Key Insights

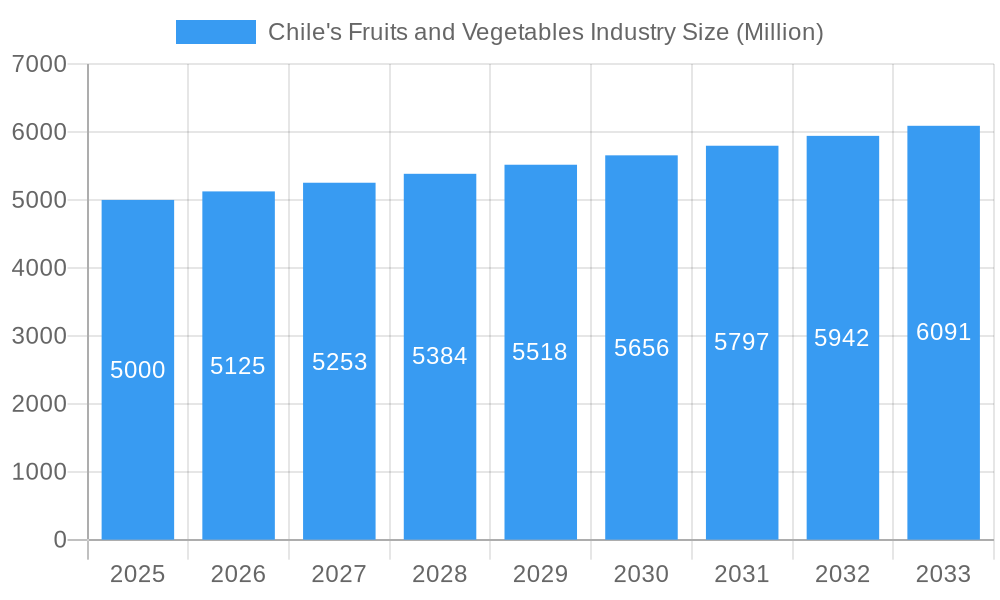

Chile's fruits and vegetables industry, valued at approximately $X million in 2025 (estimated based on provided CAGR and market size), exhibits a steady growth trajectory, projected at a 2.50% CAGR from 2025 to 2033. This growth is fueled by several key drivers. Increased global demand for high-quality, sustainably produced produce, particularly from regions known for their favorable climate and agricultural practices like Chile, is a significant factor. Furthermore, advancements in agricultural technology, including precision farming and improved irrigation techniques, are enhancing yields and efficiency. The rising popularity of fresh and minimally processed foods among health-conscious consumers worldwide also contributes to market expansion. Key players like Hortifrut, Copec Agro Industrial, Australis Seafood, CULTIVA, and Frutícola Santa Cruz are leveraging these trends, focusing on innovation, supply chain optimization, and strategic partnerships to maintain their market positions. However, challenges remain, including fluctuations in global commodity prices, climate change impacts on crop yields, and increasing transportation costs. The industry's segmentation into fruits and vegetables allows for targeted market strategies, with potential for further growth by leveraging niche markets and exploring value-added product development. The Chilean government's support for agricultural modernization and export promotion plays a crucial role in sustaining this positive growth outlook.

Chile's Fruits and Vegetables Industry Market Size (In Billion)

While the precise market size for 2025 is unavailable, reasonable estimation considering historical growth and future projections suggests a value within a reasonable range given the CAGR of 2.5%. Analysis of the sector reveals a strong correlation between global demand for high-quality produce and Chile’s consistent export success. The industry's reliance on export markets presents vulnerabilities to global economic downturns and trade policy changes. Nonetheless, the ongoing focus on sustainable farming practices and technological innovation places Chile’s fruits and vegetables industry in a favorable position for continued, albeit moderate, growth over the forecast period. Companies are likely adapting their strategies to mitigate risks associated with climate variability and ensuring a consistent supply of high-quality products.

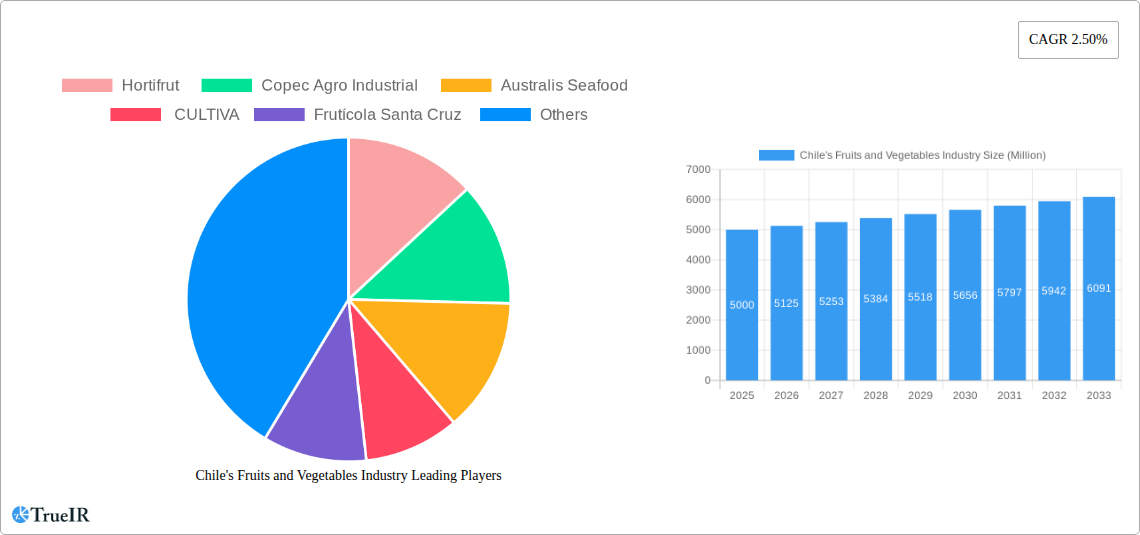

Chile's Fruits and Vegetables Industry Company Market Share

Chile's Fruits and Vegetables Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of Chile's thriving fruits and vegetables industry, covering the period from 2019 to 2033. Leveraging extensive data and insightful analysis, this study offers crucial intelligence for businesses, investors, and policymakers navigating this dynamic market. With a focus on key segments, leading players, and emerging trends, this report is essential for understanding the current landscape and predicting future growth opportunities. The report utilizes a base year of 2025 and forecasts market performance through 2033, building upon historical data from 2019-2024.

Chile's Fruits and Vegetables Industry Market Structure & Competitive Landscape

Chile's fruits and vegetables industry exhibits a moderately concentrated market structure, with a few large players like Hortifrut, Copec Agro Industrial, and Frutícola Santa Cruz dominating certain segments. The Herfindahl-Hirschman Index (HHI) for the industry in 2025 is estimated at xx, indicating a moderately competitive landscape. Innovation is driven by advancements in farming technologies (e.g., vertical farming, precision agriculture), demand for higher-quality produce, and the pursuit of sustainable farming practices. Regulatory impacts are significant, with regulations concerning pesticide use, food safety, and export standards heavily influencing market dynamics. Product substitutes, such as imported fruits and vegetables, pose a considerable competitive pressure. The end-user segmentation primarily comprises domestic consumers, food processors, and exporters catering to global markets.

- Market Concentration: HHI estimated at xx in 2025.

- M&A Activity: The past five years have witnessed xx Million USD in M&A activity, primarily driven by consolidation among fruit producers. (e.g., Hortifrut's acquisition of Atlantic Blue in 2021).

- Innovation Drivers: Technological advancements, consumer demand for quality and sustainability.

- Regulatory Impacts: Stringent food safety and export regulations.

- Product Substitutes: Imported produce.

Chile's Fruits and Vegetables Industry Market Trends & Opportunities

Chile's fruits and vegetables market demonstrates robust growth, fueled by increasing domestic consumption and strong export demand. The market size, valued at xx Million USD in 2025, is projected to reach xx Million USD by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Technological shifts, including the adoption of precision agriculture and vertical farming, are enhancing productivity and efficiency. Consumer preferences are shifting towards healthier, organic, and sustainably produced fruits and vegetables. Competitive dynamics are shaped by consolidation among large players, the emergence of innovative startups, and the increasing presence of imported products. Market penetration rates for organic produce are steadily rising, reaching xx% in 2025.

Dominant Markets & Segments in Chile's Fruits and Vegetables Industry

Fruits: The fruit segment is the dominant force within Chile's produce industry, driven by significant export volumes of high-value products like grapes, blueberries, and avocados. Key growth drivers include:

- Favorable Climate: Chile's diverse climate zones are ideal for producing a wide range of fruits.

- Strong Export Infrastructure: Well-developed port infrastructure facilitates efficient export operations.

- Government Support: Government initiatives promoting the fruit industry, such as export diversification strategies.

Vegetables: The vegetable segment is also growing, although at a slower pace compared to fruits. Key growth drivers include:

- Growing Domestic Consumption: Increasing demand from the expanding middle class.

- Investment in Modern Farming Techniques: Improvement in agricultural efficiency.

- Development of Value-Added Products: Growing demand for processed vegetable products.

Export volume of fruits in 2025 is projected at xx Million tons, while the export value is estimated at xx Million USD. Import volume for vegetables is estimated at xx Million tons with a value of xx Million USD. Domestic consumption value for fruits in 2025 is projected at xx Million USD.

Chile's Fruits and Vegetables Industry Product Analysis

Technological advancements are driving significant innovations in Chile's fruits and vegetables industry. The adoption of precision agriculture techniques, such as data-driven irrigation and fertilization, is enhancing yields and reducing resource waste. Furthermore, the emergence of vertical farming and controlled-environment agriculture (CEA) offers opportunities for year-round production and improved quality. These innovations are improving market fit by offering increased efficiency, sustainability and greater control over the production process resulting in higher quality and more consistent supply.

Key Drivers, Barriers & Challenges in Chile's Fruits and Vegetables Industry

Key Drivers:

- Favorable Climate: Chile's diverse climate is well-suited for various fruits and vegetables.

- Export-Oriented Economy: Strong focus on international markets.

- Technological Advancements: Adoption of modern farming techniques.

Challenges:

- Water Scarcity: Limited water resources pose a significant constraint. This results in a xx% reduction in potential yield in certain regions.

- Climate Change: Increased frequency of extreme weather events threatens crop yields.

- Labor Shortages: Difficulties in attracting and retaining agricultural workers.

Growth Drivers in the Chile's Fruits and Vegetables Industry Market

The continued growth of the Chilean fruits and vegetables industry is propelled by increasing global demand for high-quality produce, the adoption of innovative farming technologies, and government support for the sector. Growing domestic consumption due to rising incomes and a changing lifestyle also contributes significantly. Furthermore, supportive government policies aimed at boosting exports and improving agricultural infrastructure are instrumental in driving growth.

Challenges Impacting Chile's Fruits and Vegetables Industry Growth

Challenges hindering the industry’s growth include water scarcity impacting yields by an estimated xx%, climate change increasing risks, and labor shortages leading to increased production costs by xx%. Furthermore, fluctuating global prices and increasing competition from other producing countries present ongoing hurdles. Stricter international regulations and phytosanitary requirements also pose a challenge for exporters.

Key Players Shaping the Chile's Fruits and Vegetables Industry Market

- Hortifrut

- Copec Agro Industrial

- Australis Seafood

- CULTIVA

- Frutícola Santa Cruz

Significant Chile's Fruits and Vegetables Industry Industry Milestones

- October 2021: Hortifrut announced the acquisition of Atlantic Blue for USD 280 Million, expanding its berry production capabilities.

- March 2021: Aerofarms and Hortifrut partnered to expand R&D in indoor and vertical farming for blueberries and cranberries.

- November 2022: The Chilean government eliminated methyl bromide fumigation requirements for table grapes, boosting export competitiveness.

Future Outlook for Chile's Fruits and Vegetables Industry Market

The future of Chile's fruits and vegetables industry appears bright, driven by sustained export demand, technological advancements in sustainable farming practices, and continued government support. Strategic investments in water management, diversification of export markets, and the development of value-added products will be crucial for ensuring long-term growth and profitability. The industry is well-positioned to capitalize on growing global demand for healthy and sustainably produced food.

Chile's Fruits and Vegetables Industry Segmentation

-

1. Type (Pr

- 1.1. Vegetables

- 1.2. Fruits

-

2. Type (Pr

- 2.1. Vegetables

- 2.2. Fruits

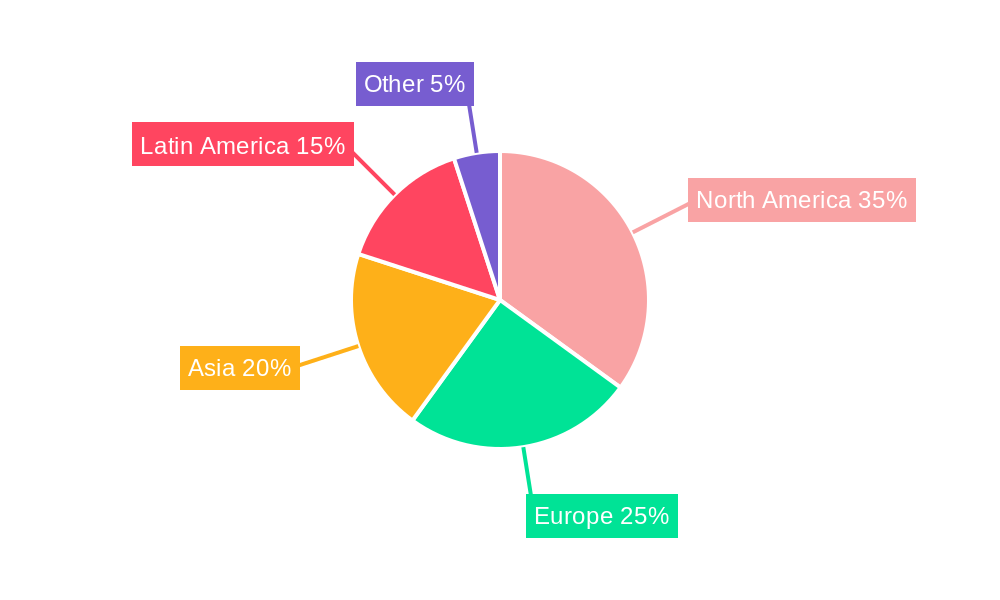

Chile's Fruits and Vegetables Industry Segmentation By Geography

- 1. Chile

Chile's Fruits and Vegetables Industry Regional Market Share

Geographic Coverage of Chile's Fruits and Vegetables Industry

Chile's Fruits and Vegetables Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming

- 3.3. Market Restrains

- 3.3.1. Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply

- 3.4. Market Trends

- 3.4.1. Increasing Exports of Fruits and Vegetables

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chile's Fruits and Vegetables Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 5.1.1. Vegetables

- 5.1.2. Fruits

- 5.2. Market Analysis, Insights and Forecast - by Type (Pr

- 5.2.1. Vegetables

- 5.2.2. Fruits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Chile

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hortifrut

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Copec Agro Industrial

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Australis Seafood

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CULTIVA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frutícola Santa Cruz

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Hortifrut

List of Figures

- Figure 1: Chile's Fruits and Vegetables Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Chile's Fruits and Vegetables Industry Share (%) by Company 2025

List of Tables

- Table 1: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 2: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 3: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 4: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 5: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 8: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 9: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Type (Pr 2020 & 2033

- Table 10: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Type (Pr 2020 & 2033

- Table 11: Chile's Fruits and Vegetables Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Chile's Fruits and Vegetables Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chile's Fruits and Vegetables Industry?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the Chile's Fruits and Vegetables Industry?

Key companies in the market include Hortifrut , Copec Agro Industrial , Australis Seafood , CULTIVA, Frutícola Santa Cruz .

3. What are the main segments of the Chile's Fruits and Vegetables Industry?

The market segments include Type (Pr, Type (Pr.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Technology in Horticulture; Government Initiatives for Self-reliance in Vegetable and Fruit Farming.

6. What are the notable trends driving market growth?

Increasing Exports of Fruits and Vegetables.

7. Are there any restraints impacting market growth?

Limited Resource Availability and Unfavourable Climatic Condition; Increasing Reliance on Imports for Domestic Supply.

8. Can you provide examples of recent developments in the market?

November 2022: The Chilean government adopted a new strategy for increasing the sales of table grapes from the country to other regions, such as North America and Europe, by removing the mandatory requirement of methyl bromide fumigation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chile's Fruits and Vegetables Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chile's Fruits and Vegetables Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chile's Fruits and Vegetables Industry?

To stay informed about further developments, trends, and reports in the Chile's Fruits and Vegetables Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence