Key Insights

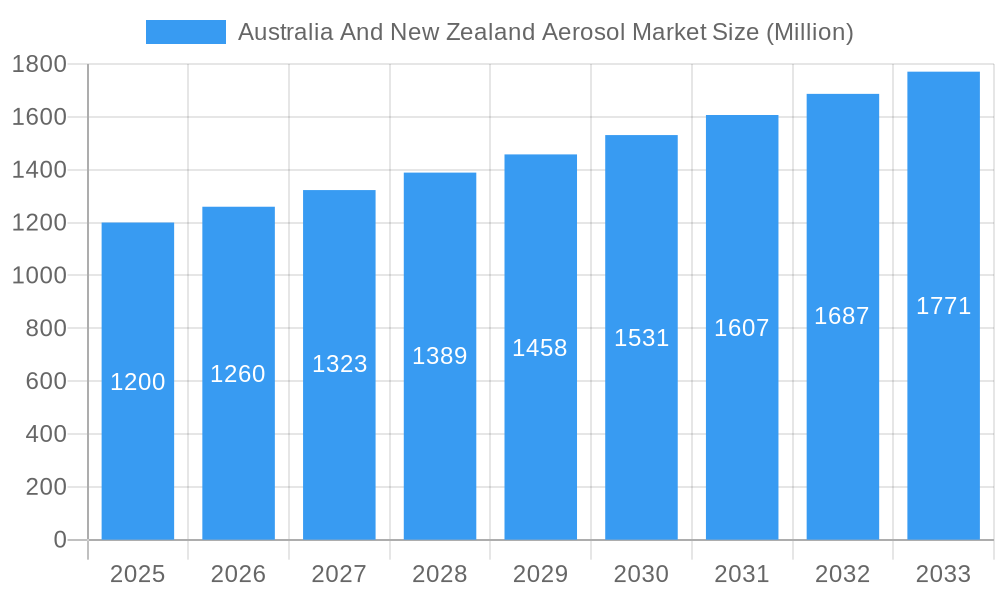

The Australia and New Zealand aerosol market, valued at $1.20 billion in 2025, is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 5.00% from 2025 to 2033. This expansion is driven by several factors. Increased consumer demand for convenience in personal care and household products fuels the market's growth. The automotive sector's reliance on aerosol-based paints and coatings further contributes to market expansion. Furthermore, the growing adoption of aerosols in the food products and insecticide segments reflects changing consumer preferences and increasing pest control needs. However, environmental concerns surrounding the use of propellant gases and the potential health risks associated with certain aerosol formulations act as restraints. The market is segmented by material (steel, aluminum, and other materials) and application (automotive, personal care, food products, herbicide, household products, insecticide, industrial and technical, medical, paint and coatings, and other applications). Major players like Henkel, Reckitt Benckiser, Honeywell, Sherwin-Williams, SC Johnson, BASF, Akzo Nobel, PPG Industries, and Unilever dominate the market, leveraging their extensive distribution networks and brand recognition to capture significant market share. Regional variations in consumer preferences and regulatory landscapes influence market dynamics within Australia and New Zealand, with urban areas exhibiting higher demand compared to rural regions. The forecast suggests a continued upward trajectory for the aerosol market in these regions, propelled by innovation in propellant technology and a focus on sustainable and environmentally friendly formulations.

Australia And New Zealand Aerosol Market Market Size (In Billion)

The competitive landscape is marked by both established multinational corporations and regional players. Competition centers around product innovation, brand loyalty, pricing strategies, and distribution channels. While established players benefit from extensive resources and brand recognition, smaller companies are gaining traction by offering niche products and focusing on sustainable practices to appeal to environmentally conscious consumers. Future growth will depend on successfully navigating environmental regulations, adapting to evolving consumer preferences, and embracing innovative aerosol technologies that minimize environmental impact while maximizing product efficacy. The market shows potential for further segmentation based on specific propellant types and aerosol functionalities, opening avenues for specialized product development and targeted marketing campaigns. Understanding consumer behavior, regulatory changes, and competitive dynamics will be crucial for success in this dynamic and evolving market.

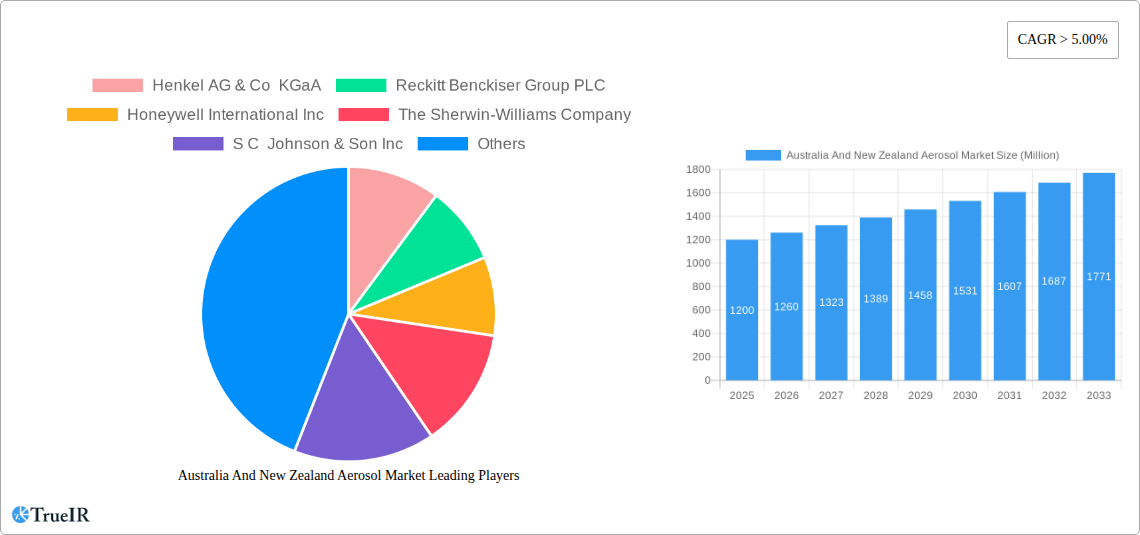

Australia And New Zealand Aerosol Market Company Market Share

Australia and New Zealand Aerosol Market Report: A Comprehensive Analysis (2019-2033)

This comprehensive report provides a detailed analysis of the Australia and New Zealand aerosol market, offering invaluable insights for businesses, investors, and industry stakeholders. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, encompassing historical data from 2019-2024. Expect detailed breakdowns of market size, segmentation, competitive dynamics, and future growth projections, all presented with precise data and expert analysis. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Australia And New Zealand Aerosol Market Market Structure & Competitive Landscape

The Australian and New Zealand aerosol market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, suggesting a moderately competitive landscape. Key players include Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, Honeywell International Inc, The Sherwin-Williams Company, S C Johnson & Son Inc, BASF, Akzo Nobel NV, PPG Industries Inc, Colep Consumer Products, Damar, Liquid Engineering NZ, Chemz Limited, Unilever, MMP Industrial, and Aerosolve. However, the presence of numerous smaller, specialized players contributes to a dynamic competitive environment.

Innovation Drivers: The market is driven by continuous innovation in aerosol technology, including the development of sustainable and eco-friendly propellants, improved dispensing mechanisms, and the introduction of new formulations to meet evolving consumer preferences. The demand for specialized aerosols for niche applications further drives innovation.

Regulatory Impacts: Stringent regulations concerning propellant emissions and packaging waste management significantly impact market players. Compliance with environmental regulations influences product development and packaging strategies.

Product Substitutes: Competition from alternative packaging formats like pumps and spray bottles presents a considerable challenge. However, the unique advantages of aerosol packaging, such as controlled dispensing and ease of use, maintain its market relevance.

End-User Segmentation: The market is segmented by application (Automotive, Personal Care, Food Products, Herbicide, Household Products, Insecticide, Industrial and Technical, Medical, Paint and Coatings, Other Applications) and material (Steel, Aluminium, Other Materials). The Personal Care and Household Products segments are major contributors to market volume, while the Industrial and Technical sectors offer significant growth potential.

M&A Trends: The past five years have seen xx mergers and acquisitions in the Australian and New Zealand aerosol market, primarily driven by consolidation among smaller players and expansion efforts by larger corporations. These transactions reflect the increasing importance of scale and technological expertise.

Australia And New Zealand Aerosol Market Market Trends & Opportunities

The Australia and New Zealand aerosol market is poised for significant growth, driven by a confluence of factors. Consumer demand for convenient and effective products fuels the market expansion across various application areas. Technological advancements in propellant technology, improved packaging designs, and sustainable manufacturing practices create exciting opportunities. The increasing adoption of aerosols in emerging application segments, like specialized industrial and medical applications, adds further impetus to growth. The market size is projected to grow from xx Million in 2025 to xx Million by 2033, exhibiting a robust CAGR of xx%. Market penetration rates in niche segments are expected to rise significantly over the forecast period, driven by successful product launches and targeted marketing campaigns.

The shift towards sustainable and eco-friendly aerosols, aligning with growing environmental consciousness among consumers, presents another significant growth opportunity. Companies are actively investing in the development of biodegradable propellants and recyclable packaging to meet this increasing demand. The competitive landscape remains dynamic, with established players facing pressure from both domestic and international competitors, necessitating continuous innovation and strategic partnerships.

Dominant Markets & Segments in Australia And New Zealand Aerosol Market

The personal care segment dominates the Australian and New Zealand aerosol market, driven by increasing consumer spending on beauty and hygiene products. The household products segment exhibits strong growth potential due to the rising demand for convenience and efficacy.

Key Growth Drivers:

- Rising Disposable Incomes: Increased purchasing power fuels consumer demand across various aerosol applications.

- Expanding Urbanization: Urban populations benefit from convenience-oriented products like aerosols.

- Government Initiatives: Pro-business policies and infrastructure development in both countries support market expansion.

Market Dominance Analysis:

Steel remains the dominant material for aerosol cans, due to its cost-effectiveness and durability. However, the demand for aluminum cans is increasing due to their recyclability and suitability for certain product formulations. The personal care and household products application segments continue to dominate market share, owing to high consumption rates. However, growth in the industrial and technical segments is expected to gain significant momentum in the coming years.

Australia And New Zealand Aerosol Market Product Analysis

Product innovation in the Australia and New Zealand aerosol market is largely focused on sustainability and enhanced functionality. This includes the development of aerosols utilizing environmentally friendly propellants and improved dispensing systems for precise application. Companies are also investing in biodegradable and recyclable packaging to cater to the rising consumer demand for environmentally conscious products. These innovations enhance product appeal and competitive advantage, resulting in improved market positioning and increased market share for companies adopting these strategies.

Key Drivers, Barriers & Challenges in Australia And New Zealand Aerosol Market

Key Drivers:

- Growing consumer demand for convenience in various applications

- Advancements in propellant technology and sustainable packaging

- Rising adoption in niche segments like industrial and medical applications

Challenges and Restraints:

- Stringent environmental regulations impacting propellant usage and packaging waste.

- Fluctuating raw material prices influence production costs.

- Intense competition from alternative packaging solutions.

Growth Drivers in the Australia And New Zealand Aerosol Market Market

The market's growth is fueled by rising disposable incomes, increasing urbanization, and technological advancements leading to innovative products. The demand for convenience-based products and the shift towards sustainable alternatives are driving market expansion. Government support for industries and infrastructure development further fosters growth. The focus on health and hygiene products and rising disposable incomes are also significant drivers.

Challenges Impacting Australia And New Zealand Aerosol Market Growth

Significant barriers to growth include stringent environmental regulations concerning propellant use and packaging waste management. Supply chain disruptions and fluctuations in raw material prices also impact production costs and profitability. Intense competition from substitute products and alternative packaging solutions poses a continual challenge.

Key Players Shaping the Australia And New Zealand Aerosol Market Market

- Henkel AG & Co KGaA

- Reckitt Benckiser Group PLC

- Honeywell International Inc

- The Sherwin-Williams Company

- S C Johnson & Son Inc

- BASF

- Akzo Nobel NV

- PPG Industries Inc

- Colep Consumer Products

- Damar

- Liquid Engineering NZ

- Chemz Limited

- Unilever

- MMP Industrial

- Aerosolve

Significant Australia And New Zealand Aerosol Market Industry Milestones

- July 2022: Jamestrong Packaging announced a USD 6 Million investment to expand its aerosol can production facility in Taree, New South Wales, signaling increased demand.

- September 2022: Unilever launched its Schmidt's certified natural aerosol deodorant brand in Australia and New Zealand, reflecting the growing demand for sustainable products. This launch followed Unilever ANZ earning B Corp status, highlighting a corporate commitment to sustainability.

Future Outlook for Australia And New Zealand Aerosol Market Market

The Australia and New Zealand aerosol market is projected to experience robust growth, driven by continuous innovation, sustainable product development, and the rising demand for convenience-based products across diverse applications. Strategic partnerships, investments in research and development, and targeted marketing campaigns will further shape the market landscape. The focus on sustainable solutions and eco-friendly materials will be crucial for sustained growth in the coming years. Expansion into niche segments, such as specialized industrial and medical applications, holds significant potential.

Australia And New Zealand Aerosol Market Segmentation

-

1. Material

- 1.1. Steel

- 1.2. Aluminium

- 1.3. Other Materials

-

2. Application

- 2.1. Automotive

- 2.2. Personal Care

- 2.3. Food Products

- 2.4. Herbicide

- 2.5. Household Products

- 2.6. Insecticide

- 2.7. Industrial and Technical

- 2.8. Medical

- 2.9. Paint and Coatings

- 2.10. Other Applications

-

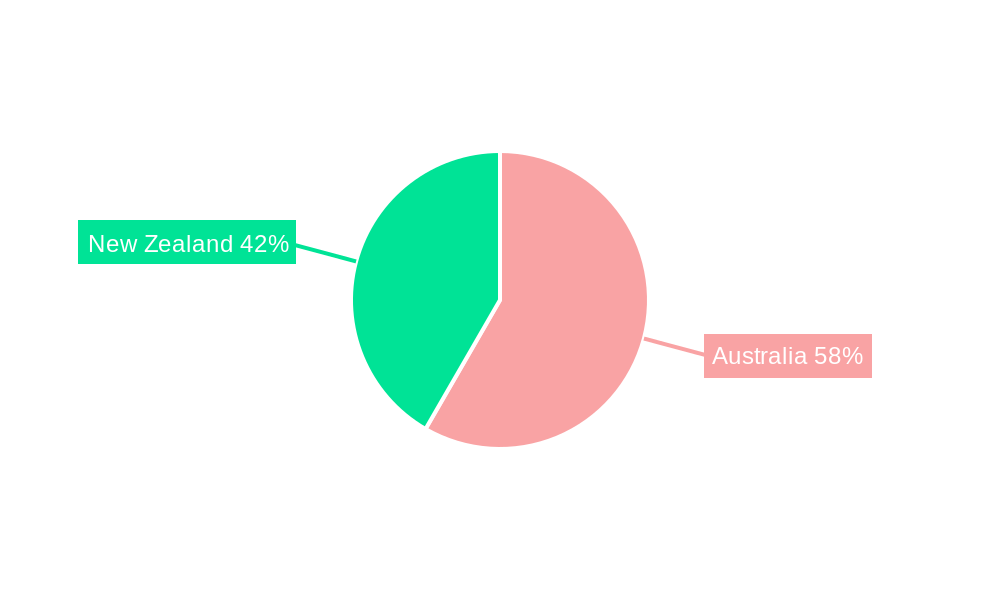

3. Geography

- 3.1. Australia

- 3.2. New Zealand

Australia And New Zealand Aerosol Market Segmentation By Geography

- 1. Australia

- 2. New Zealand

Australia And New Zealand Aerosol Market Regional Market Share

Geographic Coverage of Australia And New Zealand Aerosol Market

Australia And New Zealand Aerosol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Aerosol Cans from the Paint and Coatings Industry; Increasing Awareness of Hygiene and Personal Care

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations Related to Use of Aerosol

- 3.4. Market Trends

- 3.4.1. Increasing Awareness Regarding Hygiene and Personal Care

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Steel

- 5.1.2. Aluminium

- 5.1.3. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive

- 5.2.2. Personal Care

- 5.2.3. Food Products

- 5.2.4. Herbicide

- 5.2.5. Household Products

- 5.2.6. Insecticide

- 5.2.7. Industrial and Technical

- 5.2.8. Medical

- 5.2.9. Paint and Coatings

- 5.2.10. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Australia

- 5.3.2. New Zealand

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.4.2. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Australia Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Steel

- 6.1.2. Aluminium

- 6.1.3. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive

- 6.2.2. Personal Care

- 6.2.3. Food Products

- 6.2.4. Herbicide

- 6.2.5. Household Products

- 6.2.6. Insecticide

- 6.2.7. Industrial and Technical

- 6.2.8. Medical

- 6.2.9. Paint and Coatings

- 6.2.10. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Australia

- 6.3.2. New Zealand

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. New Zealand Australia And New Zealand Aerosol Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Steel

- 7.1.2. Aluminium

- 7.1.3. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive

- 7.2.2. Personal Care

- 7.2.3. Food Products

- 7.2.4. Herbicide

- 7.2.5. Household Products

- 7.2.6. Insecticide

- 7.2.7. Industrial and Technical

- 7.2.8. Medical

- 7.2.9. Paint and Coatings

- 7.2.10. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Australia

- 7.3.2. New Zealand

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Henkel AG & Co KGaA

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Reckitt Benckiser Group PLC

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Honeywell International Inc

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 The Sherwin-Williams Company

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 S C Johnson & Son Inc

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 BASF

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Akzo Nobel NV

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 PPG Industries Inc

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Colep Consumer Products

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Damar

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 Liquid Engineering NZ

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Chemz Limited

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Unilever*List Not Exhaustive

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.14 MMP Industrial

- 8.2.14.1. Overview

- 8.2.14.2. Products

- 8.2.14.3. SWOT Analysis

- 8.2.14.4. Recent Developments

- 8.2.14.5. Financials (Based on Availability)

- 8.2.15 Aerosolve

- 8.2.15.1. Overview

- 8.2.15.2. Products

- 8.2.15.3. SWOT Analysis

- 8.2.15.4. Recent Developments

- 8.2.15.5. Financials (Based on Availability)

- 8.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Australia And New Zealand Aerosol Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia And New Zealand Aerosol Market Share (%) by Company 2025

List of Tables

- Table 1: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Australia And New Zealand Aerosol Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia And New Zealand Aerosol Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Australia And New Zealand Aerosol Market?

Key companies in the market include Henkel AG & Co KGaA, Reckitt Benckiser Group PLC, Honeywell International Inc, The Sherwin-Williams Company, S C Johnson & Son Inc, BASF, Akzo Nobel NV, PPG Industries Inc, Colep Consumer Products, Damar, Liquid Engineering NZ, Chemz Limited, Unilever*List Not Exhaustive, MMP Industrial, Aerosolve.

3. What are the main segments of the Australia And New Zealand Aerosol Market?

The market segments include Material, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Aerosol Cans from the Paint and Coatings Industry; Increasing Awareness of Hygiene and Personal Care.

6. What are the notable trends driving market growth?

Increasing Awareness Regarding Hygiene and Personal Care.

7. Are there any restraints impacting market growth?

Stringent Regulations Related to Use of Aerosol.

8. Can you provide examples of recent developments in the market?

September 2022: Unilever launched its new certified natural aerosol deodorant brand, Schmidt's, in its first campaign in Australia and New Zealand. The brand's ozone-friendly aerosol products were announced just weeks after Unilever ANZ earned its B Corp status, making it one of the largest companies to win the Purpose Driven Business award.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia And New Zealand Aerosol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia And New Zealand Aerosol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia And New Zealand Aerosol Market?

To stay informed about further developments, trends, and reports in the Australia And New Zealand Aerosol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence