Key Insights

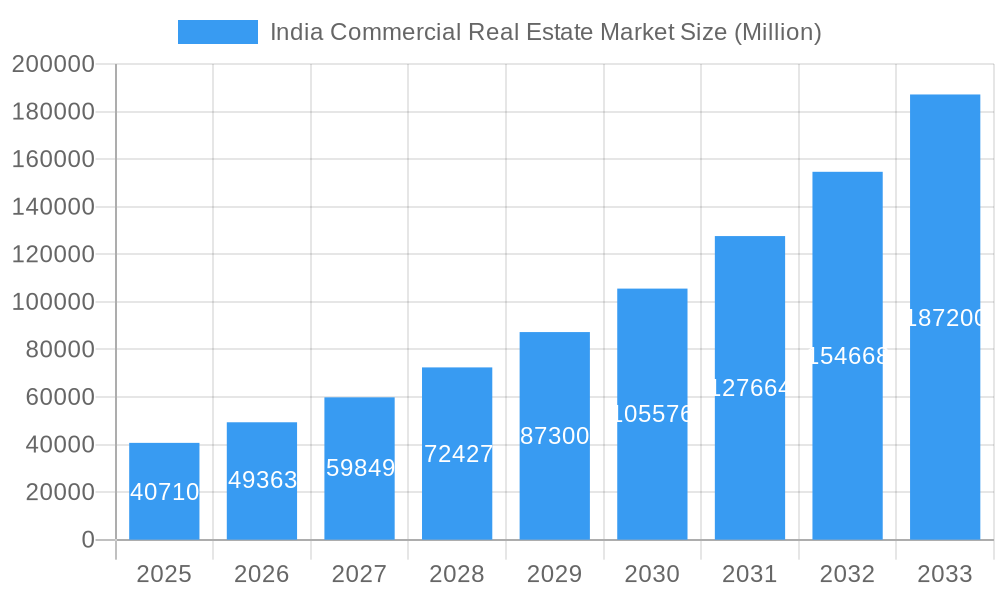

The India commercial real estate market is experiencing robust growth, projected to reach a market size of $40.71 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 21.10%. This expansion is fueled by several key factors. Increased urbanization and a burgeoning middle class are driving demand for office spaces, particularly in major metropolitan areas like Mumbai, Bangalore, Delhi, and Hyderabad. The rise of e-commerce and logistics is significantly boosting the industrial and logistics sector, leading to increased warehousing and distribution center development. Furthermore, a growing tourism sector and rising disposable incomes are contributing to the growth of the hospitality segment. The market is segmented by key cities and property types (offices, retail, industrial & logistics, hospitality), reflecting diverse investment opportunities. While challenges exist, such as regulatory hurdles and infrastructure limitations in certain regions, the overall market outlook remains positive, driven by long-term economic growth and favorable government policies promoting infrastructure development.

India Commercial Real Estate Market Market Size (In Billion)

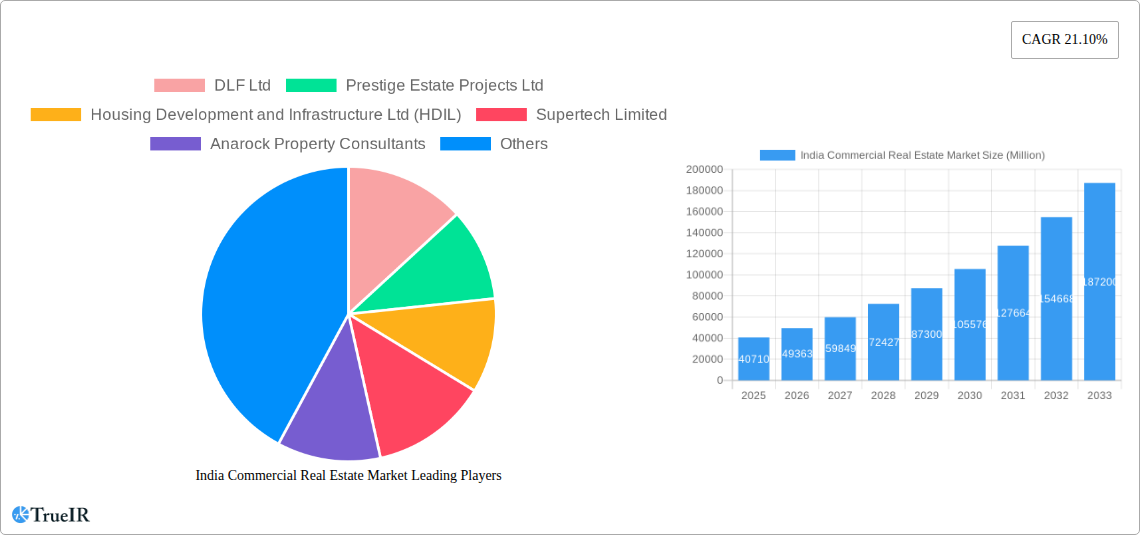

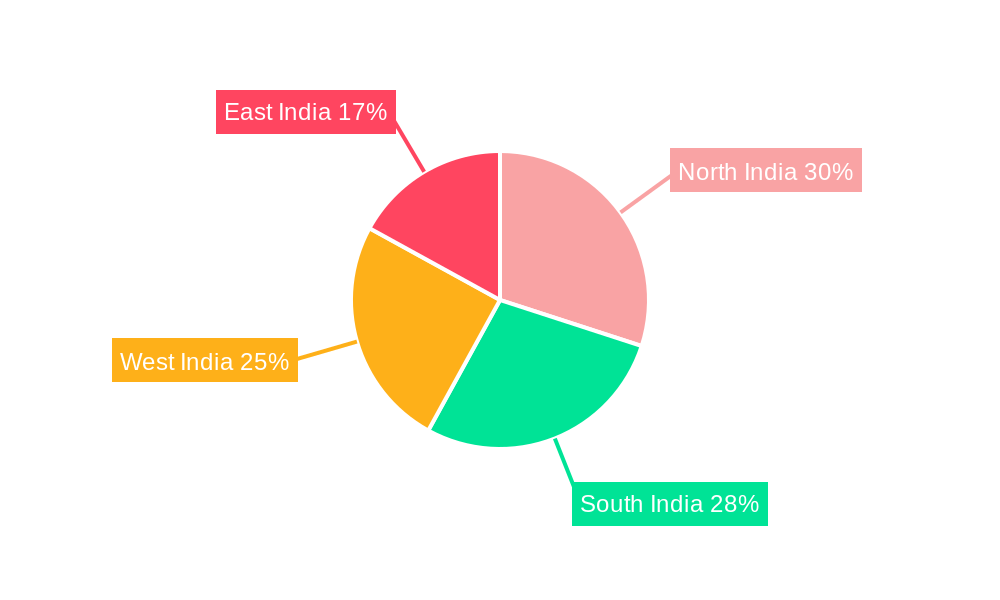

The major players in this dynamic market include established developers like DLF Ltd, Prestige Estate Projects Ltd, and Godrej Properties Ltd, alongside significant real estate agencies such as Anarock Property Consultants, 99 Acres, JLL India, and RE/MAX India. The competitive landscape is further shaped by numerous startups and associations. The market's regional distribution shows significant concentration in major metropolitan areas, although the government's initiatives aimed at improving infrastructure in other regions could lead to more balanced growth in the coming years. The forecast period (2025-2033) suggests continued expansion, driven by sustained economic growth and increasing foreign direct investment in the Indian commercial real estate sector. Understanding the nuances of each segment and region is critical for successful investment and market participation.

India Commercial Real Estate Market Company Market Share

India Commercial Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Commercial Real Estate Market, covering the period 2019-2033, with a focus on the estimated year 2025. It offers invaluable insights into market trends, competitive dynamics, and future growth potential, making it an essential resource for investors, developers, and industry professionals. The report utilizes a robust methodology, incorporating both historical data (2019-2024) and projections (2025-2033), to present a clear and actionable view of this dynamic market. The total market size is projected to reach xx Million by 2033, showcasing significant growth opportunities.

India Commercial Real Estate Market Structure & Competitive Landscape

The Indian commercial real estate market is characterized by a moderately concentrated landscape, with a few large players like DLF Ltd, Prestige Estate Projects Ltd, and Oberoi Realty dominating specific segments. However, the market also exhibits significant fragmentation, particularly in the retail and hospitality sectors, with numerous smaller players and startups competing for market share. The concentration ratio (CR4) for the office segment is estimated at xx%, indicating moderate market concentration. Innovation is primarily driven by technological advancements, such as smart building technologies and proptech solutions, which are enhancing efficiency and attracting investors. Regulatory frameworks, including zoning regulations and environmental laws, significantly impact market dynamics. The increasing adoption of sustainable building practices is a notable trend. M&A activity has been relatively robust in recent years, with a total transaction value of approximately xx Million in the period 2019-2024. Key M&A drivers include market consolidation, expansion into new segments, and access to technology and capital. End-user segmentation is diverse, encompassing large corporations, SMEs, retail chains, and hospitality groups.

India Commercial Real Estate Market Market Trends & Opportunities

The Indian commercial real estate market is experiencing robust growth, driven by rapid urbanization, economic expansion, and rising demand for modern office spaces, retail outlets, and logistics facilities. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Technological advancements, such as the integration of IoT and AI in building management systems, are transforming the industry. Consumer preferences are shifting towards sustainable and technologically advanced spaces, increasing demand for green buildings and smart offices. Competitive dynamics are intense, with established players facing increasing competition from new entrants and disruptive technologies. Market penetration rates for green building certifications are increasing steadily, indicating a growing emphasis on sustainability. The rising adoption of flexible workspaces and co-working spaces is altering the office market landscape, while e-commerce growth is driving demand for warehousing and logistics facilities.

Dominant Markets & Segments in India Commercial Real Estate Market

Leading Cities: Mumbai, Bangalore, and Delhi continue to dominate the commercial real estate market in India. Mumbai's strong financial sector and robust corporate presence drive high demand for office space, while Bangalore's thriving IT sector fuels the growth of office and retail segments. Delhi's established commercial districts and government institutions contribute to significant activity. Hyderabad is also emerging as a key player due to its growing IT and pharmaceutical sectors.

Dominant Segment: The office segment holds the largest market share, followed by retail and industrial & logistics. Mumbai and Bangalore lead in the office market due to robust corporate presence and IT sector concentration respectively. Retail is experiencing growth in major metropolitan areas fueled by rising disposable incomes and changing consumption patterns. The industrial and logistics sector is growing steadily, driven by e-commerce expansion and improvement in infrastructure.

Growth Drivers:

- Robust infrastructure development initiatives.

- Favorable government policies and incentives promoting real estate investment.

- Rising foreign direct investment (FDI) in the commercial real estate sector.

- Growing urbanization and population migration to metropolitan areas.

- Expansion of technology and e-commerce sectors.

India Commercial Real Estate Market Product Analysis

Product innovations in the Indian commercial real estate market are primarily focused on enhancing energy efficiency, improving security, and integrating smart technologies. These include smart building management systems, renewable energy solutions, and advanced security systems. The market is seeing increasing adoption of green building certifications, highlighting a shift towards sustainable practices. The competitive advantage lies in offering technologically advanced and environmentally friendly spaces that cater to evolving user preferences.

Key Drivers, Barriers & Challenges in India Commercial Real Estate Market

Key Drivers: Rapid urbanization, rising disposable incomes, technological advancements (e.g., smart building technologies), and supportive government policies (e.g., tax incentives for green buildings) are driving market growth. The expansion of e-commerce and the increasing demand for efficient logistics infrastructure also contribute significantly.

Key Challenges: Regulatory complexities, including land acquisition procedures and bureaucratic hurdles, pose significant challenges. Supply chain disruptions and fluctuations in construction material prices impact project timelines and costs. Intense competition and fluctuating interest rates also impact market dynamics. The impact of these challenges is estimated to reduce overall market growth by approximately xx% over the forecast period.

Growth Drivers in the India Commercial Real Estate Market Market

The Indian commercial real estate market is fueled by rapid urbanization, increasing demand from the IT and BFSI sectors, and significant infrastructure development. Government policies promoting real estate investment and a growing middle class further fuel market growth. Technological advancements, including smart building technologies, are enhancing efficiency and attracting investment.

Challenges Impacting India Commercial Real Estate Market Growth

Key challenges include land acquisition complexities, regulatory hurdles, and infrastructure gaps in certain regions. Fluctuating construction material prices, environmental concerns, and financing constraints also impact growth. These challenges hinder timely project completion and impact overall market expansion.

Key Players Shaping the India Commercial Real Estate Market Market

- DLF Ltd

- Prestige Estate Projects Ltd

- Housing Development and Infrastructure Ltd (HDIL)

- Supertech Limited

- Anarock Property Consultants

- 99 Acres

- Oberoi Realty

- Sulekha Properties

- Godrej Properties Ltd

- Unitech Real Estate Pvt Ltd

- 6 3 Other Companies (Real Estate Agencies Startups Associations Etc )

- Brigade Group

- JLL India

- IndiaBulls Real Estate

- RE/MAX India

- MagicBricks

- HDIL Ltd

- Awfis

Significant India Commercial Real Estate Market Industry Milestones

- 2020: Government initiatives to streamline regulatory processes for real estate projects.

- 2021: Increased adoption of green building certifications by developers.

- 2022: Launch of several large-scale commercial real estate projects in major cities.

- 2023: Significant investments in proptech startups.

- 2024: Increased focus on sustainable and smart building technologies.

Future Outlook for India Commercial Real Estate Market Market

The Indian commercial real estate market is poised for continued growth, driven by sustained economic expansion, increasing urbanization, and rising demand from diverse sectors. Strategic opportunities exist in developing sustainable and technologically advanced spaces. The market's potential is substantial, with significant growth expected in Tier-II and Tier-III cities. The increasing adoption of flexible workspaces and the growing popularity of e-commerce are expected to drive demand for specialized commercial spaces in the coming years.

India Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

-

2. Key Cities

- 2.1. Mumbai

- 2.2. Bangalore

- 2.3. Delhi

- 2.4. Hyderabad

- 2.5. Other Cities

India Commercial Real Estate Market Segmentation By Geography

- 1. India

India Commercial Real Estate Market Regional Market Share

Geographic Coverage of India Commercial Real Estate Market

India Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 3.3. Market Restrains

- 3.3.1. Availability of Financing

- 3.4. Market Trends

- 3.4.1. Office space demand to propel the market in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Mumbai

- 5.2.2. Bangalore

- 5.2.3. Delhi

- 5.2.4. Hyderabad

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DLF Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prestige Estate Projects Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Housing Development and Infrastructure Ltd (HDIL)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Supertech Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anarock Property Consultants

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 99 Acres

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oberoi Realty

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sulekha Properties

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Godrej Properties Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Unitech Real Estate Pvt Ltd*6 3 Other Companies (Real Estate Agencies Startups Associations Etc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Brigade Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 JLL India

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 IndiaBulls Real Estate

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 RE/MAX India

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 MagicBricks

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 HDIL Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Awfis

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 DLF Ltd

List of Figures

- Figure 1: India Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Commercial Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: India Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: India Commercial Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Commercial Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: India Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: India Commercial Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Commercial Real Estate Market?

The projected CAGR is approximately 21.10%.

2. Which companies are prominent players in the India Commercial Real Estate Market?

Key companies in the market include DLF Ltd, Prestige Estate Projects Ltd, Housing Development and Infrastructure Ltd (HDIL), Supertech Limited, Anarock Property Consultants, 99 Acres, Oberoi Realty, Sulekha Properties, Godrej Properties Ltd, Unitech Real Estate Pvt Ltd*6 3 Other Companies (Real Estate Agencies Startups Associations Etc ), Brigade Group, JLL India, IndiaBulls Real Estate, RE/MAX India, MagicBricks, HDIL Ltd, Awfis.

3. What are the main segments of the India Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing need for contemporary office spaces; Urban and semi-urban lodging are acting as other significant growth-inducing factors.

6. What are the notable trends driving market growth?

Office space demand to propel the market in India.

7. Are there any restraints impacting market growth?

Availability of Financing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the India Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence