Key Insights

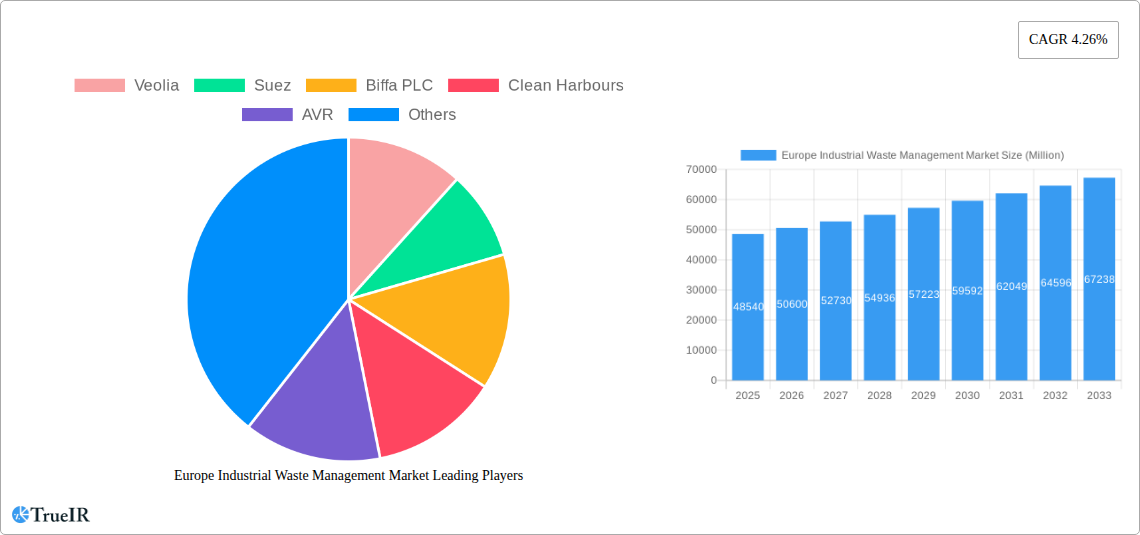

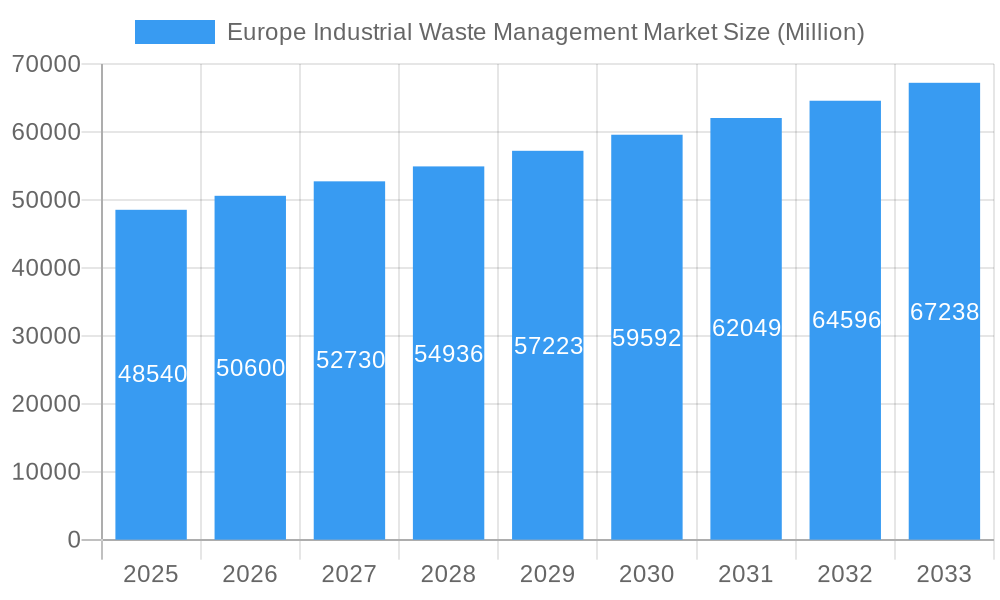

The Europe industrial waste management market, valued at €48.54 billion in 2025, is projected to experience steady growth, driven by increasing industrial activity, stricter environmental regulations, and a rising focus on sustainable waste management practices. The Compound Annual Growth Rate (CAGR) of 4.26% from 2025 to 2033 indicates a consistent expansion, although the pace might be influenced by economic fluctuations and technological advancements. Key drivers include the escalating demand for recycling and resource recovery solutions, coupled with growing pressure to reduce landfill disposal. The market's segmentation likely includes various waste streams (hazardous, non-hazardous, etc.), treatment methods (incineration, landfill, recycling), and service types (collection, processing, disposal). Leading players such as Veolia, Suez, Biffa PLC, and Clean Harbours are investing heavily in innovative technologies and expanding their service portfolios to cater to the evolving needs of industrial clients. The market is also witnessing the emergence of smaller, specialized companies focusing on niche waste streams or advanced recycling techniques. Geographic variations likely exist, with regions experiencing higher industrial concentration and stricter environmental policies showcasing faster growth rates.

Europe Industrial Waste Management Market Market Size (In Billion)

Despite the positive growth outlook, several challenges exist. Fluctuating raw material prices for recycled materials, evolving regulatory landscapes, and potential infrastructure limitations could restrain market growth. Furthermore, competition among established players and emerging companies is intense, requiring continuous innovation and cost optimization. To navigate these challenges, companies are likely focusing on strategic partnerships, mergers and acquisitions, and investments in research and development to maintain a competitive edge. Future growth will depend on the adoption of circular economy principles, technological breakthroughs in waste treatment, and effective policy support from governments in encouraging sustainable waste management practices. The market is poised for continuous evolution, with a shift toward more sustainable and resource-efficient solutions dominating the future trajectory.

Europe Industrial Waste Management Market Company Market Share

Europe Industrial Waste Management Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Europe Industrial Waste Management Market, offering invaluable insights for industry professionals, investors, and policymakers. With a detailed study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report leverages robust data and expert analysis to uncover market trends, opportunities, and challenges. Expect detailed coverage of market size, growth projections (CAGR), key players, and significant industry milestones. The report’s data-driven approach and focus on high-impact keywords ensure maximum visibility and relevance in online searches.

Europe Industrial Waste Management Market Market Structure & Competitive Landscape

The European industrial waste management market is characterized by a moderately concentrated landscape, with several large multinational corporations and a substantial number of smaller regional players. The market concentration ratio (CR4) for 2024 is estimated at xx%, indicating a degree of oligopolistic competition. Innovation is a key driver, with companies investing heavily in advanced technologies such as AI-powered waste sorting, chemical recycling, and anaerobic digestion. Stringent EU environmental regulations significantly impact market dynamics, driving the adoption of sustainable waste management practices. Product substitutes, such as bioplastics and biodegradable materials, are also gaining traction, influencing market competition.

End-user segmentation within the market includes manufacturing, construction, energy, and healthcare, each with distinct waste streams and management needs. Mergers and acquisitions (M&A) activity remains significant, with an estimated xx Million in M&A volume in 2024. This activity reflects consolidation trends and efforts by larger players to expand their market share and service capabilities. The market's competitive dynamics are further shaped by factors like pricing strategies, service offerings, geographical reach, and technological capabilities.

- Market Concentration: CR4 (2024): xx%

- Innovation Drivers: AI-powered waste sorting, chemical recycling, anaerobic digestion.

- Regulatory Impacts: Stringent EU environmental regulations driving sustainable practices.

- Product Substitutes: Bioplastics, biodegradable materials.

- End-User Segmentation: Manufacturing, Construction, Energy, Healthcare.

- M&A Trends: Estimated xx Million in M&A volume (2024).

Europe Industrial Waste Management Market Market Trends & Opportunities

The European industrial waste management market exhibits robust growth, driven by increasing industrial activity, stricter environmental regulations, and growing awareness of circular economy principles. The market size is projected to reach xx Million by 2025 and is expected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological advancements, such as improved waste-to-energy technologies and innovative recycling methods. Consumer preferences are shifting towards environmentally friendly products and services, increasing demand for sustainable waste management solutions. Competitive dynamics are shaped by the constant introduction of new technologies, mergers and acquisitions, and the evolving regulatory landscape. Market penetration rates for advanced waste management technologies vary across different regions and segments, but overall, adoption is accelerating due to both economic and environmental drivers. Further growth opportunities are presented by the rise of the circular economy, the increasing focus on reducing landfill waste, and the potential for new revenue streams from recycled materials.

Dominant Markets & Segments in Europe Industrial Waste Management Market

Germany currently holds the largest market share within the Europe Industrial Waste Management market, driven by its robust industrial base, strong environmental regulations, and established waste management infrastructure. Other key markets include the UK, France, and Italy. Within market segmentation, hazardous waste management demonstrates significant growth potential due to increasing industrial activity and stringent regulations concerning hazardous materials disposal.

Key Growth Drivers in Germany:

- Robust industrial base

- Stringent environmental regulations

- Established waste management infrastructure

- High investment in waste-to-energy technologies

Key Growth Drivers in Hazardous Waste Management:

- Increasing industrial activity

- Stringent regulations concerning hazardous materials disposal

- High value of recovered materials from hazardous waste streams

The dominance of Germany is attributed to several factors, including a high concentration of industrial activity, a mature waste management sector with advanced technologies, and proactive government policies supporting sustainable waste management practices. The country's substantial investments in waste-to-energy and recycling facilities have further fueled the market's expansion. Other countries, while showing considerable growth potential, lag behind Germany primarily due to variations in regulatory frameworks and levels of investment in infrastructure.

Europe Industrial Waste Management Market Product Analysis

The market showcases a diverse range of products and services including waste collection, transportation, treatment, recycling, and disposal. Technological advancements focus on enhancing efficiency, reducing environmental impact, and increasing the recovery of valuable resources from waste. Examples include automated sorting systems, advanced recycling technologies (e.g., chemical recycling), and innovative waste-to-energy solutions. The competitive advantage hinges on efficiency, technological sophistication, cost-effectiveness, and adherence to environmental regulations. New market entrants often focus on niche areas or specific technologies, whereas established players leverage their extensive networks and integrated service offerings.

Key Drivers, Barriers & Challenges in Europe Industrial Waste Management Market

Key Drivers:

- Growing awareness of environmental sustainability among businesses and consumers.

- Stringent EU environmental regulations driving the adoption of sustainable practices.

- Advancements in waste management technologies improving efficiency and resource recovery.

- Increasing demand for recycled materials and the circular economy model.

Key Challenges:

- High upfront investment costs for advanced waste management technologies.

- Complex regulatory landscape and permit requirements across different countries.

- Fluctuations in commodity prices impacting the economics of recycling.

- Competition from low-cost waste management providers in certain regions. This competition sometimes puts pressure on pricing and profit margins, particularly for smaller businesses.

Growth Drivers in the Europe Industrial Waste Management Market Market

The market's growth is fueled by several key factors: increasing environmental awareness, stringent government regulations promoting sustainable waste management, technological advancements enabling efficient resource recovery, and the rising adoption of the circular economy model. This creates new avenues for waste treatment, recycling, and energy recovery, further stimulating market expansion.

Challenges Impacting Europe Industrial Waste Management Market Growth

Significant challenges include high capital expenditures for advanced technologies, complex permitting processes across diverse national regulatory landscapes, and variable commodity prices affecting the profitability of recycling operations. These factors, along with intensifying competition, can impede market growth.

Key Players Shaping the Europe Industrial Waste Management Market Market

- Veolia

- Suez

- Biffa PLC

- Clean Harbours

- AVR

- Cleanaway Germany

- Remondis

- Urbaser

- Prezero International

- ALBA Group

- 73 Other Companies

Significant Europe Industrial Waste Management Market Industry Milestones

- October 2023: Veolia opened over 100 sites across France, showcasing its water, energy, and waste management solutions, boosting public awareness and trust.

- September 2023: Evonik and Remondis partnered to secure end-of-life mattress foam supply, advancing chemical recycling and promoting sustainable material use.

Future Outlook for Europe Industrial Waste Management Market Market

The Europe Industrial Waste Management Market is poised for continued growth, driven by increasing regulatory pressure, technological innovation, and a growing emphasis on circular economy principles. Strategic opportunities lie in developing advanced recycling technologies, optimizing waste-to-energy solutions, and expanding service offerings to cater to evolving end-user needs. The market's future potential is substantial, particularly in areas such as hazardous waste management and the recovery of valuable materials from waste streams.

Europe Industrial Waste Management Market Segmentation

-

1. Type

- 1.1. Construction and Demolition

- 1.2. Manufacturing Waste

- 1.3. Oil and Gas Waste

- 1.4. Other Wa

-

2. Service

- 2.1. Recycling

- 2.2. Landfill

- 2.3. Incineration

- 2.4. Other Services

Europe Industrial Waste Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

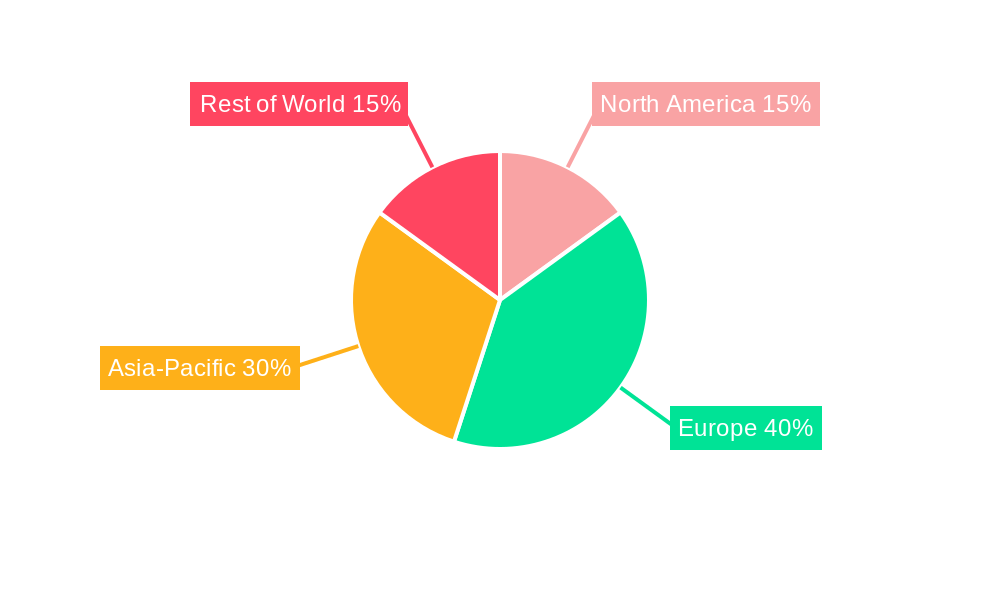

Europe Industrial Waste Management Market Regional Market Share

Geographic Coverage of Europe Industrial Waste Management Market

Europe Industrial Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies

- 3.3. Market Restrains

- 3.3.1. Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies

- 3.4. Market Trends

- 3.4.1. Germany Leads the Highest Contribution in the Waste Generation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Construction and Demolition

- 5.1.2. Manufacturing Waste

- 5.1.3. Oil and Gas Waste

- 5.1.4. Other Wa

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Recycling

- 5.2.2. Landfill

- 5.2.3. Incineration

- 5.2.4. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Veolia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Suez

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biffa PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Clean Harbours

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AVR

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleanaway Germnay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remondis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Urbaser

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Prezero International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALBA Group**List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Veolia

List of Figures

- Figure 1: Europe Industrial Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Europe Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Europe Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Europe Industrial Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Industrial Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Europe Industrial Waste Management Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Europe Industrial Waste Management Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Europe Industrial Waste Management Market Revenue Million Forecast, by Service 2020 & 2033

- Table 10: Europe Industrial Waste Management Market Volume Billion Forecast, by Service 2020 & 2033

- Table 11: Europe Industrial Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Industrial Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: France Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Industrial Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Industrial Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Waste Management Market?

The projected CAGR is approximately 4.26%.

2. Which companies are prominent players in the Europe Industrial Waste Management Market?

Key companies in the market include Veolia, Suez, Biffa PLC, Clean Harbours, AVR, Cleanaway Germnay, Remondis, Urbaser, Prezero International, ALBA Group**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Europe Industrial Waste Management Market?

The market segments include Type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 48.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies.

6. What are the notable trends driving market growth?

Germany Leads the Highest Contribution in the Waste Generation.

7. Are there any restraints impacting market growth?

Increasing Industrial Waste Generation; Growing Environmental Awareness; Investing in Advanced Recycling Technologies.

8. Can you provide examples of recent developments in the market?

October 2023: Veolia opened the doors of more than 100 sites operated by the group in France. The sites include drinking water production plants, wastewater treatment plants, waste sorting centers, or energy recovery units, enabling the general public to go behind the scenes of ecological transformation. A unique opportunity to discover the group's innovative solutions and expertise in its core businesses of water, energy, and waste management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Waste Management Market?

To stay informed about further developments, trends, and reports in the Europe Industrial Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence