Key Insights

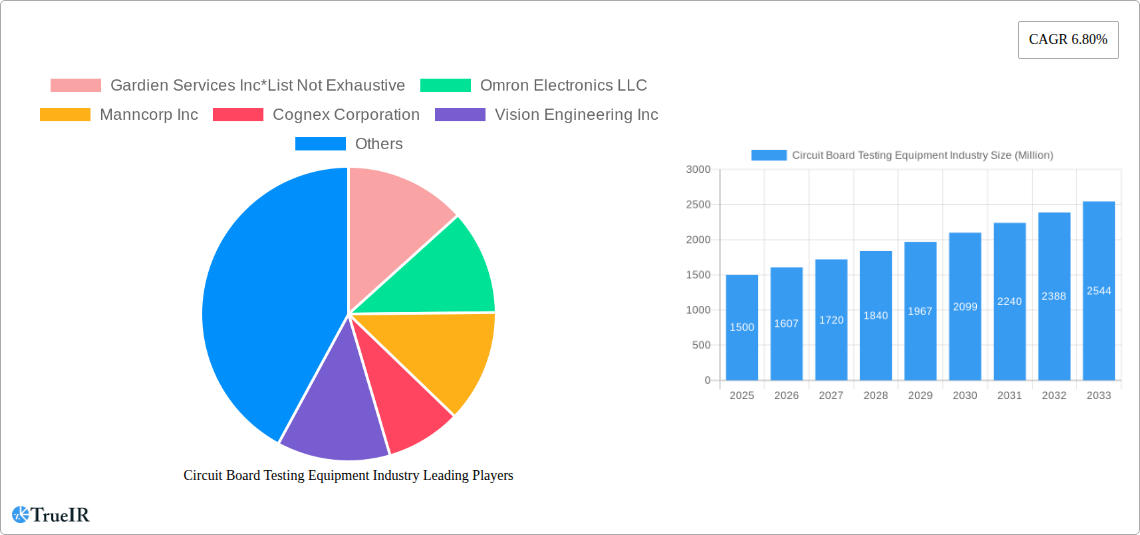

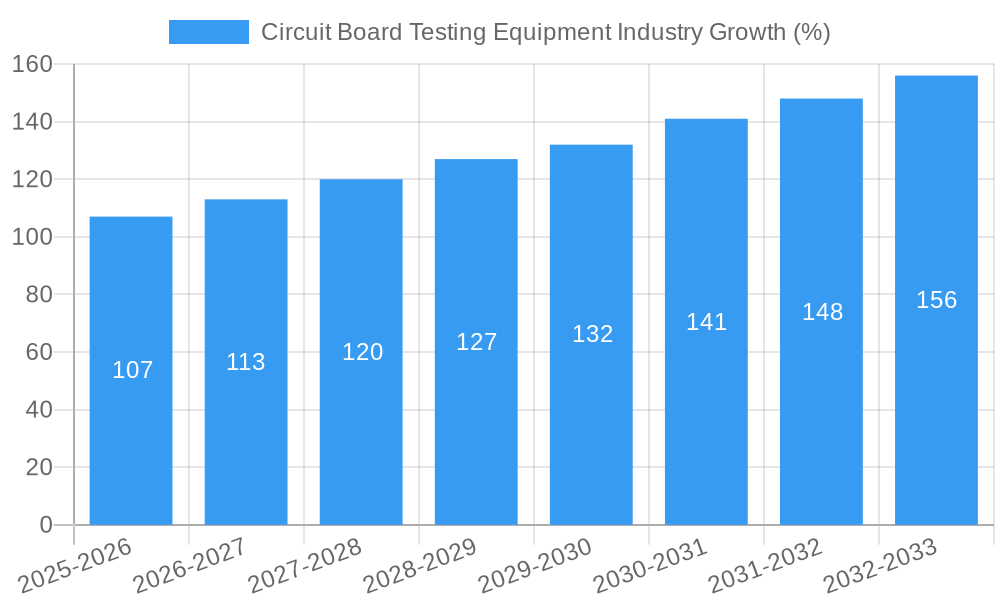

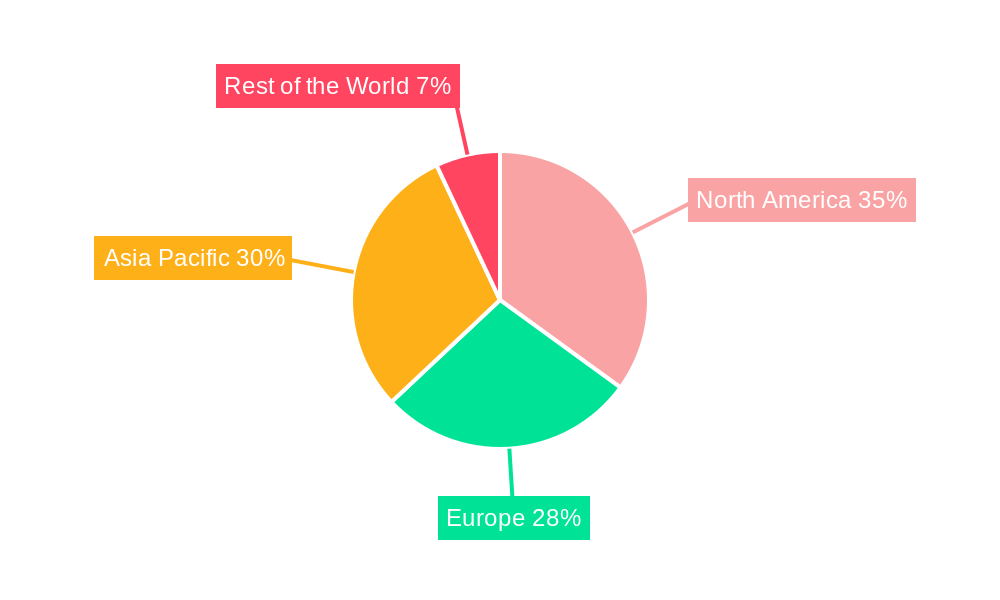

The global circuit board testing equipment market is experiencing robust growth, projected to reach a significant value by 2033. A compound annual growth rate (CAGR) of 6.80% from 2025 to 2033 indicates a consistently expanding market driven by several key factors. The increasing complexity of electronic devices, coupled with the rising demand for higher quality and reliability in manufacturing, fuels the need for advanced testing solutions. Automation is a major trend, with Automatic Optical Inspection (AOI) and X-ray inspection systems leading the charge, offering faster, more accurate, and efficient testing processes compared to manual methods. Further driving market growth are advancements in machine learning and artificial intelligence, enabling more sophisticated defect detection and analysis within circuit boards. While the market faces some restraints, such as the high initial investment cost of advanced equipment and skilled labor requirements, the overall outlook remains positive. The market is segmented by inspection method, with AOI and X-ray inspection dominating due to their capabilities in identifying a wide range of defects. Key players like Omron Electronics LLC, Cognex Corporation, and ViTrox Corp Bhd are actively shaping the market landscape through innovation and strategic partnerships. Geographical distribution sees North America and Asia Pacific as major regions, reflecting the concentration of electronics manufacturing and high technology industries.

The forecast period (2025-2033) promises continued expansion, driven by emerging applications in diverse sectors such as automotive, consumer electronics, and aerospace. The adoption of Industry 4.0 principles, including smart manufacturing and data analytics, is expected to further enhance the efficiency and effectiveness of circuit board testing, increasing the demand for sophisticated equipment and related services. The competition among established players and emerging innovative companies is likely to intensify, leading to further technological advancements and potentially lower prices, further stimulating market growth. Ongoing research and development efforts are focused on enhancing inspection speed, accuracy, and the ability to detect increasingly smaller defects, ensuring the long-term viability of this crucial segment of the electronics manufacturing industry.

Circuit Board Testing Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Circuit Board Testing Equipment industry, offering invaluable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth potential. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report leverages extensive market research and data analysis to provide a clear picture of this dynamic sector, projecting a market size of xx Million by 2033.

Circuit Board Testing Equipment Industry Market Structure & Competitive Landscape

The Circuit Board Testing Equipment industry exhibits a moderately concentrated market structure, with several key players holding significant market share. The industry's Herfindahl-Hirschman Index (HHI) in 2024 is estimated at xx, indicating a moderately consolidated market. However, the presence of numerous smaller companies and ongoing innovation ensures a dynamic competitive environment.

- Market Concentration: The top five players account for approximately xx% of the global market share in 2024.

- Innovation Drivers: Continuous advancements in AI, machine learning, and imaging technologies are driving innovation within the industry, leading to faster, more accurate, and automated inspection systems.

- Regulatory Impacts: Stringent regulatory standards for electronic product safety and quality are pushing the adoption of advanced testing equipment.

- Product Substitutes: While direct substitutes are limited, the cost-effectiveness of certain testing methods compared to others influences market share.

- End-User Segmentation: Key end-users include consumer electronics, automotive, aerospace, and industrial automation manufacturers, with growth varying by segment.

- M&A Trends: The industry has witnessed xx number of mergers and acquisitions in the past five years, indicating a trend towards consolidation and expansion of capabilities. The total value of these transactions reached approximately xx Million.

Circuit Board Testing Equipment Industry Market Trends & Opportunities

The global Circuit Board Testing Equipment market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors. The increasing demand for miniaturized and high-density PCBs across diverse industries, coupled with stricter quality control standards, is driving the adoption of sophisticated testing solutions. Technological advancements, particularly in AI and machine vision, enable greater automation and accuracy in testing processes, contributing to efficiency gains and improved product quality. Shifting consumer preferences towards higher-quality, reliable electronic devices also contribute to this upward trajectory. Competitive dynamics are marked by ongoing innovation, strategic partnerships, and an evolving landscape of players, shaping market share and influencing pricing strategies. Market penetration rates for advanced testing technologies like AOI are increasing steadily, currently at approximately xx% and projected to reach xx% by 2033.

Dominant Markets & Segments in Circuit Board Testing Equipment Industry

The Asia-Pacific region, particularly China and other Southeast Asian nations, currently dominates the Circuit Board Testing Equipment market due to the high concentration of electronics manufacturing. North America and Europe also constitute significant markets. Within the inspection methods segment, Automatic Optical Inspection (AOI) holds the largest market share, driven by its cost-effectiveness and suitability for high-volume production.

Key Growth Drivers in Asia-Pacific:

- Rapid expansion of electronics manufacturing hubs.

- Government initiatives promoting technological advancement in the electronics sector.

- Increasing adoption of automation in manufacturing processes.

Key Growth Drivers in AOI Segment:

- High speed and efficiency compared to other methods.

- Cost-effectiveness for high-volume production.

- Suitable for detecting a wide range of defects.

X-ray inspection is expected to witness significant growth, driven by the demand for inspecting complex multi-layered PCBs.

Circuit Board Testing Equipment Industry Product Analysis

The industry offers a wide range of testing equipment, including Automatic Optical Inspection (AOI) systems, X-ray inspection systems, and functional testing equipment. Recent innovations focus on incorporating AI and machine learning for enhanced accuracy and automation. These advanced systems offer competitive advantages through increased speed, improved defect detection rates, and reduced reliance on manual inspection. The market fit for these advanced products is strong, given the growing demand for higher-quality and more reliable electronic components.

Key Drivers, Barriers & Challenges in Circuit Board Testing Equipment Industry

Key Drivers: The increasing complexity of PCBs, rising demand for higher quality and reliability in electronic products, and the automation trend in manufacturing are primary growth drivers. Government regulations mandating stringent quality checks also significantly influence market growth. Furthermore, technological advancements in AI and machine vision are expanding the capabilities of testing equipment.

Key Challenges: High initial investment costs for advanced equipment can pose a barrier to entry for some companies, especially smaller enterprises. Global supply chain disruptions and component shortages have had a considerable impact on production and availability. Intense competition among established and emerging players also impacts profitability.

Growth Drivers in the Circuit Board Testing Equipment Industry Market

Several factors are driving growth in the Circuit Board Testing Equipment industry. Technological advancements such as AI-powered inspection systems and improved image processing techniques are improving efficiency and accuracy. The increasing complexity of PCBs necessitates more sophisticated testing solutions. Furthermore, government regulations emphasizing product quality and safety are boosting demand for advanced testing equipment.

Challenges Impacting Circuit Board Testing Equipment Industry Growth

The industry faces challenges such as the high cost of advanced equipment, potentially limiting adoption by smaller companies. Supply chain disruptions and geopolitical uncertainties can impact the availability of components. Intense competition and the need for continuous innovation to maintain a competitive edge also pose challenges for market players.

Key Players Shaping the Circuit Board Testing Equipment Industry Market

- Gardien Services Inc

- Omron Electronics LLC

- Manncorp Inc

- Cognex Corporation

- Vision Engineering Inc

- ViTrox Corp Bhd

- Nordson YESTECH Inc

Significant Circuit Board Testing Equipment Industry Milestones

- August 2021: Omron Corporation launched the VT-S10 Series PCB inspection system, incorporating AI and advanced imaging for automated high-precision inspection. This milestone significantly improved inspection efficiency and reduced the need for specialized skills.

- May 2022: Saki Corporation introduced the 3Di series of 3D automated optical inspection systems, designed for high-speed, high-precision inspection of complex, high-density PCBs. This launch addressed the challenges of inspecting boards with small and tall components, significantly enhancing inspection capabilities.

Future Outlook for Circuit Board Testing Equipment Industry Market

The Circuit Board Testing Equipment industry is poised for continued growth driven by technological innovation, increasing automation in electronics manufacturing, and stringent quality control standards. Strategic opportunities exist in developing AI-powered systems, expanding into emerging markets, and fostering collaborations to improve testing capabilities. The market shows great potential for continued expansion, with significant growth predicted across various segments and geographical regions.

Circuit Board Testing Equipment Industry Segmentation

-

1. Inspection Method

- 1.1. Automatic Optical Inspection (AOI)

- 1.2. X-Ray Inspection

Circuit Board Testing Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Circuit Board Testing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Diversity and Density of PCB is Fuelling the Market Demand

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity Due to Miniaturisation of Components is Challenging the Market Growth

- 3.4. Market Trends

- 3.4.1. X-Ray Inspection to Gain Majority Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Inspection Method

- 5.1.1. Automatic Optical Inspection (AOI)

- 5.1.2. X-Ray Inspection

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Inspection Method

- 6. North America Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Inspection Method

- 6.1.1. Automatic Optical Inspection (AOI)

- 6.1.2. X-Ray Inspection

- 6.1. Market Analysis, Insights and Forecast - by Inspection Method

- 7. Europe Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Inspection Method

- 7.1.1. Automatic Optical Inspection (AOI)

- 7.1.2. X-Ray Inspection

- 7.1. Market Analysis, Insights and Forecast - by Inspection Method

- 8. Asia Pacific Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Inspection Method

- 8.1.1. Automatic Optical Inspection (AOI)

- 8.1.2. X-Ray Inspection

- 8.1. Market Analysis, Insights and Forecast - by Inspection Method

- 9. Rest of the World Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Inspection Method

- 9.1.1. Automatic Optical Inspection (AOI)

- 9.1.2. X-Ray Inspection

- 9.1. Market Analysis, Insights and Forecast - by Inspection Method

- 10. North America Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Gardien Services Inc*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Omron Electronics LLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Manncorp Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Cognex Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Vision Engineering Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 ViTrox Corp Bhd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Nordson YESTECH Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.1 Gardien Services Inc*List Not Exhaustive

List of Figures

- Figure 1: Global Circuit Board Testing Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Circuit Board Testing Equipment Industry Revenue (Million), by Inspection Method 2024 & 2032

- Figure 11: North America Circuit Board Testing Equipment Industry Revenue Share (%), by Inspection Method 2024 & 2032

- Figure 12: North America Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Circuit Board Testing Equipment Industry Revenue (Million), by Inspection Method 2024 & 2032

- Figure 15: Europe Circuit Board Testing Equipment Industry Revenue Share (%), by Inspection Method 2024 & 2032

- Figure 16: Europe Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Circuit Board Testing Equipment Industry Revenue (Million), by Inspection Method 2024 & 2032

- Figure 19: Asia Pacific Circuit Board Testing Equipment Industry Revenue Share (%), by Inspection Method 2024 & 2032

- Figure 20: Asia Pacific Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Circuit Board Testing Equipment Industry Revenue (Million), by Inspection Method 2024 & 2032

- Figure 23: Rest of the World Circuit Board Testing Equipment Industry Revenue Share (%), by Inspection Method 2024 & 2032

- Figure 24: Rest of the World Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 3: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Circuit Board Testing Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Circuit Board Testing Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Circuit Board Testing Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Circuit Board Testing Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 13: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 15: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 17: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 19: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Circuit Board Testing Equipment Industry?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Circuit Board Testing Equipment Industry?

Key companies in the market include Gardien Services Inc*List Not Exhaustive, Omron Electronics LLC, Manncorp Inc, Cognex Corporation, Vision Engineering Inc, ViTrox Corp Bhd, Nordson YESTECH Inc.

3. What are the main segments of the Circuit Board Testing Equipment Industry?

The market segments include Inspection Method.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Diversity and Density of PCB is Fuelling the Market Demand.

6. What are the notable trends driving market growth?

X-Ray Inspection to Gain Majority Share.

7. Are there any restraints impacting market growth?

Increasing Complexity Due to Miniaturisation of Components is Challenging the Market Growth.

8. Can you provide examples of recent developments in the market?

May 2022 - Saki Corporation developed the new 3Di series of high-speed, high-precision, next-generation in-line 3D automated optical inspection systems. The system is ideal for the complex inspection of high-density printed circuit boards and boards with a combination of very small and tall components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Circuit Board Testing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Circuit Board Testing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Circuit Board Testing Equipment Industry?

To stay informed about further developments, trends, and reports in the Circuit Board Testing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence