Key Insights

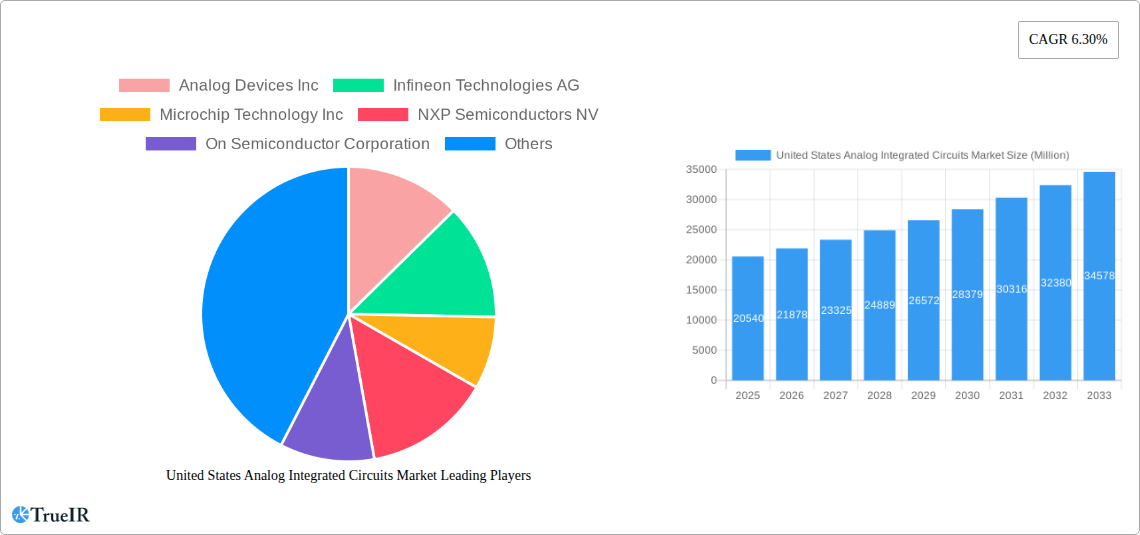

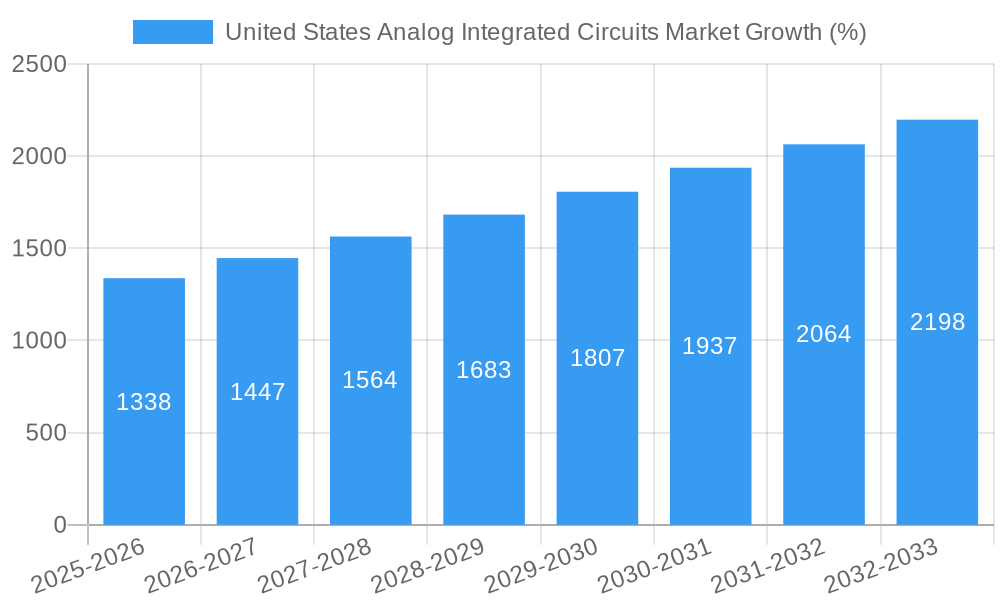

The United States analog integrated circuits (AIC) market exhibits robust growth, projected to reach \$20.54 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning automotive industry, particularly the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), demands sophisticated AICs for power management, sensor integration, and communication. Similarly, the expanding industrial automation sector, encompassing robotics and smart factories, necessitates high-performance AICs for precise control and data acquisition. The increasing adoption of 5G technology and the Internet of Things (IoT) also significantly contributes to market growth, driving demand for high-bandwidth and low-power AIC solutions. Furthermore, advancements in healthcare technology, such as wearable medical devices and advanced imaging systems, create a niche market for specialized AICs. Competitive pressures among leading manufacturers such as Analog Devices, Texas Instruments, and Infineon Technologies, stimulate innovation and price competitiveness, benefiting consumers and further propelling market expansion.

The market segmentation within the US AIC market is likely diverse, encompassing various product types (operational amplifiers, data converters, voltage regulators, etc.) and applications across different end-use sectors. While specific segment breakdowns are unavailable, it's reasonable to expect the automotive and industrial segments to hold significant market shares due to their substantial growth trajectories. Potential restraints on market growth include global economic fluctuations, supply chain disruptions, and the inherent complexity of AIC design and manufacturing. However, the continued technological advancements, particularly in silicon fabrication and design methodologies, are expected to offset these challenges and sustain the market's overall positive trajectory. The forecast period (2025-2033) promises substantial growth opportunities for manufacturers able to adapt to evolving technological demands and successfully navigate the competitive landscape.

United States Analog Integrated Circuits Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the United States analog integrated circuits market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this research explores market structure, competitive dynamics, growth drivers, challenges, and future outlook. The report leverages extensive data and analysis to provide a comprehensive understanding of this crucial technology sector. Expect detailed breakdowns of market segments, key players like Texas Instruments, Analog Devices, and Infineon Technologies, and the latest industry developments impacting growth projections.

United States Analog Integrated Circuits Market Market Structure & Competitive Landscape

The United States analog integrated circuits market exhibits a moderately concentrated structure, with a few dominant players controlling a significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated landscape. However, the market remains dynamic, fueled by continuous innovation in design, manufacturing processes, and application-specific integrated circuits (ASICs). Regulatory compliance, particularly around energy efficiency and safety standards, significantly influences market players.

- Market Concentration: The top five players account for approximately xx% of the market share in 2024.

- Innovation Drivers: Miniaturization, power efficiency improvements, and the development of advanced process nodes drive innovation.

- Regulatory Impacts: Compliance with standards like RoHS and REACH necessitates ongoing investment in materials and manufacturing processes.

- Product Substitutes: Digital signal processing (DSP) and other digital technologies pose some level of substitution, but analog ICs remain essential in many applications due to their inherent advantages in speed and power efficiency.

- End-User Segmentation: The market is segmented by applications across automotive, consumer electronics, industrial, healthcare, and telecommunications sectors.

- M&A Trends: The market has witnessed xx mergers and acquisitions in the historical period (2019-2024), with a total value of approximately $xx Million. These transactions primarily focus on strengthening product portfolios and expanding market reach.

United States Analog Integrated Circuits Market Market Trends & Opportunities

The United States analog integrated circuits market is projected to experience significant growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is driven by several factors, including the increasing demand for high-performance analog ICs in emerging applications, technological advancements leading to miniaturization and improved power efficiency, and the growing penetration of smartphones, wearables, and other consumer electronics. The automotive sector, fueled by advancements in electric vehicles (EVs) and autonomous driving, presents a particularly lucrative segment with xx% market penetration in 2024 projected to rise to xx% by 2033. The continuous miniaturization of components and increasing demand for IoT devices are also significantly impacting market expansion. Moreover, growing investments in research and development by major players are likely to further accelerate market growth.

Dominant Markets & Segments in United States Analog Integrated Circuits Market

The automotive sector represents a dominant segment, accounting for xx% of the total market revenue in 2024. The increasing adoption of advanced driver-assistance systems (ADAS) and the rising demand for electric vehicles are key drivers of growth.

- Key Growth Drivers in the Automotive Segment:

- Increasing adoption of ADAS features.

- Growing demand for electric and hybrid vehicles.

- Stringent government regulations promoting fuel efficiency and safety.

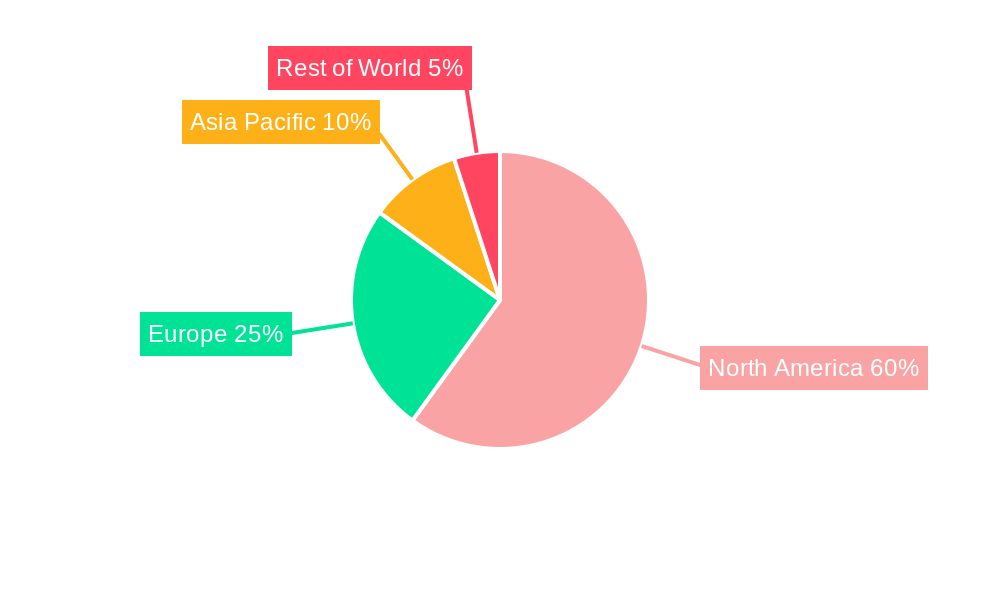

The California region currently commands the largest market share among US states due to the high concentration of technology companies and automotive manufacturers. Texas also holds a significant position due to its strong presence in the semiconductor manufacturing sector.

- Key Growth Drivers in California:

- High concentration of technology companies.

- Strong presence of major automotive manufacturers.

- Significant investments in research and development.

United States Analog Integrated Circuits Market Product Analysis

The market features a diverse range of analog integrated circuits catering to various applications. Recent innovations center around improved power efficiency, miniaturization, and enhanced performance in specific applications, such as high-frequency applications, automotive safety systems, and precision instrumentation. The competitive advantage is increasingly driven by superior process technologies, advanced packaging techniques, and strong intellectual property portfolios.

Key Drivers, Barriers & Challenges in United States Analog Integrated Circuits Market

Key Drivers: The market is primarily driven by the increasing demand for advanced electronics across various sectors, particularly automotive and industrial applications. Advancements in process technology and the emergence of new applications, such as IoT devices and wearables, further contribute to market expansion. Government initiatives promoting technological advancements and energy efficiency also play a crucial role.

Challenges: Supply chain disruptions, escalating raw material costs, and intense competition among established players pose significant challenges to market growth. Meeting stringent regulatory requirements and navigating geopolitical uncertainties also impact market dynamics. Estimated losses due to supply chain disruptions in 2022 amounted to approximately $xx Million.

Growth Drivers in the United States Analog Integrated Circuits Market Market

Technological advancements in process technology (e.g., FD-SOI), increased demand from the automotive and industrial sectors, and favorable government policies promoting domestic semiconductor manufacturing are significant growth drivers. The increasing integration of analog functions within SoCs (System on Chips) further fuels this growth.

Challenges Impacting United States Analog Integrated Circuits Market Growth

Geopolitical instability, fluctuating currency exchange rates, and skilled labor shortages impede market growth. Intense competition, particularly from Asian manufacturers, adds pressure on pricing and profitability. Supply chain vulnerabilities remain a persistent concern.

Key Players Shaping the United States Analog Integrated Circuits Market Market

- Analog Devices Inc

- Infineon Technologies AG

- Microchip Technology Inc

- NXP Semiconductors NV

- On Semiconductor Corporation

- Richtek Technology Corporation (MediaTek Inc)

- Skyworks Solutions Inc

- STMicroelectronics NV

- Texas Instruments Inc

- Renesas Electronics Corporation

- Qorvo Inc

Significant United States Analog Integrated Circuits Market Industry Milestones

- April 2024: STMicroelectronics announced a new 18 nm FD-SOI process technology with embedded phase-change memory (PCM) for next-generation embedded processing devices, enhancing reliability and performance in demanding industrial applications.

- April 2024: Infineon Technologies AG introduced its PSoC4 HVMS family of automotive microcontrollers with integrated high-voltage and advanced analog features, improving safety and efficiency in automotive applications.

Future Outlook for United States Analog Integrated Circuits Market Market

The United States analog integrated circuits market is poised for continued growth driven by technological innovation, increasing demand from key sectors, and government support for domestic semiconductor manufacturing. Strategic partnerships, investments in R&D, and expansion into emerging applications will be key factors influencing market success. The market's future trajectory hinges on addressing supply chain vulnerabilities and effectively navigating geopolitical uncertainties.

United States Analog Integrated Circuits Market Segmentation

-

1. Type

-

1.1. General-purpose IC

- 1.1.1. Interface

- 1.1.2. Power Management

- 1.1.3. Signal Conversion

- 1.1.4. Amplifiers/Comparators (Signal Conditioning)

-

1.2. Application-specific IC

-

1.2.1. Consumer

- 1.2.1.1. Audio/Video

- 1.2.1.2. Digital Still Camera and Camcorder

- 1.2.1.3. Other Consumer

-

1.2.2. Automotive

- 1.2.2.1. Infotainment

- 1.2.2.2. Other Automotive Infotainment

-

1.2.3. Communication

- 1.2.3.1. Cell Phone

- 1.2.3.2. Infrastructure

- 1.2.3.3. Wired Communication

- 1.2.3.4. Short Range

- 1.2.3.5. Other Wireless

-

1.2.4. Computer

- 1.2.4.1. Computer System and Display

- 1.2.4.2. Computer Periphery

- 1.2.4.3. Storage

- 1.2.4.4. Other Computer

- 1.2.5. Industrial and Others

-

1.2.1. Consumer

-

1.1. General-purpose IC

United States Analog Integrated Circuits Market Segmentation By Geography

- 1. United States

United States Analog Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones

- 3.2.2 Feature Phones

- 3.2.3 and Tablets; Increasing Adoption of Industrial Automation; The Growing Emphasis on Energy Efficiency Across Various Sectors

- 3.3. Market Restrains

- 3.3.1 Rising Penetration of Smartphones

- 3.3.2 Feature Phones

- 3.3.3 and Tablets; Increasing Adoption of Industrial Automation; The Growing Emphasis on Energy Efficiency Across Various Sectors

- 3.4. Market Trends

- 3.4.1. Power Management IC Segment Anticipated to Drive Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Analog Integrated Circuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General-purpose IC

- 5.1.1.1. Interface

- 5.1.1.2. Power Management

- 5.1.1.3. Signal Conversion

- 5.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 5.1.2. Application-specific IC

- 5.1.2.1. Consumer

- 5.1.2.1.1. Audio/Video

- 5.1.2.1.2. Digital Still Camera and Camcorder

- 5.1.2.1.3. Other Consumer

- 5.1.2.2. Automotive

- 5.1.2.2.1. Infotainment

- 5.1.2.2.2. Other Automotive Infotainment

- 5.1.2.3. Communication

- 5.1.2.3.1. Cell Phone

- 5.1.2.3.2. Infrastructure

- 5.1.2.3.3. Wired Communication

- 5.1.2.3.4. Short Range

- 5.1.2.3.5. Other Wireless

- 5.1.2.4. Computer

- 5.1.2.4.1. Computer System and Display

- 5.1.2.4.2. Computer Periphery

- 5.1.2.4.3. Storage

- 5.1.2.4.4. Other Computer

- 5.1.2.5. Industrial and Others

- 5.1.2.1. Consumer

- 5.1.1. General-purpose IC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Analog Devices Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microchip Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NXP Semiconductors NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 On Semiconductor Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Richtek Technology Corporation (MediaTek Inc )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Skyworks Solutions Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 STMicroelectronics NV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Texas Instruments Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Renesas Electronics Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Qorvo Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Analog Devices Inc

List of Figures

- Figure 1: United States Analog Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Analog Integrated Circuits Market Share (%) by Company 2024

List of Tables

- Table 1: United States Analog Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Analog Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United States Analog Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United States Analog Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: United States Analog Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United States Analog Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: United States Analog Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: United States Analog Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 9: United States Analog Integrated Circuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Analog Integrated Circuits Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Analog Integrated Circuits Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the United States Analog Integrated Circuits Market?

Key companies in the market include Analog Devices Inc, Infineon Technologies AG, Microchip Technology Inc, NXP Semiconductors NV, On Semiconductor Corporation, Richtek Technology Corporation (MediaTek Inc ), Skyworks Solutions Inc, STMicroelectronics NV, Texas Instruments Inc, Renesas Electronics Corporation, Qorvo Inc.

3. What are the main segments of the United States Analog Integrated Circuits Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones. Feature Phones. and Tablets; Increasing Adoption of Industrial Automation; The Growing Emphasis on Energy Efficiency Across Various Sectors.

6. What are the notable trends driving market growth?

Power Management IC Segment Anticipated to Drive Demand.

7. Are there any restraints impacting market growth?

Rising Penetration of Smartphones. Feature Phones. and Tablets; Increasing Adoption of Industrial Automation; The Growing Emphasis on Energy Efficiency Across Various Sectors.

8. Can you provide examples of recent developments in the market?

April 2024: STMicroelectronics announced a new process technology to design and build transistors for next-generation embedded processing devices. The advanced technology is based on an 18 nm fully depleted silicon on insulator (FD-SOI) process with embedded phase change memory. This is claimed to have reduced the feature size to 18 nm from 20 nm. PCM technology uses changes in the material phase to store data. It also supports 3 V operation for analog features and delivers the reliability required for demanding industrial applications like high-temperature operation, radiation hardening, and data retention capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Analog Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Analog Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Analog Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the United States Analog Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence