Key Insights

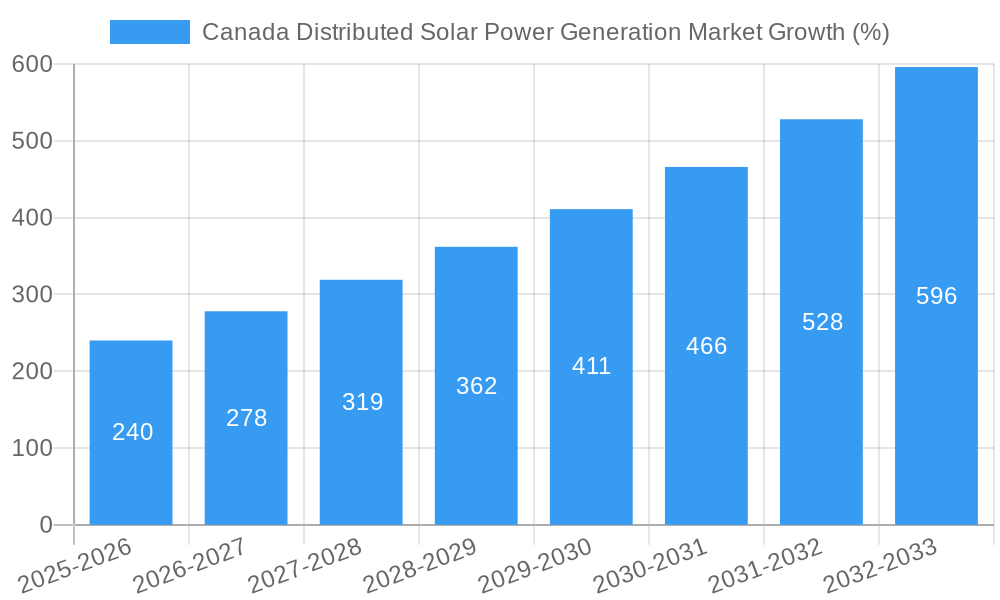

The Canadian distributed solar power generation market is experiencing robust growth, driven by increasing electricity prices, supportive government policies aimed at decarbonizing the energy sector, and a growing awareness of environmental sustainability among both residential and commercial consumers. The market, valued at approximately $X million in 2025 (assuming a logical market size based on global trends and the provided CAGR of >12%), is projected to expand significantly over the forecast period (2025-2033). This expansion is fueled by technological advancements leading to lower solar panel costs and increased efficiency, along with the rising adoption of net metering and other incentive programs. The residential segment is expected to witness substantial growth due to decreasing installation costs and the availability of financing options, while the commercial and industrial sectors are expected to see steady expansion driven by corporate sustainability goals and long-term cost savings. While the overall market exhibits strong growth potential, challenges remain, including intermittency issues associated with solar power and the need for improved grid infrastructure to handle the influx of distributed generation. Further growth will hinge on overcoming these challenges, securing further government funding and streamlining permitting processes to increase solar power adoption across Canada.

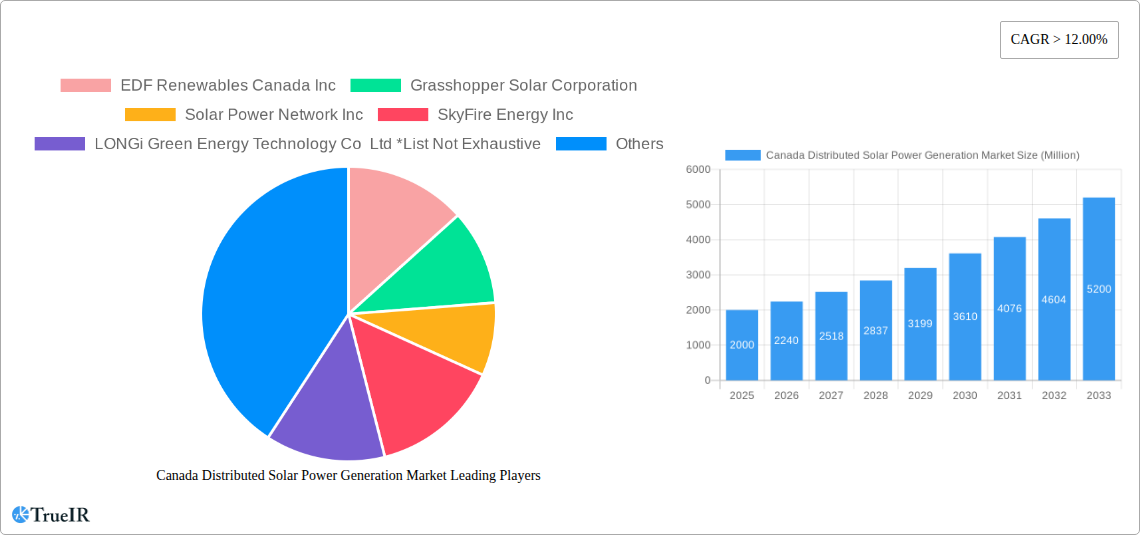

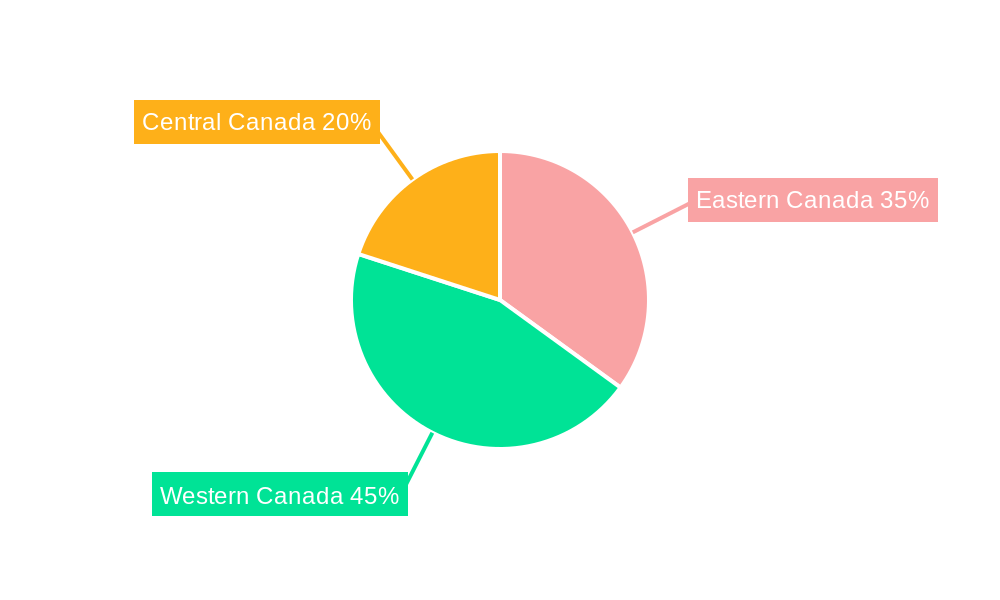

The market segmentation reveals a dynamic landscape. Solar power dominates the "type" segment, while residential applications are projected to be the largest consumer. Key players like EDF Renewables Canada Inc., Canadian Solar Inc., and LONGi Green Energy Technology Co Ltd are actively shaping the market through technological innovation, project development, and strategic partnerships. Geographical variations exist, with regions like Western Canada potentially leading in adoption due to higher solar irradiation levels. The historical period (2019-2024) showcases an upward trajectory setting the stage for strong growth in the forecast period, despite potential restraints like seasonal variations in solar energy output and land availability.

This comprehensive report provides an in-depth analysis of the dynamic Canadian distributed solar power generation market, offering invaluable insights for investors, industry professionals, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market size, trends, competitive dynamics, and future growth potential. Benefit from detailed segmentation by type (solar, wind, hydro, other) and application (residential, commercial, industrial, utility), along with analysis of key players like EDF Renewables Canada Inc, Grasshopper Solar Corporation, and Canadian Solar Inc. Discover crucial market drivers, barriers, and opportunities shaping the future of distributed solar power generation in Canada.

Canada Distributed Solar Power Generation Market Structure & Competitive Landscape

The Canadian distributed solar power generation market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2025. This indicates the presence of several significant players, alongside numerous smaller participants. Market concentration is expected to slightly increase to an HHI of xx by 2033, driven by mergers and acquisitions (M&A) activity and the consolidation of smaller companies. Over the historical period (2019-2024), M&A volume totaled approximately xx Million CAD, with an expected increase to xx Million CAD during the forecast period (2025-2033).

Innovation Drivers: Technological advancements, such as improved solar panel efficiency and reduced manufacturing costs, are key drivers. Government incentives and supportive policies are further fueling innovation.

Regulatory Impacts: Federal and provincial regulations related to renewable energy targets, net metering policies, and feed-in tariffs significantly influence market growth. These regulations, while largely supportive, introduce some complexity for market entry and expansion.

Product Substitutes: Wind and hydro power are primary substitutes for solar energy, particularly in regions with abundant wind or hydro resources. However, solar's distributed nature and decreasing costs offer a significant competitive advantage in many areas.

End-User Segmentation: The market is segmented into residential, commercial, industrial, and utility sectors, with the commercial and industrial sectors exhibiting the highest growth rates.

M&A Trends: Consolidation is a notable trend, with larger companies acquiring smaller players to expand their market share and geographic reach. This trend is expected to accelerate in the coming years.

Canada Distributed Solar Power Generation Market Market Trends & Opportunities

The Canadian distributed solar power generation market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This growth is fuelled by increasing energy costs, rising awareness of environmental sustainability, and supportive government policies aimed at transitioning to cleaner energy sources. Market penetration is steadily increasing, projected to reach xx% of total electricity generation by 2033, up from xx% in 2025.

Technological advancements, including improved solar panel efficiency and energy storage solutions, are significantly impacting market dynamics. Consumer preferences are shifting towards renewable energy sources, driven by environmental concerns and the desire for energy independence. Furthermore, the increasing affordability of solar power systems is widening market accessibility, making them economically viable for a broader range of consumers and businesses. Competitive dynamics are characterized by increased participation from both domestic and international companies, leading to innovation and cost reductions.

Dominant Markets & Segments in Canada Distributed Solar Power Generation Market

The Ontario province currently dominates the Canadian distributed solar power generation market, driven by supportive provincial policies, a robust economy, and a high concentration of population and businesses. The solar segment holds the largest market share within the ‘type’ category, followed by wind and hydro. Within the application segments, the commercial and industrial sectors exhibit the most significant growth potential, attributed to substantial energy consumption and a growing awareness of the economic benefits of on-site solar power generation.

Key Growth Drivers for Ontario:

- Favorable renewable energy policies and incentives.

- Strong economic growth and significant investment in infrastructure.

- High population density and a large commercial and industrial sector.

- Government programs supporting the adoption of solar energy technologies.

Detailed analysis of market dominance reveals that Ontario's success is largely attributed to its proactive renewable energy policies, which provide significant financial incentives for solar power installations, making it an attractive option for both residential and commercial consumers. The province also benefits from a well-developed grid infrastructure, which simplifies the integration of distributed solar generation. However, growth in other provinces is expected to accelerate as policies and incentives are further expanded nationally.

Canada Distributed Solar Power Generation Market Product Analysis

Technological advancements in photovoltaic (PV) technology, such as the development of higher-efficiency solar panels and improved energy storage systems, are driving product innovation within the Canadian market. These advancements enhance the efficiency and cost-effectiveness of solar power systems, resulting in increased adoption rates across various segments. Key competitive advantages include lower lifetime costs compared to traditional energy sources, reduced carbon footprint, and potential for energy independence. The market is witnessing the emergence of smart grid integration technologies, optimizing energy distribution and enhancing the overall effectiveness of distributed solar power generation.

Key Drivers, Barriers & Challenges in Canada Distributed Solar Power Generation Market

Key Drivers: Government incentives, declining solar panel costs, increasing energy prices, and growing environmental awareness are significant factors pushing market growth. Technological advancements, such as improved energy storage solutions, further enhance the viability of distributed solar power generation.

Challenges: Intermittency of solar power, land constraints in densely populated areas, and the complexities of grid integration pose notable barriers. Regulatory complexities and permitting processes can slow down project deployment, and supply chain disruptions could impact material availability and project costs. The impact of these challenges is estimated to constrain market growth by approximately xx% by 2033.

Growth Drivers in the Canada Distributed Solar Power Generation Market Market

The key drivers propelling the market are a supportive regulatory environment, technological advancements leading to more efficient and affordable systems, and increasing consumer and business demand driven by environmental concerns and the desire for energy independence. Government incentives, such as tax credits and rebates, are also vital drivers.

Challenges Impacting Canada Distributed Solar Power Generation Market Growth

Significant challenges include intermittency issues (addressed by energy storage solutions), permitting and regulatory complexities (requiring streamlined processes), and potential supply chain vulnerabilities (mitigated through diversification strategies). These factors could impact the market by slowing down the rate of adoption.

Key Players Shaping the Canada Distributed Solar Power Generation Market Market

- EDF Renewables Canada Inc

- Grasshopper Solar Corporation

- Solar Power Network Inc

- SkyFire Energy Inc

- LONGi Green Energy Technology Co Ltd

- Canadian Solar Inc

- Polaron Solartech Corp

- Great Canadian Solar

- Morgan Solar

Significant Canada Distributed Solar Power Generation Market Industry Milestones

- June 2022: Ontario announces an accelerated target for renewable energy adoption.

- October 2021: Canadian Solar Inc announces a significant investment in new manufacturing capacity.

- March 2020: New federal regulations streamline the approval process for solar power projects.

Future Outlook for Canada Distributed Solar Power Generation Market Market

The Canadian distributed solar power generation market is poised for substantial growth, driven by a combination of strong government support, technological innovation, and increasing market demand. Strategic opportunities exist for companies focusing on innovative energy storage solutions, grid integration technologies, and expansion into underserved markets. The potential for market expansion is significant, particularly as technology costs continue to decline and consumer awareness of environmental sustainability increases.

Canada Distributed Solar Power Generation Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Canada Distributed Solar Power Generation Market Segmentation By Geography

- 1. Canada

Canada Distributed Solar Power Generation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies4.; Increasing Demand for Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Inefficient Grid Infrastructure and A High Number Of Islands in the Country

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Clean Electricity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Eastern Canada Canada Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Distributed Solar Power Generation Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 EDF Renewables Canada Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Grasshopper Solar Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Solar Power Network Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 SkyFire Energy Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 LONGi Green Energy Technology Co Ltd *List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Canadian Solar Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Polaron Solartech Corp

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Great Canadian Solar

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Morgan Solar

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 EDF Renewables Canada Inc

List of Figures

- Figure 1: Canada Distributed Solar Power Generation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Distributed Solar Power Generation Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Eastern Canada Canada Distributed Solar Power Generation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Western Canada Canada Distributed Solar Power Generation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Central Canada Canada Distributed Solar Power Generation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 13: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 14: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 15: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 16: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 17: Canada Distributed Solar Power Generation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Distributed Solar Power Generation Market?

The projected CAGR is approximately > 12.00%.

2. Which companies are prominent players in the Canada Distributed Solar Power Generation Market?

Key companies in the market include EDF Renewables Canada Inc, Grasshopper Solar Corporation, Solar Power Network Inc, SkyFire Energy Inc, LONGi Green Energy Technology Co Ltd *List Not Exhaustive, Canadian Solar Inc, Polaron Solartech Corp, Great Canadian Solar, Morgan Solar.

3. What are the main segments of the Canada Distributed Solar Power Generation Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies4.; Increasing Demand for Renewable Energy.

6. What are the notable trends driving market growth?

Increasing Demand for Clean Electricity.

7. Are there any restraints impacting market growth?

4.; Inefficient Grid Infrastructure and A High Number Of Islands in the Country.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Distributed Solar Power Generation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Distributed Solar Power Generation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Distributed Solar Power Generation Market?

To stay informed about further developments, trends, and reports in the Canada Distributed Solar Power Generation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence