Key Insights

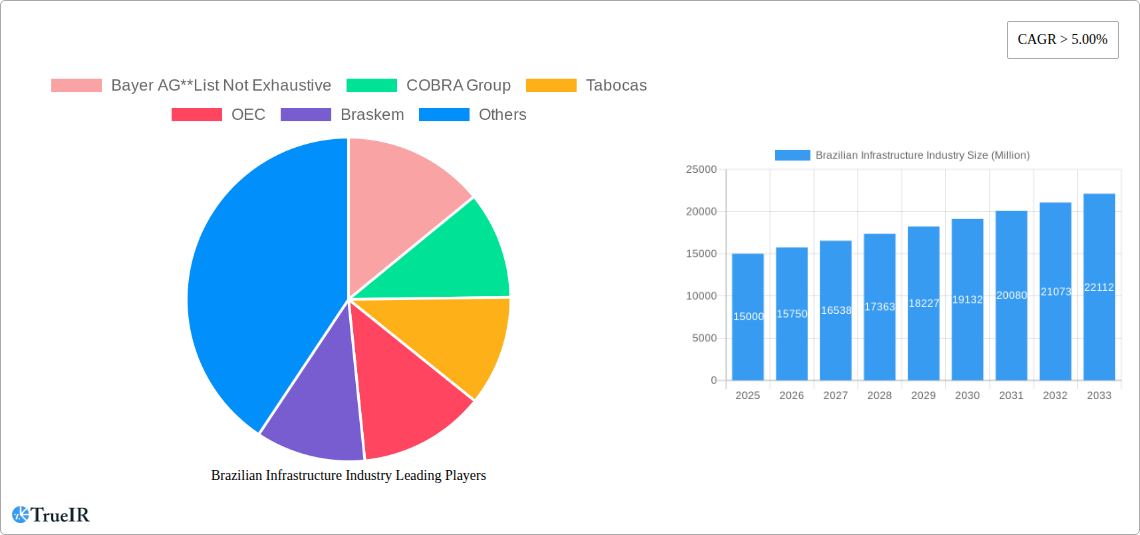

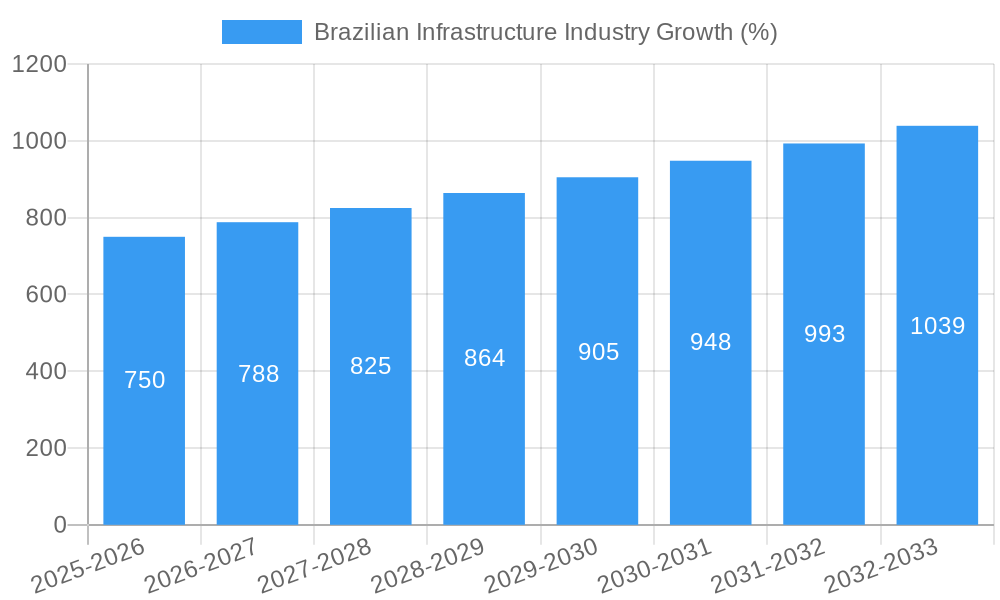

The Brazilian infrastructure industry presents a significant investment opportunity, exhibiting robust growth potential. With a market size exceeding (estimated) $XX million in 2025 and a Compound Annual Growth Rate (CAGR) exceeding 5%, the sector is poised for considerable expansion through 2033. This growth is driven by several key factors, including increasing government investment in social infrastructure projects—particularly transportation (roads, railways, and waterways) and telecommunications—to improve connectivity and enhance public services. Furthermore, urbanization, especially in major cities like Sao Paulo, Rio de Janeiro, and Salvador, fuels demand for upgraded infrastructure to support growing populations and economic activity. The industry is segmented by infrastructure type (social, transportation, waterways, telecoms, manufacturing) and geographically, highlighting regional development priorities and investment hotspots. While challenges like bureaucratic hurdles and economic volatility could act as restraints, the long-term outlook remains positive, fueled by Brazil's commitment to modernizing its infrastructure and attracting foreign direct investment.

The leading players in the Brazilian infrastructure market include both domestic and international companies. Large construction conglomerates like Andrade Gutierrez, Construcap, and Queiroz Galvao, along with multinational corporations such as Bayer AG, are actively involved in large-scale projects. The presence of these key players suggests a healthy level of competition and innovation. The industry's success hinges on effective project management, efficient resource allocation, and the ability to navigate regulatory complexities. Ongoing efforts to streamline permitting processes and foster a more predictable investment climate will be crucial for sustained growth. Furthermore, a focus on sustainable infrastructure development, integrating environmental considerations into project planning, will increasingly influence future investment decisions and operational practices. This will contribute to the long-term viability and positive societal impact of the industry.

Brazilian Infrastructure Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Brazilian infrastructure industry, projecting a market valued at $XX Million by 2033. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We examine key market segments, dominant players, and future growth opportunities, offering crucial insights for investors, businesses, and policymakers. The report leverages extensive data analysis, covering market size, CAGR, market penetration rates, and M&A activity, enabling informed strategic decision-making.

Brazilian Infrastructure Industry Market Structure & Competitive Landscape

The Brazilian infrastructure market exhibits a moderately concentrated structure, with a few large players dominating certain segments. The Herfindahl-Hirschman Index (HHI) for the overall market is estimated at xx, indicating a moderately competitive landscape. Key factors shaping the competitive landscape include:

- Innovation Drivers: Technological advancements in construction techniques, materials science, and digital technologies are driving innovation, particularly in areas like smart cities and sustainable infrastructure.

- Regulatory Impacts: Government regulations, including environmental permits and procurement processes, significantly influence market dynamics. Changes in regulatory frameworks can create both opportunities and challenges for companies.

- Product Substitutes: The availability of alternative materials and technologies influences the competitiveness of traditional infrastructure solutions. The adoption of sustainable and cost-effective alternatives, such as recycled materials, is gaining traction.

- End-User Segmentation: The market is segmented by end-user, including public sector agencies, private companies, and PPP projects. Understanding the specific needs of each segment is crucial for effective market penetration.

- M&A Trends: The past five years have witnessed a significant number of mergers and acquisitions (M&As) in the Brazilian infrastructure sector, with a total deal value estimated at $XX Million. These M&As are driven by factors such as expansion into new markets, access to new technologies and financial resources, and increased efficiency.

Brazilian Infrastructure Industry Market Trends & Opportunities

The Brazilian infrastructure market is experiencing robust growth, driven by government investments in mega-projects and increasing private sector participation. The market size is projected to expand at a CAGR of xx% during the forecast period (2025-2033), reaching $XX Million by 2033. Key trends shaping market growth include:

- Technological Shifts: The increasing adoption of Building Information Modeling (BIM), automation technologies, and data analytics is revolutionizing construction practices, improving efficiency, and reducing costs.

- Government Initiatives: Government programs aimed at upgrading infrastructure are key catalysts for market growth. The emphasis on PPPs (Public-Private Partnerships) is fostering private sector investments.

- Urbanization and Population Growth: Rapid urbanization and population growth are driving demand for new infrastructure development in major cities across Brazil.

- Sustainability Concerns: The growing focus on sustainable infrastructure development presents opportunities for companies offering environmentally friendly solutions.

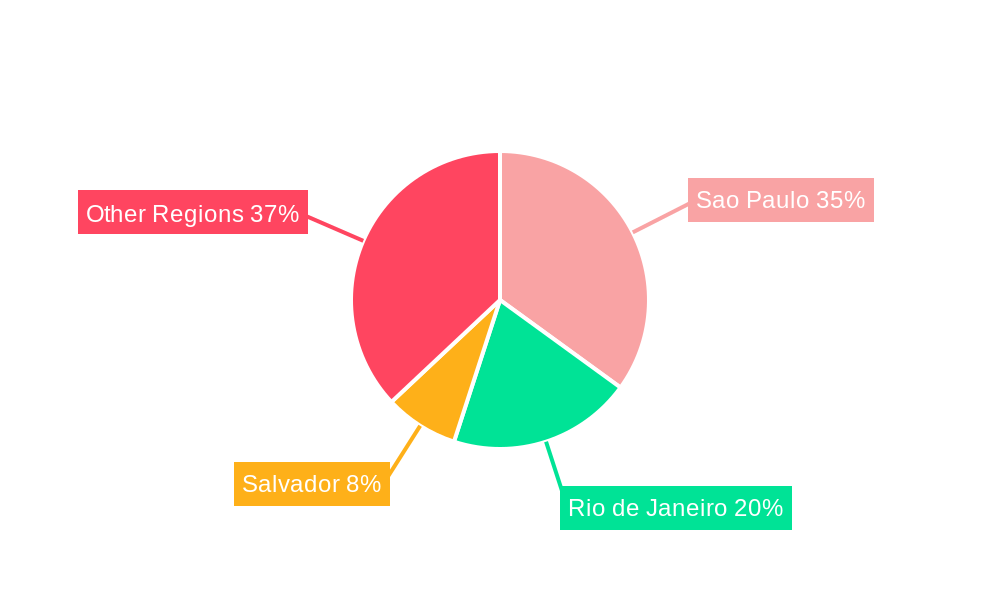

Dominant Markets & Segments in Brazilian Infrastructure Industry

The São Paulo metropolitan area accounts for the largest share of the Brazilian infrastructure market, followed by Rio de Janeiro and Salvador. Key growth drivers across segments include:

Social Infrastructure: Growing demand for improved healthcare facilities, education infrastructure, and public housing is driving substantial growth.

Transportation Infrastructure: Significant investments in road networks, railways, airports, and public transportation systems contribute significantly to market growth.

Waterways Infrastructure: Expansion of port facilities and waterway infrastructure, particularly in export-oriented regions, contributes to the segment's growth.

Extraction Infrastructure: The extraction sector's infrastructural requirements are a driver of the growth of this particular market segment.

Telecoms Infrastructure: Increased demand for high-speed internet and digital connectivity fuels growth in this segment.

Key Growth Drivers (Sao Paulo): High population density, concentration of economic activity, and extensive government investment in infrastructure projects.

Key Growth Drivers (Rio de Janeiro): Tourism, major events, and ongoing urban renewal projects.

Key Growth Drivers (Salvador): Port development, tourism, and growing industrial activity.

Brazilian Infrastructure Industry Product Analysis

Innovation in infrastructure materials, construction techniques, and digital technologies are transforming the industry. Companies are increasingly adopting prefabricated components, modular construction, and advanced materials to improve efficiency, reduce costs, and enhance project sustainability. The market sees a high demand for durable, cost-effective, and eco-friendly infrastructure solutions.

Key Drivers, Barriers & Challenges in Brazilian Infrastructure Industry

Key Drivers: Government investments in infrastructure, urbanization, economic growth, and technological advancements are driving market expansion. Specific examples include the ongoing expansion of the São Paulo metro system and the development of new ports.

Key Challenges: Regulatory hurdles, bureaucratic complexities, and supply chain disruptions pose significant challenges. The impact of corruption scandals on project timelines and costs is also a substantial impediment. A shortage of skilled labor adds to the existing challenges.

Growth Drivers in the Brazilian Infrastructure Industry Market

Robust economic growth, rising urbanization, and government initiatives to modernize infrastructure are major drivers. Technological advancements, including the use of BIM and automation, are also increasing efficiency and productivity.

Challenges Impacting Brazilian Infrastructure Industry Growth

Bureaucracy, corruption, and financing challenges remain significant obstacles. The fluctuating exchange rate poses risks to import-dependent projects. Also, the availability of skilled labor and managing environmental concerns are other issues impacting growth.

Key Players Shaping the Brazilian Infrastructure Industry Market

- Bayer AG

- COBRA Group

- Tabocas

- OEC

- Braskem

- Telemont

- Andrade Gutierrez

- Construcap

- Construtora Queiroz Galvao

- U&M Mineracao e Construcao

- Camargo Correa Infra Construcoes

- Novonor

Significant Brazilian Infrastructure Industry Industry Milestones

- 2021: Launch of a major national infrastructure investment program by the Brazilian government.

- 2022: Successful completion of a large-scale PPP project in São Paulo.

- 2023: Significant advancements in the adoption of BIM technology across several projects. (Further milestones would be added here based on available data.)

Future Outlook for Brazilian Infrastructure Industry Market

The Brazilian infrastructure market is poised for continued growth, driven by ongoing government investments, increasing private sector participation, and technological advancements. The market offers substantial opportunities for companies to capitalize on emerging trends such as sustainable infrastructure and smart city development. However, addressing challenges related to regulatory hurdles and skilled labor shortages remains crucial.

Brazilian Infrastructure Industry Segmentation

-

1. Type

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defence

- 1.1.4. Other Social Infrastructures

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Power Generation

- 1.3.2. Electricity Transmission and Distribution

- 1.3.3. Gas

- 1.3.4. Telecoms

-

1.4. Manufacturing Infrastructure

- 1.4.1. Metal and Ore Production

- 1.4.2. Petroleum Refining

- 1.4.3. Chemical Manufacturing

- 1.4.4. Industrial Parks and clusters

- 1.4.5. Other Manufacturing Infrastructures

-

1.1. Social Infrastructure

-

2. Key Cities

- 2.1. Sao Paulo

- 2.2. Rio de Janeiro

- 2.3. Salvador

Brazilian Infrastructure Industry Segmentation By Geography

- 1. Brazil

Brazilian Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continued Expansion of Higher Education; The Surge in the Number of International Students

- 3.3. Market Restrains

- 3.3.1. Affordability and Shortage of Supply; High Cost for International Students

- 3.4. Market Trends

- 3.4.1. Increasing Investments in Infrastructure Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazilian Infrastructure Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defence

- 5.1.1.4. Other Social Infrastructures

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Power Generation

- 5.1.3.2. Electricity Transmission and Distribution

- 5.1.3.3. Gas

- 5.1.3.4. Telecoms

- 5.1.4. Manufacturing Infrastructure

- 5.1.4.1. Metal and Ore Production

- 5.1.4.2. Petroleum Refining

- 5.1.4.3. Chemical Manufacturing

- 5.1.4.4. Industrial Parks and clusters

- 5.1.4.5. Other Manufacturing Infrastructures

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Sao Paulo

- 5.2.2. Rio de Janeiro

- 5.2.3. Salvador

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer AG**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 COBRA Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tabocas

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OEC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Braskem

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telemont

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Andrade Gutierrez

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Construcap

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Construtora Queiroz Galvao

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 U&M Mineracao e Construcao

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Camargo Correa Infra Construcoes

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novonor

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Bayer AG**List Not Exhaustive

List of Figures

- Figure 1: Brazilian Infrastructure Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazilian Infrastructure Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazilian Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazilian Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Brazilian Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Brazilian Infrastructure Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazilian Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazilian Infrastructure Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Brazilian Infrastructure Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Brazilian Infrastructure Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazilian Infrastructure Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Brazilian Infrastructure Industry?

Key companies in the market include Bayer AG**List Not Exhaustive, COBRA Group, Tabocas, OEC, Braskem, Telemont, Andrade Gutierrez, Construcap, Construtora Queiroz Galvao, U&M Mineracao e Construcao, Camargo Correa Infra Construcoes, Novonor.

3. What are the main segments of the Brazilian Infrastructure Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Continued Expansion of Higher Education; The Surge in the Number of International Students.

6. What are the notable trends driving market growth?

Increasing Investments in Infrastructure Sector.

7. Are there any restraints impacting market growth?

Affordability and Shortage of Supply; High Cost for International Students.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazilian Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazilian Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazilian Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Brazilian Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence