Key Insights

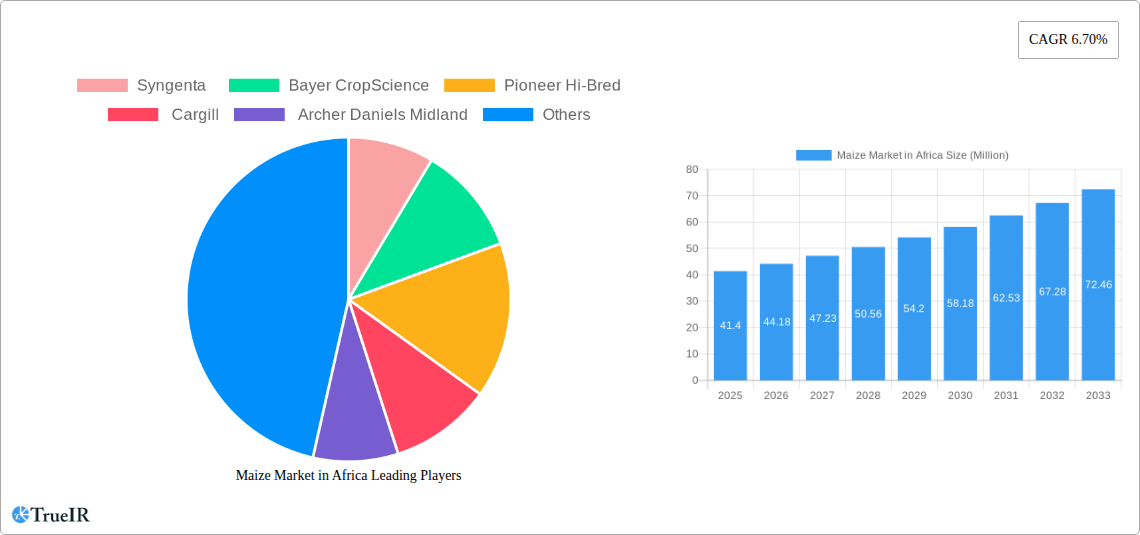

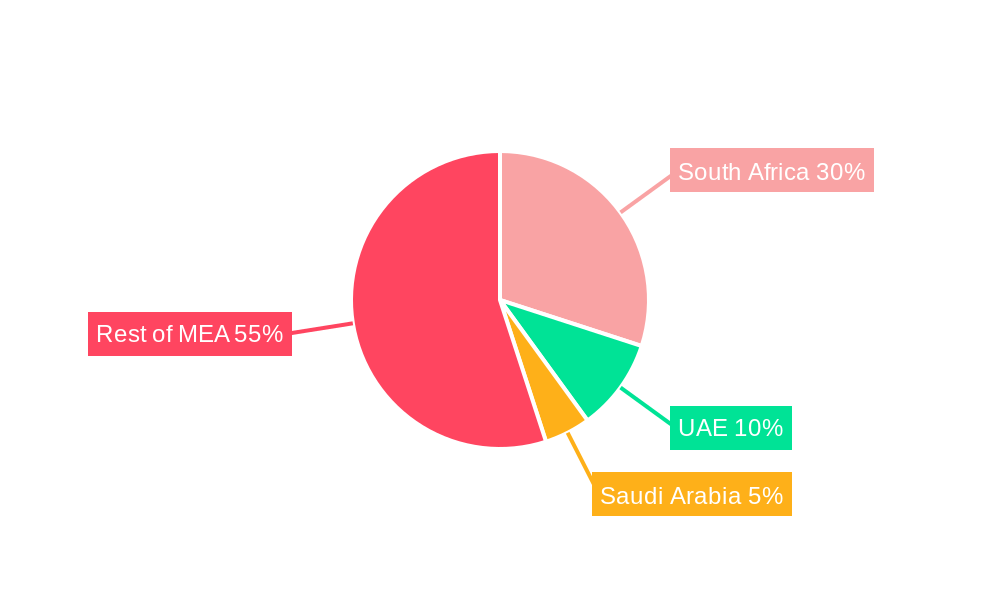

The African maize market, valued at $41.40 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.70% from 2025 to 2033. This growth is fueled by several key factors. Increasing demand for maize as a staple food across the continent drives significant market expansion. The rising adoption of hybrid seeds, offering higher yields and improved resistance to pests and diseases, further contributes to market growth. Additionally, the burgeoning biofuel industry in certain African nations is creating a new avenue for maize utilization, adding to market demand. Growth within the feed segment is also notable, driven by the expansion of livestock farming in several key regions. While challenges such as climate change and inconsistent rainfall patterns pose restraints, technological advancements in drought-resistant maize varieties are mitigating these risks and fostering continued market expansion. The Middle East and Africa (MEA) region, specifically countries like South Africa, the UAE, and Saudi Arabia, are key contributors to this growth trajectory, showcasing substantial market potential for maize producers and distributors. Market segmentation reveals a strong preference for hybrid seeds over open-pollinated varieties, reflecting the growing focus on improved agricultural productivity. Major players like Syngenta, Bayer CropScience, Pioneer Hi-Bred, Cargill, and Archer Daniels Midland are strategically positioning themselves to capitalize on this promising market.

Maize Market in Africa Market Size (In Million)

The forecast for the African maize market indicates sustained growth through 2033. Continued investment in agricultural infrastructure, coupled with government support programs promoting improved farming techniques and access to high-yielding seeds, will further accelerate market expansion. The increasing adoption of precision agriculture technologies and the expanding role of technology in optimizing maize production will also play a vital role in shaping the future of the market. Furthermore, rising incomes and evolving dietary habits across the continent contribute to increased maize consumption, solidifying its position as a cornerstone crop. However, maintaining sustainable agricultural practices and addressing issues like post-harvest losses will be crucial for ensuring the long-term viability and responsible growth of the African maize market.

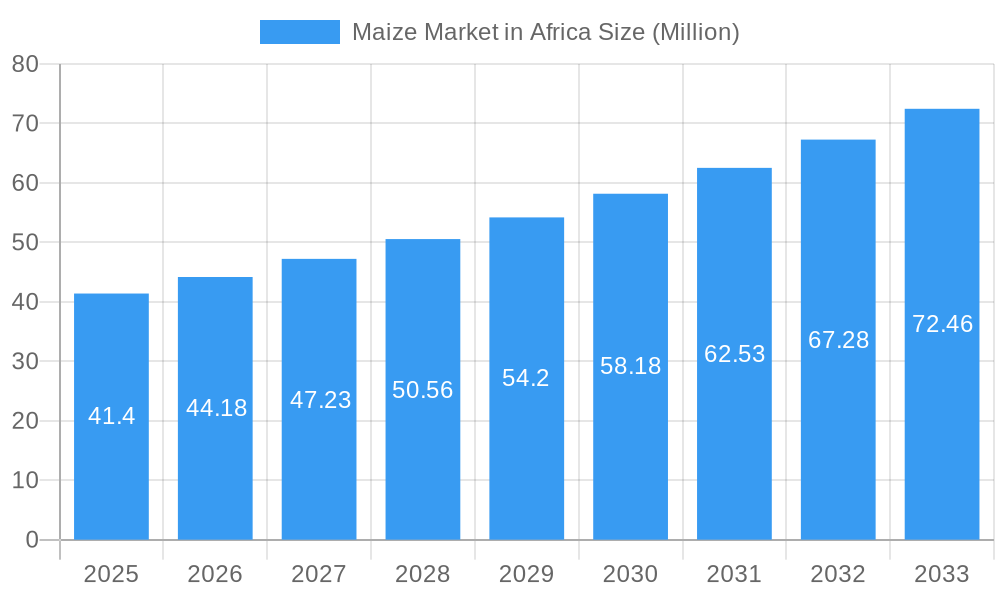

Maize Market in Africa Company Market Share

This dynamic report offers a comprehensive analysis of the Maize Market in Africa, providing invaluable insights for industry stakeholders, investors, and researchers. Covering the period 2019-2033, with a focus on 2025, this report leverages extensive data and expert analysis to illuminate market trends, opportunities, and challenges. The study period is 2019–2033, the base year is 2025, the estimated year is 2025, and the forecast period is 2025–2033, with the historical period covering 2019–2024.

Maize Market in Africa Market Structure & Competitive Landscape

The African maize market is characterized by a moderately concentrated structure, with key players like Syngenta, Bayer CropScience, Pioneer Hi-Bred, Cargill, and Archer Daniels Midland holding significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating a moderate level of competition. Innovation is driven by the need for high-yielding, drought-resistant, and pest-resistant varieties, fueled by climate change and increasing food security concerns. Regulatory frameworks vary across African nations, impacting seed approvals and GMO adoption. Open-pollinated varieties still hold significant market share, particularly in smaller-scale farming operations, while hybrid seeds are gaining traction due to higher yields. Product substitutes include other staple crops like sorghum and millet, depending on regional availability and consumer preferences. The market witnesses occasional M&A activity, primarily focused on seed companies seeking to expand their reach and product portfolio. The volume of M&A transactions in the last five years is estimated at xx deals.

- Market Concentration: CR4 estimated at xx%

- Key Players: Syngenta, Bayer CropScience, Pioneer Hi-Bred, Cargill, Archer Daniels Midland

- Innovation Drivers: Climate change, food security, demand for high-yielding varieties

- Regulatory Impacts: Varying regulations across countries affect GMO adoption and seed approvals.

- Product Substitutes: Sorghum, millet

- M&A Trends: xx deals in the last five years

Maize Market in Africa Market Trends & Opportunities

The African maize market exhibits substantial growth potential, driven by a rising population, increasing urbanization, and shifting dietary patterns. The market size is projected to reach xx Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements in seed breeding are leading to the development of improved varieties with enhanced yields and resilience. Consumer preferences are shifting towards higher-quality maize products, boosting demand for hybrid seeds and processed maize-based foods. Competitive dynamics are characterized by increasing competition among both local and multinational companies, leading to product diversification and strategic partnerships. Market penetration rates for hybrid seeds are steadily rising, particularly in regions with improved infrastructure and access to technology.

Dominant Markets & Segments in Maize Market in Africa

East Africa and Southern Africa are currently the dominant regions for maize production and consumption in Africa. Within these regions, countries like Kenya, Tanzania, South Africa, and Ethiopia represent significant markets.

Product Type:

- Hybrid Seeds: This segment is experiencing the fastest growth due to higher yields and improved quality. Key growth drivers include increasing farmer awareness, improved agricultural extension services, and the adoption of advanced farming techniques.

- Open-Pollinated Varieties: This segment continues to hold a significant share of the market, particularly in smaller-scale farming operations, where cost remains a primary factor.

Application:

- Food: Maize is a staple food across Africa, making this the largest application segment. Growth in this segment is driven by population growth and increasing urbanization.

- Feed: Maize is a crucial component of animal feed, driving significant demand from the livestock industry.

- Biofuel: The biofuel sector presents emerging opportunities for maize as a source of ethanol production, particularly in countries with supportive policies.

Key Growth Drivers:

- Improved agricultural infrastructure (irrigation, storage facilities)

- Supportive government policies and investments in agriculture

- Increasing access to credit and financial services for farmers

- Advances in agricultural technology (e.g., precision farming)

Maize Market in Africa Product Analysis

The maize market is witnessing significant product innovations, driven by the need for improved crop yields and resilience to climate change. Hybrid seeds with traits like drought tolerance, pest resistance, and enhanced nutrient content are gaining popularity. These technological advancements significantly improve crop yields and reduce production costs, enhancing the market fit of these advanced products. Competition is fierce, with companies focusing on product differentiation through superior genetics, robust distribution networks, and value-added services.

Key Drivers, Barriers & Challenges in Maize Market in Africa

Key Drivers:

- Growing population and rising demand for food

- Increasing urbanization and changing dietary patterns

- Government initiatives to support agricultural development

- Technological advancements in seed breeding and agricultural practices

Challenges and Restraints:

- Climate change impacts (droughts, floods) affecting yields and production.

- Inadequate infrastructure (storage, transportation) leading to post-harvest losses estimated at xx Million USD annually.

- Limited access to credit and financial services for farmers hindering investment in improved technologies.

- Regulatory complexities and inconsistent policies create uncertainty for investors.

Growth Drivers in the Maize Market in Africa Market

Key growth drivers include a rising population boosting food demand, government investments in agricultural infrastructure, and the introduction of high-yielding, climate-resilient maize varieties. Technological advancements such as precision farming and improved irrigation techniques further enhance yields and efficiency, stimulating market expansion. Favorable government policies and subsidies play a crucial role in promoting maize production and adoption of advanced farming practices.

Challenges Impacting Maize Market in Africa Growth

Challenges include climate change impacting yields, inadequate infrastructure causing post-harvest losses, limited access to finance for farmers, and regulatory complexities hindering investment. High input costs, including seeds and fertilizers, also pose a barrier to growth, affecting profitability for farmers and potentially slowing market expansion. The competitive landscape, with both local and international companies vying for market share, adds another layer of complexity.

Key Players Shaping the Maize Market in Africa Market

Significant Maize Market in Africa Industry Milestones

- October 2022: Kenya approved GMOs after a 10-year ban, potentially revolutionizing maize production.

- August 2022: The United States pledged USD 120 Million for African seed improvement, focusing on maize, wheat, and rice.

- July 2022: The African Development Bank granted USD 5.4 Million to Burundi for increased maize and rice production using climate-resilient seeds.

Future Outlook for Maize Market in Africa Market

The African maize market is poised for continued growth, driven by a combination of factors including population growth, increasing demand for processed maize products, and the adoption of improved agricultural technologies. Strategic opportunities exist for companies investing in high-yielding, climate-resilient seed varieties, expanding distribution networks, and developing value-added products. The market holds substantial potential for both domestic and international players, presenting lucrative investment opportunities.

Maize Market in Africa Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Maize Market in Africa Segmentation By Geography

- 1. South Africa

- 2. Ethiopia

- 3. Zambia

- 4. Nigeria

- 5. Malawi

Maize Market in Africa Regional Market Share

Geographic Coverage of Maize Market in Africa

Maize Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Animal Feed Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Maize Market in Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.6.2. Ethiopia

- 5.6.3. Zambia

- 5.6.4. Nigeria

- 5.6.5. Malawi

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. South Africa Maize Market in Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Ethiopia Maize Market in Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Zambia Maize Market in Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Nigeria Maize Market in Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Malawi Maize Market in Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Syngenta

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer CropScience

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pioneer Hi-Bred

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cargill

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Archer Daniels Midland

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Syngenta

List of Figures

- Figure 1: Maize Market in Africa Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Maize Market in Africa Share (%) by Company 2025

List of Tables

- Table 1: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Maize Market in Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Maize Market in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Maize Market in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 20: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Maize Market in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Maize Market in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Maize Market in Africa Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 32: Maize Market in Africa Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Maize Market in Africa Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Maize Market in Africa Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Maize Market in Africa Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Maize Market in Africa Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Maize Market in Africa?

The projected CAGR is approximately 6.70%.

2. Which companies are prominent players in the Maize Market in Africa?

Key companies in the market include Syngenta , Bayer CropScience, Pioneer Hi-Bred, Cargill, Archer Daniels Midland.

3. What are the main segments of the Maize Market in Africa?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.40 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

Increasing Demand from the Animal Feed Industry.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

October 2022: Kenya approved GMOs after a 10-year ban on the use of this technology, and this is expected to bring a major shift in the current crop production scenario in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Maize Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Maize Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Maize Market in Africa?

To stay informed about further developments, trends, and reports in the Maize Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence