Key Insights

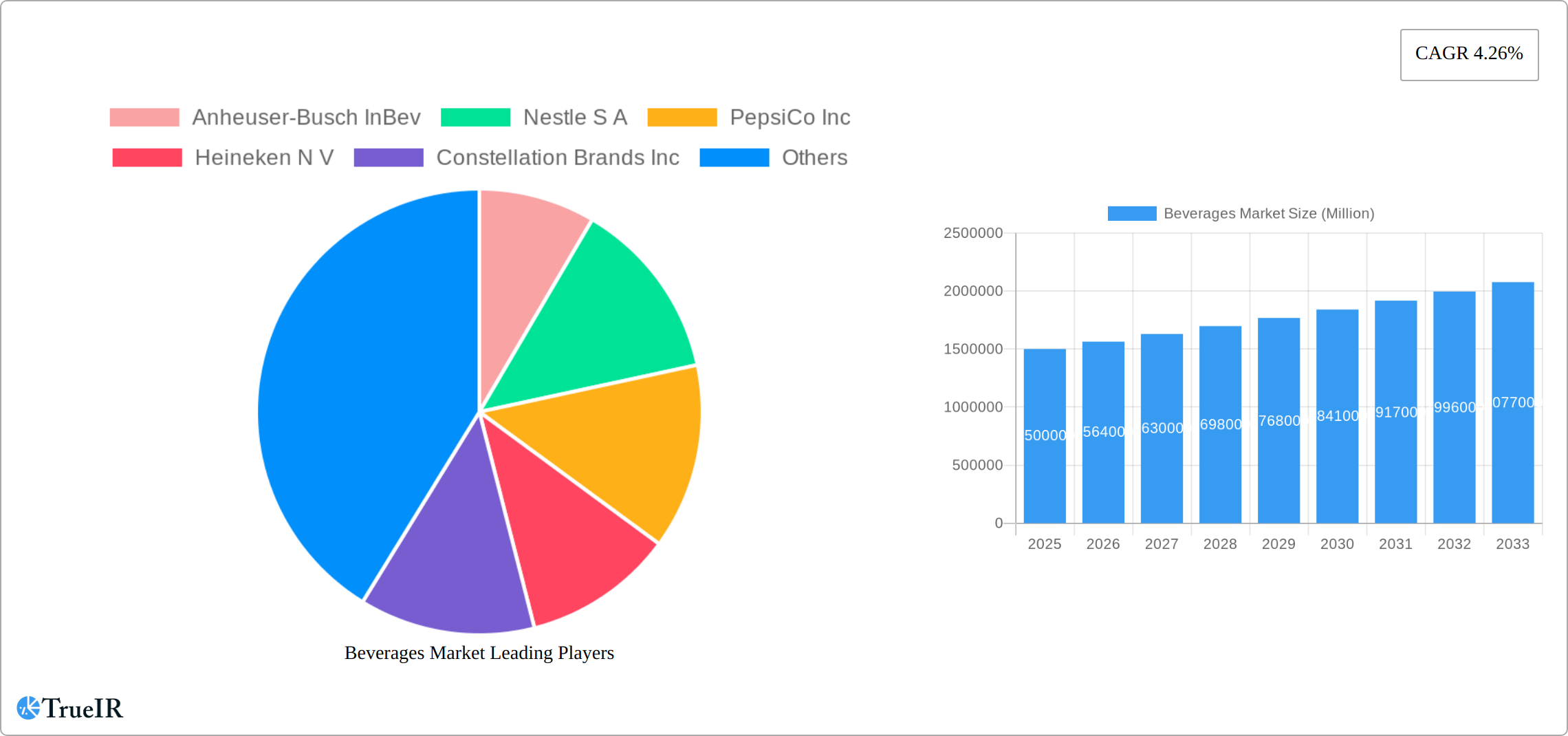

The global beverage market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.26% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes, particularly in emerging economies, are increasing consumer spending on diverse beverage options, including premium and functional beverages. Health and wellness trends are driving demand for healthier alternatives like low-sugar, organic, and functional drinks, while changing lifestyle preferences are boosting the ready-to-drink (RTD) segment's popularity. The on-trade channel, encompassing restaurants and bars, is expected to see significant growth due to the resurgence of social gatherings and dining out post-pandemic. However, the market faces certain restraints, such as fluctuating raw material prices and increasing health concerns related to excessive sugar consumption, impacting the demand for certain traditional beverage categories. The market is segmented by product type (alcoholic and non-alcoholic beverages, including spirits) and distribution channel (on-trade and off-trade). Major players like Anheuser-Busch InBev, Nestle S.A., PepsiCo Inc., and Coca-Cola Company are aggressively competing through innovation, branding, and strategic acquisitions to maintain market share. Regional variations in consumption patterns and preferences significantly influence the market dynamics, with North America and Asia Pacific expected to be key growth regions.

The competitive landscape is intensely dynamic, characterized by mergers and acquisitions, product diversification, and the emergence of innovative beverage categories. Companies are focusing on sustainable sourcing, environmentally friendly packaging, and personalized beverage experiences to appeal to a growing environmentally and health-conscious consumer base. The forecast period (2025-2033) is poised for significant growth, driven by the ongoing trends of premiumization, health consciousness, and the increasing demand for convenient and ready-to-consume beverage options. Regional expansion strategies, particularly in developing markets, are expected to play a crucial role in the overall market expansion during this period. Understanding these dynamics is critical for stakeholders seeking to navigate the evolving global beverage market successfully.

Beverages Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the global beverages market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market structure, competitive dynamics, key trends, and growth drivers, offering invaluable insights for industry stakeholders. With a focus on high-impact keywords like alcoholic beverages, non-alcoholic beverages, beverage market size, beverage industry trends, and beverage distribution, this report is an essential resource for strategic decision-making. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Beverages Market Market Structure & Competitive Landscape

The global beverages market is intensely competitive, dominated by a handful of multinational corporations wielding substantial market share. Key players like Anheuser-Busch InBev, Nestlé S.A., PepsiCo Inc., Heineken N.V., and The Coca-Cola Company significantly shape market dynamics through strategic innovation, aggressive acquisitions, and extensive distribution networks. While the precise Herfindahl-Hirschman Index (HHI) fluctuates, the market exhibits a moderately to highly concentrated structure, reflecting the influence of these major players. Smaller, niche players also contribute significantly to market diversity and innovation, particularly within the rapidly expanding segments of functional and specialty beverages.

- Market Concentration: Highly concentrated, with the top 10 players commanding a substantial percentage (estimated at approximately X% - replace X with accurate data) of global revenue. This concentration, however, is challenged by the growth of smaller, specialized brands in niche markets.

- Innovation Drivers: Health and wellness trends are paramount, driving demand for low-sugar, organic, functional, and sustainably sourced beverages. Evolving consumer preferences, coupled with technological advancements in production (e.g., precision fermentation) and packaging (e.g., eco-friendly materials), fuel innovation.

- Regulatory Impacts: Government regulations concerning alcohol content, sugar taxes, labeling requirements (including health warnings and ingredient transparency), and sustainable packaging mandates significantly impact operational strategies and product formulations.

- Product Substitutes: The competitive landscape extends beyond traditional beverages. Water, juices, plant-based milk alternatives, and other non-carbonated drinks, including functional waters and enhanced beverages, represent strong competitive forces.

- End-User Segmentation: The market displays diverse segmentation based on demographics (age, income, gender), lifestyle (health-conscious, adventurous, etc.), geographic location, and cultural preferences.

- M&A Trends: Mergers and acquisitions remain a prominent feature of the market, driving consolidation and expansion. The period between 2019 and 2024 witnessed an estimated X number of M&A deals (replace X with precise data), indicating ongoing industry restructuring and the pursuit of scale and diversification.

Beverages Market Market Trends & Opportunities

The global beverages market demonstrates robust and dynamic growth, propelled by several interconnected factors. Rising disposable incomes in developing economies fuel increased spending on beverages, particularly premium and functional options. Changing lifestyles, including increased urbanization and evolving social trends, further enhance demand. Technological advancements enhance production efficiency, enabling greater customization and personalization of beverage offerings. The burgeoning health-conscious consumer base actively seeks low-sugar, organic, and functional beverages, presenting lucrative opportunities for innovative product development. The expansion of online and direct-to-consumer (D2C) distribution channels offers significant growth avenues, with online beverage sales penetration projected to reach X% by 2033 (replace X with accurate data) from an estimated X% in 2025 (replace X with accurate data). Competitive success hinges on effective product innovation, powerful branding, and strategic distribution networks.

Dominant Markets & Segments in Beverages Market

The Asia-Pacific region dominates the global beverages market, fueled by rapid urbanization, rising disposable incomes, and a large young population. China and India are particularly significant markets within this region. Within product types, non-alcoholic beverages hold the largest share, driven by high demand for carbonated soft drinks, juices, and bottled water. The off-trade channel (supermarkets, convenience stores) accounts for a larger market share compared to the on-trade (restaurants, bars).

Key Growth Drivers (Asia-Pacific):

- Rapid economic growth and rising disposable incomes.

- Increasing urbanization and changing lifestyles.

- Growing preference for convenience and ready-to-drink beverages.

- Favorable government policies promoting domestic beverage industries.

Dominant Segments:

- By Product Type: Non-alcoholic beverages currently hold the largest market share.

- By Distribution Channel: Off-trade channels currently dominate the market.

Beverages Market Product Analysis

The beverages market showcases continuous product innovation. Companies are introducing new flavors, functional ingredients (e.g., probiotics, antioxidants), and sustainable packaging options. Technological advancements in fermentation, extraction, and preservation are enhancing product quality and shelf life. The market is witnessing a strong trend toward personalized and customized beverages, catering to individual dietary needs and preferences.

Key Drivers, Barriers & Challenges in Beverages Market

Key Drivers: Rising disposable incomes, changing consumer preferences, technological advancements, and increasing health consciousness are driving the market growth.

Challenges: Fluctuating raw material prices, intense competition, stringent regulatory norms, and supply chain disruptions pose significant challenges. Estimated impact of supply chain disruptions on market revenue in 2024: xx Million.

Growth Drivers in the Beverages Market Market

Technological advancements across the entire value chain – from production and processing to packaging and distribution – are crucial growth drivers. Economic growth, particularly in emerging markets, significantly contributes to increased disposable incomes, fueling market expansion. Government policies incentivizing sustainable practices, promoting innovation, and supporting local producers also create a favorable environment for growth.

Challenges Impacting Beverages Market Growth

Supply chain disruptions, resulting in increased costs and reduced availability of raw materials, represent a significant challenge. Stricter regulations on sugar content and labeling requirements can hinder growth. Intense competition among established players and new entrants creates pressure on pricing and profitability.

Key Players Shaping the Beverages Market Market

- Anheuser-Busch InBev

- Nestle S.A.

- PepsiCo Inc.

- Heineken N.V.

- Constellation Brands Inc.

- Suntory Holdings Limited

- Red Bull GmbH

- Keurig Dr Pepper

- The Coca-Cola Company

- Diageo plc

Significant Beverages Market Industry Milestones

- October 2022: Budweiser APAC opened a state-of-the-art brewery in Putian, China, signifying expansion in a key growth market and demonstrating investment in advanced brewing technologies.

- October 2022: Victoria™ launched Vicky Chamoy, a unique beer showcasing product innovation and strategic expansion into new flavor profiles to cater to evolving consumer preferences.

- March 2023: Red Bull's introduction of its Juneberry Summer Edition in the UK highlights the significance of seasonal product lines and targeted flavor innovation to meet seasonal demands and maintain consumer engagement.

- Add more recent significant milestones here.

Future Outlook for Beverages Market Market

The beverages market is poised for continued growth, driven by innovation, evolving consumer preferences, and expanding distribution channels. Strategic opportunities lie in developing sustainable and healthy beverage options, leveraging technological advancements for personalized products, and capitalizing on emerging markets with high growth potential. The market is expected to witness increased consolidation through M&A activity and a growing focus on digital marketing and e-commerce strategies.

Beverages Market Segmentation

-

1. Product Type

-

1.1. Alcoholic Beverages

- 1.1.1. Beer

- 1.1.2. Wine

- 1.1.3. Spirits

-

1.2. Non-Alcoholic Beverages

- 1.2.1. Energy & Sports Drink

- 1.2.2. Soft Drinks

- 1.2.3. Bottled Water

- 1.2.4. Packaged Juice

- 1.2.5. RTD Tea and Coffee

- 1.2.6. Other Non-Alcoholic Beverages

-

1.1. Alcoholic Beverages

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience/Grocery Stores

- 2.2.3. Online Retail Stores

- 2.2.4. Other Off Trade Channels

Beverages Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Preference for Plant-based and Clean-label RTD Products; Consumer Inclination Toward Sugar-Free Drinks

- 3.3. Market Restrains

- 3.3.1. Concerns Over Health Issues Associated With Beverages

- 3.4. Market Trends

- 3.4.1. Consumer Inclination Toward Sugar-Free Drinks

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Beverages Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Alcoholic Beverages

- 5.1.1.1. Beer

- 5.1.1.2. Wine

- 5.1.1.3. Spirits

- 5.1.2. Non-Alcoholic Beverages

- 5.1.2.1. Energy & Sports Drink

- 5.1.2.2. Soft Drinks

- 5.1.2.3. Bottled Water

- 5.1.2.4. Packaged Juice

- 5.1.2.5. RTD Tea and Coffee

- 5.1.2.6. Other Non-Alcoholic Beverages

- 5.1.1. Alcoholic Beverages

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience/Grocery Stores

- 5.2.2.3. Online Retail Stores

- 5.2.2.4. Other Off Trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Beverages Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Alcoholic Beverages

- 6.1.1.1. Beer

- 6.1.1.2. Wine

- 6.1.1.3. Spirits

- 6.1.2. Non-Alcoholic Beverages

- 6.1.2.1. Energy & Sports Drink

- 6.1.2.2. Soft Drinks

- 6.1.2.3. Bottled Water

- 6.1.2.4. Packaged Juice

- 6.1.2.5. RTD Tea and Coffee

- 6.1.2.6. Other Non-Alcoholic Beverages

- 6.1.1. Alcoholic Beverages

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience/Grocery Stores

- 6.2.2.3. Online Retail Stores

- 6.2.2.4. Other Off Trade Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Beverages Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Alcoholic Beverages

- 7.1.1.1. Beer

- 7.1.1.2. Wine

- 7.1.1.3. Spirits

- 7.1.2. Non-Alcoholic Beverages

- 7.1.2.1. Energy & Sports Drink

- 7.1.2.2. Soft Drinks

- 7.1.2.3. Bottled Water

- 7.1.2.4. Packaged Juice

- 7.1.2.5. RTD Tea and Coffee

- 7.1.2.6. Other Non-Alcoholic Beverages

- 7.1.1. Alcoholic Beverages

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience/Grocery Stores

- 7.2.2.3. Online Retail Stores

- 7.2.2.4. Other Off Trade Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Beverages Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Alcoholic Beverages

- 8.1.1.1. Beer

- 8.1.1.2. Wine

- 8.1.1.3. Spirits

- 8.1.2. Non-Alcoholic Beverages

- 8.1.2.1. Energy & Sports Drink

- 8.1.2.2. Soft Drinks

- 8.1.2.3. Bottled Water

- 8.1.2.4. Packaged Juice

- 8.1.2.5. RTD Tea and Coffee

- 8.1.2.6. Other Non-Alcoholic Beverages

- 8.1.1. Alcoholic Beverages

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience/Grocery Stores

- 8.2.2.3. Online Retail Stores

- 8.2.2.4. Other Off Trade Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Beverages Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Alcoholic Beverages

- 9.1.1.1. Beer

- 9.1.1.2. Wine

- 9.1.1.3. Spirits

- 9.1.2. Non-Alcoholic Beverages

- 9.1.2.1. Energy & Sports Drink

- 9.1.2.2. Soft Drinks

- 9.1.2.3. Bottled Water

- 9.1.2.4. Packaged Juice

- 9.1.2.5. RTD Tea and Coffee

- 9.1.2.6. Other Non-Alcoholic Beverages

- 9.1.1. Alcoholic Beverages

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience/Grocery Stores

- 9.2.2.3. Online Retail Stores

- 9.2.2.4. Other Off Trade Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Beverages Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Alcoholic Beverages

- 10.1.1.1. Beer

- 10.1.1.2. Wine

- 10.1.1.3. Spirits

- 10.1.2. Non-Alcoholic Beverages

- 10.1.2.1. Energy & Sports Drink

- 10.1.2.2. Soft Drinks

- 10.1.2.3. Bottled Water

- 10.1.2.4. Packaged Juice

- 10.1.2.5. RTD Tea and Coffee

- 10.1.2.6. Other Non-Alcoholic Beverages

- 10.1.1. Alcoholic Beverages

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience/Grocery Stores

- 10.2.2.3. Online Retail Stores

- 10.2.2.4. Other Off Trade Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Beverages Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Alcoholic Beverages

- 11.1.1.1. Beer

- 11.1.1.2. Wine

- 11.1.1.3. Spirits

- 11.1.2. Non-Alcoholic Beverages

- 11.1.2.1. Energy & Sports Drink

- 11.1.2.2. Soft Drinks

- 11.1.2.3. Bottled Water

- 11.1.2.4. Packaged Juice

- 11.1.2.5. RTD Tea and Coffee

- 11.1.2.6. Other Non-Alcoholic Beverages

- 11.1.1. Alcoholic Beverages

- 11.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.2.1. On-trade

- 11.2.2. Off-trade

- 11.2.2.1. Supermarkets/Hypermarkets

- 11.2.2.2. Convenience/Grocery Stores

- 11.2.2.3. Online Retail Stores

- 11.2.2.4. Other Off Trade Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. North America Beverages Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 12.1.4 Rest of North America

- 13. Europe Beverages Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 Spain

- 13.1.4 France

- 13.1.5 Italy

- 13.1.6 Russia

- 13.1.7 Rest of Europe

- 14. Asia Pacific Beverages Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 Australia

- 14.1.5 Rest of Asia Pacific

- 15. South America Beverages Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Middle East & Africa Beverages Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 UAE

- 16.1.2 South Africa

- 16.1.3 Saudi Arabia

- 16.1.4 Rest of MEA

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Anheuser-Busch InBev

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Nestle S A

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 PepsiCo Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Heineken N V

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Constellation Brands Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Suntory Holdings Limited

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Red Bull GmbH

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Keurig Dr Pepper*List Not Exhaustive

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 The Coca-Cola Company

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Diageo plc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Anheuser-Busch InBev

List of Figures

- Figure 1: Global Beverages Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East & Africa Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East & Africa Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Beverages Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Beverages Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Beverages Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Europe Beverages Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Beverages Market Revenue (Million), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Beverages Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Asia Pacific Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Asia Pacific Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Beverages Market Revenue (Million), by Product Type 2024 & 2032

- Figure 31: South America Beverages Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: South America Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: South America Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: South America Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Beverages Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Middle East Beverages Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Middle East Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Middle East Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Middle East Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Beverages Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Saudi Arabia Beverages Market Revenue (Million), by Product Type 2024 & 2032

- Figure 43: Saudi Arabia Beverages Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 44: Saudi Arabia Beverages Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 45: Saudi Arabia Beverages Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 46: Saudi Arabia Beverages Market Revenue (Million), by Country 2024 & 2032

- Figure 47: Saudi Arabia Beverages Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Beverages Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Beverages Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United Kingdom Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Russia Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: UAE Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: South Africa Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Saudi Arabia Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of MEA Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Global Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 35: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of North America Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 41: Global Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United Kingdom Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Spain Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: France Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Italy Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Russia Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Europe Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 51: Global Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia Pacific Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Global Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 59: Global Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 60: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 61: Brazil Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Argentina Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of South America Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Global Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 65: Global Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 66: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 67: Global Beverages Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 68: Global Beverages Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 69: Global Beverages Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: South Africa Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Rest of Middle East Beverages Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Beverages Market?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Beverages Market?

Key companies in the market include Anheuser-Busch InBev, Nestle S A, PepsiCo Inc, Heineken N V, Constellation Brands Inc, Suntory Holdings Limited, Red Bull GmbH, Keurig Dr Pepper*List Not Exhaustive, The Coca-Cola Company, Diageo plc.

3. What are the main segments of the Beverages Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Preference for Plant-based and Clean-label RTD Products; Consumer Inclination Toward Sugar-Free Drinks.

6. What are the notable trends driving market growth?

Consumer Inclination Toward Sugar-Free Drinks.

7. Are there any restraints impacting market growth?

Concerns Over Health Issues Associated With Beverages.

8. Can you provide examples of recent developments in the market?

March 2023: Red Bull unveiled its Summer Edition product line in the United Kingdom, featuring an exciting new flavor - Juneberry. These Juneberry-flavored energy drinks are now widely accessible, being distributed across major retailers throughout the country. Consumers can enjoy them in both single-serving and multipack options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Beverages Market?

To stay informed about further developments, trends, and reports in the Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence