Key Insights

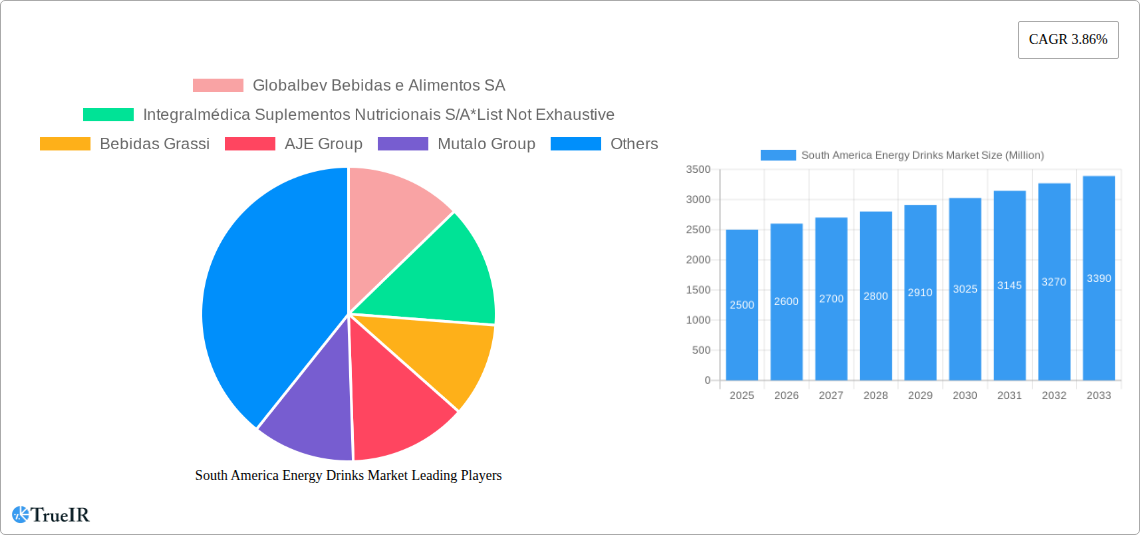

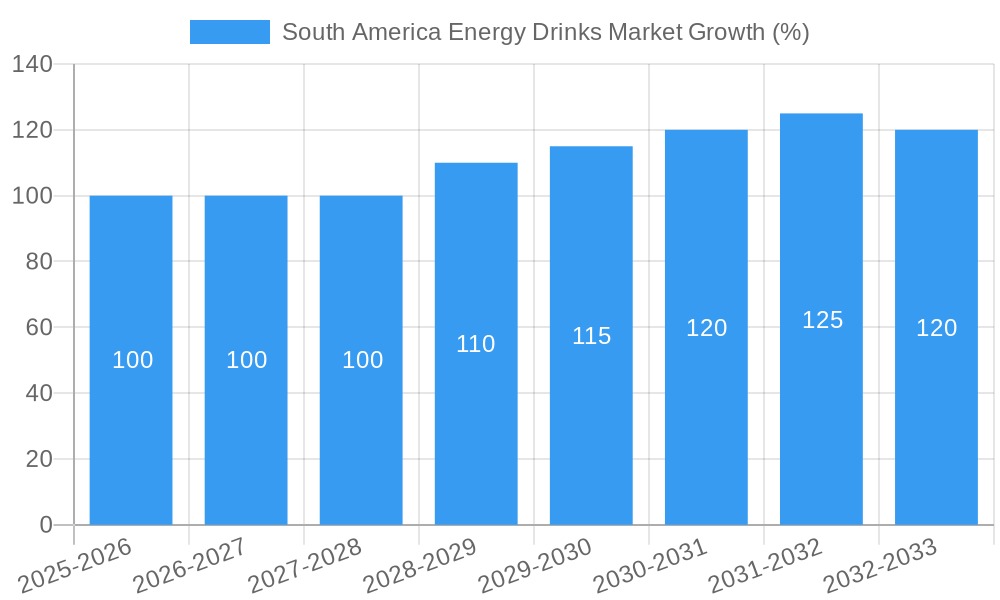

The South American energy drink market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.86% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes, particularly among young adults and urban populations across Brazil, Argentina, and the rest of South America, are driving increased consumption of energy drinks. The popularity of active lifestyles, including fitness trends and participation in sports, further contributes to demand. Furthermore, innovative product development, such as the introduction of new flavors, functional ingredients, and healthier formulations (e.g., lower sugar options), is broadening the appeal of energy drinks to a wider consumer base. The market is segmented by distribution channels (on-trade, off-trade), product type (drinks, shots, mixers), and packaging type (bottles, cans, other). The on-trade segment, encompassing restaurants, bars, and nightclubs, is expected to maintain significant market share, while the off-trade channel (retail stores, supermarkets) will also see strong growth driven by increasing consumer preference for convenience and home consumption. Competitive dynamics are shaped by established players like Coca-Cola, PepsiCo, Red Bull, and Anheuser-Busch InBev, alongside local and regional brands such as Globalbev Bebidas e Alimentos SA and AJE Group. These companies are actively engaged in marketing and distribution strategies to gain market share and cater to diverse consumer preferences.

However, the market's expansion faces certain challenges. Health concerns related to high sugar and caffeine content in traditional energy drinks represent a significant restraint. Growing consumer awareness of health and wellness is prompting many individuals to explore healthier alternatives, including functional beverages or natural energy boosters. Furthermore, fluctuating economic conditions in certain South American countries may affect consumer spending on discretionary items like energy drinks. Regulatory changes related to food and beverage labeling and marketing could also impact market growth. Despite these challenges, the long-term outlook for the South American energy drink market remains positive, driven by sustained economic growth, changing consumer preferences, and the ongoing innovation within the industry. Strategic partnerships and investments in product diversification and targeted marketing campaigns are likely to be crucial for companies aiming to capitalize on the market's potential.

This dynamic report provides a thorough analysis of the South America energy drinks market, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this rapidly evolving landscape. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. Expect detailed market sizing, segment analysis, competitive landscaping, and future projections, all underpinned by rigorous data analysis and expert insights. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

South America Energy Drinks Market Structure & Competitive Landscape

This section delves into the competitive dynamics of the South American energy drink market. We analyze market concentration, utilizing metrics such as the Herfindahl-Hirschman Index (HHI) to assess the degree of market dominance by key players. The report also examines innovation drivers, including new product launches, technological advancements in formulation and packaging, and the increasing demand for functional beverages. Regulatory impacts, such as labeling requirements and taxation policies, are assessed for their influence on market growth. Furthermore, the report explores product substitutes, such as sports drinks and functional waters, and analyzes their competitive pressure on the energy drink market. The report also details the significant M&A activity within the industry, quantifying the volume of mergers and acquisitions over the historical period (2019-2024) and projecting future trends. End-user segmentation, based on demographics, lifestyle preferences, and consumption patterns, is analyzed to determine key market segments.

- Market Concentration: The HHI for the South American energy drink market in 2024 was estimated at xx, indicating a (Highly Concentrated/ Moderately Concentrated/Fragmented) market.

- Innovation Drivers: The increasing demand for healthier and functional energy drinks, coupled with technological advancements in packaging and flavor profiles, is driving innovation.

- Regulatory Impacts: Varying regulations across South American countries create both challenges and opportunities for market players.

- M&A Activity: The volume of M&A transactions in the South American energy drinks market during 2019-2024 was xx, with a projected increase to xx during the forecast period.

South America Energy Drinks Market Trends & Opportunities

This section provides a comprehensive overview of the prevailing market trends and emerging opportunities within the South American energy drink sector. We analyze the market size and growth trajectory, presenting historical data (2019-2024) and forecasting future performance (2025-2033). Key market metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates are included. The influence of technological advancements, such as improved manufacturing processes and innovative packaging solutions, on market growth is meticulously examined. The analysis also considers the evolving consumer preferences, including the rising demand for healthier alternatives, natural ingredients, and functional benefits, impacting market demand. Furthermore, we assess the competitive landscape and the strategies adopted by key players to gain market share.

The market is experiencing a shift towards healthier options, with increased demand for low-sugar, natural ingredients, and functional benefits. Consumer preferences are heavily influencing the innovations observed in the market. Competition is fierce, particularly among established multinational corporations and regional players. The rising disposable incomes in certain South American countries are also driving growth.

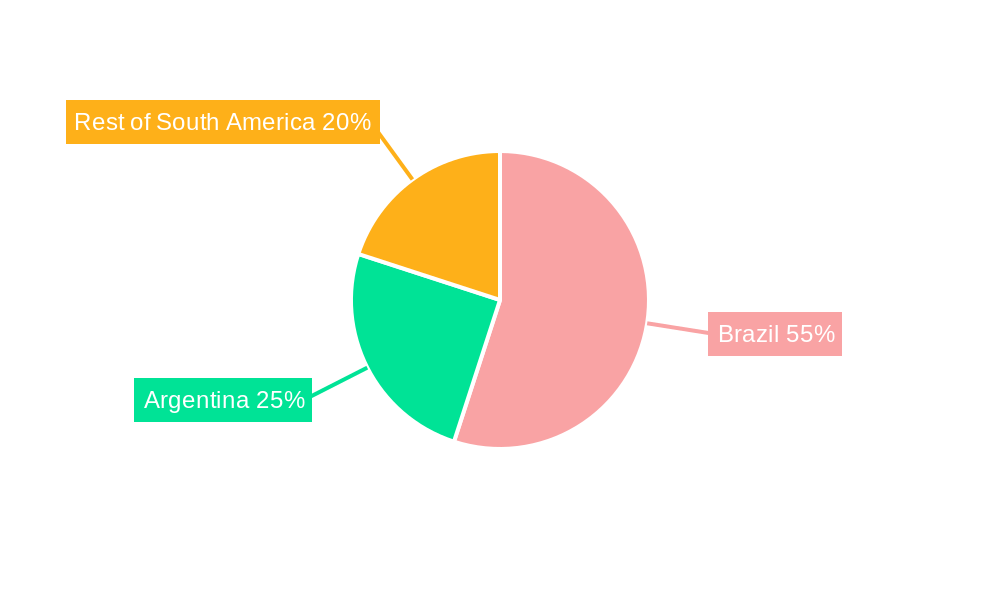

Dominant Markets & Segments in South America Energy Drinks Market

This section pinpoints the leading regions, countries, and segments within the South American energy drink market. We analyze the performance of different distribution channels (on-trade vs. off-trade), product types (drinks, shots, mixers), and packaging types (bottles, cans, other). We delve into the factors driving the growth of these dominant segments, providing granular insights for strategic decision-making.

Leading Segments:

- Distribution Channel: Off-trade (supermarkets, convenience stores) dominates due to wider accessibility.

- Product Type: Ready-to-drink energy drinks constitute the largest segment.

- Packaging Type: Cans are preferred due to portability and cost-effectiveness.

Key Growth Drivers:

- Brazil: Large population, rising disposable incomes, and a vibrant youth culture drive substantial growth.

- Mexico: High energy drink consumption per capita and an established distribution network contribute to its prominence.

- Colombia: Increasing urbanization and a growing middle class are fueling demand.

South America Energy Drinks Market Product Analysis

This report examines the range of energy drink products available in South America, analyzing their characteristics, applications, and competitive advantages. It highlights recent product innovations, such as the introduction of functional and healthier options, and assesses the impact of technological advancements in enhancing product quality, taste, and shelf life.

Key Drivers, Barriers & Challenges in South America Energy Drinks Market

Key Drivers:

The South American energy drinks market is propelled by factors such as increasing urbanization, rising disposable incomes, and a growing youth population with active lifestyles. The expanding presence of international brands is further stimulating growth. Moreover, increasing awareness of functional benefits contributes to market expansion.

Challenges and Restraints:

The market faces challenges including stringent regulatory environments, fluctuating raw material prices, and intense competition. Economic volatility in some regions and health concerns related to high sugar content also pose restraints.

Growth Drivers in the South America Energy Drinks Market Market

The market's growth is driven by factors such as rising disposable incomes, increasing urbanization, and a young, health-conscious population. The adoption of innovative marketing strategies and the introduction of new product varieties, including functional and healthier options, further stimulate the market.

Challenges Impacting South America Energy Drinks Market Growth

The market faces several challenges, including the rising costs of raw materials, stringent regulations regarding health and safety, and increasing competition from established players. Economic instability in some South American countries also poses a significant threat.

Key Players Shaping the South America Energy Drinks Market Market

- Globalbev Bebidas e Alimentos SA

- Integralmédica Suplementos Nutricionais S/A

- Bebidas Grassi

- AJE Group

- Mutalo Group

- PepsiCo Inc

- Red Bull GmbH

- The Coca-Cola Company

- Anheuser-Busch InBev SA/NV (Ambev SA)

- Grupo Petrópolis

Significant South America Energy Drinks Market Industry Milestones

- November 2022: Grupo Petrópolis launched TNT Energy Drink in 473ml and 269ml cans.

- May 2022: Monster Beverage Corporation launched various new products across South America (Argentina, Chile, Colombia, Puerto Rico).

- February 2022: Acer Inc. launched PredatorShot energy drink in Brazil.

Future Outlook for South America Energy Drinks Market Market

The South American energy drinks market is poised for continued growth, driven by expanding consumer base, rising disposable incomes, and increasing health consciousness. The market will witness increased product diversification, with a focus on functional and healthier options. Strategic partnerships and innovations in packaging and distribution will further shape market dynamics.

South America Energy Drinks Market Segmentation

-

1. Product Type

- 1.1. Drinks

- 1.2. Shots

- 1.3. Mixers

-

2. Packaging Type

- 2.1. Bottle (Pet/Glass)

- 2.2. Cans

- 2.3. Other Packaging Types

-

3. Distribution Channel

- 3.1. On-trade

-

3.2. Off-trade

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Convenience Stores

- 3.2.3. Online Retail Stores

- 3.2.4. Other Off-trade Channels

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Energy Drinks Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Energy Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Low-Sugar/Sugar-free Beverages

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated with Functional Beverages

- 3.4. Market Trends

- 3.4.1. Foodservice and E-commerce Channels Significantly Creating Shelf Space to Energy Drinks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Drinks

- 5.1.2. Shots

- 5.1.3. Mixers

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Bottle (Pet/Glass)

- 5.2.2. Cans

- 5.2.3. Other Packaging Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. On-trade

- 5.3.2. Off-trade

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Convenience Stores

- 5.3.2.3. Online Retail Stores

- 5.3.2.4. Other Off-trade Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Drinks

- 6.1.2. Shots

- 6.1.3. Mixers

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Bottle (Pet/Glass)

- 6.2.2. Cans

- 6.2.3. Other Packaging Types

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. On-trade

- 6.3.2. Off-trade

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Convenience Stores

- 6.3.2.3. Online Retail Stores

- 6.3.2.4. Other Off-trade Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Drinks

- 7.1.2. Shots

- 7.1.3. Mixers

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Bottle (Pet/Glass)

- 7.2.2. Cans

- 7.2.3. Other Packaging Types

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. On-trade

- 7.3.2. Off-trade

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Convenience Stores

- 7.3.2.3. Online Retail Stores

- 7.3.2.4. Other Off-trade Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Drinks

- 8.1.2. Shots

- 8.1.3. Mixers

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Bottle (Pet/Glass)

- 8.2.2. Cans

- 8.2.3. Other Packaging Types

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. On-trade

- 8.3.2. Off-trade

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Convenience Stores

- 8.3.2.3. Online Retail Stores

- 8.3.2.4. Other Off-trade Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Brazil South America Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Energy Drinks Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Globalbev Bebidas e Alimentos SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Integralmédica Suplementos Nutricionais S/A*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Bebidas Grassi

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AJE Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Mutalo Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PepsiCo Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Red Bull GmbH

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 The Coca-Cola Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Anheuser-Busch InBev SA/NV (Ambev SA)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Grupo Petrópolis

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Globalbev Bebidas e Alimentos SA

List of Figures

- Figure 1: South America Energy Drinks Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Energy Drinks Market Share (%) by Company 2024

List of Tables

- Table 1: South America Energy Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Energy Drinks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South America Energy Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 4: South America Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: South America Energy Drinks Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: South America Energy Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: South America Energy Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil South America Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina South America Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of South America South America Energy Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South America Energy Drinks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: South America Energy Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 13: South America Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: South America Energy Drinks Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: South America Energy Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: South America Energy Drinks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: South America Energy Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 18: South America Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: South America Energy Drinks Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: South America Energy Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: South America Energy Drinks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: South America Energy Drinks Market Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 23: South America Energy Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: South America Energy Drinks Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: South America Energy Drinks Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Energy Drinks Market?

The projected CAGR is approximately 3.86%.

2. Which companies are prominent players in the South America Energy Drinks Market?

Key companies in the market include Globalbev Bebidas e Alimentos SA, Integralmédica Suplementos Nutricionais S/A*List Not Exhaustive, Bebidas Grassi, AJE Group, Mutalo Group, PepsiCo Inc, Red Bull GmbH, The Coca-Cola Company, Anheuser-Busch InBev SA/NV (Ambev SA), Grupo Petrópolis.

3. What are the main segments of the South America Energy Drinks Market?

The market segments include Product Type, Packaging Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Low-Sugar/Sugar-free Beverages.

6. What are the notable trends driving market growth?

Foodservice and E-commerce Channels Significantly Creating Shelf Space to Energy Drinks.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated with Functional Beverages.

8. Can you provide examples of recent developments in the market?

In November 2022, Grupo Petrópolis launched a range of fruit-based energy drinks under the brand name TNT Energy Drink. The first flavor of the extended product line is Mango Summer, which consists of a mix of fruits with a high presence of mango flavor. It is available in 473ml and 269ml cans in the South American market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Energy Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Energy Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Energy Drinks Market?

To stay informed about further developments, trends, and reports in the South America Energy Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence