Key Insights

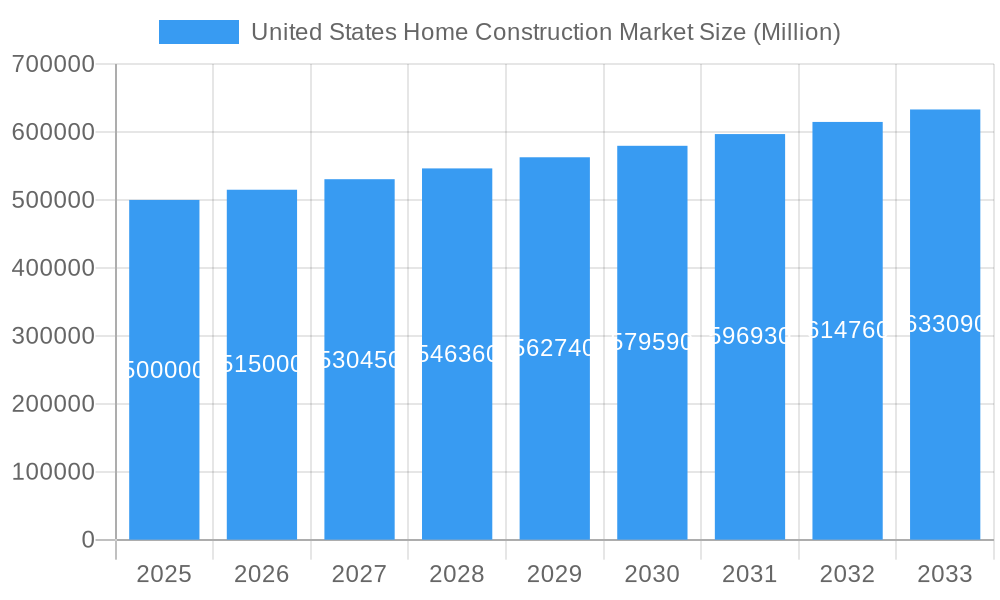

The United States home construction market is projected for robust expansion, forecasting a Compound Annual Growth Rate (CAGR) of 5.6%. The market size is estimated at $1.5 million in the base year of 2024, with significant growth anticipated throughout the forecast period. Key growth drivers include increasing urbanization, a rising population, and sustained demand for both single-family and multi-family residences, particularly in major metropolitan hubs. The market is segmented by dwelling type (apartments, condominiums, villas, and others), construction type (new construction and renovation), and geographic location. While new construction leads, the renovation segment presents considerable opportunity, driven by the need for upgrades in an aging housing stock. The presence of leading industry players underscores a competitive yet consolidated market landscape. Challenges such as escalating construction costs, material scarcity, and interest rate volatility may influence market dynamics and affordability. Regional housing price variations also play a crucial role in shaping growth trajectories. The market's performance is intrinsically linked to macroeconomic factors like job growth, mortgage rates, and consumer confidence.

United States Home Construction Market Market Size (In Million)

The dynamic multi-family construction sector, propelled by high rental demand in densely populated urban areas, is a pivotal contributor to the market's overall growth. Companies adept in both single-family and multi-family development are strategically positioned to leverage this expansion. Future market growth is contingent upon addressing housing affordability, optimizing permitting processes, and promoting sustainable building practices. Continuous monitoring of economic indicators and regulatory shifts is essential for precise future projections.

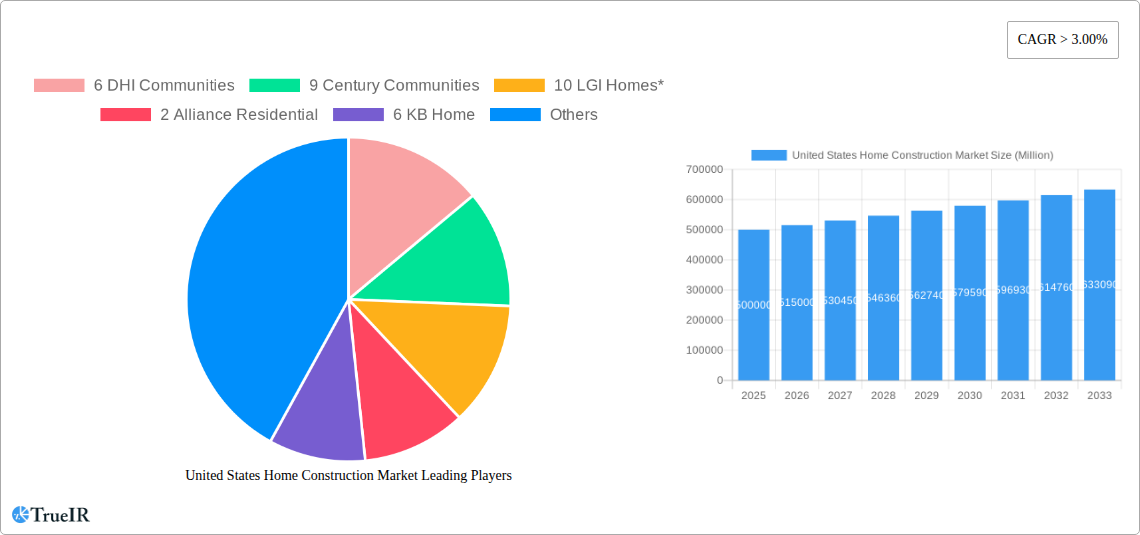

United States Home Construction Market Company Market Share

United States Home Construction Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the United States home construction market, offering invaluable insights for industry stakeholders, investors, and researchers. With a detailed study period spanning from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report meticulously examines market trends, competitive dynamics, and future growth prospects. The report leverages extensive data analysis and qualitative insights to deliver a holistic understanding of this dynamic sector. Expect detailed breakdowns by type (apartments & condominiums, villas, other types), construction type (new construction, renovation), and key cities (New York City, Los Angeles, San Francisco, Washington DC, Miami, and other cities). Discover the key players driving innovation and growth, including D.R. Horton, Lennar Corp, PulteGroup, and many more.

United States Home Construction Market Structure & Competitive Landscape

The US home construction market is characterized by a moderately concentrated landscape, with a few large players dominating specific segments. The Herfindahl-Hirschman Index (HHI) for single-family home builders is estimated at xx, indicating a moderately concentrated market. For multi-family, the HHI is estimated at yy. Innovation is driven by advancements in building materials, construction technologies (e.g., modular construction, 3D printing), and smart home integration. Regulatory impacts, including zoning laws, building codes, and environmental regulations, significantly influence market dynamics. Substitutes exist in the form of rental housing and repurposed commercial spaces, particularly affecting the apartment and condominium segments.

- Market Concentration: HHI for single-family homes: xx; Multi-family homes: yy.

- Innovation Drivers: Smart home technology, modular construction, sustainable building materials.

- Regulatory Impacts: Zoning laws, building codes, environmental regulations significantly influence development costs and timelines.

- Product Substitutes: Rental housing, repurposed commercial spaces.

- End-User Segmentation: Single-family homeowners, multi-family renters, institutional investors.

- M&A Trends: The past five years have seen xx billion in M&A activity, with a focus on consolidation among both single-family and multi-family builders. Notable acquisitions include D.R. Horton's acquisition of Riggins Custom Homes (December 2022).

United States Home Construction Market Market Trends & Opportunities

The US home construction market exhibits strong growth potential, driven by several key factors. The market size is projected to reach USD xx billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Technological advancements continue to shape construction methods and building designs, leading to increased efficiency and reduced costs. Consumer preferences are shifting towards sustainable and energy-efficient homes, creating opportunities for eco-friendly building solutions. The competitive landscape is marked by both intense rivalry and strategic collaborations, with companies constantly seeking to differentiate their offerings and expand their market share. The market penetration rate for smart home technology in new constructions is projected to reach xx% by 2033, while the penetration rate for sustainable building materials is expected to rise to yy%.

Dominant Markets & Segments in United States Home Construction Market

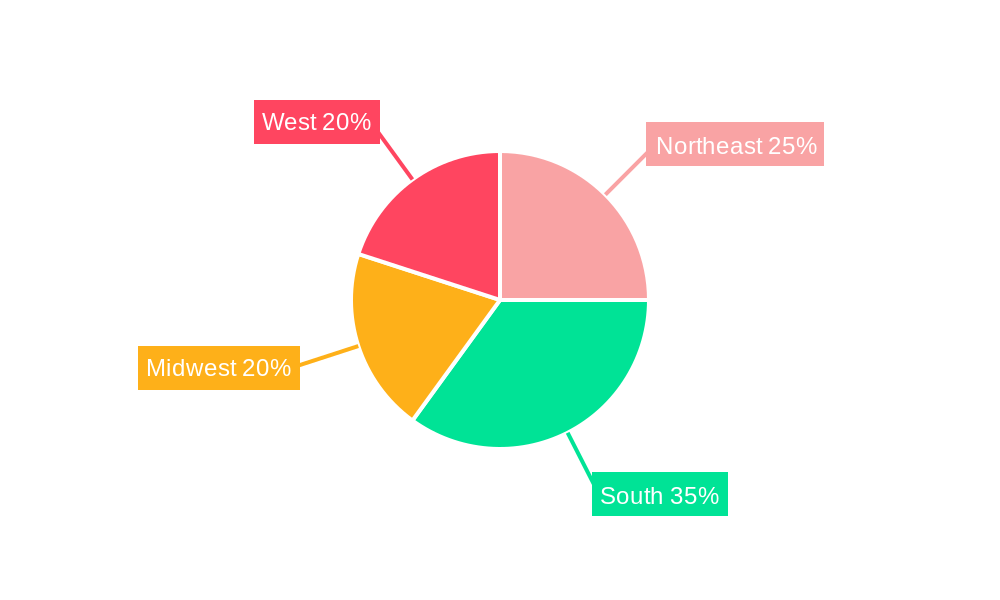

The Northeast and West Coast regions, specifically New York City, Los Angeles, San Francisco, and Washington DC, represent dominant markets due to high population density and strong demand. However, rapid growth is also observed in other cities across the sunbelt.

- By Type: New construction of single-family homes remains the largest segment, followed by multi-family apartments and condominiums. The villa segment shows moderate growth.

- By Construction Type: New construction accounts for the majority of market share, however, renovation activities are experiencing notable growth, particularly in existing urban areas.

- By City: New York City, Los Angeles, and San Francisco continue to be leading markets for high-rise apartment buildings, while suburban areas witness more single-family home construction.

Key Growth Drivers:

- Strong population growth: particularly in sunbelt states.

- Favorable demographics: Millennial and Gen Z homebuyers are entering the market.

- Infrastructure development: supporting growth in suburban areas.

- Government policies: incentivizing homeownership and sustainable building practices.

United States Home Construction Market Product Analysis

Product innovations are focused on improving energy efficiency, incorporating smart home technology, and enhancing overall sustainability. Advancements in materials science, construction techniques (like modular and 3D printing), and smart home integration are driving the development of more efficient, durable, and aesthetically appealing homes. These innovations cater to evolving consumer preferences for sustainable, technologically advanced, and comfortable living spaces.

Key Drivers, Barriers & Challenges in United States Home Construction Market

Key Drivers:

- Strong housing demand: fueled by population growth and urbanization.

- Low interest rates: making mortgages more accessible.

- Government incentives: supporting homeownership and green building.

- Technological advancements: increasing efficiency and reducing construction time.

Key Challenges:

- Supply chain disruptions: impacting the availability and cost of building materials.

- Labor shortages: particularly skilled labor.

- Rising material costs: increasing construction costs.

- Regulatory hurdles: complex permitting processes and environmental regulations.

Growth Drivers in the United States Home Construction Market Market

Strong population growth, particularly in the sunbelt states, drives demand. Favorable demographics, with Millennials and Gen Z entering the market, fuel further growth. Infrastructure development supports expansion in suburban areas. Government policies promoting homeownership and sustainable building practices create additional momentum. These factors collectively contribute to the market's upward trajectory.

Challenges Impacting United States Home Construction Market Growth

The market faces challenges from supply chain disruptions leading to material shortages and cost increases. Labor shortages, particularly for skilled workers, constrain construction capacity. Stringent regulations add complexity and delays to projects. Increased competition among builders exerts pressure on pricing.

Key Players Shaping the United States Home Construction Market Market

- DHI Communities

- Century Communities

- LGI Homes

- Alliance Residential

- KB Home

- Clayton Properties Group

- Related Group

- Mill Creek Residential

- PulteGroup

- Continental Properties Co

- D R Horton

- Bridge Investment Group

- Meritage Homes Corp

- NVR

- Wood Partners

- The NRP Group

- Trammell Crow Residential

- Greystar Worldwide

- Lennar Corp

- Taylor Morrison

Significant United States Home Construction Market Industry Milestones

- June 2022: Pulte Homes launched Woodland Hill, a new community in Grafton, MA, featuring 46 single-family homes. This highlights the ongoing expansion of single-family home development.

- December 2022: D.R. Horton acquired Riggins Custom Homes, significantly expanding its presence in Northwest Arkansas. This exemplifies the ongoing consolidation within the home construction industry.

Future Outlook for United States Home Construction Market Market

The US home construction market is poised for continued growth, driven by sustained demand, technological advancements, and supportive government policies. Strategic investments in sustainable building practices and smart home technology will shape the future of the industry. The market's potential remains strong, particularly in high-growth regions and segments.

United States Home Construction Market Segmentation

-

1. Type

- 1.1. Apartment & Condominiums

- 1.2. Villas

- 1.3. Other types

-

2. Construction Type

- 2.1. New Construction

- 2.2. Renovation

-

3. City

- 3.1. New York City

- 3.2. Los Angeles

- 3.3. San Francisco

- 3.4. Washington DC

- 3.5. Miami

- 3.6. Other Cities

United States Home Construction Market Segmentation By Geography

- 1. United States

United States Home Construction Market Regional Market Share

Geographic Coverage of United States Home Construction Market

United States Home Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Indonesia's Hospitality Market Shifting Preference for Local and Authentic Experiences

- 3.3. Market Restrains

- 3.3.1. Difficulties in Implementing Tourism Policies

- 3.4. Market Trends

- 3.4.1. High-interest Rates are Negatively Impacting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Home Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartment & Condominiums

- 5.1.2. Villas

- 5.1.3. Other types

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. New Construction

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. New York City

- 5.3.2. Los Angeles

- 5.3.3. San Francisco

- 5.3.4. Washington DC

- 5.3.5. Miami

- 5.3.6. Other Cities

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 6 DHI Communities

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 9 Century Communities

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 10 LGI Homes*

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Alliance Residential

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 6 KB Home

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 8 Clayton Properties Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 8 Related Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 3 Mill Creek Residential

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 3 PulteGroup

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 10 Continental Properties Co **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 1 D R Horton

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 7 Bridge Investment Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 7 Meritage Homes Corp

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 4 NVR

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Single Family Home Builders

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 4 Wood Partners

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 9 The NRP Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 5 Trammell Crow Residential

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 1 Greystar Worldwide

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Multi Family Home Builders

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 2 Lennar Corp

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 5 Taylor Morrison

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.1 6 DHI Communities

List of Figures

- Figure 1: United States Home Construction Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United States Home Construction Market Share (%) by Company 2025

List of Tables

- Table 1: United States Home Construction Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: United States Home Construction Market Revenue million Forecast, by Construction Type 2020 & 2033

- Table 3: United States Home Construction Market Revenue million Forecast, by City 2020 & 2033

- Table 4: United States Home Construction Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: United States Home Construction Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: United States Home Construction Market Revenue million Forecast, by Construction Type 2020 & 2033

- Table 7: United States Home Construction Market Revenue million Forecast, by City 2020 & 2033

- Table 8: United States Home Construction Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Home Construction Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the United States Home Construction Market?

Key companies in the market include 6 DHI Communities, 9 Century Communities, 10 LGI Homes*, 2 Alliance Residential, 6 KB Home, 8 Clayton Properties Group, 8 Related Group, 3 Mill Creek Residential, 3 PulteGroup, 10 Continental Properties Co **List Not Exhaustive, 1 D R Horton, 7 Bridge Investment Group, 7 Meritage Homes Corp, 4 NVR, Single Family Home Builders, 4 Wood Partners, 9 The NRP Group, 5 Trammell Crow Residential, 1 Greystar Worldwide, Multi Family Home Builders, 2 Lennar Corp, 5 Taylor Morrison.

3. What are the main segments of the United States Home Construction Market?

The market segments include Type, Construction Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.5 million as of 2022.

5. What are some drivers contributing to market growth?

Indonesia's Hospitality Market Shifting Preference for Local and Authentic Experiences.

6. What are the notable trends driving market growth?

High-interest Rates are Negatively Impacting the Market.

7. Are there any restraints impacting market growth?

Difficulties in Implementing Tourism Policies.

8. Can you provide examples of recent developments in the market?

June 2022 - Pulte Homes - a national brand of PulteGroup, Inc. - announced the opening of its newest Boston-area community, Woodland Hill. Offering 46 new construction single-family homes in the charming town of Grafton, the community is conveniently located near schools, dining, and entertainment, with the Massachusetts Bay Transportation Authority commuter rail less than a mile away. The collection of home designs at Woodland Hill includes three two-story floor plans, ranging in size from 3,013 to 4,019 sq. ft. with four to six bedrooms, 2.5-3.5 baths, and 2-3 car garages. These spacious home designs feature flexible living spaces, plenty of natural light, gas fireplaces, and the signature Pulte Planning Center®, a unique multi-use workstation perfect for homework or a family office.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Home Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Home Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Home Construction Market?

To stay informed about further developments, trends, and reports in the United States Home Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence