Key Insights

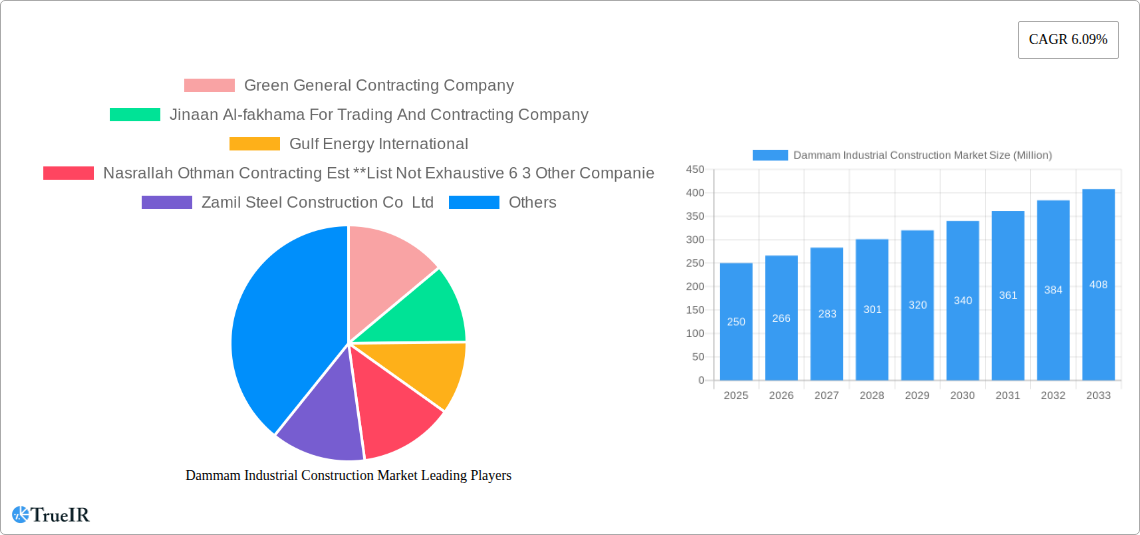

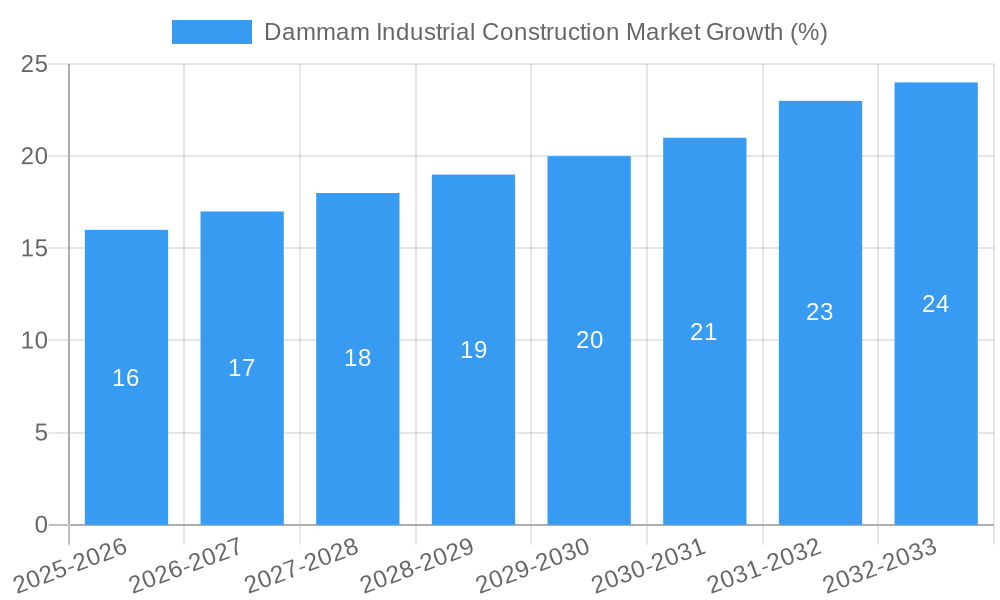

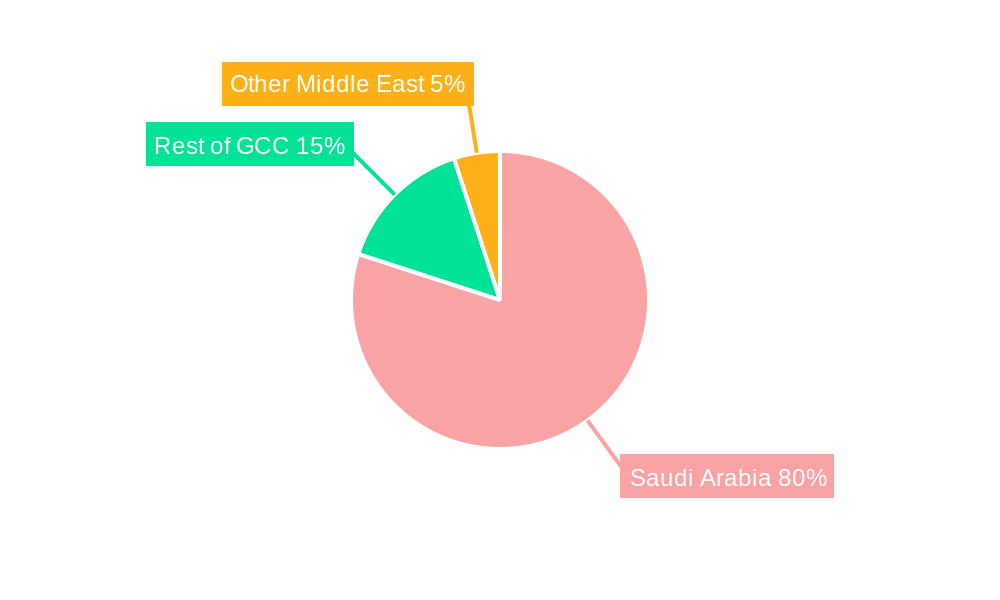

The Dammam Industrial Construction market, valued at $250 million in 2025, is projected to experience robust growth, driven by increasing industrialization and infrastructure development within the region. A Compound Annual Growth Rate (CAGR) of 6.09% from 2025 to 2033 suggests a significant expansion of the market, reaching an estimated value exceeding $400 million by 2033. Key drivers include government initiatives promoting industrial diversification, burgeoning energy and petrochemical sectors, and rising demand for warehousing and logistics facilities to support the region's economic growth. The market is segmented into warehouse and distribution, and manufacturing construction, with warehouse and distribution likely holding a larger share due to the growing e-commerce sector and supply chain optimization efforts. While specific regional breakdowns for India, Japan, China, South Korea, and the Rest of Asia Pacific are unavailable, the market's growth is anticipated to be influenced by broader economic trends within the Asia-Pacific region. Competitive dynamics are shaped by both established players like Zamil Steel Construction and Nes Global Arabia, and numerous smaller contracting companies demonstrating a fragmented yet active market. Challenges could include fluctuating material costs, labor shortages, and potential regulatory changes impacting project timelines and budgets.

The continued expansion of the Dammam Industrial Construction market hinges on sustained economic growth in Saudi Arabia and the broader Middle East. Factors such as strategic investments in infrastructure, technological advancements in construction techniques, and adoption of sustainable building practices will influence the market's trajectory. Companies within the sector are likely to face increasing pressure to improve efficiency, adopt innovative technologies, and offer competitive pricing to maintain market share. A deeper understanding of the specific regional dynamics, regulatory landscape, and supply chain complexities is crucial for accurate forecasting and strategic decision-making within the Dammam Industrial Construction market. The current market structure, characterized by a mix of large and small firms, will likely continue in the forecast period although mergers and acquisitions may reshape the competitive landscape over time.

Dammam Industrial Construction Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Dammam Industrial Construction Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils the market's structure, competitive landscape, growth drivers, and future outlook. Leveraging robust data and expert analysis, this report is essential for navigating the complexities and opportunities within this thriving market. The market is expected to reach XX Million by 2033.

Dammam Industrial Construction Market Market Structure & Competitive Landscape

The Dammam Industrial Construction Market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players, including Green General Contracting Company, Jinaan Al-fakhama For Trading And Contracting Company, Gulf Energy International, and Zamil Steel Construction Co Ltd, dominate significant market share. However, several mid-sized and smaller players contribute significantly to the overall market dynamism. The market's competitive landscape is shaped by factors such as:

- Innovation Drivers: Technological advancements in construction materials, techniques, and project management software are driving efficiency and cost optimization, attracting investment and fostering competition.

- Regulatory Impacts: Saudi Arabia's Vision 2030 initiative and related industrial development plans significantly impact the market, creating both opportunities and challenges regarding regulations and permits.

- Product Substitutes: The availability of prefabricated building components and alternative construction methods exerts pressure on traditional construction practices.

- End-User Segmentation: The market caters to diverse end-users, including warehousing and distribution facilities, manufacturing plants, and other industrial projects. Market share varies depending on the specific requirements of each sector.

- M&A Trends: The number of mergers and acquisitions (M&A) within the Dammam Industrial Construction Market has been relatively moderate in recent years, averaging xx deals per year during the historical period (2019-2024), however, with the projected increase in market value, we anticipate a xx% increase in M&A activities over the forecast period.

Dammam Industrial Construction Market Market Trends & Opportunities

The Dammam Industrial Construction Market is witnessing robust growth, driven by sustained economic expansion and ambitious infrastructure development plans within the Kingdom of Saudi Arabia. The market size is projected to reach XX Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors:

The increasing demand for industrial spaces and facilities, spurred by government initiatives to diversify the economy and attract foreign investment, is a major contributing factor. Technological advancements are driving efficiency and innovation in construction methods, lowering costs, and improving project timelines. Furthermore, changing consumer preferences towards sustainable and technologically advanced infrastructure are influencing the market. Competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, fostering innovation and pushing prices downwards. Market penetration rates vary considerably across different segments, with warehouse and distribution facilities experiencing particularly high growth. The projected CAGR suggests a continuously expanding market with significant opportunities for both established and emerging companies.

Dominant Markets & Segments in Dammam Industrial Construction Market

The Dammam Industrial Construction Market is dominated by the Warehouse and Distribution segment, currently representing approximately xx% of the total market value in 2025. This is primarily attributed to the rapid growth of e-commerce and the increasing need for efficient logistics infrastructure. The Manufacturing segment also contributes significantly, driven by Saudi Arabia's focus on industrial diversification and the establishment of new industrial cities and zones.

Key Growth Drivers for Warehouse and Distribution:

- Growing E-commerce: The booming e-commerce sector is driving demand for modern, efficient warehousing and distribution facilities.

- Logistics Infrastructure Development: Government investments in improving logistics infrastructure are boosting growth.

- Favorable Government Policies: Supportive government policies and regulations are encouraging investments in the sector.

Key Growth Drivers for Manufacturing:

- Industrial Diversification: Government initiatives to diversify the economy are attracting significant manufacturing investments.

- Foreign Direct Investment (FDI): Increased FDI in the manufacturing sector fuels the construction of new facilities.

- Technological Advancements: Adoption of automation and advanced technologies in manufacturing boosts demand for specialized facilities.

Dammam Industrial Construction Market Product Analysis

Recent innovations in construction materials (e.g., advanced composites and sustainable building materials) and techniques (e.g., prefabrication and 3D printing) are transforming the Dammam Industrial Construction Market. These innovations offer improved efficiency, reduced construction time, and enhanced sustainability. The market is increasingly focused on the application of these technologies in the construction of modern and efficient industrial facilities, aligning with both economic and environmental demands. The competitive advantage lies in offering innovative, cost-effective, and sustainable solutions that meet the evolving needs of the end-users.

Key Drivers, Barriers & Challenges in Dammam Industrial Construction Market

Key Drivers:

The Dammam Industrial Construction Market is propelled by significant government investments in infrastructure development, the burgeoning e-commerce sector, and Saudi Arabia’s Vision 2030 economic diversification plan. These factors translate into a substantial demand for warehousing, logistics, and manufacturing facilities. Technological advancements in construction methods also contribute to heightened efficiency and reduced project timelines, further driving market growth.

Challenges & Restraints:

Challenges include the potential for supply chain disruptions, fluctuations in global commodity prices, and regulatory complexities associated with obtaining construction permits and approvals. The intense competition among established players and the emergence of new entrants can also create pressure on profit margins. Moreover, skilled labor shortages might constrain project delivery timelines, influencing market dynamics and potentially slowing growth if not adequately addressed. These challenges account for an estimated xx% reduction in project efficiency annually.

Growth Drivers in the Dammam Industrial Construction Market Market

Government initiatives, like Vision 2030, are driving significant investment in industrial infrastructure. The expansion of e-commerce and the resultant demand for logistics facilities are key factors. Furthermore, technological advancements are optimizing construction processes, leading to cost reductions and time savings.

Challenges Impacting Dammam Industrial Construction Market Growth

Regulatory hurdles, including obtaining necessary permits, can delay projects. Supply chain disruptions due to global events can impact material availability and costs. Intense competition can pressure margins and limit profitability for some market players.

Key Players Shaping the Dammam Industrial Construction Market Market

- Green General Contracting Company

- Jinaan Al-fakhama For Trading And Contracting Company

- Gulf Energy International

- Nasrallah Othman Contracting Est

- 6 Other Companies

- Zamil Steel Construction Co Ltd

- Nes Global Arabia Company Limited

- Abdullah Fouad Company

- Aiples Arabia Company

- Nabatat Contracting Company

- Mammoet Ksa Limited Company

Significant Dammam Industrial Construction Market Industry Milestones

- November 2023: AJEX Logistics Services partnered with MODON, expanding logistics services in Dammam with a 6,000 sq. m warehousing facility. This signals a significant increase in demand for warehouse construction.

- June 2023: NATGAS was awarded a contract to establish a dry gas network in Dammam's Third Industrial City, indicating growth in energy sector infrastructure projects.

Future Outlook for Dammam Industrial Construction Market Market

The Dammam Industrial Construction Market is poised for continued growth, fueled by ongoing government investment, the expansion of industrial zones, and technological innovation. The market presents significant opportunities for companies offering sustainable and efficient construction solutions. Strategic partnerships and technological advancements will be crucial for maintaining a competitive edge in this dynamic market.

Dammam Industrial Construction Market Segmentation

-

1. Type

- 1.1. Warehouse and Distribution

- 1.2. Manufacturing

Dammam Industrial Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dammam Industrial Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.09% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Oil and Gas Sector

- 3.3. Market Restrains

- 3.3.1. Skills shortages.

- 3.4. Market Trends

- 3.4.1. Development of Manufacturing Hubs Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Warehouse and Distribution

- 5.1.2. Manufacturing

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Warehouse and Distribution

- 6.1.2. Manufacturing

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Warehouse and Distribution

- 7.1.2. Manufacturing

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Warehouse and Distribution

- 8.1.2. Manufacturing

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Warehouse and Distribution

- 9.1.2. Manufacturing

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Warehouse and Distribution

- 10.1.2. Manufacturing

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. India Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Japan Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. China Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. South Korea Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Rest of Asia Pacific Dammam Industrial Construction Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Green General Contracting Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Jinaan Al-fakhama For Trading And Contracting Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Gulf Energy International

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nasrallah Othman Contracting Est **List Not Exhaustive 6 3 Other Companie

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Zamil Steel Construction Co Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Nes Global Arabia Company Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Abdullah Fouad Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Aiples Arabia Company

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Nabatat Contracting Company

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Mammoet Ksa Limited Company

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Green General Contracting Company

List of Figures

- Figure 1: Global Dammam Industrial Construction Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: India Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 3: India Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Japan Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Japan Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: China Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 7: China Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South Korea Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South Korea Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Rest of Asia Pacific Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Rest of Asia Pacific Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Dammam Industrial Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Dammam Industrial Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: South America Dammam Industrial Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 17: South America Dammam Industrial Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: South America Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Dammam Industrial Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Dammam Industrial Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East & Africa Dammam Industrial Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Middle East & Africa Dammam Industrial Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Middle East & Africa Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Dammam Industrial Construction Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Dammam Industrial Construction Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Dammam Industrial Construction Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Dammam Industrial Construction Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dammam Industrial Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Dammam Industrial Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Dammam Industrial Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Dammam Industrial Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Dammam Industrial Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of South America Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Dammam Industrial Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Dammam Industrial Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Turkey Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Israel Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: GCC Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: North Africa Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: South Africa Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Middle East & Africa Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Dammam Industrial Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Dammam Industrial Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: India Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: ASEAN Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Oceania Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Dammam Industrial Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dammam Industrial Construction Market?

The projected CAGR is approximately 6.09%.

2. Which companies are prominent players in the Dammam Industrial Construction Market?

Key companies in the market include Green General Contracting Company, Jinaan Al-fakhama For Trading And Contracting Company, Gulf Energy International, Nasrallah Othman Contracting Est **List Not Exhaustive 6 3 Other Companie, Zamil Steel Construction Co Ltd, Nes Global Arabia Company Limited, Abdullah Fouad Company, Aiples Arabia Company, Nabatat Contracting Company, Mammoet Ksa Limited Company.

3. What are the main segments of the Dammam Industrial Construction Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 250 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Oil and Gas Sector.

6. What are the notable trends driving market growth?

Development of Manufacturing Hubs Dominating the Market.

7. Are there any restraints impacting market growth?

Skills shortages..

8. Can you provide examples of recent developments in the market?

November 2023: AJEX Logistics Services announced a new partnership agreement with the Saudi Authority for Industrial Cities and Technology Zones – MODON. The agreement will allow AJEX to operate expanded logistics services from the burgeoning industrial epicenter of Dammam. The agreement will see the Saudi-headquartered logistics firm use warehousing facilities over a 6,000 sq. m area at MODON. The units will be utilized for the warehousing of various goods, including dangerous goods, the storage of food and beverages, and more general items.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dammam Industrial Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dammam Industrial Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dammam Industrial Construction Market?

To stay informed about further developments, trends, and reports in the Dammam Industrial Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence