Key Insights

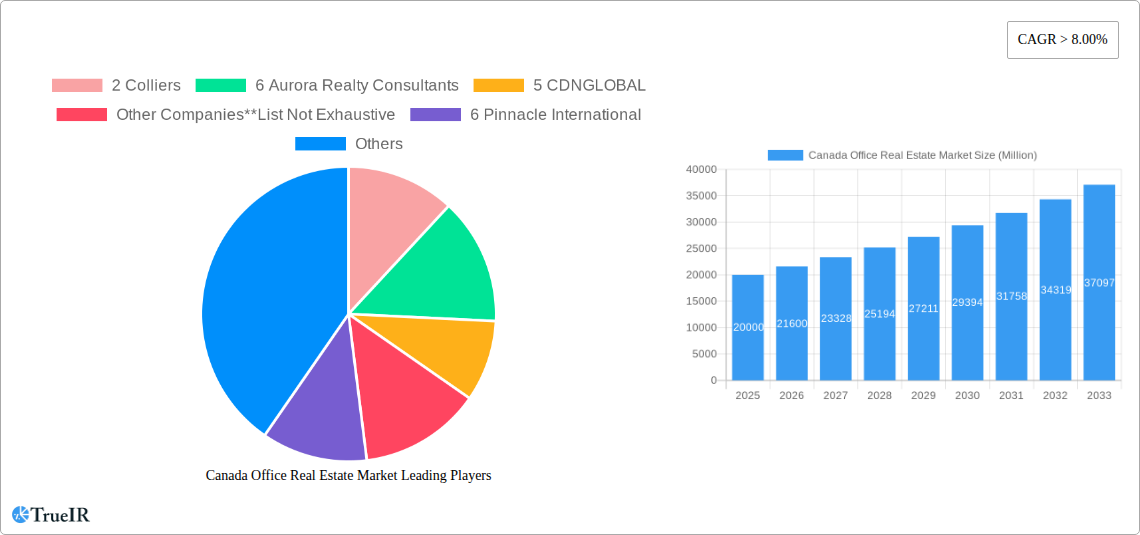

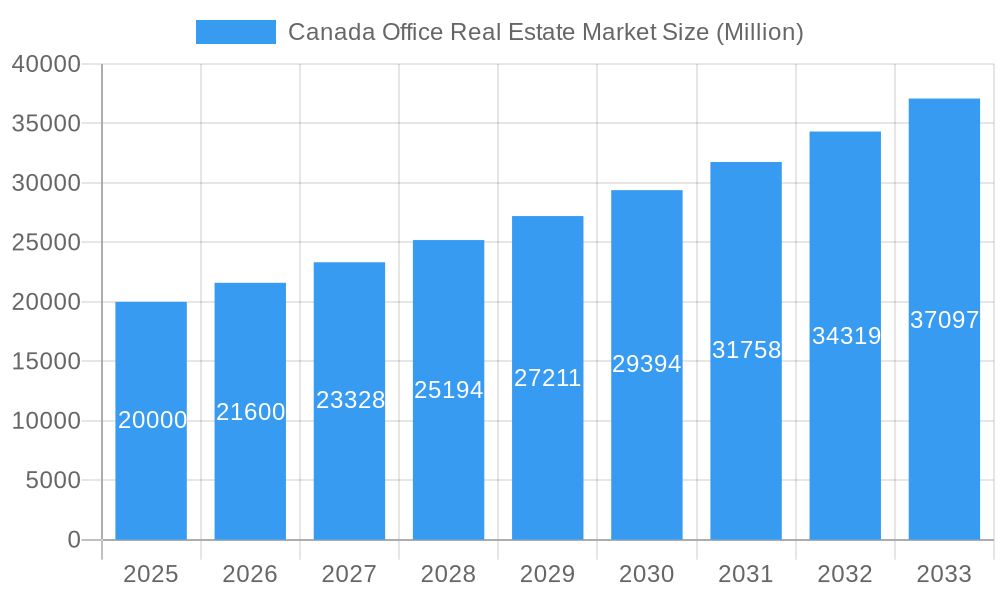

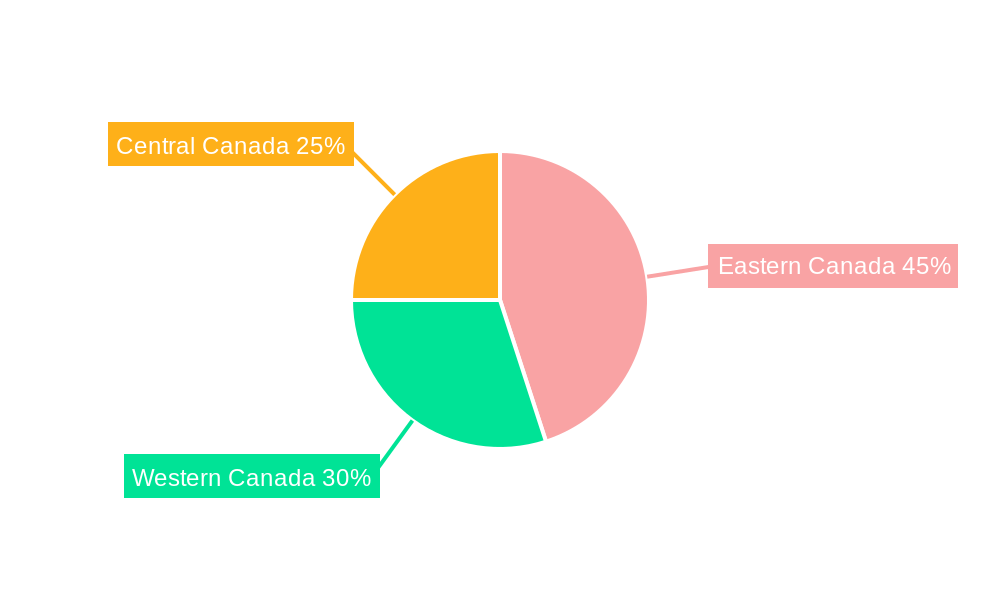

The Canadian office real estate market, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is experiencing robust growth, with a compound annual growth rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, a burgeoning tech sector and increasing foreign direct investment are contributing to heightened demand for office space, particularly in major metropolitan areas like Toronto, Montreal, and Ottawa. Secondly, a shift towards hybrid work models is impacting the type of office space in demand, with a focus on flexible and collaborative workspaces becoming increasingly prevalent. The growth is not uniform across the country, with Eastern Canada likely experiencing a faster pace of development compared to other regions due to its higher concentration of major cities and established business hubs. While these positive factors drive the market, challenges such as rising interest rates, inflation, and potential economic downturns represent significant restraints to consider. The market is segmented by major cities and broader regions (Eastern, Western, and Central Canada), with key players including Colliers, Aurora Realty Consultants, CDNGLOBAL, Pinnacle International, Avison Young, CBRE Canada, Brookfield Asset Management, QUADREAL, EllisDon, BROCCOLINI, Amacon, Hines, and JLL actively shaping market dynamics.

Canada Office Real Estate Market Market Size (In Billion)

The forecast for the next decade shows continued positive growth, though the pace may moderate slightly in the latter half of the forecast period depending on the broader economic climate. The ongoing evolution of workplace trends will require landlords to adapt their offerings to meet evolving tenant demands. Competition among developers and real estate firms remains intense, driving innovation and investment in sustainable, technologically advanced office buildings. Strategic acquisitions and mergers within the industry are expected to consolidate market share and further refine the competitive landscape. Monitoring economic indicators, interest rate fluctuations, and evolving workplace trends will be crucial for navigating the market effectively in the years ahead.

Canada Office Real Estate Market Company Market Share

Canada Office Real Estate Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Canadian office real estate market, offering invaluable insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a base year of 2025, this study examines market structure, competitive dynamics, key trends, and future growth potential. The report leverages extensive data and expert analysis to present a clear and actionable understanding of this dynamic sector.

Canada Office Real Estate Market Structure & Competitive Landscape

The Canadian office real estate market exhibits a moderately concentrated structure, with several major players dominating key segments. Concentration ratios vary significantly by region and property type. Toronto, for instance, shows higher concentration than smaller cities. While a few large firms control a substantial market share, there is also a significant number of smaller, regional players. This suggests a competitive landscape with both opportunities and challenges for market entrants.

Key aspects driving market dynamism:

- Innovation: Sustainable building practices, smart building technologies, and flexible workspace solutions are driving innovation and influencing investor preferences.

- Regulatory Impacts: Building codes, zoning regulations, and environmental policies significantly shape development and investment decisions. Recent changes to these regulations have impacted development timelines and costs.

- Product Substitutes: The rise of remote work and co-working spaces presents a degree of substitution, impacting demand for traditional office spaces. This has resulted in a xx% decrease in demand in certain markets.

- End-User Segmentation: The market is segmented by industry type (e.g., finance, technology, government), impacting demand for specific types of office space. The tech sector currently accounts for xx% of office space demand in major cities.

- M&A Activity: Mergers and acquisitions (M&A) activity has been moderately high in recent years, with a total volume of approximately $XX Million in deals completed between 2022-2024. This demonstrates industry consolidation and investor interest in expanding portfolios.

Canada Office Real Estate Market Market Trends & Opportunities

The Canadian office real estate market is poised for growth, with projected annual growth rates reaching a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size in 2025 is estimated at $XX Million, with a projected market size of $XX Million by 2033. This growth is influenced by several factors.

Technological advancements like smart building technologies and flexible workspace solutions are transforming the sector, driving demand for higher-quality, more efficient office spaces. Shifting consumer preferences towards sustainability and wellness are also impacting market dynamics. The increasing adoption of hybrid work models presents both opportunities and challenges. Some companies are downsizing their physical footprint, while others invest in high-quality workspaces. Competition is intense, with established players and new entrants vying for market share. Strategic partnerships, innovative offerings, and efficient operational strategies are crucial for success. Market penetration rates for new technologies vary widely, ranging from xx% for smart building systems to xx% for flexible workspaces.

Dominant Markets & Segments in Canada Office Real Estate Market

Toronto, Montreal, and Ottawa are the dominant markets within the Canadian office real estate sector, representing xx%, xx%, and xx% of the total market value respectively in 2025. However, growth patterns vary across these cities.

Toronto:

- Growth Drivers: Strong economic activity, a large and diverse workforce, significant infrastructure investments, and a concentration of corporate headquarters.

- Market Dominance: Toronto’s robust economy, large talent pool, and extensive transit infrastructure make it the most dominant market, accounting for a majority of investment and development activity.

Montreal:

- Growth Drivers: A thriving tech sector, a relatively lower cost of living compared to Toronto, and increasing government initiatives to attract businesses.

- Market Position: Montreal benefits from a dynamic tech ecosystem and a growing international presence, making it a significant player in the Canadian office market.

Ottawa:

- Growth Drivers: A strong government presence, a burgeoning tech sector, and relatively stable economic conditions.

- Market Position: Ottawa's government-driven economy provides a stable base for the market, although its growth potential might be comparatively lower than Toronto or Montreal.

Canada Office Real Estate Market Product Analysis

Product innovation in the Canadian office real estate market is focused on sustainable designs, smart building technologies, and flexible workspace configurations. These features cater to the evolving needs of businesses prioritizing energy efficiency, employee well-being, and adaptable work environments. The competitive advantage lies in offering spaces with superior technology integration, sustainable practices, and prime locations. The successful integration of these elements has proven to command higher rental rates and greater tenant demand.

Key Drivers, Barriers & Challenges in Canada Office Real Estate Market

Key Drivers:

- Technological advancements driving demand for smart and sustainable buildings.

- Strong economic growth in major cities fueling demand for office space.

- Government policies and initiatives supporting sustainable development and urban revitalization.

Challenges:

- Supply chain disruptions impacting construction timelines and costs. Increased material costs have led to a xx% rise in development expenses.

- Regulatory hurdles and permitting processes can cause delays and increase costs. Bureaucratic complexities add an average of xx months to project completion times.

- Competition from alternative work models such as remote work and co-working spaces. The shift to remote work has caused a xx% decrease in occupancy rates in some areas.

Growth Drivers in the Canada Office Real Estate Market Market

The Canadian office market is driven by a strong economy in major cities, technological advancements, and government support for sustainable development. Increased foreign investment and a growing population further stimulate demand.

Challenges Impacting Canada Office Real Estate Market Growth

Challenges include supply chain disruptions, rising construction costs, and competition from alternative work models like remote work and co-working spaces. Regulatory complexities and lengthy approval processes also pose significant hurdles.

Key Players Shaping the Canada Office Real Estate Market Market

- Colliers

- Aurora Realty Consultants

- CDNGLOBAL

- Other Companies (List Not Exhaustive)

- Pinnacle International

- Avison Young (Canada) Inc

- CBRE Canada

- Brookfield Asset Management

- QUADREAL

- EllisDon Inc

- BROCCOLINI

- Amacon

- Hines

- JLL

Significant Canada Office Real Estate Market Industry Milestones

- April 2022: Canadian Net Real Estate Investment Trust's USD 18.8 Million acquisition of four properties in Quebec and Nova Scotia reflects investor confidence in the market and a focus on portfolio diversification. The 6.5% capitalization rate indicates a stable market value.

- February 2022: Crown Realty Partners' acquisition of the Park of Commerce property in Ottawa highlights the growing interest in value-add opportunities and a focus on sustainability within the sector.

Future Outlook for Canada Office Real Estate Market Market

The Canadian office real estate market is expected to experience steady growth, driven by ongoing economic expansion in major cities, technological advancements improving workspace efficiency, and a focus on sustainable development. Strategic opportunities exist in developing high-quality, flexible office spaces that cater to evolving business needs and prioritize sustainability. The market's potential is significant, particularly in major urban centers with strong economic fundamentals.

Canada Office Real Estate Market Segmentation

-

1. Major Cities

- 1.1. Toronto

- 1.2. Ottawa

- 1.3. Montreal

Canada Office Real Estate Market Segmentation By Geography

- 1. Canada

Canada Office Real Estate Market Regional Market Share

Geographic Coverage of Canada Office Real Estate Market

Canada Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing new construction activity as well as expansion of new startups and small enterprises; Increasing demand for affordable housing units

- 3.3. Market Restrains

- 3.3.1. Lack of housing spaces and mortgage regulation

- 3.4. Market Trends

- 3.4.1. Office spaces in Toronto and Vancouver are increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 5.1.1. Toronto

- 5.1.2. Ottawa

- 5.1.3. Montreal

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Major Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 2 Colliers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 6 Aurora Realty Consultants

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 5 CDNGLOBAL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Other Companies**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 6 Pinnacle International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 4 Avison Young (Canada) Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3 CBRE Canada

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 1 Brookfield Asset Management

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 5 QUADREAL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 2 EllisDon Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 4 BROCCOLINI

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 7 Amacon

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 3 Hines

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 1 JLL

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 2 Colliers

List of Figures

- Figure 1: Canada Office Real Estate Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Office Real Estate Market Revenue undefined Forecast, by Major Cities 2020 & 2033

- Table 2: Canada Office Real Estate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Canada Office Real Estate Market Revenue undefined Forecast, by Major Cities 2020 & 2033

- Table 4: Canada Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Office Real Estate Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Canada Office Real Estate Market?

Key companies in the market include 2 Colliers, 6 Aurora Realty Consultants, 5 CDNGLOBAL, Other Companies**List Not Exhaustive, 6 Pinnacle International, 4 Avison Young (Canada) Inc, 3 CBRE Canada, 1 Brookfield Asset Management, 5 QUADREAL, 2 EllisDon Inc, 4 BROCCOLINI, 7 Amacon, 3 Hines, 1 JLL.

3. What are the main segments of the Canada Office Real Estate Market?

The market segments include Major Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing new construction activity as well as expansion of new startups and small enterprises; Increasing demand for affordable housing units.

6. What are the notable trends driving market growth?

Office spaces in Toronto and Vancouver are increasing.

7. Are there any restraints impacting market growth?

Lack of housing spaces and mortgage regulation.

8. Can you provide examples of recent developments in the market?

April 2022: Canadian Net Real Estate Investment Trust announced the purchase of four properties in Quebec and Nova Scotia. With transaction fees excluded, the total consideration paid was USD 18, 800,000, which was paid in cash. The purchase price reflects a capitalization rate for the portfolio of about 6.5%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Canada Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence