Key Insights

The France Metal Fabrication Equipment market is projected for significant expansion, driven by technological innovation and a strong manufacturing sector. The historical period (2019-2024) saw steady development, influenced by European economic trends and investment cycles in manufacturing. With France's prominent automotive, aerospace, and construction industries, the market exhibited consistent growth. The market size in 2024 is estimated at approximately €1.8 billion, considering economic nuances. The base year of 2025 marks a period of stabilization and anticipated acceleration, with a projected market size of 663.3 million.

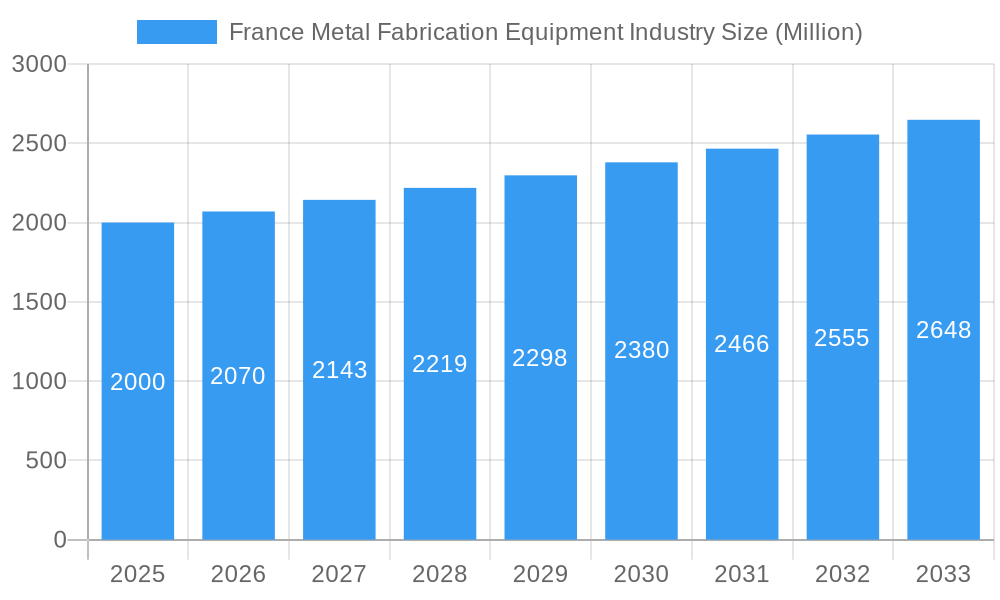

France Metal Fabrication Equipment Industry Market Size (In Million)

The forecast period (2025-2033) is poised for robust growth fueled by increasing automation, the adoption of advanced technologies like laser cutting and 3D printing, and a commitment to sustainable manufacturing practices. Government initiatives supporting industrial competitiveness and infrastructure development will further bolster market expansion. A conservative Compound Annual Growth Rate (CAGR) of 3.5% is anticipated, projecting the market size to reach approximately 663.3 million by 2033. This growth reflects the interplay of technological advancements and economic stability within the European Union, solidifying France's position as a key manufacturing hub.

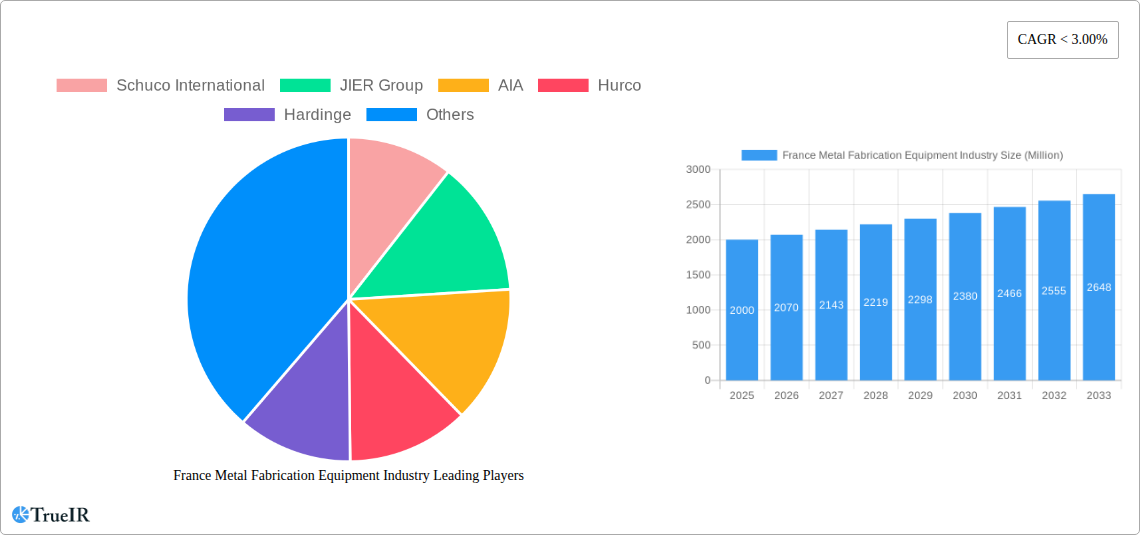

France Metal Fabrication Equipment Industry Company Market Share

France Metal Fabrication Equipment Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the France metal fabrication equipment industry, offering invaluable insights into market dynamics, competitive landscapes, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

France Metal Fabrication Equipment Industry Market Structure & Competitive Landscape

The France metal fabrication equipment market exhibits a moderately concentrated structure. While several major players dominate significant market share, a sizable number of smaller, specialized firms contribute to the overall market volume. Key players include Schuco International, JIER Group, AIA, Hurco, Hardinge, Kennametal, MAG Giddings & Lewis, and Amada. However, this list is not exhaustive.

The market concentration ratio (CR4) for 2025 is estimated to be xx%, indicating moderate dominance by the top four players. Innovation is a crucial driver, with companies continually investing in R&D to develop advanced technologies like laser cutting, 3D printing, and robotics. Stringent regulatory frameworks related to safety and environmental standards influence market operations. Substitute products, such as additive manufacturing techniques, present both challenges and opportunities. End-user segmentation is diverse, encompassing automotive, aerospace, construction, and consumer goods industries. Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024, primarily driven by strategic expansion and technology acquisition.

France Metal Fabrication Equipment Industry Market Trends & Opportunities

The French metal fabrication equipment market is experiencing steady growth, driven by several key factors. The increasing demand from various sectors like automotive and aerospace, coupled with government initiatives promoting industrial modernization, fuels market expansion. Technological advancements such as automation and digitalization are transforming manufacturing processes, leading to higher efficiency and productivity. The preference for advanced, precision-engineered equipment, enhanced by the rise of Industry 4.0, is pushing the demand for sophisticated and integrated systems. Intense competition among established and new players results in price optimization and innovative product offerings. The market is witnessing increasing adoption of Industry 4.0 technologies like IoT and cloud computing, improving overall operational efficiency and predictive maintenance. The CAGR for the forecast period (2025-2033) is projected at xx%, with a market penetration rate of xx% for advanced automation solutions in the automotive sector by 2033.

Dominant Markets & Segments in France Metal Fabrication Equipment Industry

The automotive sector represents the largest segment within the French metal fabrication equipment market, contributing approximately xx% of the total revenue in 2025. The Île-de-France region (Paris region) is the dominant market, accounting for xx% of the total market share.

Key Growth Drivers in the Automotive Segment:

- Strong domestic automotive production.

- Government support for electric vehicle (EV) manufacturing.

- Investments in advanced manufacturing technologies.

- Increased demand for lightweight materials.

The aerospace segment also shows significant growth potential, fueled by investments in new aircraft production and maintenance activities. Other key segments include construction, consumer goods, and energy. The continued growth in these sectors will drive further demand for metal fabrication equipment.

France Metal Fabrication Equipment Industry Product Analysis

The French market sees a diverse range of metal fabrication equipment, encompassing traditional technologies like stamping, bending, and welding, alongside modern solutions like laser cutting, waterjet cutting, and robotic systems. Technological advancements are focused on improving precision, automation, speed, and energy efficiency. These innovations enhance productivity, reduce waste, and meet the stringent quality requirements of diverse end-users. The market trend favors integrated and automated solutions that can optimize entire production lines, improving overall manufacturing efficiency and flexibility.

Key Drivers, Barriers & Challenges in France Metal Fabrication Equipment Industry

Key Drivers:

The market is propelled by rising industrial automation, technological advancements in cutting, welding, and forming techniques, and government incentives for industrial modernization. The strong presence of major automotive and aerospace manufacturers in France creates a substantial demand for high-quality fabrication equipment.

Challenges:

Key challenges include the high initial investment costs for advanced equipment, competition from low-cost imports, and potential skills shortages in operating and maintaining sophisticated technologies. Supply chain disruptions related to global events also contribute to price volatility and delayed deliveries. These factors can collectively influence overall market growth. Stringent environmental regulations may lead to higher compliance costs for manufacturers.

Growth Drivers in the France Metal Fabrication Equipment Industry Market

The growth of the French metal fabrication equipment market is primarily driven by the increasing demand from automotive, aerospace, and construction industries, along with government initiatives promoting industrial modernization and automation. Technological advancements such as advanced CNC machining, robotics, and additive manufacturing are significantly impacting productivity and efficiency, boosting market demand.

Challenges Impacting France Metal Fabrication Equipment Industry Growth

The primary challenges include the high capital expenditure required for advanced equipment, intense competition, and potential supply chain disruptions. Fluctuations in raw material prices and stringent environmental regulations also pose challenges to market growth. Additionally, a skilled workforce shortage may hinder the adoption of advanced technologies.

Key Players Shaping the France Metal Fabrication Equipment Industry Market

- Schuco International

- JIER Group

- AIA

- Hurco

- Hardinge

- Kennametal

- MAG Giddings & Lewis

- Amada *List Not Exhaustive

Significant France Metal Fabrication Equipment Industry Industry Milestones

- 2021: Introduction of a new high-speed laser cutting machine by Amada.

- 2022: Partnership between Schuco International and a French automotive manufacturer for the development of customized fabrication solutions.

- 2023: Government investment in a national skills development program to support the adoption of advanced technologies in the metal fabrication sector. (Further milestones require specific data)

Future Outlook for France Metal Fabrication Equipment Industry Market

The French metal fabrication equipment market is poised for continued growth, driven by technological advancements and a robust industrial sector. Strategic opportunities exist for companies focused on automation, digitalization, and sustainable manufacturing solutions. The increasing adoption of Industry 4.0 technologies and a growing demand for customized and high-precision equipment will present significant market potential in the coming years. Government initiatives promoting industrial competitiveness will further stimulate market expansion.

France Metal Fabrication Equipment Industry Segmentation

-

1. Product Type

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. End-user industry

- 2.1. Oil and Gas

- 2.2. Manufacturing

- 2.3. Power and Utilities

- 2.4. Construction

- 2.5. Other end-user industries

France Metal Fabrication Equipment Industry Segmentation By Geography

- 1. France

France Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of France Metal Fabrication Equipment Industry

France Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing Production is a Key Trend in Demand Generation in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by End-user industry

- 5.2.1. Oil and Gas

- 5.2.2. Manufacturing

- 5.2.3. Power and Utilities

- 5.2.4. Construction

- 5.2.5. Other end-user industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Schuco International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JIER Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AIA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hurco

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hardinge

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kennametal

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MAG Giddings & Lewis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amada*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Schuco International

List of Figures

- Figure 1: France Metal Fabrication Equipment Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: France Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: France Metal Fabrication Equipment Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: France Metal Fabrication Equipment Industry Revenue million Forecast, by End-user industry 2020 & 2033

- Table 3: France Metal Fabrication Equipment Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: France Metal Fabrication Equipment Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 5: France Metal Fabrication Equipment Industry Revenue million Forecast, by End-user industry 2020 & 2033

- Table 6: France Metal Fabrication Equipment Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Metal Fabrication Equipment Industry?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the France Metal Fabrication Equipment Industry?

Key companies in the market include Schuco International, JIER Group, AIA, Hurco, Hardinge, Kennametal, MAG Giddings & Lewis, Amada*List Not Exhaustive.

3. What are the main segments of the France Metal Fabrication Equipment Industry?

The market segments include Product Type, End-user industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 663.3 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing Production is a Key Trend in Demand Generation in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the France Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence