Key Insights

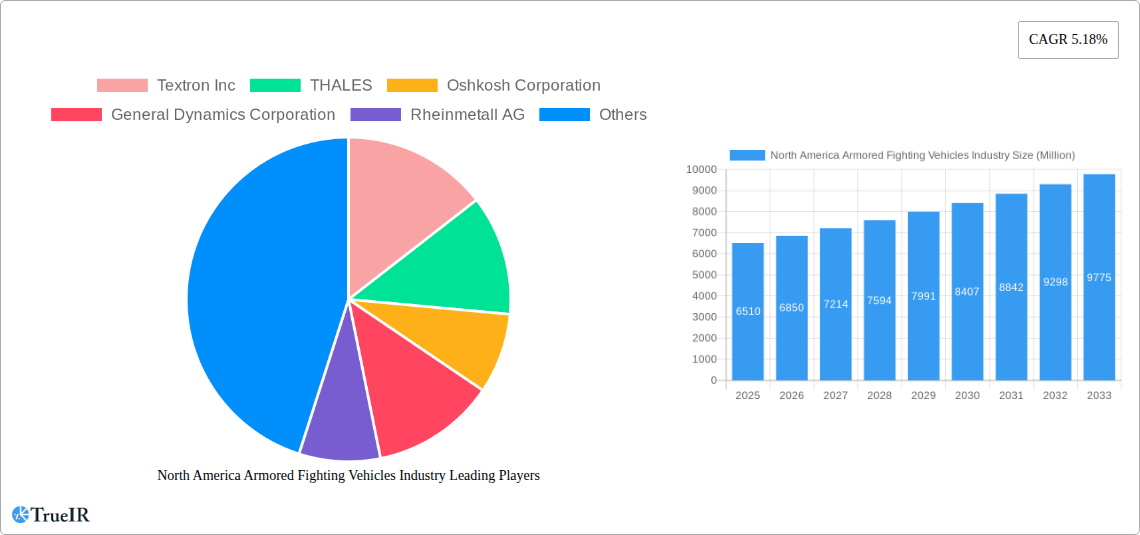

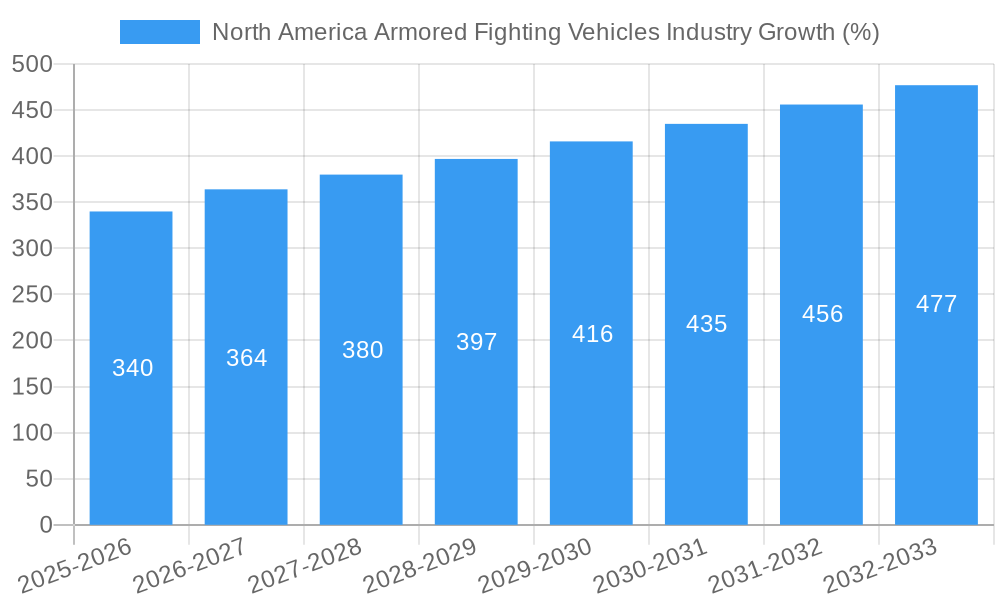

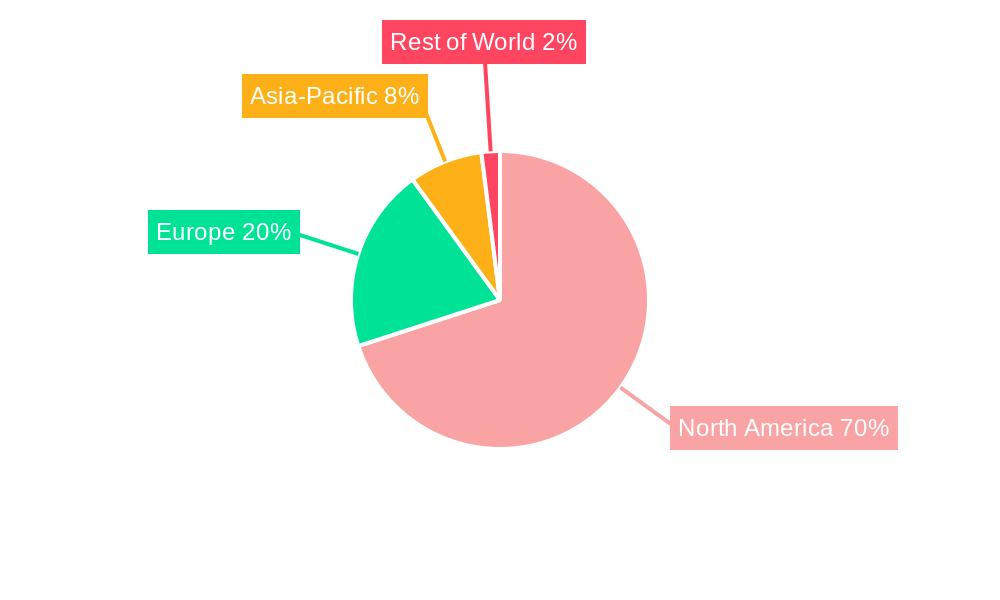

The North American armored fighting vehicles (AFV) market, valued at $6.51 billion in 2025, is projected to experience robust growth, driven by escalating geopolitical tensions, increasing defense budgets, and modernization initiatives across the region. The market's Compound Annual Growth Rate (CAGR) of 5.18% from 2025 to 2033 signifies a steady expansion, particularly fueled by the demand for advanced technological capabilities in APCs, IFVs, and MBTs. Key growth drivers include the ongoing need for enhanced battlefield situational awareness, improved survivability features, and the integration of cutting-edge technologies such as advanced sensors, communication systems, and AI-powered decision support tools. The United States, as the largest market within North America, is expected to contribute significantly to this growth, primarily due to its substantial military spending and ongoing fleet upgrades. Canada and Mexico, while possessing smaller markets, are also anticipated to contribute to the overall regional expansion, driven by their own defense modernization plans and regional security concerns. The segmentation within the market reflects the diverse operational needs of the armed forces, with APCs, IFVs, and MBTs representing significant portions of the total demand. Competition within the market is intense, involving major players like Textron, Thales, Oshkosh, General Dynamics, Rheinmetall, Elbit Systems, QinetiQ, AM General, Leonardo, BAE Systems, and HDT Global, each vying for market share through technological innovation and strategic partnerships.

Market restraints may include budgetary constraints in certain government sectors, potential shifts in geopolitical landscapes leading to decreased military spending, and the inherent high cost of research and development for new AFV technologies. However, the predicted continued investment in national security and technological advancements within the defense sector is anticipated to mitigate these challenges. The increasing integration of unmanned and autonomous systems into AFV design is a key trend, poised to further enhance operational efficiency and soldier safety. The evolution toward lighter yet more robust vehicles, emphasizing improved mobility and fuel efficiency, also represents a notable trend shaping the future of the North American AFV market. This combination of drivers and trends suggests a positive outlook for the market's continued growth and technological advancement over the forecast period.

North America Armored Fighting Vehicles Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America armored fighting vehicles industry, covering market size, segmentation, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and researchers seeking to understand this dynamic sector. The report leverages extensive data analysis to predict market trends and identify key growth opportunities.

North America Armored Fighting Vehicles Industry Market Structure & Competitive Landscape

The North American armored fighting vehicles market exhibits a moderately concentrated structure, with a few major players dominating the landscape. Key players such as Textron Inc, THALES, Oshkosh Corporation, General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, QinetiQ Group, AM General LLC, Leonardo S p A, BAE Systems plc, and HDT Global compete fiercely, driving innovation and shaping market dynamics.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in areas such as advanced materials, active protection systems, and autonomous capabilities are key drivers of innovation.

- Regulatory Impacts: Government regulations concerning defense spending, export controls, and environmental standards significantly influence market growth.

- Product Substitutes: While direct substitutes are limited, cost-effective alternatives like unmanned aerial vehicles (UAVs) are emerging, presenting a potential challenge.

- End-User Segmentation: The market is primarily driven by government procurement from the US and Canadian militaries, with secondary demand from law enforcement and other specialized agencies.

- M&A Trends: The past five years have witnessed xx M&A deals, with an average transaction value of USD xx Million, indicating a moderate level of consolidation within the industry.

North America Armored Fighting Vehicles Industry Market Trends & Opportunities

The North American armored fighting vehicles market is experiencing significant growth, driven by rising defense budgets, geopolitical instability, and the increasing need for advanced military equipment. The market size is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological shifts towards unmanned and autonomous systems are reshaping the competitive landscape, while increasing emphasis on lightweight, adaptable vehicles and advanced protection technologies are driving product innovation. Market penetration rates for newer technologies are increasing at an estimated xx% annually. The strong demand for upgraded and modernized fleets provides substantial opportunities for existing players, while the potential for technological disruption creates avenues for innovative entrants. Furthermore, collaborative efforts between governments and private entities are expected to boost market growth. The shifting geopolitical dynamics are also significantly influencing procurement decisions and driving investment in advanced capabilities.

Dominant Markets & Segments in North America Armored Fighting Vehicles Industry

The United States dominates the North American armored fighting vehicles market, accounting for the largest share of revenue. Canada represents a significant secondary market.

Leading Segments:

- Armored Personnel Carrier (APC): This segment holds the largest market share, driven by the continuous need for troop transportation and protection. Growth is further propelled by technological advancements in armor materials and mobility systems.

- Infantry Fighting Vehicle (IFV): This segment demonstrates strong growth, fueled by the demand for vehicles with enhanced firepower and battlefield situational awareness capabilities.

- Main Battle Tank (MBT): This segment displays stable growth, primarily driven by modernization programs and new procurement initiatives, albeit at a slower pace than APCs and IFVs.

- Other Vehicle Types: This category encompasses a variety of specialized armored vehicles, including reconnaissance vehicles, command and control vehicles, and engineering vehicles, exhibiting a niche but steady growth trajectory.

Key Growth Drivers:

- Increased Defense Budgets: The substantial allocation of defense budgets in the US and Canada directly translates to increased procurement of armored vehicles.

- Modernization Programs: Existing fleets require continuous modernization and upgrading, driving significant demand.

- Technological Advancements: Innovation in areas like AI, autonomous capabilities, and advanced protection systems fuels demand for cutting-edge vehicles.

- Geopolitical Instability: Regional conflicts and global instability contribute to a heightened demand for enhanced military capabilities.

North America Armored Fighting Vehicles Industry Product Analysis

The North American armored fighting vehicles market is characterized by a diverse range of products, each tailored to specific operational requirements. Recent innovations focus on enhanced mobility, protection, and firepower. Technological advancements include the integration of advanced sensors, improved communication systems, and the incorporation of AI for enhanced situational awareness. This trend towards increased technological sophistication directly impacts the vehicles' market competitiveness, offering superior performance and operational advantages.

Key Drivers, Barriers & Challenges in North America Armored Fighting Vehicles Industry

Key Drivers:

- Technological advancements in armor materials, propulsion systems, and sensor technologies drive performance enhancements and increased demand.

- Geopolitical instability and global security concerns necessitate continuous investment in modernized defense capabilities.

- Government spending on defense modernization programs fuels market growth and stimulates innovation.

Challenges & Restraints:

- Supply chain disruptions and material shortages impact production timelines and increase costs. Estimated impact: USD xx Million in lost revenue annually.

- Stringent regulatory requirements concerning export controls and environmental standards complicate procurement and increase lead times.

- Intense competition among established players necessitates continuous innovation and cost optimization.

Growth Drivers in the North America Armored Fighting Vehicles Industry Market

The market's growth is propelled by technological innovation, robust government spending on defense modernization, and geopolitical instability necessitating advanced defense capabilities.

Challenges Impacting North America Armored Fighting Vehicles Industry Growth

The industry faces challenges from supply chain disruptions, leading to production delays and increased costs. Strict regulatory hurdles complicate procurement processes, and fierce competition necessitates constant innovation and cost optimization.

Key Players Shaping the North America Armored Fighting Vehicles Industry Market

- Textron Inc

- THALES

- Oshkosh Corporation

- General Dynamics Corporation

- Rheinmetall AG

- Elbit Systems Ltd

- QinetiQ Group

- AM General LLC

- Leonardo S p A

- BAE Systems plc

- HDT Global

Significant North America Armored Fighting Vehicles Industry Industry Milestones

- November 2022: BAE Systems plc secured a USD 32 Million contract from the US DoD to supply M2A4 and M7A4 Bradley fighting vehicles. This signifies a significant boost to the IFV segment.

- November 2022: General Dynamics Corporation received a USD 165 Million contract from the Canadian military for 39 light-armored vehicles. This highlights the continued demand for light armored vehicles in the region.

Future Outlook for North America Armored Fighting Vehicles Industry Market

The North American armored fighting vehicles market is poised for continued growth driven by sustained government investment in defense modernization, technological advancements, and geopolitical uncertainties. Strategic opportunities lie in developing and integrating advanced technologies like autonomous systems, AI, and improved protection systems. The market's potential is significant, promising substantial growth in the coming years.

North America Armored Fighting Vehicles Industry Segmentation

-

1. Vehicle Type

- 1.1. Armored Personnel Carrier (APC)

- 1.2. Infantry Fighting Vehicle (IFV)

- 1.3. Main Battle Tank (MBT)

- 1.4. Other Vehicle Types

-

2. Geography

- 2.1. United States

- 2.2. Canada

North America Armored Fighting Vehicles Industry Segmentation By Geography

- 1. United States

- 2. Canada

North America Armored Fighting Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Main Battle Tanks Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Armored Fighting Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Armored Personnel Carrier (APC)

- 5.1.2. Infantry Fighting Vehicle (IFV)

- 5.1.3. Main Battle Tank (MBT)

- 5.1.4. Other Vehicle Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Armored Fighting Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Armored Personnel Carrier (APC)

- 6.1.2. Infantry Fighting Vehicle (IFV)

- 6.1.3. Main Battle Tank (MBT)

- 6.1.4. Other Vehicle Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Canada North America Armored Fighting Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Armored Personnel Carrier (APC)

- 7.1.2. Infantry Fighting Vehicle (IFV)

- 7.1.3. Main Battle Tank (MBT)

- 7.1.4. Other Vehicle Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. United States North America Armored Fighting Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 9. Canada North America Armored Fighting Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 10. Mexico North America Armored Fighting Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of North America North America Armored Fighting Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Textron Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 THALES

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Oshkosh Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 General Dynamics Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rheinmetall AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Elbit Systems Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 QinetiQ Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 AM General LLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Leonardo S p A

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 BAE Systems plc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 HDT Global

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Textron Inc

List of Figures

- Figure 1: North America Armored Fighting Vehicles Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Armored Fighting Vehicles Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Armored Fighting Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Armored Fighting Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Armored Fighting Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Armored Fighting Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Armored Fighting Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Armored Fighting Vehicles Industry?

The projected CAGR is approximately 5.18%.

2. Which companies are prominent players in the North America Armored Fighting Vehicles Industry?

Key companies in the market include Textron Inc, THALES, Oshkosh Corporation, General Dynamics Corporation, Rheinmetall AG, Elbit Systems Ltd, QinetiQ Group, AM General LLC, Leonardo S p A, BAE Systems plc, HDT Global.

3. What are the main segments of the North America Armored Fighting Vehicles Industry?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.51 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Main Battle Tanks Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: BAE Systems plc was awarded a contract worth USD 32 million by the US Department of Defense (DoD) to supply M2A4 and M7A4 Bradley fighting vehicles to the US Army. These vehicles are designed to provide mechanized infantry with improved mobility, firepower, and protection. The project is slated to be completed by August 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Armored Fighting Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Armored Fighting Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Armored Fighting Vehicles Industry?

To stay informed about further developments, trends, and reports in the North America Armored Fighting Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence