Key Insights

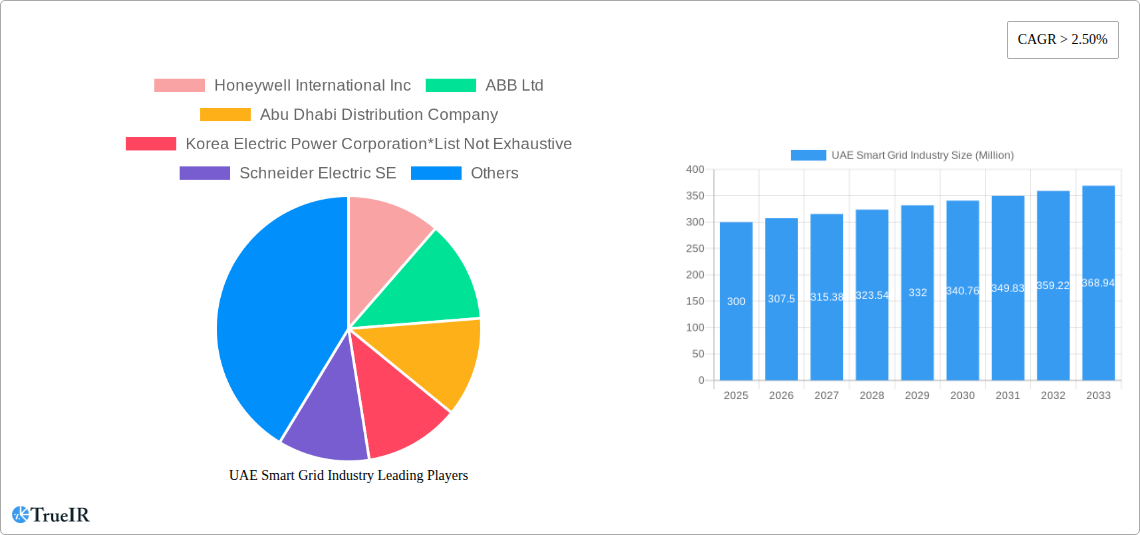

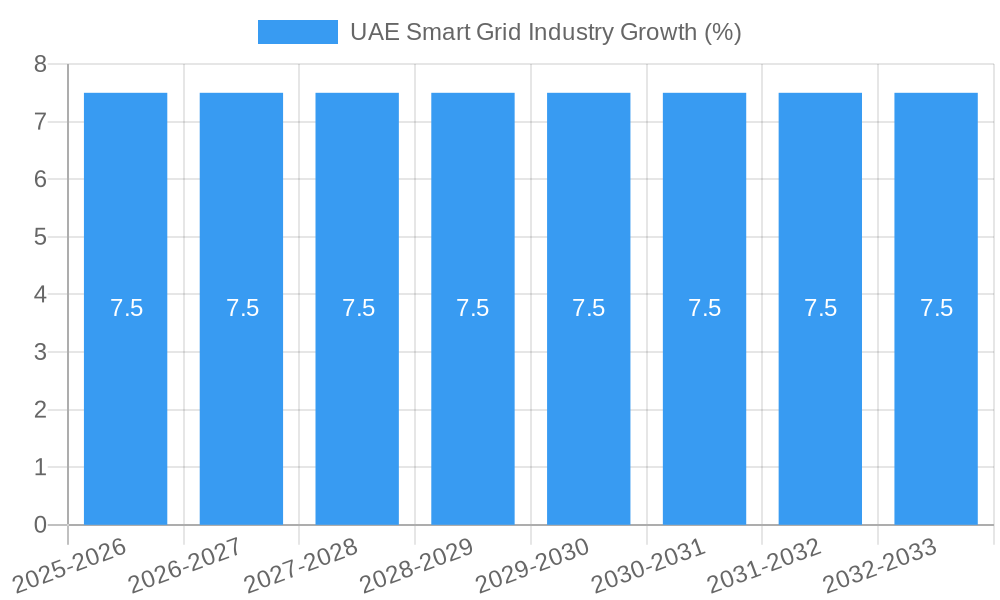

The UAE smart grid market is experiencing robust growth, driven by the nation's ambitious sustainability goals and increasing energy demand. With a Compound Annual Growth Rate (CAGR) exceeding 2.5% and a 2025 market size estimated in the hundreds of millions (precise figures require further data), the sector presents significant investment opportunities. Key drivers include the government's commitment to renewable energy integration, the need for improved grid efficiency and reliability, and the rising adoption of smart metering infrastructure (AMI) to enhance energy management. The ongoing expansion of communication technologies within the grid, alongside advancements in transmission infrastructure, further fuels market expansion. While data on specific market restraints is limited, potential challenges could include high initial investment costs associated with smart grid deployment and the integration of diverse technologies. The market is segmented by technology application areas, with transmission, communication technologies, and AMI dominating. Major players like Honeywell, ABB, Schneider Electric, and GE are actively shaping the market landscape through their technological offerings and project implementations. The UAE's strategic location and commitment to technological innovation position it as a leading hub for smart grid development in the region.

The forecast period (2025-2033) anticipates continued growth, driven by increasing urbanization, economic development, and the continued push for a more resilient and sustainable energy system. Growth will likely be influenced by government policies promoting energy efficiency and renewable energy sources, alongside technological advancements leading to cost reductions and improved performance of smart grid components. Companies are expected to focus on developing innovative solutions that address the specific needs of the UAE market, focusing on areas such as energy storage, demand-side management, and grid modernization. Analyzing past performance (2019-2024) and considering the current growth trajectory provides a strong basis for projecting future market size and dynamics, indicating considerable potential for further expansion.

UAE Smart Grid Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UAE smart grid industry, encompassing market size, growth forecasts, technological advancements, competitive landscape, and key industry trends. The study period covers 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. This report is crucial for investors, industry professionals, and policymakers seeking to understand and capitalize on the significant growth opportunities within the UAE's rapidly evolving energy sector. The market is projected to reach a value of XX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX%.

UAE Smart Grid Industry Market Structure & Competitive Landscape

The UAE smart grid market demonstrates a moderately concentrated structure, with key players such as Honeywell International Inc, ABB Ltd, Schneider Electric SE, and General Electric Company holding significant market share. However, the presence of several regional players, including Abu Dhabi Distribution Company, Dubai Electricity and Water Authority (DEWA), and Sharjah Electricity and Water Board, contributes to a dynamic competitive landscape. The market exhibits a high level of innovation driven by the UAE's commitment to sustainable energy and technological advancement. Stringent government regulations focused on grid modernization and energy efficiency play a crucial role in shaping market dynamics. Product substitution, mainly from renewable energy integration, is a significant factor, influencing technological choices within smart grid deployments. End-user segmentation is largely driven by utility companies and industrial consumers. M&A activity is moderate, with occasional strategic acquisitions enhancing market consolidation. While precise quantitative data like concentration ratios and M&A volumes for this specific period are unavailable for public dissemination, the qualitative insights provided offer a comprehensive overview of the sector's competitive intensity.

UAE Smart Grid Industry Market Trends & Opportunities

The UAE smart grid market is experiencing substantial growth, driven by government initiatives promoting energy efficiency and renewable energy integration. The market size is projected to expand significantly over the forecast period, reaching XX Million by 2033. This growth is fueled by technological advancements like Artificial Intelligence (AI) for predictive maintenance and Smart Design of Electricity Distribution Networks (SDEDNs) enhancing network efficiency. Consumer preferences are shifting towards reliable and sustainable energy solutions, further driving the demand for smart grid technologies. The market also witnesses increasing adoption of Advanced Metering Infrastructure (AMI) and communication technologies for improved grid management and enhanced customer engagement. The high CAGR and increasing market penetration rate for smart grid solutions underscore the industry's dynamic growth trajectory. Competitive dynamics are shaped by technological innovation, pricing strategies, and the ability to meet the specific requirements of the UAE's energy landscape.

Dominant Markets & Segments in UAE Smart Grid Industry

The Advanced Metering Infrastructure (AMI) segment currently holds a dominant position in the UAE smart grid market, followed by the communication technology segment. This is primarily due to the significant investments by utility companies like DEWA and the ongoing efforts to modernize metering systems across the UAE.

Key Growth Drivers for AMI:

- Increasing government focus on energy efficiency and smart metering deployment.

- Growing demand for real-time energy monitoring and management capabilities.

- The need for accurate billing and enhanced revenue collection.

- Reduced energy losses through timely detection of faults and outages.

Key Growth Drivers for Communication Technology:

- Expansion of the telecommunication infrastructure supporting robust smart grid communication networks.

- The need for real-time data exchange and remote control of grid assets.

- Integration of diverse energy sources, requiring effective communication protocols for optimized grid operation.

The Transmission segment also exhibits significant growth potential due to investments in grid upgrades and expansion to support the increasing energy demand and integration of renewable sources. However, AMI and Communication Technologies, with their immediate consumer benefits and relatively faster implementation cycles, currently contribute most significantly to the market's overall expansion. The "Other Technology Application Areas" segment will continue to witness growth, primarily driven by ongoing innovation in energy storage, grid automation and cybersecurity.

UAE Smart Grid Industry Product Analysis

The UAE smart grid industry is witnessing rapid innovation in smart meters, grid automation systems, and advanced analytics platforms. These products are designed to enhance grid efficiency, reliability, and security. Key competitive advantages stem from technological advancements in AI-driven predictive maintenance, data analytics for optimizing grid operations, and improved cybersecurity measures to mitigate potential threats. The market's product landscape is dynamic, with constant evolution to meet the unique demands of the UAE's diverse energy mix and climate conditions.

Key Drivers, Barriers & Challenges in UAE Smart Grid Industry

Key Drivers:

The UAE's ambitious renewable energy targets, coupled with increasing energy demand and the need for a reliable power supply, are the primary drivers of the smart grid market. Government initiatives and investments in smart grid infrastructure, along with technological advancements such as AI and IoT, are further propelling market growth. The focus on optimizing grid efficiency and enhancing energy security fuels significant investment.

Key Challenges:

The high initial investment cost of smart grid technologies and potential integration challenges with legacy systems pose significant barriers. Regulatory complexities surrounding data privacy, cybersecurity, and standardization can also hinder wider adoption. Furthermore, the competitive landscape might lead to pricing pressures and potential delays in project implementation. Supply chain disruptions, especially related to specialized equipment and components, can also negatively impact project timelines and overall market expansion. It's estimated these factors could cumulatively reduce market growth by approximately XX Million by 2033.

Growth Drivers in the UAE Smart Grid Industry Market

Technological innovation in AI, machine learning, and IoT applications significantly influences growth. Government-led initiatives, such as the UAE Energy Strategy 2050, create a favorable regulatory environment driving investments. Economic factors like increasing energy demand and the rising cost of traditional energy sources accelerate the adoption of smart grid solutions. The increasing focus on energy efficiency and renewable energy integration also play crucial roles.

Challenges Impacting UAE Smart Grid Industry Growth

Regulatory complexities concerning data security and interoperability standards represent key challenges. Supply chain issues related to the import of specialized equipment, especially during periods of global uncertainty, can impact timely project implementation. High upfront capital costs for smart grid infrastructure can deter some investment. Intense competition among technology providers and service providers might constrain profit margins.

Key Players Shaping the UAE Smart Grid Industry Market

- Honeywell International Inc

- ABB Ltd

- Abu Dhabi Distribution Company

- Korea Electric Power Corporation

- Schneider Electric SE

- Dubai Electricity and Water Authority

- General Electric Company

- Sharjah Electricity and Water Board

Significant UAE Smart Grid Industry Industry Milestones

- August 2022: DEWA announced new software for Smart Design of Electricity Distribution Networks (SDEDNs), improving network design efficiency.

- August 2022: DEWA implemented AI-powered "iService" for predictive smart meter maintenance and fraud detection.

Future Outlook for UAE Smart Grid Industry Market

The UAE smart grid market is poised for continued robust growth, driven by sustained government support, technological advancements, and increasing demand for reliable and sustainable energy solutions. Strategic opportunities lie in developing innovative solutions for grid modernization, integrating renewable energy sources, and enhancing cybersecurity. The market's potential is significant, promising substantial returns for investors and significant improvements to the energy infrastructure of the UAE.

UAE Smart Grid Industry Segmentation

-

1. Technology Application Area

- 1.1. Transmission

- 1.2. Communication Technology

- 1.3. Advanced Metering Infrastructure (AMI)

- 1.4. Other Technology Application Areas

UAE Smart Grid Industry Segmentation By Geography

- 1. UAE

UAE Smart Grid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Policies; Growing Demand for Heating and Cooling Systems

- 3.3. Market Restrains

- 3.3.1. Adoption of Alternative Clean Energy Sources Like Solar and Wind

- 3.4. Market Trends

- 3.4.1. Advanced Metering Infrastructure to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Smart Grid Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 5.1.1. Transmission

- 5.1.2. Communication Technology

- 5.1.3. Advanced Metering Infrastructure (AMI)

- 5.1.4. Other Technology Application Areas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. UAE

- 5.1. Market Analysis, Insights and Forecast - by Technology Application Area

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ABB Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abu Dhabi Distribution Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Korea Electric Power Corporation*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dubai Electricity and Water Authority

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 General Electric Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sharjah Electricity and Water Board

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global UAE Smart Grid Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Smart Grid Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Smart Grid Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: UAE UAE Smart Grid Industry Revenue (Million), by Technology Application Area 2024 & 2032

- Figure 5: UAE UAE Smart Grid Industry Revenue Share (%), by Technology Application Area 2024 & 2032

- Figure 6: UAE UAE Smart Grid Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: UAE UAE Smart Grid Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Smart Grid Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Smart Grid Industry Revenue Million Forecast, by Technology Application Area 2019 & 2032

- Table 3: Global UAE Smart Grid Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UAE Smart Grid Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global UAE Smart Grid Industry Revenue Million Forecast, by Technology Application Area 2019 & 2032

- Table 6: Global UAE Smart Grid Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Smart Grid Industry?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the UAE Smart Grid Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Abu Dhabi Distribution Company, Korea Electric Power Corporation*List Not Exhaustive, Schneider Electric SE, Dubai Electricity and Water Authority, General Electric Company, Sharjah Electricity and Water Board.

3. What are the main segments of the UAE Smart Grid Industry?

The market segments include Technology Application Area.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Policies; Growing Demand for Heating and Cooling Systems.

6. What are the notable trends driving market growth?

Advanced Metering Infrastructure to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Adoption of Alternative Clean Energy Sources Like Solar and Wind.

8. Can you provide examples of recent developments in the market?

August 2022: DEWA announced software to augment its electricity distribution network. The software is dedicated to the Smart Design of Electricity Distribution Networks (SDEDNs), which will merge databases and electric network designs (11kV) through developed solutions. This will help network engineers to design a more effective and effective network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Smart Grid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Smart Grid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Smart Grid Industry?

To stay informed about further developments, trends, and reports in the UAE Smart Grid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence