Key Insights

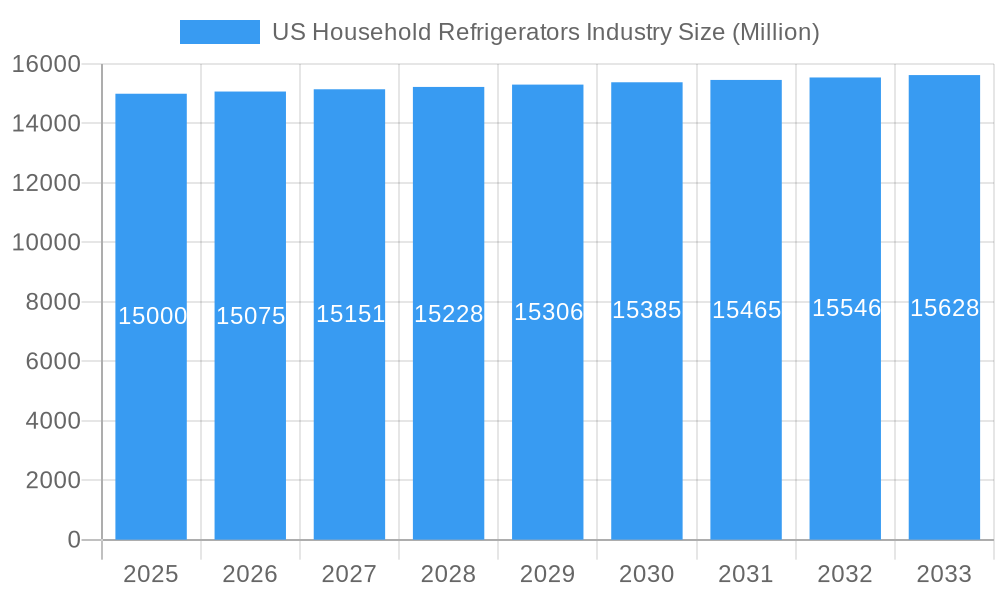

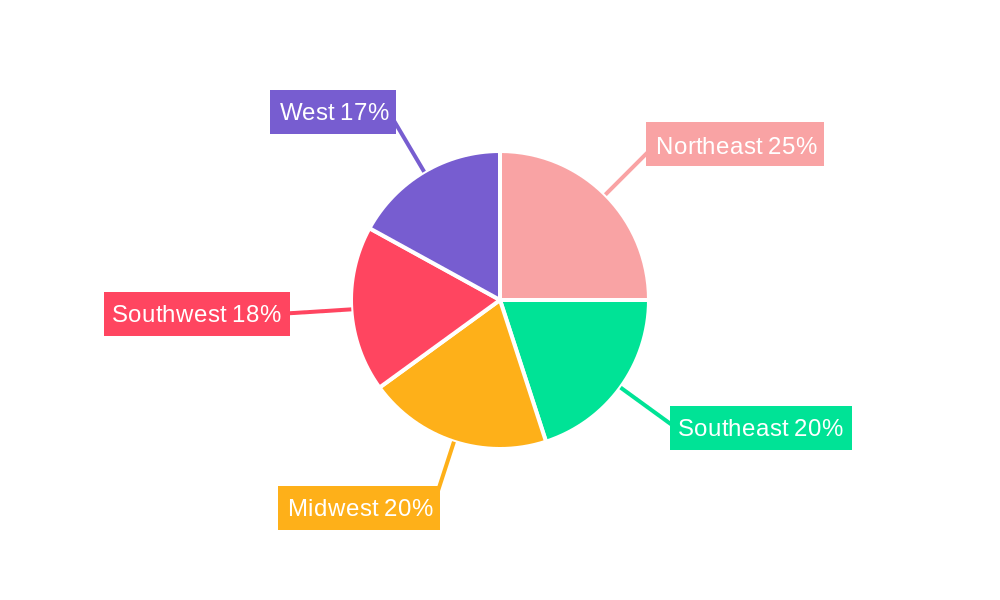

The U.S. household refrigerator market, projected to reach $124.9 billion by 2025 with a CAGR of 5%, is experiencing substantial expansion. This growth is fueled by rising disposable incomes, a strong preference for energy-efficient appliances, and increasing consumer demand for advanced features such as smart technology and superior food preservation. The market anticipates continued steady growth through 2033. Key segments driving this expansion include high-volume demand for side-by-side and French door refrigerator models, reflecting consumer needs for greater capacity and organized storage. The online distribution channel is rapidly growing, propelled by e-commerce proliferation and enhanced consumer convenience. However, challenges persist, including volatile raw material costs and intense competition among leading brands like Whirlpool, Samsung, LG, and Haier, which can lead to price pressures and impact profitability. Regional consumption varies, with the Northeast and West Coast exhibiting higher per capita spending due to elevated income levels and population density. An intensified focus on sustainability is spurring innovation in energy-efficient models, featuring improved insulation and compressor technology, further bolstering long-term market prospects.

US Household Refrigerators Industry Market Size (In Billion)

This sustained growth trajectory is expected to continue, with consumers increasingly prioritizing features such as smart connectivity, precise temperature control, and advanced food preservation capabilities. The growing popularity of frozen foods, including ready-to-eat meals, is also a significant demand driver. Intensified competitive pressures will likely compel manufacturers to focus on product differentiation through innovative features, aesthetic enhancements, and strategic marketing to secure market share. The ongoing expansion of e-commerce will continue to reshape the distribution landscape, necessitating adaptive supply chain and logistics strategies from manufacturers. Technological advancements, particularly in smart home integration and AI-driven food management, are poised to disrupt the market and unlock significant future growth opportunities.

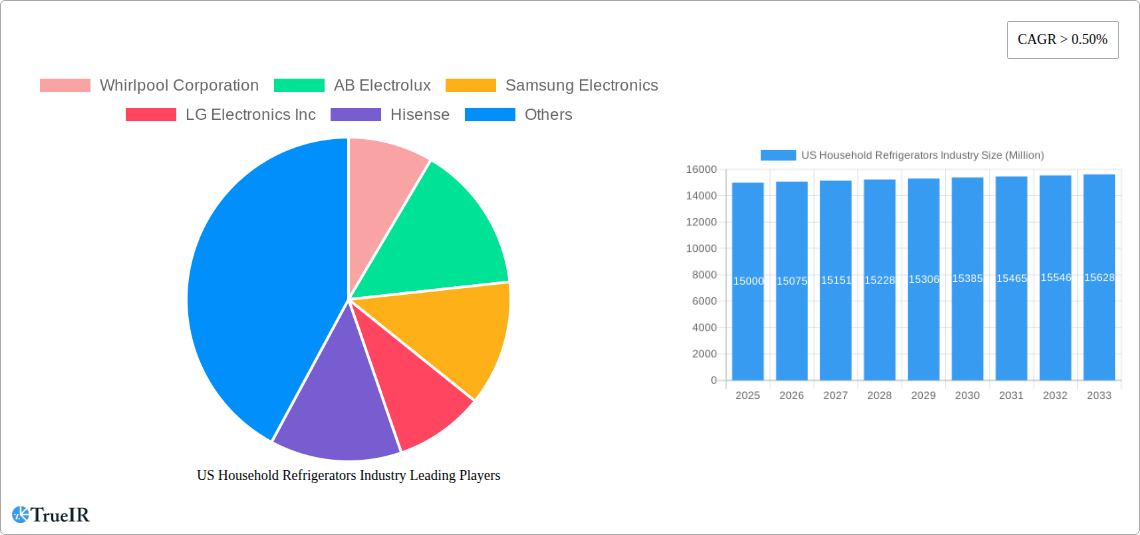

US Household Refrigerators Industry Company Market Share

US Household Refrigerators Industry Report: 2019-2033 Forecast

This comprehensive report delivers an in-depth analysis of the US household refrigerators industry, providing crucial insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report offers a detailed examination of market size, segmentation, competitive landscape, and future growth prospects. The report leverages extensive data analysis and expert insights to provide a 360-degree view of the industry, including detailed forecasts and strategic recommendations.

US Household Refrigerators Industry Market Structure & Competitive Landscape

This section analyzes the competitive intensity and structure of the US household refrigerator market. We examine market concentration through metrics like the Herfindahl-Hirschman Index (HHI), revealing the dominance of key players like Whirlpool Corporation, AB Electrolux, Samsung Electronics, and LG Electronics Inc. The report explores innovation drivers, including technological advancements in energy efficiency, smart features, and design aesthetics. We also assess the regulatory landscape, focusing on energy efficiency standards and their impact on market dynamics. Furthermore, the analysis delves into the presence of substitute products (e.g., alternative food preservation methods) and their market share. End-user segmentation, focusing on household size, income levels, and lifestyle preferences, is examined in detail. Finally, we analyze recent mergers and acquisitions (M&A) activity, quantifying deal volumes and their impact on market consolidation (e.g., xx M&A deals resulting in a xx% increase in market concentration from 2020 to 2024). Qualitative insights on competitive strategies and industry collaborations are also provided. The influence of rising raw material costs and fluctuating energy prices on profitability is explored, alongside discussions of supply chain resilience and geopolitical factors.

US Household Refrigerators Industry Market Trends & Opportunities

The US household refrigerator market exhibits a robust growth trajectory, projected to reach xx Million units by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors: increasing disposable incomes, rising urbanization, shifting consumer preferences towards premium features (like smart connectivity and advanced cooling technologies), and the replacement of aging appliances. Technological innovations, such as the integration of smart home ecosystems and the development of energy-efficient models, are driving market transformation. Consumer preferences are increasingly focused on sustainability, convenience, and aesthetic appeal. Competitive dynamics are intense, with established players and emerging brands vying for market share through product differentiation, branding, and aggressive pricing strategies. Market penetration of smart refrigerators is steadily increasing, reaching an estimated xx% in 2025 and projected to exceed xx% by 2033.

Dominant Markets & Segments in US Household Refrigerators Industry

The US household refrigerator market is geographically diverse, with significant variations in demand across different regions. However, the analysis suggests that xx region dominates overall sales, attributed to factors like high household income levels, greater appliance ownership, and a large population base.

By Distribution Channel: Supermarkets/hypermarkets currently hold the largest market share, although online sales are experiencing rapid growth, driven by e-commerce expansion and convenient home delivery options. Specialty stores maintain a niche but loyal customer base seeking premium models and specialized services.

By Type: Side-by-side refrigerators and French door refrigerators dominate the market due to their large capacity and appealing aesthetics. However, growing consumer awareness of energy efficiency is boosting the demand for counter-depth and bottom-freeze refrigerators.

By Application: Frozen vegetable and fruit storage accounts for a significant share of refrigerator usage, followed by frozen meat storage. These applications are critical factors driving refrigerator capacity and feature choices.

Growth drivers within these segments include expanding retail infrastructure, favorable government policies supporting energy efficiency upgrades, and a preference for larger-capacity refrigerators in larger households.

US Household Refrigerators Industry Product Analysis

The US household refrigerator market is characterized by continuous product innovation. Manufacturers are introducing energy-efficient models featuring advanced insulation technologies and intelligent cooling systems. Smart features, including connectivity to smart home platforms, remote temperature control, and internal cameras, are increasingly common. Competitive advantages stem from superior energy efficiency ratings, enhanced durability, innovative design elements, and the integration of smart features. These advancements cater to the evolving consumer preferences for convenience, sustainability, and technological integration.

Key Drivers, Barriers & Challenges in US Household Refrigerators Industry

Key Drivers: Technological advancements (energy-efficient compressors, smart functionalities), rising disposable incomes enabling higher spending on durable goods, and supportive government regulations promoting energy-efficient appliances are key drivers.

Key Challenges: Fluctuating raw material prices, supply chain disruptions impacting production costs and delivery times, intense competition resulting in price pressures, and the increasing complexity of regulatory compliance represent major hurdles. These factors have resulted in an estimated xx% increase in production costs from 2020 to 2024, impacting overall profitability.

Growth Drivers in the US Household Refrigerators Industry Market

The market's expansion is driven by technological advancements (smart features, energy efficiency), rising disposable incomes, and government policies promoting energy conservation. Increased urbanization and a growing preference for convenience also contribute to the market's growth.

Challenges Impacting US Household Refrigerators Industry Growth

Supply chain vulnerabilities, escalating raw material prices, and rigorous environmental regulations present significant growth barriers. Intense competition further complicates the landscape, impacting pricing strategies and profitability margins.

Key Players Shaping the US Household Refrigerators Industry Market

- Whirlpool Corporation

- AB Electrolux

- Samsung Electronics

- LG Electronics Inc

- Hisense

- Haier Group Corporation

- Dover Corporation

- Robert Bosch GmbH

- Philips Electronics

- Siemens Group

- Panasonic Corporation

Significant US Household Refrigerators Industry Industry Milestones

- 2020: Introduction of several energy-efficient models by major manufacturers.

- 2021: Launch of smart refrigerator models with enhanced connectivity features.

- 2022: Implementation of stricter energy efficiency standards by the US government.

- 2023: Several significant M&A activities consolidating the industry landscape.

- 2024: Increased focus on sustainable manufacturing practices among key players.

Future Outlook for US Household Refrigerators Industry Market

The US household refrigerator market is poised for continued growth, driven by technological advancements, shifting consumer preferences, and supportive government policies. Strategic opportunities lie in developing energy-efficient, smart, and aesthetically appealing models, catering to the growing demand for sustainable and technologically advanced appliances. Market expansion is anticipated, particularly in the online sales channels and premium segments.

US Household Refrigerators Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

US Household Refrigerators Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Household Refrigerators Industry Regional Market Share

Geographic Coverage of US Household Refrigerators Industry

US Household Refrigerators Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Smart Home is boosting the Market

- 3.3. Market Restrains

- 3.3.1. Flactuting Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Increase in Number of Smart Homes in United States is Driving the Market for Smart Refrigerators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Household Refrigerators Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America US Household Refrigerators Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America US Household Refrigerators Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe US Household Refrigerators Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa US Household Refrigerators Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific US Household Refrigerators Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Whirlpool Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AB Electrolux

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samsung Electronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LG Electronics Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hisense

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Haier Group Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dover Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Robert Bosch GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Philips Electronics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Siemens Group*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Panasonic Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Whirlpool Corporation

List of Figures

- Figure 1: Global US Household Refrigerators Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Household Refrigerators Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 3: North America US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America US Household Refrigerators Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 5: North America US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America US Household Refrigerators Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America US Household Refrigerators Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America US Household Refrigerators Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 11: North America US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America US Household Refrigerators Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America US Household Refrigerators Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America US Household Refrigerators Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 15: South America US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America US Household Refrigerators Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 17: South America US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America US Household Refrigerators Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America US Household Refrigerators Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America US Household Refrigerators Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 23: South America US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America US Household Refrigerators Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America US Household Refrigerators Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe US Household Refrigerators Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 27: Europe US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe US Household Refrigerators Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 29: Europe US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe US Household Refrigerators Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe US Household Refrigerators Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe US Household Refrigerators Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe US Household Refrigerators Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Europe US Household Refrigerators Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa US Household Refrigerators Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa US Household Refrigerators Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa US Household Refrigerators Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa US Household Refrigerators Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa US Household Refrigerators Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa US Household Refrigerators Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa US Household Refrigerators Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific US Household Refrigerators Industry Revenue (billion), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific US Household Refrigerators Industry Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific US Household Refrigerators Industry Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific US Household Refrigerators Industry Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific US Household Refrigerators Industry Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific US Household Refrigerators Industry Revenue (billion), by Country 2025 & 2033

- Figure 61: Asia Pacific US Household Refrigerators Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Household Refrigerators Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Global US Household Refrigerators Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global US Household Refrigerators Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global US Household Refrigerators Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global US Household Refrigerators Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global US Household Refrigerators Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global US Household Refrigerators Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Global US Household Refrigerators Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global US Household Refrigerators Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global US Household Refrigerators Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global US Household Refrigerators Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global US Household Refrigerators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global US Household Refrigerators Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 17: Global US Household Refrigerators Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global US Household Refrigerators Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global US Household Refrigerators Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global US Household Refrigerators Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global US Household Refrigerators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Brazil US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Argentina US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global US Household Refrigerators Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 26: Global US Household Refrigerators Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global US Household Refrigerators Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global US Household Refrigerators Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global US Household Refrigerators Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global US Household Refrigerators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: United Kingdom US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: France US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Italy US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Spain US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Russia US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Benelux US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Nordics US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global US Household Refrigerators Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 41: Global US Household Refrigerators Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global US Household Refrigerators Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global US Household Refrigerators Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global US Household Refrigerators Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global US Household Refrigerators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 46: Turkey US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Israel US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: GCC US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: North Africa US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: South Africa US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Global US Household Refrigerators Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 53: Global US Household Refrigerators Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global US Household Refrigerators Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global US Household Refrigerators Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global US Household Refrigerators Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global US Household Refrigerators Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 58: China US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 59: India US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Japan US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 61: South Korea US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: ASEAN US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 63: Oceania US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific US Household Refrigerators Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Household Refrigerators Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the US Household Refrigerators Industry?

Key companies in the market include Whirlpool Corporation, AB Electrolux, Samsung Electronics, LG Electronics Inc, Hisense, Haier Group Corporation, Dover Corporation, Robert Bosch GmbH, Philips Electronics, Siemens Group*List Not Exhaustive, Panasonic Corporation.

3. What are the main segments of the US Household Refrigerators Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 124.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Smart Home is boosting the Market.

6. What are the notable trends driving market growth?

Increase in Number of Smart Homes in United States is Driving the Market for Smart Refrigerators.

7. Are there any restraints impacting market growth?

Flactuting Raw Material Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Household Refrigerators Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Household Refrigerators Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Household Refrigerators Industry?

To stay informed about further developments, trends, and reports in the US Household Refrigerators Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence