Rest of North America NA Halal Food & Beverage Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Rest of North America NA Halal Food & Beverage Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Rest of North America NA Halal Food & Beverage Market Revenue (Million), by Geography 2024 & 2032

- Figure 33: Rest of North America NA Halal Food & Beverage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 34: Rest of North America NA Halal Food & Beverage Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Rest of North America NA Halal Food & Beverage Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States NA Halal Food & Beverage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada NA Halal Food & Beverage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico NA Halal Food & Beverage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Global NA Halal Food & Beverage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Halal Food & Beverage Market?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the NA Halal Food & Beverage Market?

Key companies in the market include Wellmune (Kerry Group PLC), Midamar Corporation, Nestle S A, Saffron Road, Harris Ranch Beef Company, American Foods Group LLC, Prima Quality Food Industries Sdn Bhd, Cresent Foods, Cargill Inc, Pampanga's Best Inc *List Not Exhaustive, Noor Pharmaceuticals LLC, BRF SA.

3. What are the main segments of the NA Halal Food & Beverage Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Escalating Concern for Quality Drinking Water; Strategic Investment by the Key Players.

6. What are the notable trends driving market growth?

Halal Certification Attracting a New Consumer Base.

7. Are there any restraints impacting market growth?

Need for Stringent Regulatory Landscape.

8. Can you provide examples of recent developments in the market?

January 2022: Cresent Foods launched its halal-certified products in the H.E.B Stores located across Houston, United States. The products include a variety of fresh, halal hand-cut chicken, beef, and lamb products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Halal Food & Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Halal Food & Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Halal Food & Beverage Market?

To stay informed about further developments, trends, and reports in the NA Halal Food & Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence