Key Insights

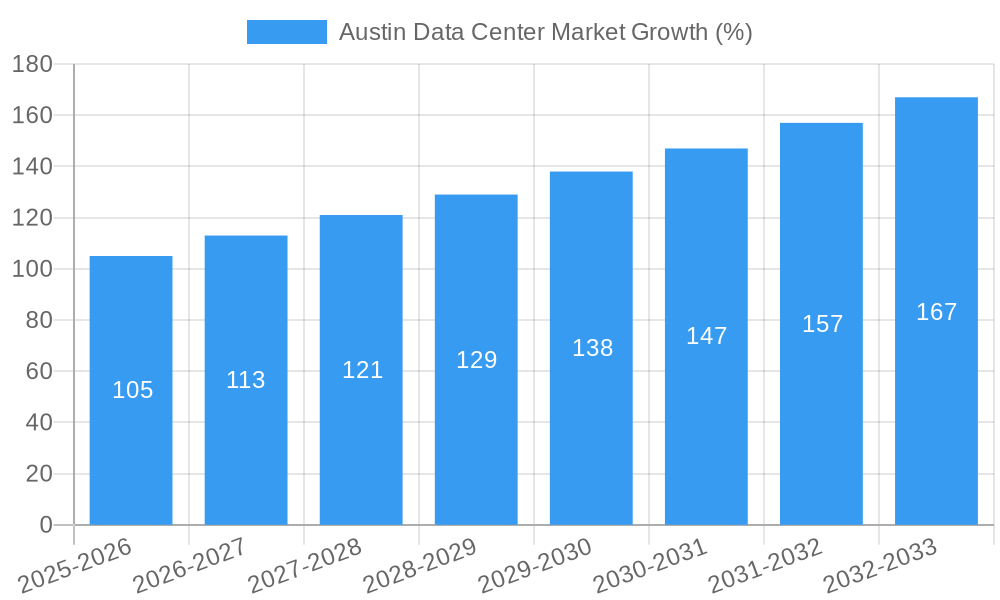

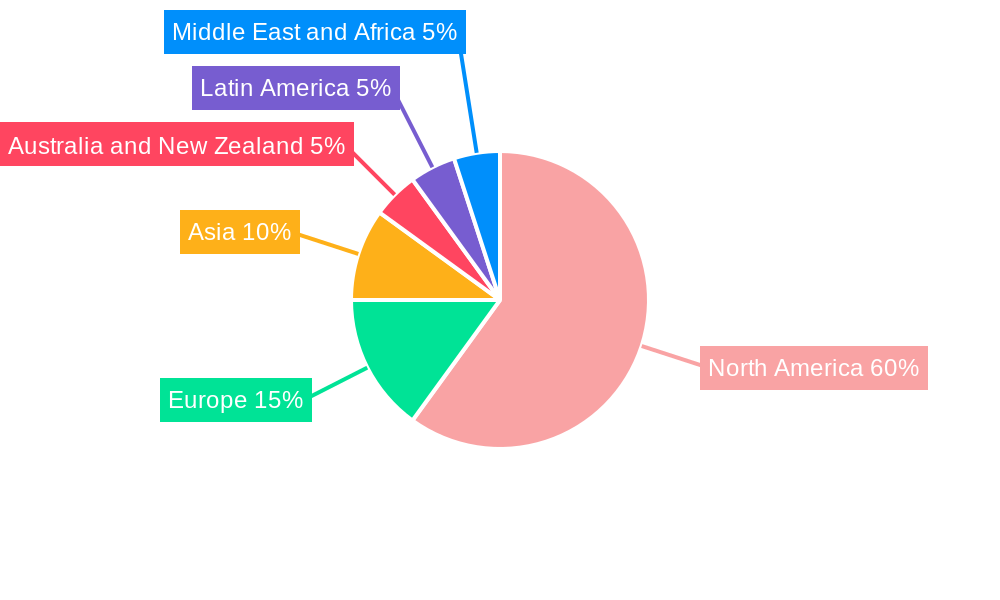

The Austin data center market is experiencing robust growth, driven by a confluence of factors including the city's burgeoning tech sector, strong talent pool, favorable business environment, and expanding cloud computing infrastructure needs. The 7% CAGR projected for the overall data center market suggests significant expansion in Austin as well, although the specific Austin market size (XX million) requires further clarification to accurately project future values. However, considering Austin's position as a major technology hub in the US, it's reasonable to assume the Austin market is a substantial portion of the overall North American market. Growth is further fueled by increasing demand from cloud providers, hyperscale operators, and enterprises seeking colocation services to support their growing data processing needs. The segments exhibiting the strongest growth are likely to be hyperscale colocation and large-scale data centers catering to the demands of major tech companies and cloud service providers. While factors such as rising energy costs and land scarcity could act as potential restraints, the overall positive economic climate and strong demand are expected to outweigh these challenges. The market segmentation by DC size (small to mega), tier type, absorption rate (utilized vs. non-utilized), and end-user industry will provide a granular view of market dynamics and opportunities.

The competitive landscape is characterized by the presence of major data center providers such as DataBank Ltd, CyrusOne LLC, Sabey Data Center Properties LLC, Switch Inc, and Digital Realty Trust Inc. The intense competition drives innovation and fosters competitive pricing, which in turn accelerates market adoption. However, the market is ripe for new entrants offering niche services or specializing in sustainable data center solutions. Further analysis regarding the regional split of the North American market share will provide a clearer understanding of Austin’s specific contribution and potential future growth trajectory. Analyzing the absorption rate across different DC sizes and colocation types will reveal crucial insights into the current market saturation and future expansion prospects within the Austin data center market.

This dynamic report provides a detailed analysis of the Austin data center market, offering invaluable insights for investors, industry professionals, and strategic planners. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report leverages extensive data and analysis to illuminate current market dynamics and predict future trends. The report incorporates data on key players such as DataBank Ltd, CyrusOne LLC, Sabey Data Center Properties LLC, Switch Inc, and Digital Realty Trust Inc, covering various segments including DC size, tier type, absorption, colocation type, and end-user industries.

Austin Data Center Market Market Structure & Competitive Landscape

The Austin data center market exhibits a moderately concentrated structure, with a few major players dominating the landscape. The market's competitive intensity is driven by factors such as technological innovation, regulatory changes, and the presence of substitute products and services. While precise concentration ratios require proprietary data, estimations suggest a relatively high level of concentration among the top 5 players, potentially exceeding 60% of the total market revenue. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a projected xx Million USD in M&A volume during the historical period (2019-2024), largely driven by consolidation efforts among existing players.

- Market Concentration: Moderate, with a few dominant players. Estimated top 5 player market share: 60% (estimated).

- Innovation Drivers: Advances in cooling technologies, cloud computing expansion, and increasing demand for edge computing.

- Regulatory Impacts: Local and state regulations concerning energy consumption and environmental impact are key factors.

- Product Substitutes: Cloud services and distributed computing models pose some level of competitive pressure.

- End-User Segmentation: The market caters to diverse end-users, including Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-commerce, and Others.

- M&A Trends: Moderate M&A activity, with a focus on consolidation and expansion of existing players.

Austin Data Center Market Market Trends & Opportunities

The Austin data center market has witnessed substantial growth in recent years, driven by the region's robust economy, expanding technology sector, and increasing demand for digital services. The market size is projected to reach xx Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth reflects a high market penetration rate, particularly amongst large enterprises. Technological shifts such as the rise of edge computing, AI, and the Internet of Things (IoT) are creating new opportunities. Consumer preferences for enhanced digital experiences and increased reliance on cloud-based solutions further fuel market expansion. Competitive dynamics are shaped by ongoing technological advancements, pricing strategies, and the constant quest for operational efficiency.

Dominant Markets & Segments in Austin Data Center Market

The Austin data center market demonstrates strong growth across multiple segments. While specific revenue figures by segment require more detailed market research data, certain segments show clear dominance. The market exhibits significant demand for Large and Mega data centers, driven by the needs of hyperscale cloud providers and large enterprises. The Utilized absorption segment constitutes the bulk of the market, reflecting high demand and occupancy rates. Retail colocation remains a significant segment, alongside growing demand from Hyperscale providers.

Key Growth Drivers:

- Robust Economic Growth: Austin’s thriving economy attracts significant tech investments.

- Technological Advancements: Growth of cloud computing, AI, and IoT.

- Favorable Government Policies: Pro-business policies and infrastructure development initiatives.

- Strong Talent Pool: Availability of skilled IT professionals.

Market Dominance Analysis:

Large and Mega data centers dominate due to high demand from hyperscale operators and large enterprises. The Utilized absorption segment represents a significant portion of market share due to robust demand. Retail colocation and Hyperscale colocation represent significant components of the overall market, with Retail Colocation having a more established presence currently. The Cloud & IT sector is a key end-user driver, along with increasing demand from the Telecom sector.

Austin Data Center Market Product Analysis

The Austin data center market is characterized by sophisticated data center infrastructure, including advanced cooling systems, high-density server racks, and robust network connectivity. Product innovation focuses on enhancing energy efficiency, improving security, and increasing scalability to meet the evolving needs of customers. Companies are focusing on delivering flexible, scalable solutions with strong focus on security features, tailored to different customer needs and application requirements. This is driven by the intense competitive pressure among major data center operators to stand out and gain a greater market share.

Key Drivers, Barriers & Challenges in Austin Data Center Market

Key Drivers:

- Technological advancements: Demand for high-performance computing, cloud services, and edge computing.

- Economic growth: The strong Austin economy fuels investment in data center infrastructure.

- Favorable government policies: Incentives and initiatives that support data center development.

Challenges and Restraints:

- Energy costs: High energy consumption creates significant operational expenses.

- Land availability: Finding suitable land for new data center construction poses challenges.

- Regulatory compliance: Meeting environmental and safety regulations adds complexities. This includes permitting issues and compliance with local power grid regulations. The impact is estimated to increase operational costs by approximately xx Million USD annually (estimated).

Growth Drivers in the Austin Data Center Market Market

The Austin data center market's growth is primarily driven by the burgeoning tech industry, increasing demand for cloud services, and supportive government policies encouraging tech-related investments. Further growth is spurred by the robust economic climate and ample supply of skilled labor in the region. These positive factors combined create a favourable environment that allows data center investment and expansion to thrive, ensuring the future success of this market.

Challenges Impacting Austin Data Center Market Growth

Growth is challenged by increasing energy costs, limited land availability for new construction, and regulatory hurdles involving environmental regulations and permitting processes. Competitive pressures from other data center hubs in the US pose additional challenges, along with the ongoing quest for better energy efficiency and sustainability initiatives.

Key Players Shaping the Austin Data Center Market Market

Significant Austin Data Center Market Industry Milestones

December 2022: Equinix, Inc. announced a commitment to reduce overall power consumption by increasing operating temperature ranges in its data centers, a significant step toward improving energy efficiency and sustainability.

January 2023: NTT's announcement to build the 'TX3 Data Centre' in Texas signals confidence in the market and promises a USD 110 Million investment, adding significant capacity.

Future Outlook for Austin Data Center Market Market

The Austin data center market is poised for continued growth, driven by sustained technological advancements, increasing cloud adoption, and ongoing economic expansion. Strategic opportunities abound for data center operators and investors alike, given the favorable regulatory environment and growing demand for robust and scalable digital infrastructure. The market's future success hinges on navigating the challenges of energy efficiency, sustainability, and land availability, while continuously innovating to meet the ever-evolving needs of the tech industry.

Austin Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Austin Data Center Market Segmentation By Geography

- 1. Austin

Austin Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's

- 3.3. Market Restrains

- 3.3.1. Dependence on Regulatory Landscape & Stringent Security Requirements

- 3.4. Market Trends

- 3.4.1. Tier 4 is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Austin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Austin

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Austin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Austin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Austin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Austin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Austin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Austin Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 DataBank Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 CyrusOne LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sabey Data Center Properties LLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Switch Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Digital Realty Trust Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.1 DataBank Ltd

List of Figures

- Figure 1: Austin Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Austin Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Austin Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Austin Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Austin Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Austin Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Austin Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Austin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Austin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Austin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Austin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Austin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Austin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Austin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Austin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Austin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Austin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Austin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Austin Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Austin Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Austin Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Austin Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Austin Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Austin Data Center Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Austin Data Center Market?

Key companies in the market include DataBank Ltd, CyrusOne LLC, Sabey Data Center Properties LLC, Switch Inc, Digital Realty Trust Inc.

3. What are the main segments of the Austin Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Cloud Services is expected to flourish the market; Increasing Growth in Wholesale Datacenter Multi-tenant Spaces to propel demand (albeit from a lower base); Increased Emphasis on Compliance with Data Regulations and Cost-Effective Nature of Multi-tenant Facilities to Drive Adoption among SME's.

6. What are the notable trends driving market growth?

Tier 4 is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Dependence on Regulatory Landscape & Stringent Security Requirements.

8. Can you provide examples of recent developments in the market?

January 2023 : NTT intends to build a new data center in Texas. NTT filed for a new data center dubbed 'TX3 Data Centre' with the Texas Department of Licensing and Regulation (TDLR) . According to the business, the 230,000 square foot (21,350 square metres) facility includes a data center and a two-story office. The corporation intends to invest USD110 million in the project, which is scheduled to start building in March 2023 and finish in April 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Austin Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Austin Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Austin Data Center Market?

To stay informed about further developments, trends, and reports in the Austin Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence