Key Insights

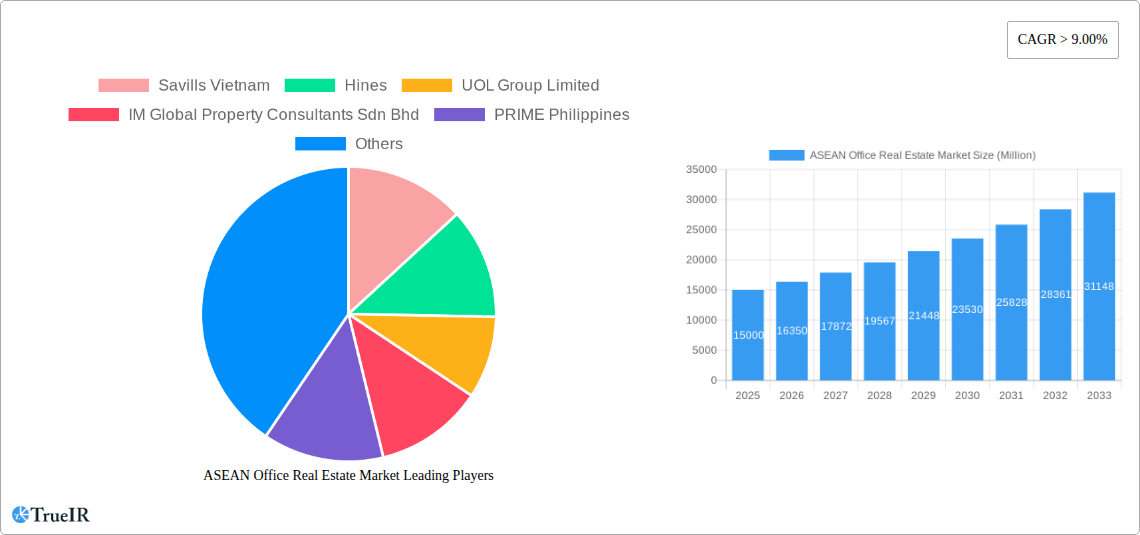

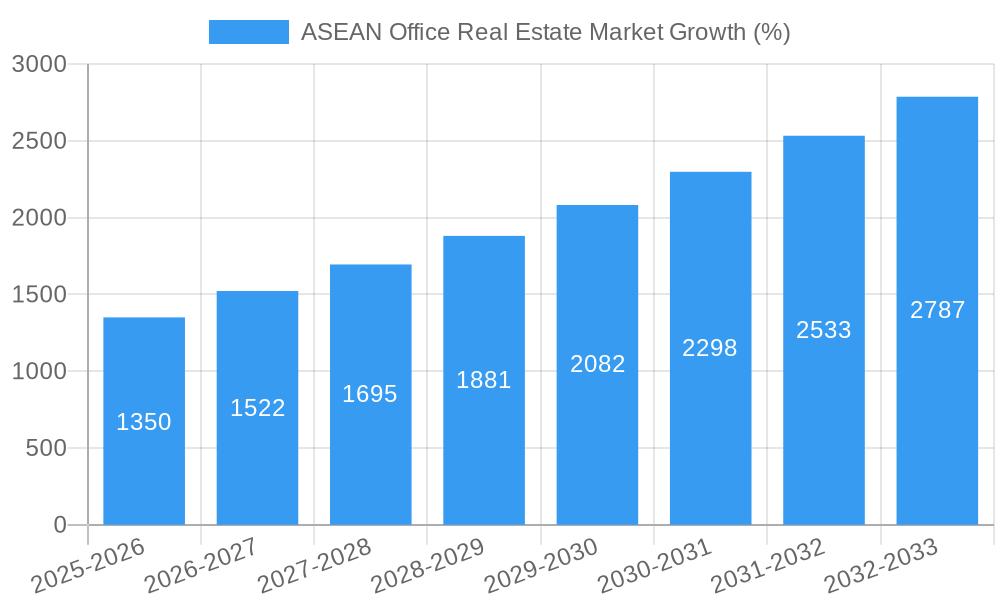

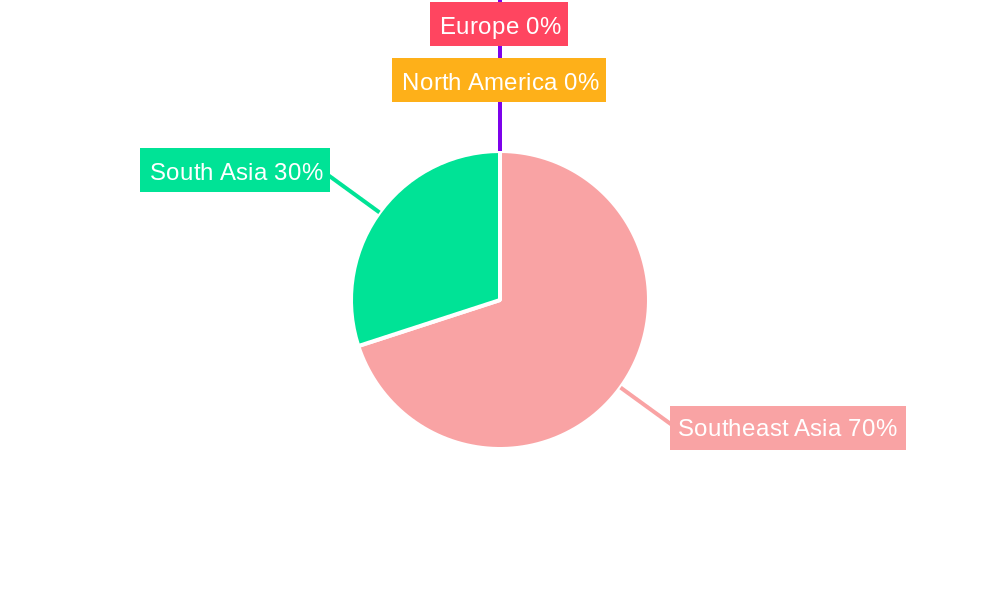

The ASEAN office real estate market is experiencing robust growth, driven by a burgeoning middle class, increasing urbanization, and the expansion of multinational corporations and SMEs across Southeast and South Asia. The market's Compound Annual Growth Rate (CAGR) exceeding 9% from 2019-2024 indicates a significant upward trajectory. This growth is fueled by strong demand from various end-users, including corporate offices, SMEs, and government agencies, particularly in Grade A and B office spaces which command higher rents due to their superior amenities and locations. Prime locations in major cities like Singapore, Bangkok, Jakarta, and Kuala Lumpur are witnessing intense competition for high-quality office space, driving rental rates higher. The market is segmented geographically into Southeast Asia and South Asia, with Southeast Asia currently holding a larger market share due to its more advanced infrastructure and established business ecosystems. However, South Asia's rapidly developing economies offer significant potential for future growth.

Despite the positive outlook, the market faces certain constraints. These include the potential impact of global economic uncertainties, competition from co-working spaces, and challenges related to infrastructure development in some regions. Furthermore, the market is subject to fluctuations in government policies and regulations. Nevertheless, the long-term outlook remains optimistic, driven by sustained economic growth, ongoing infrastructure improvements, and the increasing preference for modern, efficient office spaces. Key players such as Savills Vietnam, Hines, UOL Group Limited, and CBRE Vietnam are actively shaping the market landscape through development, leasing, and property management services. The market is projected to continue its expansion throughout the forecast period (2025-2033), with opportunities for further growth in emerging markets within the region. A strategic focus on sustainable and technologically advanced office spaces will be crucial for developers to attract tenants and remain competitive.

ASEAN Office Real Estate Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the ASEAN office real estate market, offering invaluable insights for investors, developers, and industry professionals. With a comprehensive analysis spanning the period from 2019 to 2033, including a detailed forecast from 2025 to 2033, this report leverages robust data and expert analysis to illuminate market trends, opportunities, and challenges. The base year for this report is 2025 and the study period is 2019-2033. The historical period is 2019-2024 and the forecast period is 2025-2033. The report includes data on Grade A, Grade B, and Grade C office spaces across Southeast Asia and South Asia, analyzing various end-users, including corporate offices, SMEs, and government agencies. The total market size in 2025 is estimated to be xx Million USD.

ASEAN Office Real Estate Market Market Structure & Competitive Landscape

The ASEAN office real estate market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of approximately xx in 2024. Key players such as Savills Vietnam, Hines, UOL Group Limited, and CBRE Vietnam exert significant influence, though the market is characterized by both local and international players, making it a dynamic competitive landscape.

Market Concentration:

- High concentration in major cities like Singapore, Jakarta, and Bangkok.

- Moderate concentration in secondary cities.

- Increasing presence of international players driving competition.

Innovation Drivers:

- Technological advancements in building management systems (BMS) and smart office technologies.

- Sustainable building designs and green certifications gaining traction.

- Focus on enhancing tenant experience through amenities and flexible workspaces.

Regulatory Impacts:

- Varying regulations across ASEAN countries impacting development and investment decisions.

- Government incentives and policies aimed at attracting foreign investment in specific locations.

- Building codes and zoning regulations influencing design and construction standards.

Product Substitutes:

- Co-working spaces and flexible office solutions pose a growing challenge.

- Remote work models present a long-term structural shift in demand.

- Technological advancements impacting office space requirements.

End-User Segmentation:

- Corporate offices remain the dominant segment, representing roughly xx% of total demand.

- SME offices are a significant growth area.

- Government agencies contribute a stable but less dynamic portion of the market.

M&A Trends:

- M&A activity has seen a moderate increase in recent years, with a total volume of approximately xx Million USD in transactions in 2024.

- Consolidation among smaller players is expected to continue.

- Strategic partnerships and joint ventures are becoming increasingly common.

ASEAN Office Real Estate Market Market Trends & Opportunities

The ASEAN office real estate market is experiencing significant growth, driven by robust economic expansion across the region. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%, with a market penetration rate for Grade A office space reaching xx% by 2033. Several factors are contributing to this growth, including urbanization, population growth, and increased foreign direct investment (FDI). Technological advancements, particularly in smart building technologies and flexible workspaces, are also driving demand. Shifting consumer preferences towards sustainable and technologically advanced office spaces present significant opportunities for developers. Increased competition among developers is pushing innovation and the development of high-quality, differentiated products. However, challenges such as economic volatility, political instability, and supply chain disruptions could dampen growth in certain areas.

Dominant Markets & Segments in ASEAN Office Real Estate Market

- Leading Region: Southeast Asia dominates the market due to higher economic growth and urbanization rates. Singapore, Jakarta, and Bangkok are the leading cities.

- Leading Country: Singapore maintains its position as the dominant market in terms of Grade A office space, followed by Jakarta and Bangkok.

- Leading Segment (By Type): Grade A offices continue to command the highest rental rates and attract premium tenants.

- Leading Segment (By Location): Major metropolitan areas within Southeast Asia (Singapore, Jakarta, Bangkok, Kuala Lumpur, Ho Chi Minh City) have the highest concentration of modern office space and demand.

- Leading Segment (By End-User): Corporate offices make up the largest share of demand.

Key Growth Drivers:

- Infrastructure Development: Significant investments in transportation, utilities, and communication infrastructure are improving business environments and attracting investment.

- Government Policies: Supportive government policies aimed at encouraging foreign investment and fostering economic growth are facilitating market expansion.

- Economic Growth: Sustained economic growth in many ASEAN countries is driving demand for office space.

- Urbanization: Rapid urbanization leads to increased demand for commercial real estate, including office space.

ASEAN Office Real Estate Market Product Analysis

The ASEAN office real estate market showcases a diverse range of products, from traditional Grade A office towers to modern, flexible workspaces incorporating smart building technologies. Key innovations include building management systems that optimize energy efficiency and enhance tenant experience, integration of sustainability features to meet growing environmental consciousness, and the provision of flexible, adaptable spaces to cater to the evolving needs of businesses. The market is characterized by a shift towards creating spaces that enhance productivity, collaboration, and wellbeing, emphasizing functionality, aesthetics, and technological integration for a competitive advantage.

Key Drivers, Barriers & Challenges in ASEAN Office Real Estate Market

Key Drivers:

- Strong economic growth: The robust economic performance of many ASEAN nations fuels demand for office space.

- Rapid urbanization: The ongoing migration from rural areas to cities drives substantial demand.

- Foreign direct investment: Growing FDI infuses capital and creates a need for modern office infrastructure.

- Technological advancements: Smart building technology and flexible workspace solutions are enhancing attractiveness.

Key Challenges and Restraints:

- Geopolitical risks: Regional political instability can deter investment and hinder development.

- Supply chain disruptions: Global supply chain issues can impact construction timelines and costs.

- Competition: The intensifying competition among developers puts downward pressure on margins.

- Regulatory hurdles: Inconsistent regulations and bureaucratic processes across the region create uncertainty. These complexities can add to project development times and costs, negatively impacting market growth by an estimated xx% in certain markets.

Growth Drivers in the ASEAN Office Real Estate Market Market

The ASEAN office real estate market's growth is fueled by strong economic expansion, rapid urbanization, and increased foreign direct investment. Technological advancements, particularly in smart building technologies and flexible workspaces, are creating new opportunities. Government initiatives to improve infrastructure and attract investment also play a significant role. The increasing preference for sustainable and technologically advanced office spaces presents further growth potential.

Challenges Impacting ASEAN Office Real Estate Market Growth

Significant challenges include economic volatility, political instability, and potential supply chain disruptions. Regulatory complexities and bureaucratic processes can hinder development, while intense competition among developers creates pricing pressure. The impact of remote work models on demand for traditional office spaces also poses a medium-term challenge.

Key Players Shaping the ASEAN Office Real Estate Market Market

- Savills Vietnam

- Hines

- UOL Group Limited

- IM Global Property Consultants Sdn Bhd

- PRIME Philippines

- Frasers Property

- City Developments Limited

- PT Ciputra Development Tbk

- CBRE Vietnam

- Malton Berhad

Significant ASEAN Office Real Estate Market Industry Milestones

- September 2022: Ciputra International inaugurated the Propan Tower in Jakarta, a 17-floor project within a 7.4-hectare development comprising 10 buildings (6 offices, 3 apartments, 1 hotel), highlighting the strong demand for office space in the Indonesian market.

- February 2022: Hulic's acquisition of Trust Beneficiary Rights in the Shintomicho Building in Tokyo (USD 25.4 Million) signals continued investment interest from international players in prime office assets, even outside the ASEAN region, indicating investor confidence in similar properties in the ASEAN market.

Future Outlook for ASEAN Office Real Estate Market Market

The ASEAN office real estate market is poised for sustained growth driven by continued economic expansion, urbanization, and technological advancements. Strategic opportunities exist in developing sustainable, technologically advanced, and flexible office spaces to cater to evolving business needs. The market presents significant potential for investors and developers, with a positive outlook for the foreseeable future, although cautious monitoring of global economic conditions remains important.

ASEAN Office Real Estate Market Segmentation

-

1. Geography

- 1.1. Singapore

- 1.2. Thailand

- 1.3. Vietnam

- 1.4. Indonesia

- 1.5. Malaysia

- 1.6. Philippines

- 1.7. Rest of ASEAN

ASEAN Office Real Estate Market Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Vietnam

- 4. Indonesia

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 9.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Demand for Co-Working Spaces Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Singapore

- 5.1.2. Thailand

- 5.1.3. Vietnam

- 5.1.4. Indonesia

- 5.1.5. Malaysia

- 5.1.6. Philippines

- 5.1.7. Rest of ASEAN

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Vietnam

- 5.2.4. Indonesia

- 5.2.5. Malaysia

- 5.2.6. Philippines

- 5.2.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Singapore ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Singapore

- 6.1.2. Thailand

- 6.1.3. Vietnam

- 6.1.4. Indonesia

- 6.1.5. Malaysia

- 6.1.6. Philippines

- 6.1.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Thailand ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Singapore

- 7.1.2. Thailand

- 7.1.3. Vietnam

- 7.1.4. Indonesia

- 7.1.5. Malaysia

- 7.1.6. Philippines

- 7.1.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Vietnam ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Singapore

- 8.1.2. Thailand

- 8.1.3. Vietnam

- 8.1.4. Indonesia

- 8.1.5. Malaysia

- 8.1.6. Philippines

- 8.1.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Indonesia ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Singapore

- 9.1.2. Thailand

- 9.1.3. Vietnam

- 9.1.4. Indonesia

- 9.1.5. Malaysia

- 9.1.6. Philippines

- 9.1.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Malaysia ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Singapore

- 10.1.2. Thailand

- 10.1.3. Vietnam

- 10.1.4. Indonesia

- 10.1.5. Malaysia

- 10.1.6. Philippines

- 10.1.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Philippines ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Singapore

- 11.1.2. Thailand

- 11.1.3. Vietnam

- 11.1.4. Indonesia

- 11.1.5. Malaysia

- 11.1.6. Philippines

- 11.1.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Rest of ASEAN ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Singapore

- 12.1.2. Thailand

- 12.1.3. Vietnam

- 12.1.4. Indonesia

- 12.1.5. Malaysia

- 12.1.6. Philippines

- 12.1.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. North America ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United States

- 13.1.2 Canada

- 13.1.3 Mexico

- 14. South America ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Europe ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Germany

- 15.1.2 France

- 15.1.3 Italy

- 15.1.4 United Kingdom

- 15.1.5 Netherlands

- 15.1.6 Rest of Europe

- 16. Asia Pacific ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 China

- 16.1.2 India

- 16.1.3 Japan

- 16.1.4 Australia

- 16.1.5 Rest of Asia Pacific

- 17. Middle East & Africa ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 UAE

- 17.1.2 South Africa

- 17.1.3 Saudi Arabia

- 17.1.4 Rest of MEA

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Savills Vietnam

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Hines

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 UOL Group Limited

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 IM Global Property Consultants Sdn Bhd

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 PRIME Philippines

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Frasers Property

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 City Developments Limited

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 PT Ciputra Development Tbk

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 CBRE Vietnam

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Malton Berhad

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Savills Vietnam

List of Figures

- Figure 1: Global ASEAN Office Real Estate Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 5: South America ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East & Africa ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East & Africa ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Singapore ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 13: Singapore ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 14: Singapore ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Singapore ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Thailand ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 17: Thailand ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 18: Thailand ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Thailand ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Vietnam ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 21: Vietnam ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 22: Vietnam ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Vietnam ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Indonesia ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 25: Indonesia ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 26: Indonesia ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Indonesia ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Malaysia ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 29: Malaysia ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 30: Malaysia ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Malaysia ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Philippines ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 33: Philippines ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 34: Philippines ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Philippines ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Rest of ASEAN ASEAN Office Real Estate Market Revenue (Million), by Geography 2024 & 2032

- Figure 37: Rest of ASEAN ASEAN Office Real Estate Market Revenue Share (%), by Geography 2024 & 2032

- Figure 38: Rest of ASEAN ASEAN Office Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 39: Rest of ASEAN ASEAN Office Real Estate Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 3: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of South America ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherlands ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: UAE ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Saudi Arabia ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of MEA ASEAN Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 35: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 41: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 43: Global ASEAN Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Office Real Estate Market?

The projected CAGR is approximately > 9.00%.

2. Which companies are prominent players in the ASEAN Office Real Estate Market?

Key companies in the market include Savills Vietnam, Hines, UOL Group Limited, IM Global Property Consultants Sdn Bhd, PRIME Philippines, Frasers Property, City Developments Limited, PT Ciputra Development Tbk, CBRE Vietnam, Malton Berhad.

3. What are the main segments of the ASEAN Office Real Estate Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Demand for Co-Working Spaces Driving the Market.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

September 2022 - Ciputra International (a real estate company), inaugurated the Propan Tower. This project has 17 floors and is spread across 7.4 hectares, consisting of 10 buildings, 6 offices, 3 apartments, and 1 hotel. The project was developed to meet the increasing demand for office space in Jakarta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Office Real Estate Market?

To stay informed about further developments, trends, and reports in the ASEAN Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence