Key Insights

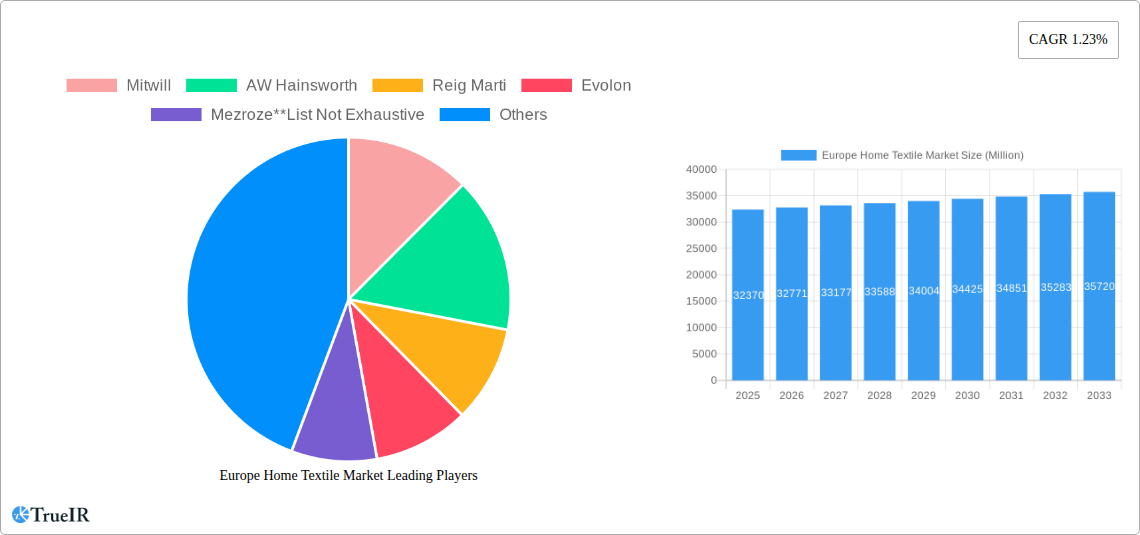

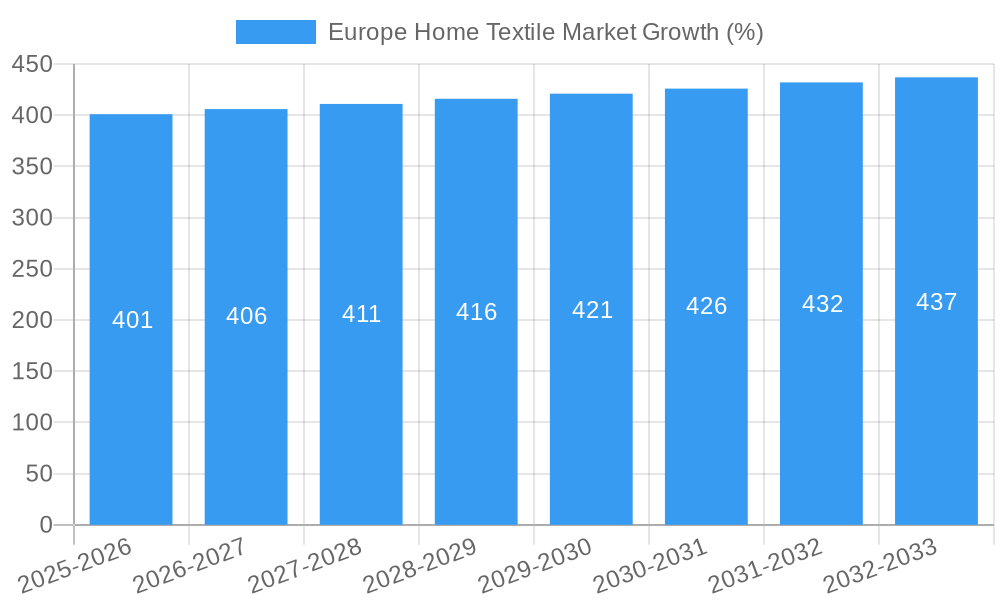

The European home textile market, valued at €32.37 billion in 2025, is projected to experience steady growth, driven by several key factors. Increasing disposable incomes across several European countries, coupled with a growing preference for comfort and aesthetics in home décor, are fueling demand for high-quality bed linens, bath linens, and other home textile products. The rise of e-commerce platforms has significantly broadened distribution channels, providing consumers with greater access to a wider variety of products and brands. This online accessibility is further enhanced by targeted digital marketing campaigns and influencer collaborations, driving sales and market expansion. While the market's Compound Annual Growth Rate (CAGR) of 1.23% suggests a moderate growth trajectory, segment-specific variations exist. The premium segment, encompassing high-thread-count bedding and luxury bathrobes, is likely to demonstrate stronger growth than the mass market due to rising consumer willingness to invest in superior quality and sustainable materials. Furthermore, the increasing popularity of eco-friendly and ethically sourced textiles is creating new opportunities for businesses committed to sustainability.

However, certain challenges persist within the European home textile market. Fluctuations in raw material prices, particularly cotton, can impact production costs and profitability. Intense competition from low-cost manufacturers in Asia presents an ongoing challenge, requiring European companies to focus on differentiation through superior design, quality, and branding. Furthermore, shifting consumer preferences towards minimalism and multi-functional furniture might slightly constrain demand for certain traditional home textile items. To mitigate these challenges and sustain growth, manufacturers are increasingly focusing on innovation, incorporating technological advancements into product development, and expanding their product offerings to cater to evolving consumer needs and preferences. This includes the integration of smart home technologies and the development of innovative materials offering enhanced functionality and durability. The focus on sustainability and ethical sourcing is also becoming a key differentiator in the increasingly competitive market landscape.

Europe Home Textile Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Home Textile Market, offering invaluable insights for businesses, investors, and industry professionals. With a detailed examination of market structure, trends, and future projections (2019-2033), this report is an essential resource for navigating the complexities of this dynamic sector. The report covers market size, segmentation, competitive landscape, key players, and significant industry milestones, offering a complete picture of the current state and future trajectory of the European home textile market. The Base Year is 2025, and the Estimated and Forecast Period is 2025-2033, with the Historical Period covering 2019-2024.

Europe Home Textile Market Market Structure & Competitive Landscape

The European home textile market is characterized by a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized companies creates a dynamic and competitive landscape. Innovation, particularly in sustainable and technologically advanced materials, is a key driver of growth, while regulatory changes related to environmental sustainability and product safety significantly impact market dynamics. Product substitutes, such as synthetic materials and alternatives to traditional fibers, exert competitive pressure. The end-user segmentation encompasses diverse consumer preferences, impacting product design and marketing strategies. Mergers and acquisitions (M&A) activity, though not extraordinarily high, demonstrates consolidation and expansion efforts within the sector. Over the past five years (2019-2024), the average annual volume of M&A deals in the sector was approximately xx. The market concentration ratio (CR4) for 2024 is estimated at xx%, indicating moderate market concentration.

- High Concentration in Certain Segments: While overall concentration is moderate, some specific product segments, like high-end bed linen, exhibit higher concentration levels.

- Increasing M&A Activity: The number of M&A deals is expected to increase by xx% in the forecast period (2025-2033), driven by the need for scale and access to new technologies.

- Focus on Sustainable Products: Growing consumer demand for eco-friendly and sustainable products is pushing companies to invest in research and development of sustainable materials and production processes.

Europe Home Textile Market Market Trends & Opportunities

The European home textile market is experiencing substantial growth, driven by several key factors. The market size, estimated at €xx Million in 2025, is projected to reach €xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several factors, including rising disposable incomes, changing consumer preferences towards higher quality and aesthetically pleasing home furnishings, and the increasing popularity of online shopping. Technological advancements in fabric manufacturing, such as the use of innovative fibers and smart textiles, contribute significantly to market expansion. Market penetration of online distribution channels is steadily increasing, presenting significant growth opportunities for businesses leveraging e-commerce platforms. However, competitive pressures and fluctuations in raw material prices remain significant challenges.

- Shifting Consumer Preferences: Growing preference for personalized and customized home textiles is driving demand for bespoke products and services.

- E-commerce Growth: Online channels continue to gain market share, offering opportunities for both established and new players.

- Sustainable Practices: Increasing focus on sustainability and eco-friendly production methods is influencing product development and consumer choices.

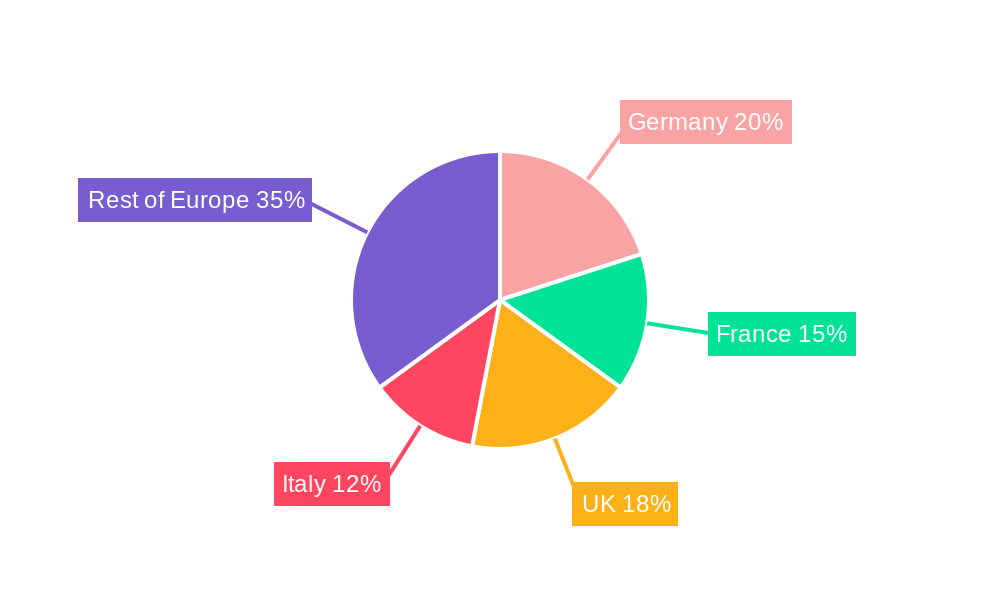

Dominant Markets & Segments in Europe Home Textile Market

The United Kingdom remains the dominant market within Europe, followed by Germany and France. Within the product segments, Bed Linen holds the largest market share, driven by consistent demand and diverse product offerings. In terms of distribution channels, Supermarkets and Hypermarkets dominate due to their wide reach and affordability. However, the online distribution channel shows the fastest growth rate.

- United Kingdom: Strong consumer spending, established retail infrastructure, and a large population contribute to its market leadership.

- Germany: A preference for high-quality and durable products contributes to its strong market position.

- Online Distribution: Rapid growth driven by convenience, wider selection, and competitive pricing.

- Bed Linen: High demand for various types of bed linen (e.g., cotton, linen, silk) drives market growth.

Growth Drivers by Segment:

- Bed Linen: Rising disposable incomes and the increasing focus on home comfort.

- Bath Linen: Growing awareness of hygiene and personal care.

- Online Distribution: Ease of access, wider selection, and competitive pricing.

- Supermarkets & Hypermarkets: Wide reach and affordability.

Europe Home Textile Market Product Analysis

The European home textile market witnesses continuous product innovation, driven by technological advancements in fabric production and design. The focus is on creating sustainable, durable, and aesthetically pleasing products. Companies are developing innovative materials with enhanced performance characteristics, such as moisture-wicking, stain-resistant, and hypoallergenic properties. Technological advancements like 3D printing are also transforming product design and customization options. The market effectively caters to diverse consumer needs and preferences with a wide range of products, from budget-friendly options to premium, luxury items.

Key Drivers, Barriers & Challenges in Europe Home Textile Market

Key Drivers:

Rising disposable incomes across Europe are fueling demand for premium home textiles, while increasing awareness of sustainability is driving demand for eco-friendly materials and production processes. Technological innovations in fabric production are leading to new product features like hypoallergenic and stain-resistant fabrics. Favorable government policies supporting domestic textile industries also contribute to market growth.

Challenges:

Fluctuating raw material prices, particularly cotton, significantly impact production costs and profitability. Stringent environmental regulations impose compliance burdens, and the increasing intensity of competition from low-cost manufacturers in other regions poses a significant challenge. Supply chain disruptions caused by geopolitical events or pandemics can impact availability and timely delivery of products.

Growth Drivers in the Europe Home Textile Market Market

The market's growth is propelled by increased consumer spending on home improvement and a growing preference for comfort and aesthetics in home environments. Technological advancements, including the development of sustainable and high-performance fabrics, are stimulating innovation and product diversification. Government initiatives supporting the textile industry and favorable macroeconomic conditions in some European countries also contribute significantly.

Challenges Impacting Europe Home Textile Market Growth

The market faces challenges like rising raw material costs, environmental regulations, and intense competition from low-cost producers. Supply chain complexities and geopolitical instability further impact production and distribution, potentially leading to increased prices and reduced availability. Meeting evolving consumer demands for eco-friendly products while maintaining cost-effectiveness presents a significant operational challenge.

Key Players Shaping the Europe Home Textile Market Market

- Mitwill

- AW Hainsworth

- Reig Marti

- Evolon

- Mezroze

- Tirotex

- Limaso

- Palmhive

- Lameirinho

- Lantex

- Tissery & Cie

Significant Europe Home Textile Market Industry Milestones

- October 2022: AIMPLAS and its partners launched the CISUTAC project, focusing on circular and sustainable textiles, boosting the transition towards eco-friendly practices within the industry.

- February 2023: Archroma's acquisition of Huntsman Textile Effects significantly expanded the global reach and production capacity within the sustainable specialty chemicals sector for textiles, impacting the availability of sustainable solutions for the home textile industry.

Future Outlook for Europe Home Textile Market Market

The European home textile market is poised for continued growth, driven by increasing disposable incomes, a heightened focus on sustainability, and ongoing technological advancements. Strategic opportunities exist for companies that prioritize innovation, sustainability, and effective e-commerce strategies. The market is expected to witness strong growth across diverse product segments and distribution channels, presenting significant potential for both established and emerging players.

Europe Home Textile Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Home Textile Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Home Textile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.23% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Residential Space in Europe; Rising Urbanization Driving Demand of Home Textile

- 3.3. Market Restrains

- 3.3.1. Major Market Share Is Restricted To Bed Linen; Higher Price of Branded Textile Affecting their Sales

- 3.4. Market Trends

- 3.4.1. Germany Leading the European Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Home Textile Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Germany Europe Home Textile Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Home Textile Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Home Textile Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Home Textile Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Home Textile Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Home Textile Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Home Textile Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mitwill

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 AW Hainsworth

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Reig Marti

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Evolon

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Mezroze**List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Tirotex

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Limaso

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Palmhive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lameirinho

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Lantex

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Tissery & Cie

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Mitwill

List of Figures

- Figure 1: Europe Home Textile Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Home Textile Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Home Textile Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Home Textile Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Europe Home Textile Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Europe Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Europe Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Europe Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Europe Home Textile Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Home Textile Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Netherlands Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sweden Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Europe Home Textile Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Europe Home Textile Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Europe Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Europe Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Europe Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Europe Home Textile Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Belgium Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Sweden Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Norway Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Poland Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Denmark Europe Home Textile Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Home Textile Market?

The projected CAGR is approximately 1.23%.

2. Which companies are prominent players in the Europe Home Textile Market?

Key companies in the market include Mitwill, AW Hainsworth, Reig Marti, Evolon, Mezroze**List Not Exhaustive, Tirotex, Limaso, Palmhive, Lameirinho, Lantex, Tissery & Cie.

3. What are the main segments of the Europe Home Textile Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Residential Space in Europe; Rising Urbanization Driving Demand of Home Textile.

6. What are the notable trends driving market growth?

Germany Leading the European Market.

7. Are there any restraints impacting market growth?

Major Market Share Is Restricted To Bed Linen; Higher Price of Branded Textile Affecting their Sales.

8. Can you provide examples of recent developments in the market?

October 2022: AIMPLAS & its partners launched the CISUTAC project based on circular and sustainable textiles. The project supported the transition to a circular and sustainable textile sector and is carried out by a consortium of 27 partners covering a major part of the textile sector. AIMPLAS has expertise in the extraction technology for removing inks, dyes, and other surface contaminants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Home Textile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Home Textile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Home Textile Market?

To stay informed about further developments, trends, and reports in the Europe Home Textile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence