Key Insights

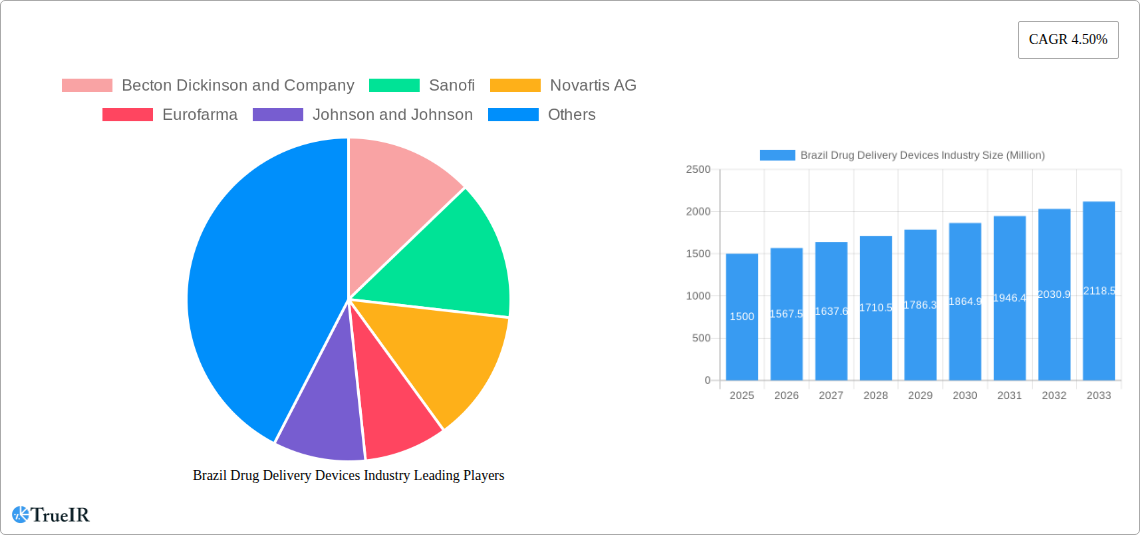

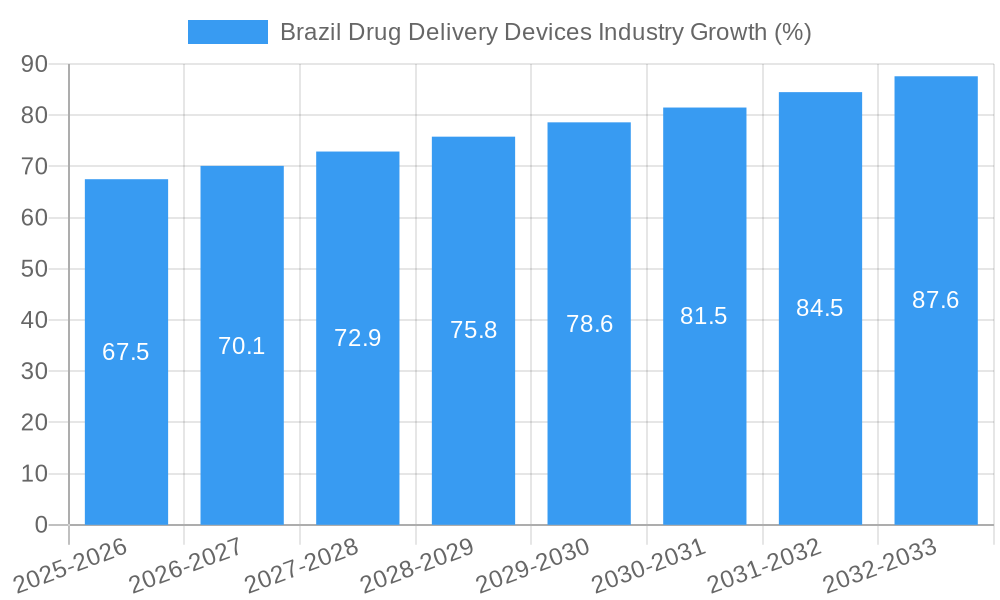

The Brazilian drug delivery devices market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.50% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases like cancer, cardiovascular ailments, and diabetes within Brazil's growing population necessitates advanced drug delivery systems for effective treatment. Secondly, the ongoing development and adoption of innovative drug delivery technologies, such as targeted drug delivery and personalized medicine, are driving market growth. Furthermore, increasing government initiatives focused on improving healthcare infrastructure and accessibility are creating a favorable environment for market expansion. Significant investments by pharmaceutical companies in R&D and collaborations with device manufacturers are also contributing to the market's growth trajectory.

However, the market's growth is not without challenges. High costs associated with advanced drug delivery devices, particularly injectables and those used in specialized applications like ocular drug delivery, can limit market penetration, especially among lower-income segments of the population. Regulatory hurdles and stringent approval processes for new devices also pose a potential restraint on market expansion. Despite these challenges, the long-term outlook for the Brazilian drug delivery devices market remains positive, driven by the confluence of demographic trends, technological advancements, and increasing healthcare expenditure. The market segmentation reveals a significant demand across various routes of administration (injectable, topical, ocular), applications (cancer, cardiovascular, diabetes), and end-users (hospitals, ambulatory surgical centers). Key players such as Becton Dickinson, Sanofi, Novartis, and others are strategically positioned to capitalize on this growth potential through product innovation and market expansion strategies.

Brazil Drug Delivery Devices Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Brazil drug delivery devices market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and an estimated and forecast period of 2025-2033, this report utilizes historical data from 2019-2024 to project future market trends. The report covers key market segments, competitive landscapes, growth drivers, and challenges, providing actionable intelligence for informed decision-making.

Brazil Drug Delivery Devices Industry Market Structure & Competitive Landscape

The Brazilian drug delivery devices market exhibits a moderately concentrated structure, with key players like Becton Dickinson and Company, Sanofi, Novartis AG, Eurofarma, Johnson & Johnson, Teva Pharmaceutical Industries Ltd, Merck KGaA, GSK plc, and Pfizer Inc. holding significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating a moderate level of competition. Innovation is a crucial driver, with companies continually developing advanced drug delivery systems to enhance efficacy and patient compliance. Stringent regulatory oversight by ANVISA (Agência Nacional de Vigilância Sanitária) significantly impacts market dynamics, requiring rigorous testing and approvals before product launch. The market witnesses some level of substitution with alternative drug delivery methods and generic formulations impacting the market dynamics.

The end-user segment is dominated by hospitals and ambulatory surgical centers, accounting for approximately xx% of total market revenue in 2025. The increasing prevalence of chronic diseases, coupled with a growing healthcare infrastructure, fuels the demand for sophisticated drug delivery devices. M&A activity in the Brazilian drug delivery devices market has been moderate in recent years, with xx major transactions recorded between 2019 and 2024. These transactions primarily focused on expanding product portfolios and gaining access to new technologies.

Brazil Drug Delivery Devices Industry Market Trends & Opportunities

The Brazilian drug delivery devices market is poised for robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the rising prevalence of chronic diseases (such as diabetes, cardiovascular diseases, and cancer), an aging population, increasing healthcare expenditure, and the government's focus on improving healthcare infrastructure. Technological advancements, including the development of smart drug delivery systems, personalized medicine approaches, and nanotechnology-based drug delivery, are also significantly driving market expansion. Consumer preferences are shifting towards more convenient, user-friendly, and minimally invasive drug delivery methods. Competitive intensity is moderate, with both domestic and international players vying for market share. Market penetration rates for advanced drug delivery systems, such as injectable and implantable devices, are expected to increase significantly over the forecast period, reaching xx% by 2033.

Dominant Markets & Segments in Brazil Drug Delivery Devices Industry

The injectable route of administration segment dominates the Brazilian drug delivery devices market, holding approximately xx% of the market share in 2025. This is primarily due to the high prevalence of chronic diseases requiring regular injections, and the growing acceptance of injectable biologics. The cancer application segment is another significant growth driver, with a market share of xx% in 2025, driven by increasing cancer incidence and the adoption of targeted drug delivery systems. Hospitals continue to be the largest end-user segment, accounting for approximately xx% of market revenue in 2025.

- Key Growth Drivers for Injectable Drug Delivery: Increasing prevalence of chronic diseases requiring injectable therapies.

- Key Growth Drivers for Cancer Application: Rising cancer incidence rates and expanding oncology treatment options.

- Key Growth Drivers for Hospitals: Expanding healthcare infrastructure and increasing patient volume.

Brazil Drug Delivery Devices Industry Product Analysis

The Brazilian drug delivery devices market showcases a diverse range of products, from conventional syringes and needles to advanced technologies like insulin pumps, implantable drug delivery systems, and microneedle patches. Innovation focuses on enhancing patient convenience, improving drug efficacy, and reducing side effects. The competitive landscape is characterized by product differentiation through unique features, such as ease of use, safety, and improved drug delivery mechanisms. The success of specific products hinges on factors such as regulatory approvals, pricing strategies, and effective marketing campaigns.

Key Drivers, Barriers & Challenges in Brazil Drug Delivery Devices Industry

Key Drivers:

- Rising prevalence of chronic diseases.

- Growing government investments in healthcare infrastructure.

- Technological advancements in drug delivery systems.

Key Challenges:

- Stringent regulatory requirements leading to longer approval times and increased costs.

- High import costs for advanced drug delivery devices.

- Competition from generic drug manufacturers.

Growth Drivers in the Brazil Drug Delivery Devices Industry Market

The market is primarily driven by the increasing prevalence of chronic diseases, such as diabetes and cardiovascular diseases, requiring long-term medication administration. Technological advancements, including smart drug delivery systems and personalized medicine, are also significant drivers, alongside improving healthcare infrastructure and government initiatives promoting better healthcare access.

Challenges Impacting Brazil Drug Delivery Devices Industry Growth

Regulatory hurdles, including stringent approval processes and high import duties, pose significant challenges. Supply chain disruptions, competition from less expensive generic alternatives, and pricing pressures also hinder market growth. The fluctuating Brazilian Real also poses an ongoing challenge for international players.

Key Players Shaping the Brazil Drug Delivery Devices Industry Market

- Becton Dickinson and Company

- Sanofi

- Novartis AG

- Eurofarma

- Johnson & Johnson

- Teva Pharmaceutical Industries Ltd

- Merck KGaA

- GSK plc

- Pfizer Inc

Significant Brazil Drug Delivery Devices Industry Milestones

- September 2022: Evandro Chagas National Institute of Infectious Disease sponsored a clinical trial for injectable Cabotegravir (CAB-LA) PrEP. This highlights the growing focus on preventative care and injectable drug delivery systems for infectious diseases.

- June 2021: Instituto Nacional de Cancer sponsored a Phase III clinical trial (ELSA) evaluating intravenous Lidocaine delivery via infusion pump. This demonstrates the ongoing research and development in drug delivery methods for specific therapeutic areas.

Future Outlook for Brazil Drug Delivery Devices Industry Market

The Brazilian drug delivery devices market is projected to experience sustained growth, driven by increasing healthcare spending, technological advancements, and the growing prevalence of chronic diseases. Strategic opportunities lie in developing innovative drug delivery systems tailored to the specific needs of the Brazilian population, focusing on affordability, accessibility, and convenience. The market’s potential is significant, particularly in areas such as personalized medicine and advanced therapies.

Brazil Drug Delivery Devices Industry Segmentation

-

1. Route of Administration

- 1.1. Injectable

- 1.2. Topical

- 1.3. Ocular

- 1.4. Other Route of Administration

-

2. Application

- 2.1. Cancer

- 2.2. Cardiovascular

- 2.3. Diabetes

- 2.4. Infectious diseases

- 2.5. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Ambulatory Surgical Centers

- 3.3. Other End Users

Brazil Drug Delivery Devices Industry Segmentation By Geography

- 1. Brazil

Brazil Drug Delivery Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases; Increased Funding and Research Activity in Drug Development

- 3.3. Market Restrains

- 3.3.1. Risk Associated With Needlestick Injuries

- 3.4. Market Trends

- 3.4.1. Ocular Segment is Likely to Witness a Growth in the Brazil Drug Delivery Devices Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Drug Delivery Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Injectable

- 5.1.2. Topical

- 5.1.3. Ocular

- 5.1.4. Other Route of Administration

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer

- 5.2.2. Cardiovascular

- 5.2.3. Diabetes

- 5.2.4. Infectious diseases

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sanofi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novartis AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eurofarma

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson and Johnson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teva Pharmaceutical Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Merck KGaA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 GSK plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pfizer Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Brazil Drug Delivery Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Drug Delivery Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 4: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 5: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 14: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 15: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Brazil Drug Delivery Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Drug Delivery Devices Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Drug Delivery Devices Industry?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Brazil Drug Delivery Devices Industry?

Key companies in the market include Becton Dickinson and Company, Sanofi, Novartis AG, Eurofarma, Johnson and Johnson, Teva Pharmaceutical Industries Ltd, Merck KGaA, GSK plc, Pfizer Inc.

3. What are the main segments of the Brazil Drug Delivery Devices Industry?

The market segments include Route of Administration, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases; Increased Funding and Research Activity in Drug Development.

6. What are the notable trends driving market growth?

Ocular Segment is Likely to Witness a Growth in the Brazil Drug Delivery Devices Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Risk Associated With Needlestick Injuries.

8. Can you provide examples of recent developments in the market?

In September 2022, Evandro Chagas National Institute of Infectious Disease sponsored a clinical trial study under the title "The Implementation of Pre-exposure Prophylaxis of Injectable Cabotegravir (ImPrepCab)" the study is to assess the safety and effectiveness of open-label CAB LA PrEP when offered at public health facilities to cisgender men and transgender or gender non-binary individuals. Cabotegravir (CAB-LA) is given as injectable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Drug Delivery Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Drug Delivery Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Drug Delivery Devices Industry?

To stay informed about further developments, trends, and reports in the Brazil Drug Delivery Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence