Key Insights

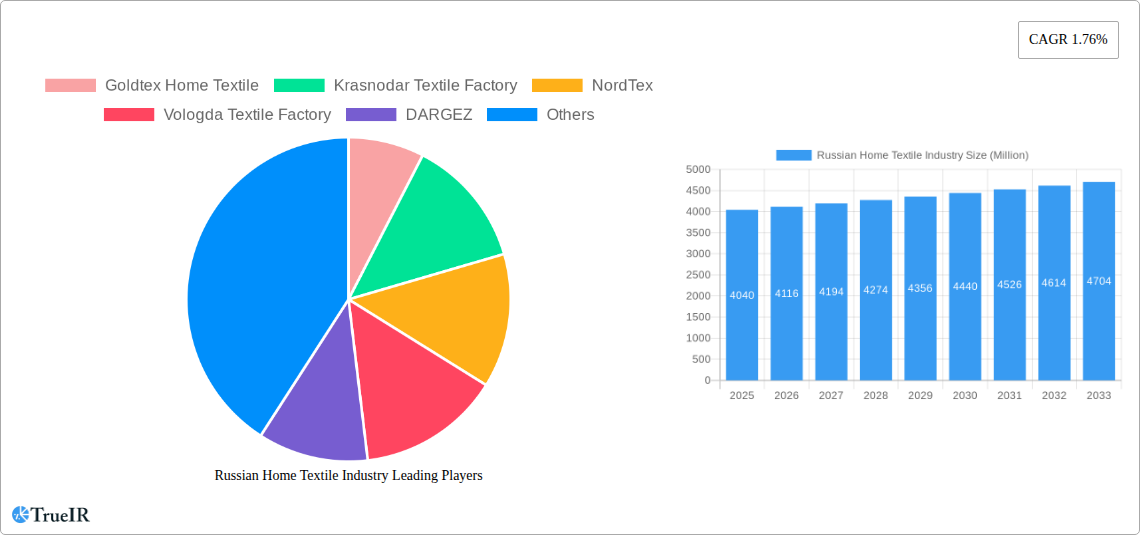

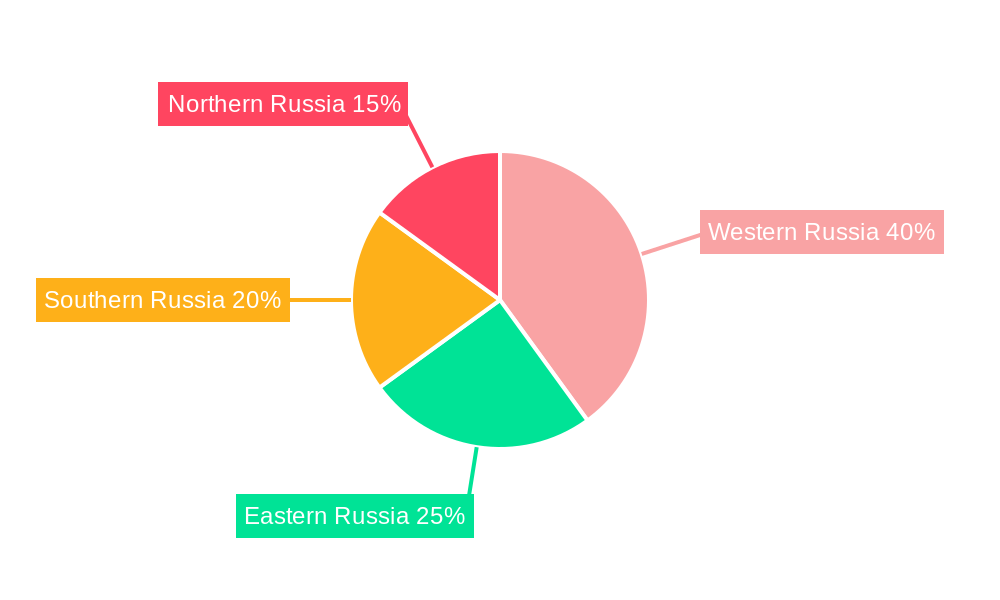

The Russian home textile market, valued at $4.04 billion in 2025, exhibits a steady growth trajectory, projected at a CAGR of 1.76% from 2025 to 2033. This growth is driven by several factors. Rising disposable incomes, particularly in urban centers, are fueling increased consumer spending on home furnishings, including higher-quality bed linen, bath linen, and kitchen textiles. Furthermore, a growing preference for comfortable and aesthetically pleasing home environments is boosting demand for premium products. The expansion of e-commerce platforms offers convenient access to a wider range of products, accelerating market growth. However, the market faces challenges such as economic fluctuations impacting consumer confidence and potential import restrictions affecting the availability and cost of raw materials. The segmentation reveals a diverse market with bed linen holding a significant share followed by bath linen and kitchen linen. Supermarkets and hypermarkets dominate distribution channels, though online stores are witnessing rapid expansion, capturing an increasing proportion of sales. Key players like Goldtex Home Textile, Krasnodar Textile Factory, and others are vying for market share through product innovation, brand building, and strategic partnerships. Regional variations in demand exist, with Western Russia likely exhibiting higher consumption due to its higher population density and economic activity.

Russian Home Textile Industry Market Size (In Billion)

The forecast period (2025-2033) suggests continued growth albeit at a moderate pace. While the CAGR of 1.76% implies a relatively stable market, strategic investments in online sales channels, diversification of product offerings, and efficient supply chain management will be crucial for companies to enhance their market position. Furthermore, adapting to evolving consumer preferences and incorporating sustainable and eco-friendly practices will be vital for long-term success. The competitive landscape necessitates companies adopting innovative marketing strategies and focusing on value-added services to differentiate themselves. The regional differences in market penetration require tailored marketing strategies for each region based on their socio-economic factors and cultural nuances.

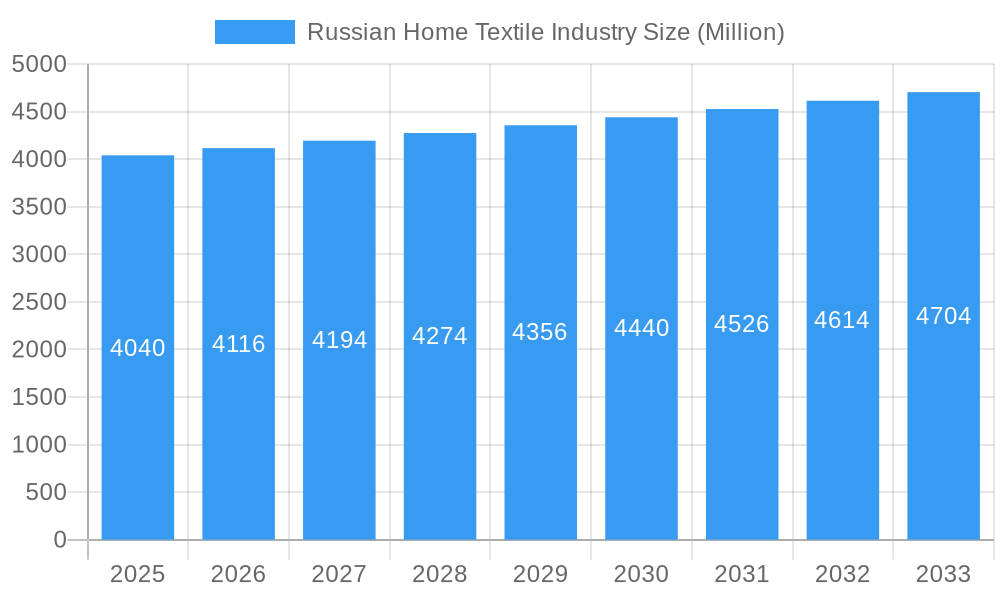

Russian Home Textile Industry Company Market Share

Russian Home Textile Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Russian home textile industry, covering market size, competitive landscape, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for businesses, investors, and policymakers seeking to understand this dynamic market. The report leverages extensive data analysis and expert insights to deliver actionable intelligence, focusing on key segments, including bed linen, bath linen, kitchen linen, upholstery, and floor coverings, across various distribution channels. The report analyzes the impact of significant events such as the rising global cotton prices and government initiatives to promote domestic technical textile production. Expected market value is estimated to reach xx Million USD by 2033.

Russian Home Textile Industry Market Structure & Competitive Landscape

The Russian home textile market exhibits a moderately fragmented structure, with several large players and numerous smaller companies. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately competitive landscape. Market concentration is influenced by factors like brand recognition, product differentiation, and distribution network strength. Innovation is driven by the need to offer superior quality, diverse designs, and eco-friendly materials. Regulatory changes, particularly related to product safety and labeling, significantly impact the industry. Substitute products, such as imported textiles or alternative home furnishings, pose a threat to the market. End-user segmentation largely revolves around demographics (age, income, lifestyle) and geographic location. M&A activity is relatively low, with an estimated xx Million USD in transactions in the past five years, driven primarily by smaller players seeking scale and market share expansion.

- Key Market Characteristics: Moderate fragmentation, brand-driven competition, increasing emphasis on sustainability.

- Regulatory Impacts: Product safety standards, labeling requirements, import/export regulations.

- End-User Segmentation: Urban vs. Rural, Income Levels, Age Demographics

- M&A Trends: Low volume, consolidation among smaller players.

Russian Home Textile Industry Market Trends & Opportunities

The Russian home textile market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for comfortable and aesthetically pleasing home environments. Technological advancements, such as the use of smart textiles and automated manufacturing processes, are creating new opportunities for market players. Consumer preferences are shifting towards higher-quality, sustainable, and technologically advanced products. The market penetration of online channels is steadily increasing, offering new opportunities for both established and emerging brands. Competitive dynamics are characterized by a mix of price competition and product differentiation, requiring businesses to adapt to evolving consumer preferences. Market penetration rate for online sales is estimated to reach xx% by 2033.

Dominant Markets & Segments in Russian Home Textile Industry

The Moscow and St. Petersburg regions represent the most dominant markets within the Russian home textile industry, fueled by higher disposable incomes and a concentration of population. Within product segments, bed linen commands the largest market share, followed by bath linen and kitchen linen. The largest distribution channel is supermarkets and hypermarkets, followed by specialty stores. Online stores are experiencing rapid growth.

- Key Growth Drivers:

- Moscow & St. Petersburg: High population density, affluent consumers, well-developed infrastructure.

- Bed Linen: Strong demand due to large household sizes and preference for comfortable bedding.

- Supermarkets & Hypermarkets: Wide reach, convenient access, competitive pricing.

- Market Dominance Analysis: The dominance of Moscow and St. Petersburg is linked to purchasing power and consumer preference. The substantial market share of bed linen reflects a priority on comfort and home aesthetics among Russian consumers. Supermarkets and hypermarkets benefit from accessibility and established distribution networks.

Russian Home Textile Industry Product Analysis

The Russian home textile industry is witnessing ongoing product innovation, focusing on improved comfort, durability, and aesthetic appeal. New technologies such as antimicrobial treatments and advanced weaving techniques are enhancing product performance. The market is also seeing a growing demand for sustainable and eco-friendly products made from recycled materials or organic cotton. The competitive advantage lies in offering high-quality, innovative products at competitive prices.

Key Drivers, Barriers & Challenges in Russian Home Textile Industry

Key Drivers: Rising disposable incomes, increasing urbanization, preference for improved home aesthetics, technological advancements.

Challenges: High import costs for raw materials (cotton), intense competition from imported products, fluctuations in exchange rates, and supply chain disruptions. The import reliance on cotton from Uzbekistan causes significant price volatility impacting the industry's cost structure.

Growth Drivers in the Russian Home Textile Industry Market

The Russian home textile industry's growth is primarily driven by rising disposable incomes, leading to increased spending on home furnishings. Urbanization trends contribute to a larger market size, while technological innovations such as smart textiles offer new product opportunities. Government support for domestic textile manufacturing could also stimulate growth.

Challenges Impacting Russian Home Textile Industry Growth

Significant challenges include the high cost and volatility of cotton imports, intense competition from foreign brands, and potential supply chain disruptions. Regulatory hurdles and exchange rate fluctuations also pose significant risks to the industry's growth trajectory.

Key Players Shaping the Russian Home Textile Industry Market

- Goldtex Home Textile

- Krasnodar Textile Factory

- NordTex

- Vologda Textile Factory

- DARGEZ

- TDL Textile

- Askona

- Vyshnevolotsk Cotton Mill

- Togas

- Sortex Company

- Ecotex

Significant Russian Home Textile Industry Industry Milestones

- December 2021: Leading domestic manufacturers begin expanding into technical and nonwoven textiles.

- 2022: Balashov Textile Mill (Baltex) announces a USD 200 Million investment in polyamide fiber and fabric production.

Future Outlook for Russian Home Textile Industry Market

The Russian home textile market is poised for continued growth, driven by sustained economic development, evolving consumer preferences, and technological advancements. Strategic opportunities exist in developing innovative, sustainable, and technologically advanced products, catering to the rising demand for higher quality and convenience. The market's potential is substantial, offering significant opportunities for both domestic and international players.

Russian Home Textile Industry Segmentation

-

1. Product

- 1.1. Bed Linen

- 1.2. Bath Linen

- 1.3. Kitchen Linen

- 1.4. Upholstery

- 1.5. Floor Covering

-

2. Distribution Channel

- 2.1. Supermarkets & Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Russian Home Textile Industry Segmentation By Geography

- 1. Russia

Russian Home Textile Industry Regional Market Share

Geographic Coverage of Russian Home Textile Industry

Russian Home Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rise in demand of cordless

- 3.2.2 light-weight and small-sized vacuum cleaner

- 3.3. Market Restrains

- 3.3.1. Rise in price of electronic products post covid

- 3.4. Market Trends

- 3.4.1. Increase in E-Commerce of Textile Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Home Textile Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bed Linen

- 5.1.2. Bath Linen

- 5.1.3. Kitchen Linen

- 5.1.4. Upholstery

- 5.1.5. Floor Covering

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets & Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Goldtex Home Textile

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Krasnodar Textile Factory

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NordTex

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vologda Textile Factory

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DARGEZ

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TDL Textile

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Askona

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vyshnevolotsk Cotton Mill

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Togas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sortex Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ecotex

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Goldtex Home Textile

List of Figures

- Figure 1: Russian Home Textile Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Russian Home Textile Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Home Textile Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Russian Home Textile Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Russian Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Russian Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Russian Home Textile Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Russian Home Textile Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Russian Home Textile Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Russian Home Textile Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Russian Home Textile Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Russian Home Textile Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Russian Home Textile Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Russian Home Textile Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Home Textile Industry?

The projected CAGR is approximately 1.76%.

2. Which companies are prominent players in the Russian Home Textile Industry?

Key companies in the market include Goldtex Home Textile, Krasnodar Textile Factory, NordTex, Vologda Textile Factory, DARGEZ, TDL Textile, Askona, Vyshnevolotsk Cotton Mill, Togas, Sortex Company, Ecotex.

3. What are the main segments of the Russian Home Textile Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand of cordless. light-weight and small-sized vacuum cleaner.

6. What are the notable trends driving market growth?

Increase in E-Commerce of Textile Market.

7. Are there any restraints impacting market growth?

Rise in price of electronic products post covid.

8. Can you provide examples of recent developments in the market?

In 2022, One of Russia's leading producers of technical textiles and nonwovens, Balashov Textile Mill (Baltex), will invest USD 200 million for expansion of the production of polyamide fibres and fabrics over the next few years. The current market of technical textiles in Russia relies on imports. The contribution of domestic manufacturers is estimated to be merely 17 per cent of the total market. Nevertheless, with Russia's growing automotive sector, healthcare and construction industry, the internal demand for technical textile will rise. Other leading groups like Kuibyshevazot, Kurskhimvolokno and BTK Group have also declared expansion plans in Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Home Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Home Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Home Textile Industry?

To stay informed about further developments, trends, and reports in the Russian Home Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence