Key Insights

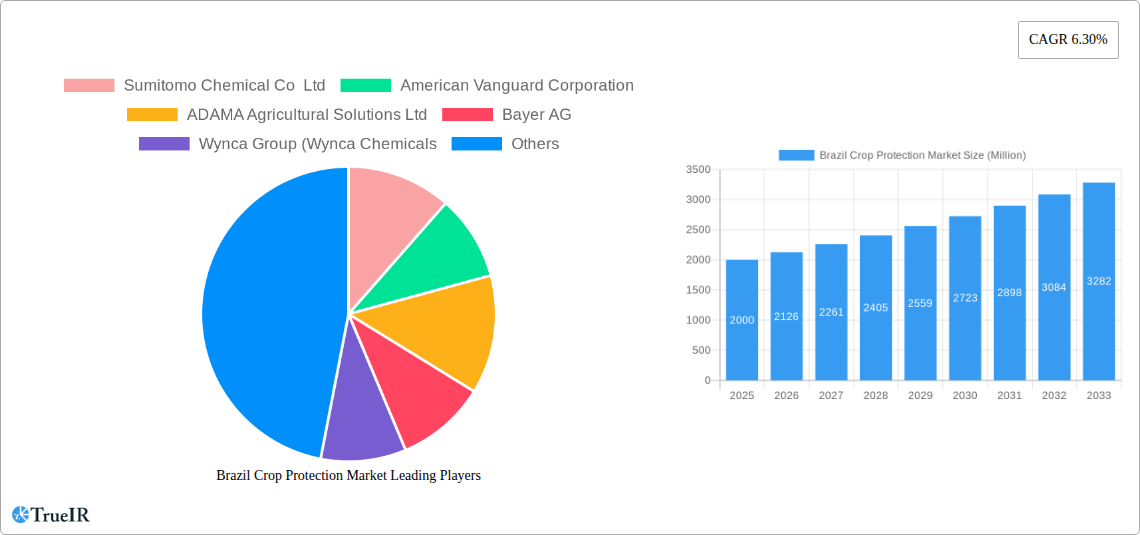

The Brazil crop protection market, valued at approximately 213.5 million in its base year of 2025, is projected to experience significant expansion. Forecasted to grow at a compound annual growth rate (CAGR) of 2.98% from 2025 to 2033, this growth is underpinned by Brazil's substantial agricultural sector, a global leader in producing soybeans, coffee, and sugarcane. The imperative to maximize yields and mitigate pest and disease impacts necessitates robust crop protection strategies. Advancements in precision agriculture, which optimize pesticide application and reduce overall chemical reliance, are key growth drivers. Furthermore, supportive government policies encouraging agricultural modernization and sustainable practices are fostering market development. The increasing incidence of crop diseases and pest infestations, coupled with heightened farmer awareness of effective crop protection methodologies, is stimulating demand for sophisticated solutions. Fungicides, insecticides, and herbicides represent dominant market segments, directly addressing the primary agricultural needs in Brazil. Foliar, seed, and soil treatments are the predominant application methods, catering to a wide array of crop types and cultivation techniques. Intense competition among leading companies, including Sumitomo Chemical, Bayer, Syngenta, and BASF, is driving innovation and product portfolio expansion.

Brazil Crop Protection Market Market Size (In Million)

Conversely, the market navigates inherent challenges, including price volatility in commodity markets and currency exchange rate fluctuations, which can affect profitability. Stringent regulations on pesticide use and increasing emphasis on environmental sustainability present operational constraints. Continuous investment in research and development for innovative and eco-friendly crop protection solutions remains a critical focus for all stakeholders. Despite these hurdles, the long-term growth outlook remains positive, propelled by escalating agricultural output and the persistent demand for enhanced crop yields and disease resistance within Brazil. The market is strategically positioned for sustained expansion, fueled by technological progress and the ongoing adoption of sustainable agricultural paradigms.

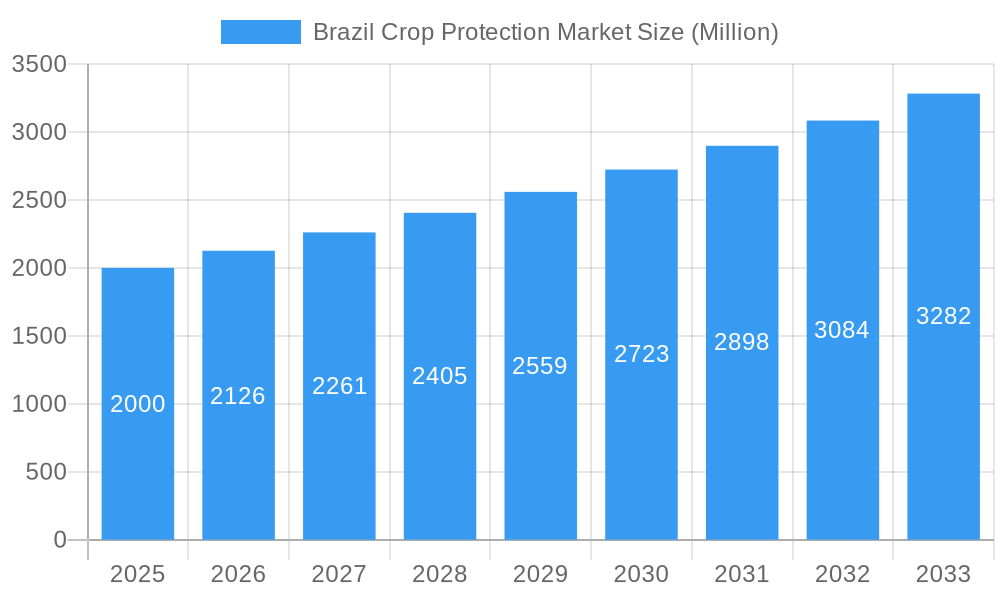

Brazil Crop Protection Market Company Market Share

Brazil Crop Protection Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Brazil crop protection market, offering invaluable insights for stakeholders across the agricultural value chain. Leveraging extensive market research and data analysis covering the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report reveals crucial trends, opportunities, and challenges shaping this vital sector. The study encompasses market sizing, segmentation analysis across function (fungicide, herbicide, insecticide, molluscicide, nematicide), application mode (chemigation, foliar, fumigation, seed treatment, soil treatment), and crop type (commercial crops, fruits & vegetables, grains & cereals, pulses & oilseeds, turf & ornamental), competitive landscape, and future outlook.

Brazil Crop Protection Market Structure & Competitive Landscape

The Brazilian crop protection market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation plays a crucial role, driven by the need for higher-yielding crops, pest resistance management, and the demand for more sustainable and environmentally friendly solutions. Stringent regulations imposed by the Brazilian government significantly impact market dynamics, shaping product development and registration processes. The presence of biopesticides and other biological control agents represents a growing segment of product substitutes, gradually increasing their market share. The market shows clear end-user segmentation, with large-scale commercial farms demanding higher volumes of crop protection products compared to smaller-scale farms. The M&A activity in the period 2019-2024 witnessed xx deals, primarily focused on expanding product portfolios and geographical reach.

- Key Market Characteristics: Moderately concentrated, innovation-driven, regulated, presence of substitutes.

- Competitive Dynamics: Intense competition among multinational companies, increasing presence of regional players.

- M&A Activity: xx deals between 2019-2024, driven by portfolio expansion and geographical reach.

- Regulatory Landscape: Stringent regulations regarding product registration and environmental impact.

Brazil Crop Protection Market Trends & Opportunities

The Brazil crop protection market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is propelled by several factors: increasing demand for food and feed crops due to population growth and rising incomes, expansion of agricultural land under cultivation, adoption of improved farming techniques, and increasing awareness of crop protection solutions among farmers. Technological advancements, such as precision agriculture techniques and the development of more targeted and efficient crop protection products are transforming market dynamics. Consumers are increasingly demanding higher-quality, safer, and more environmentally friendly crop protection solutions, driving the growth of biopesticides and other sustainable alternatives. The competitive landscape remains dynamic, with ongoing innovation and strategic partnerships shaping the market's evolution. Market penetration of advanced technologies is estimated to reach xx% by 2033.

Dominant Markets & Segments in Brazil Crop Protection Market

The Brazilian crop protection market is characterized by diverse segments, with significant variations in growth potential and market share. The Grains & Cereals segment dominates the crop type category, driven by the country's significant production of soybeans, corn, and other major crops. Within application modes, Foliar application holds the largest market share, reflecting the widespread adoption of conventional spraying techniques. Among functions, Herbicides represent the largest market segment, reflecting the significant need for weed control in Brazil's diverse agricultural landscape.

- Key Growth Drivers in Grains & Cereals: High production volume, government support for agricultural expansion.

- Key Growth Drivers in Foliar Application: Ease of use, widespread adoption among farmers.

- Key Growth Drivers in Herbicides: Prevalence of weeds in major crops, growing adoption of herbicide-resistant crops.

- Regional Variations: Significant variations exist across different agricultural regions within Brazil.

Brazil Crop Protection Market Product Analysis

Significant product innovations are reshaping the crop protection landscape in Brazil. These innovations include the development of more targeted pesticides, with improved efficacy and reduced environmental impact. The increasing adoption of biopesticides and other sustainable alternatives represents a key trend, responding to consumer demands for environmentally responsible solutions. The focus on precision agriculture and digital technologies further enhances product application and efficacy. The competitive advantages are increasingly based on factors such as superior efficacy, reduced environmental impact, and ease of use.

Key Drivers, Barriers & Challenges in Brazil Crop Protection Market

Key Drivers:

- Increasing demand for food and feed crops.

- Expansion of agricultural land under cultivation.

- Technological advancements in crop protection.

- Government support for agricultural development.

Challenges & Restraints:

- Stringent regulatory environment for pesticide registration.

- High cost of new product development and registration.

- Fluctuations in commodity prices impacting farmer spending.

- Supply chain disruptions influencing product availability and pricing. The impact of supply chain issues in 2022 resulted in a xx% increase in average product pricing.

Growth Drivers in the Brazil Crop Protection Market

The Brazilian crop protection market is primarily driven by increasing food demand, agricultural land expansion, technological advancements, and supportive government policies. The adoption of precision agriculture, development of new product formulations, and market entry of biopesticides are further accelerating market expansion.

Challenges Impacting Brazil Crop Protection Market Growth

Challenges include regulatory hurdles for new product registrations, volatility in raw material costs impacting production costs, and competition from generic and bio-based alternatives. These factors influence pricing and market access.

Key Players Shaping the Brazil Crop Protection Market Market

Significant Brazil Crop Protection Market Industry Milestones

- October 2022: Corteva Agriscience launched Haviza™ Active, a new fungicide to manage Asian soybean rot, broadening its picolinamide active class.

- January 2023: Bayer partnered with Oerth Bio to develop eco-friendly crop protection solutions.

- February 2023: ADAMA opened a new multi-purpose facility in Brazil, expanding its Prothioconazole-based product offerings.

Future Outlook for Brazil Crop Protection Market Market

The Brazil crop protection market presents significant growth opportunities driven by the increasing demand for food security, technological advancements towards sustainable solutions, and supportive government policies. Strategic partnerships, investments in research and development, and the adoption of precision agriculture will further propel market expansion in the coming years. The market is expected to experience considerable growth, fuelled by both conventional and sustainable crop protection products.

Brazil Crop Protection Market Segmentation

-

1. Function

- 1.1. Fungicide

- 1.2. Herbicide

- 1.3. Insecticide

- 1.4. Molluscicide

- 1.5. Nematicide

-

2. Application Mode

- 2.1. Chemigation

- 2.2. Foliar

- 2.3. Fumigation

- 2.4. Seed Treatment

- 2.5. Soil Treatment

-

3. Crop Type

- 3.1. Commercial Crops

- 3.2. Fruits & Vegetables

- 3.3. Grains & Cereals

- 3.4. Pulses & Oilseeds

- 3.5. Turf & Ornamental

-

4. Function

- 4.1. Fungicide

- 4.2. Herbicide

- 4.3. Insecticide

- 4.4. Molluscicide

- 4.5. Nematicide

-

5. Application Mode

- 5.1. Chemigation

- 5.2. Foliar

- 5.3. Fumigation

- 5.4. Seed Treatment

- 5.5. Soil Treatment

-

6. Crop Type

- 6.1. Commercial Crops

- 6.2. Fruits & Vegetables

- 6.3. Grains & Cereals

- 6.4. Pulses & Oilseeds

- 6.5. Turf & Ornamental

Brazil Crop Protection Market Segmentation By Geography

- 1. Brazil

Brazil Crop Protection Market Regional Market Share

Geographic Coverage of Brazil Crop Protection Market

Brazil Crop Protection Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Insecticides occupy the largest share of the Brazilian crop protection chemicals market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Crop Protection Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Fungicide

- 5.1.2. Herbicide

- 5.1.3. Insecticide

- 5.1.4. Molluscicide

- 5.1.5. Nematicide

- 5.2. Market Analysis, Insights and Forecast - by Application Mode

- 5.2.1. Chemigation

- 5.2.2. Foliar

- 5.2.3. Fumigation

- 5.2.4. Seed Treatment

- 5.2.5. Soil Treatment

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Commercial Crops

- 5.3.2. Fruits & Vegetables

- 5.3.3. Grains & Cereals

- 5.3.4. Pulses & Oilseeds

- 5.3.5. Turf & Ornamental

- 5.4. Market Analysis, Insights and Forecast - by Function

- 5.4.1. Fungicide

- 5.4.2. Herbicide

- 5.4.3. Insecticide

- 5.4.4. Molluscicide

- 5.4.5. Nematicide

- 5.5. Market Analysis, Insights and Forecast - by Application Mode

- 5.5.1. Chemigation

- 5.5.2. Foliar

- 5.5.3. Fumigation

- 5.5.4. Seed Treatment

- 5.5.5. Soil Treatment

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Commercial Crops

- 5.6.2. Fruits & Vegetables

- 5.6.3. Grains & Cereals

- 5.6.4. Pulses & Oilseeds

- 5.6.5. Turf & Ornamental

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sumitomo Chemical Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Vanguard Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADAMA Agricultural Solutions Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wynca Group (Wynca Chemicals

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPL Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 FMC Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corteva Agriscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: Brazil Crop Protection Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Brazil Crop Protection Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Crop Protection Market Revenue million Forecast, by Function 2020 & 2033

- Table 2: Brazil Crop Protection Market Revenue million Forecast, by Application Mode 2020 & 2033

- Table 3: Brazil Crop Protection Market Revenue million Forecast, by Crop Type 2020 & 2033

- Table 4: Brazil Crop Protection Market Revenue million Forecast, by Function 2020 & 2033

- Table 5: Brazil Crop Protection Market Revenue million Forecast, by Application Mode 2020 & 2033

- Table 6: Brazil Crop Protection Market Revenue million Forecast, by Crop Type 2020 & 2033

- Table 7: Brazil Crop Protection Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: Brazil Crop Protection Market Revenue million Forecast, by Function 2020 & 2033

- Table 9: Brazil Crop Protection Market Revenue million Forecast, by Application Mode 2020 & 2033

- Table 10: Brazil Crop Protection Market Revenue million Forecast, by Crop Type 2020 & 2033

- Table 11: Brazil Crop Protection Market Revenue million Forecast, by Function 2020 & 2033

- Table 12: Brazil Crop Protection Market Revenue million Forecast, by Application Mode 2020 & 2033

- Table 13: Brazil Crop Protection Market Revenue million Forecast, by Crop Type 2020 & 2033

- Table 14: Brazil Crop Protection Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Crop Protection Market?

The projected CAGR is approximately 2.98%.

2. Which companies are prominent players in the Brazil Crop Protection Market?

Key companies in the market include Sumitomo Chemical Co Ltd, American Vanguard Corporation, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, BASF SE, FMC Corporation, Corteva Agriscience.

3. What are the main segments of the Brazil Crop Protection Market?

The market segments include Function, Application Mode, Crop Type, Function, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Insecticides occupy the largest share of the Brazilian crop protection chemicals market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

February 2023: ADAMA opened a new multi-purpose facility in Brazil. With this factory, the company will be able to deliver all the Prothioconazole-based products in its pipeline to the global market and achieve its objective of introducing a number of innovative items to the Brazilian market in the upcoming years.January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.October 2022: HavizaTM Active was the newest fungicide brand added to Corteva Agriscience's strong innovation pipeline. The product is an alternative for farmers in South America to manage Asian soybean rot. The company broadened its active class of picolinamide through this innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Crop Protection Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Crop Protection Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Crop Protection Market?

To stay informed about further developments, trends, and reports in the Brazil Crop Protection Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence