Key Insights

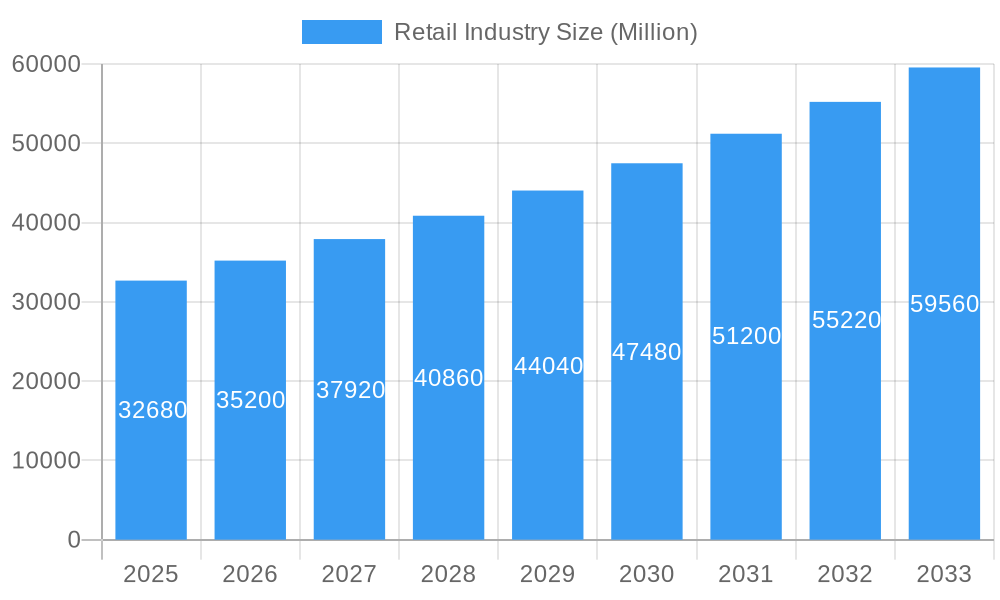

The global retail industry, valued at $32.68 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.65% from 2025 to 2033. This expansion is fueled by several key drivers. The rise of e-commerce continues to disrupt traditional brick-and-mortar models, driving innovation in online retail experiences, including personalized recommendations, seamless checkout processes, and advanced logistics. Simultaneously, consumer preferences are shifting towards omnichannel retail, demanding integrated online and offline shopping experiences. Increased disposable incomes in developing economies further contribute to market growth, opening new avenues for retail expansion. However, the industry faces challenges such as intensifying competition, rising operational costs, and the need for constant adaptation to evolving consumer demands and technological advancements. Successfully navigating these challenges will require retailers to invest in robust supply chain management, data analytics for personalized marketing, and sustainable business practices.

Retail Industry Market Size (In Billion)

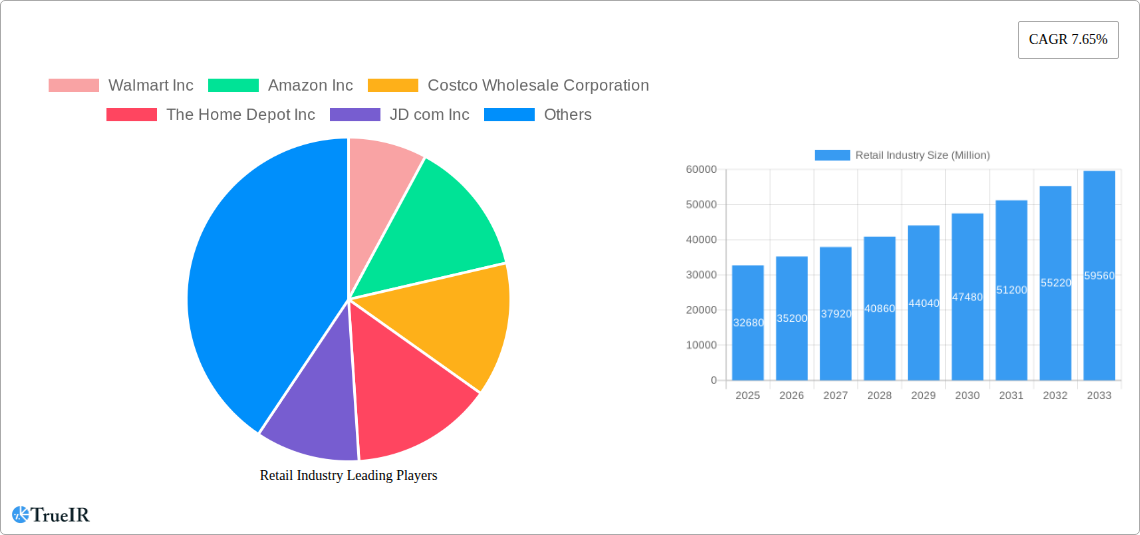

Key players like Walmart, Amazon, Costco, and others are actively competing to capture market share through strategic acquisitions, technological investments, and expansion into new markets. The industry is also seeing a significant rise in the adoption of innovative technologies like artificial intelligence (AI) for inventory management and customer service, and blockchain for supply chain transparency and security. Furthermore, the focus on sustainability and ethical sourcing is gaining traction, influencing consumer purchasing decisions and forcing retailers to adopt environmentally friendly practices. The segmentation of the retail industry, though not explicitly detailed, likely includes categories such as grocery, apparel, electronics, home improvement, and pharmaceuticals. Regional variations in market growth will depend on economic conditions, consumer behavior, and government regulations in each specific area. The forecast period of 2025-2033 promises continued transformation and growth for the retail industry, demanding agile strategies and continuous innovation from established players and newcomers alike.

Retail Industry Company Market Share

Retail Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global retail industry, projecting a market value exceeding $XX Million by 2033. Leveraging data from 2019-2024 (historical period), with 2025 as the base year and forecasting until 2033, this report offers invaluable insights for investors, industry professionals, and strategists. The study covers key players like Walmart Inc, Amazon Inc, Costco Wholesale Corporation, The Home Depot Inc, JD.com Inc, The Kroger Co, Walgreens Boots Alliance Inc, Alibaba Group Holding Limited, Target Corporation, and Lowe's Companies Inc, amongst others.

Retail Industry Market Structure & Competitive Landscape

The global retail market exhibits a complex structure characterized by both intense competition and significant consolidation. The four-firm concentration ratio, while fluctuating, has remained above xx% throughout the historical period (2019-2024), indicating a moderately concentrated market. However, the emergence of e-commerce giants and the rapid expansion of smaller, specialized retailers creates a dynamic competitive landscape.

- Innovation Drivers: Technological advancements such as AI-powered personalization, omnichannel strategies, and advanced supply chain management are driving significant innovation.

- Regulatory Impacts: Stringent data privacy regulations, evolving trade policies, and antitrust concerns are shaping the competitive dynamics and requiring significant adaptation.

- Product Substitutes: The rise of subscription services and the increasing prevalence of secondhand markets pose significant challenges to traditional retail models.

- End-User Segmentation: The market is segmented by demographics (age, income, location), shopping habits (online vs. in-store), and product categories (apparel, groceries, electronics, etc.), each presenting unique opportunities and challenges.

- M&A Trends: The retail sector has witnessed considerable M&A activity over the past five years, with an estimated $XX Million in transactions during 2019-2024, reflecting strategies for expansion, diversification, and technological integration. This trend is expected to continue, albeit with a focus on strategic acquisitions rather than consolidation.

Retail Industry Market Trends & Opportunities

The global retail market is projected to experience a CAGR of xx% from 2025 to 2033, driven by several key trends. E-commerce continues its relentless growth, exceeding xx% market penetration in several key markets by 2025. This is accompanied by the rise of mobile commerce, creating significant opportunities for retailers to reach increasingly digitally-savvy consumers. Changing consumer preferences towards sustainability and ethical sourcing are also influencing market dynamics.

Technological shifts towards AI-driven personalization, omnichannel experiences, and data analytics are revolutionizing customer engagement and optimizing operational efficiency. The competitive landscape is characterized by intense rivalry, particularly among e-commerce giants, and the emergence of disruptive business models, like subscription services and direct-to-consumer brands, requires significant strategic adaptation and innovation. Market size growth, driven by factors such as increasing disposable incomes in emerging economies and the expansion of middle class populations, is expected to remain substantial, though the pace will be influenced by macroeconomic conditions and geopolitical uncertainties.

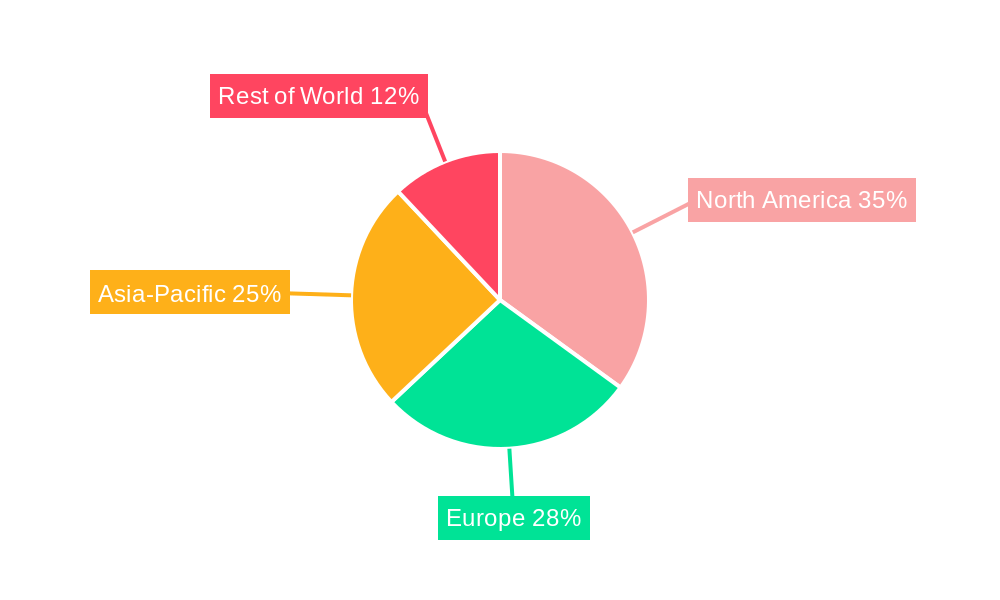

Dominant Markets & Segments in Retail Industry

The North American market maintains its position as the largest retail market globally, accounting for approximately xx% of the total market value in 2025. This dominance is largely attributable to strong consumer spending, advanced infrastructure, and a high degree of technological adoption. However, Asia-Pacific is experiencing the fastest growth, driven by rapidly expanding e-commerce and a burgeoning middle class.

Key Growth Drivers in North America:

- Strong consumer spending power.

- Well-developed logistics and infrastructure.

- High level of technological adoption and innovation.

- Established regulatory frameworks that support business growth.

Key Growth Drivers in Asia-Pacific:

- Rapidly expanding e-commerce market.

- Significant growth in middle-class population.

- Increasing disposable incomes.

- Government initiatives to support infrastructure development.

The grocery sector remains the largest segment, accounting for $XX Million in 2025, although its growth rate may moderate compared to other, faster-growing segments such as online apparel and electronics retail.

Retail Industry Product Analysis

Significant product innovations are reshaping the retail landscape. The integration of AI and machine learning enhances personalization, inventory management, and supply chain optimization. The focus on omnichannel integration allows seamless transitions between online and in-store shopping experiences, offering customers a personalized and convenient journey. Finally, the incorporation of AR/VR technologies is enhancing the customer experience by providing immersive ways to engage with products before purchase. These innovations are improving market fit by enhancing customer experience and efficiency for retailers.

Key Drivers, Barriers & Challenges in Retail Industry

Key Drivers: Technological advancements, including AI-powered personalization, omnichannel retail, and blockchain-based supply chain solutions, are primary growth drivers. Economic factors like rising disposable incomes and the expansion of the middle class in emerging markets fuel market expansion. Favorable government regulations promoting e-commerce and digitalization further accelerate industry growth.

Key Challenges: Supply chain disruptions caused by global events continue to impact retailers' operational efficiency, leading to cost increases and stock shortages. Stringent data privacy regulations increase compliance costs and complexities. Intense competition among established and emerging players puts downward pressure on margins.

Growth Drivers in the Retail Industry Market

Technological advancements, particularly in e-commerce and omnichannel strategies, continue to drive market expansion. Rising disposable incomes globally and the expansion of the middle class in emerging markets generate increased consumer spending. Supportive government policies and regulations promoting digital transformation and e-commerce contribute to market growth.

Challenges Impacting Retail Industry Growth

Supply chain disruptions, impacting logistics and inventory management, pose significant challenges. Increasing regulatory complexities related to data privacy and e-commerce compliance add operational costs. Intense competition, particularly from e-commerce giants and new entrants, leads to margin compression.

Key Players Shaping the Retail Industry Market

Significant Retail Industry Milestones

- May 2023: Walmart announced the launch of over 28 healthcare facilities in its Walmart Supercenters, providing value-based and dental care services. This diversification strategy expands Walmart's service offerings and strengthens its community presence.

- August 2023: Gucci and JD.com partnered to launch a digital flagship store on JD.com's platform, expanding Gucci's reach in the Chinese market and leveraging JD.com's extensive e-commerce infrastructure.

- October 2023: Amazon launched online shopping services in South Africa, aiding independent retailers in their growth. This demonstrates Amazon's global expansion strategy and its commitment to supporting small businesses.

Future Outlook for Retail Industry Market

The retail industry's future is bright, characterized by continued growth driven by technological innovation, evolving consumer preferences, and expanding global markets. Strategic opportunities abound for companies adapting to omnichannel strategies, leveraging data analytics for personalized experiences, and focusing on sustainability and ethical sourcing. However, navigating supply chain challenges and adapting to the constantly evolving regulatory landscape will remain crucial for success. The market is poised for significant expansion, with potential for considerable growth in emerging markets and niche sectors.

Retail Industry Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Grocery

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture and Home Decor

- 1.5. Toys, Hobby, and Household Appliances

- 1.6. Pharmaceuticals

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Retail Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Retail Industry Regional Market Share

Geographic Coverage of Retail Industry

Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Expansion of Urban Areas; Rise of E-commerce and Omnichannel Retailing

- 3.3. Market Restrains

- 3.3.1. Rapid Expansion of Urban Areas; Rise of E-commerce and Omnichannel Retailing

- 3.4. Market Trends

- 3.4.1. E-commerce is the Fastest-growing Segment in the Retail Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Grocery

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture and Home Decor

- 5.1.5. Toys, Hobby, and Household Appliances

- 5.1.6. Pharmaceuticals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Food, Beverage, and Grocery

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel, Footwear, and Accessories

- 6.1.4. Furniture and Home Decor

- 6.1.5. Toys, Hobby, and Household Appliances

- 6.1.6. Pharmaceuticals

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Food, Beverage, and Grocery

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel, Footwear, and Accessories

- 7.1.4. Furniture and Home Decor

- 7.1.5. Toys, Hobby, and Household Appliances

- 7.1.6. Pharmaceuticals

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Food, Beverage, and Grocery

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel, Footwear, and Accessories

- 8.1.4. Furniture and Home Decor

- 8.1.5. Toys, Hobby, and Household Appliances

- 8.1.6. Pharmaceuticals

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Food, Beverage, and Grocery

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel, Footwear, and Accessories

- 9.1.4. Furniture and Home Decor

- 9.1.5. Toys, Hobby, and Household Appliances

- 9.1.6. Pharmaceuticals

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Retail Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Food, Beverage, and Grocery

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel, Footwear, and Accessories

- 10.1.4. Furniture and Home Decor

- 10.1.5. Toys, Hobby, and Household Appliances

- 10.1.6. Pharmaceuticals

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Walmart Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amazon Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Costco Wholesale Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Home Depot Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JD com Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Kroger Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Walgreens Boots Alliance Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alibaba Group Holding Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Target Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lowe's Companies Inc **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Walmart Inc

List of Figures

- Figure 1: Global Retail Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Retail Industry Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Retail Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Retail Industry Volume (Trillion), by Product Type 2025 & 2033

- Figure 5: North America Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Retail Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Retail Industry Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 9: North America Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Retail Industry Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Retail Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 16: Europe Retail Industry Volume (Trillion), by Product Type 2025 & 2033

- Figure 17: Europe Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Retail Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: Europe Retail Industry Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 21: Europe Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Retail Industry Volume (Trillion), by Country 2025 & 2033

- Figure 25: Europe Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Retail Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Retail Industry Volume (Trillion), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Retail Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Retail Industry Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Retail Industry Volume (Trillion), by Country 2025 & 2033

- Figure 37: Asia Pacific Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Retail Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 40: South America Retail Industry Volume (Trillion), by Product Type 2025 & 2033

- Figure 41: South America Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: South America Retail Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: South America Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: South America Retail Industry Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 45: South America Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: South America Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: South America Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Retail Industry Volume (Trillion), by Country 2025 & 2033

- Figure 49: South America Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Retail Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Retail Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Retail Industry Volume (Trillion), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Retail Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Retail Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Retail Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Middle East and Africa Retail Industry Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 57: Middle East and Africa Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Middle East and Africa Retail Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Middle East and Africa Retail Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Retail Industry Volume (Trillion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Retail Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Retail Industry Volume Trillion Forecast, by Product Type 2020 & 2033

- Table 3: Global Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Retail Industry Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Retail Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Retail Industry Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Retail Industry Volume Trillion Forecast, by Product Type 2020 & 2033

- Table 9: Global Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Retail Industry Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Retail Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Rest of North America Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Retail Industry Volume Trillion Forecast, by Product Type 2020 & 2033

- Table 21: Global Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Retail Industry Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Retail Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Germany Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: France Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Russia Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: Italy Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Spain Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Spain Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Rest of Europe Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Europe Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Global Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Retail Industry Volume Trillion Forecast, by Product Type 2020 & 2033

- Table 41: Global Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Retail Industry Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Retail Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 45: India Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: India Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: China Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: China Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Japan Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Japan Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Australia Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Australia Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 56: Global Retail Industry Volume Trillion Forecast, by Product Type 2020 & 2033

- Table 57: Global Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Retail Industry Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Retail Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Brazil Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Brazil Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Argentina Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Argentina Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: Global Retail Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 68: Global Retail Industry Volume Trillion Forecast, by Product Type 2020 & 2033

- Table 69: Global Retail Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 70: Global Retail Industry Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 71: Global Retail Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Retail Industry Volume Trillion Forecast, by Country 2020 & 2033

- Table 73: United Arab Emirates Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: United Arab Emirates Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 75: South Africa Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: South Africa Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 77: Rest of Middle East and Africa Retail Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of Middle East and Africa Retail Industry Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Industry?

The projected CAGR is approximately 7.65%.

2. Which companies are prominent players in the Retail Industry?

Key companies in the market include Walmart Inc, Amazon Inc, Costco Wholesale Corporation, The Home Depot Inc, JD com Inc, The Kroger Co, Walgreens Boots Alliance Inc, Alibaba Group Holding Limited, Target Corporation, Lowe's Companies Inc **List Not Exhaustive.

3. What are the main segments of the Retail Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Expansion of Urban Areas; Rise of E-commerce and Omnichannel Retailing.

6. What are the notable trends driving market growth?

E-commerce is the Fastest-growing Segment in the Retail Industry.

7. Are there any restraints impacting market growth?

Rapid Expansion of Urban Areas; Rise of E-commerce and Omnichannel Retailing.

8. Can you provide examples of recent developments in the market?

October 2023: Amazon announced that it provides online shopping services in South Africa to assist independent retailers in starting, expanding, and growing their enterprises.August 2023: Italian luxury fashion brand Gucci and Chinese e-commerce giant JD.com, popularly known as Jingdong, have partnered digitally. With the launch of a new digital flagship shop on the e-commerce retailer's platform, the partnership will reach a significant milestone.May 2023: Walmart announced the launch of over 28 healthcare facilities in its Walmart Supercenters, providing value-based and dental care services, among others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Industry?

To stay informed about further developments, trends, and reports in the Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence