Key Insights

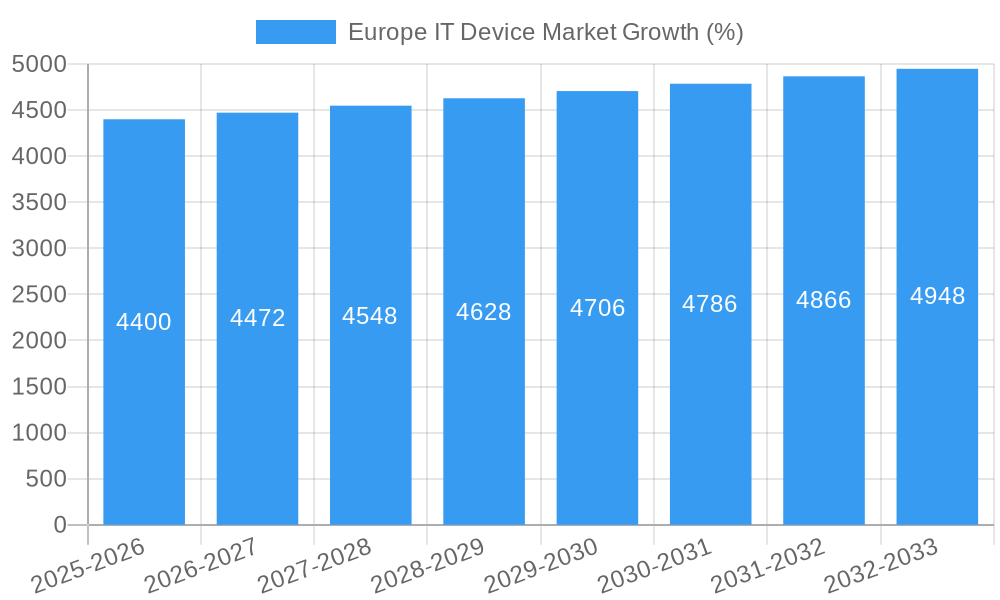

The European IT device market, encompassing PCs, tablets, and phones, exhibits moderate but consistent growth, projected at a CAGR of 1.80% from 2025 to 2033. While the market size in 2025 isn't explicitly stated, considering the substantial presence of major tech players like Apple, Samsung, Lenovo, and others within Europe, a reasonable estimate for the 2025 market size would be in the range of €200-€250 billion. This estimate reflects the significant consumer base and robust infrastructure supporting IT device consumption in the region. Key drivers include increasing digitalization across sectors, the burgeoning demand for remote work solutions, and the continuous upgrade cycle of existing devices. Significant trends include the growing adoption of 5G-enabled devices, the increasing demand for premium features like improved camera capabilities and enhanced processing power, and the rising popularity of foldable devices and other innovative form factors. However, economic fluctuations, potential supply chain disruptions, and increasing competition from emerging markets present notable restraints to market expansion. The segment analysis reveals that PCs continue to hold a significant market share, owing to their importance in professional and educational contexts, followed by smartphones and tablets, reflecting the increasing reliance on mobile devices for both personal and professional uses. Germany, France, and the UK are expected to remain the key contributors to the overall market size, based on their developed economies and high per-capita IT device consumption.

The forecast period from 2025 to 2033 presents both opportunities and challenges. Continued innovation in device technology, especially in areas like artificial intelligence and augmented reality, will likely fuel market expansion. Companies are investing heavily in research and development to maintain a competitive edge, offering devices with superior performance, longer battery life, and enhanced security features. Strategic partnerships and mergers and acquisitions within the industry will shape the competitive landscape, influencing pricing and product availability. The long-term success of players in this market depends on their ability to adapt to changing consumer preferences, address growing concerns about data privacy and security, and leverage technological advancements efficiently.

Europe IT Device Market: A Comprehensive Analysis (2019-2033)

This dynamic report provides a detailed analysis of the Europe IT Device Market, offering invaluable insights for businesses, investors, and policymakers. Leveraging extensive data from 2019 to 2024 (historical period), with a base year of 2025 and a forecast extending to 2033, this report meticulously examines market structure, trends, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Key players like Lenovo, Apple, Samsung, and others are analyzed, alongside segment breakdowns of PCs, Tablets, and Phones.

Europe IT Device Market Market Structure & Competitive Landscape

The Europe IT Device Market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a relatively competitive yet consolidated market. Innovation, particularly in areas like 5G technology, foldable devices, and enhanced processing power, is a key driver of market growth. Stringent data privacy regulations, such as GDPR, significantly impact market operations, pushing manufacturers toward greater data security implementations. Product substitutes, like older generation devices in the secondary market, present a challenge to new product penetration. The end-user segmentation is broad, including consumers, businesses, and government entities, each with unique purchasing behaviors and device requirements. M&A activity in the period 2019-2024 totaled approximately xx Million, indicating a dynamic landscape where companies seek strategic acquisitions to expand market reach and capabilities.

- Market Concentration: HHI estimated at xx.

- Innovation Drivers: 5G technology, foldable screens, AI integration.

- Regulatory Impacts: GDPR, data privacy concerns.

- Product Substitutes: Second-hand market, older generation devices.

- End-User Segmentation: Consumers, businesses, government.

- M&A Activity (2019-2024): Approximately xx Million

Europe IT Device Market Market Trends & Opportunities

The Europe IT Device Market demonstrates robust growth, driven by factors like increasing smartphone penetration, the adoption of advanced computing technologies in businesses, and the rising demand for portable devices. Technological shifts toward faster processing speeds, improved battery life, and enhanced camera capabilities are creating significant opportunities. Consumer preferences are shifting towards larger screen sizes, more durable designs, and enhanced features across all device segments. The competitive landscape is marked by continuous innovation, aggressive pricing strategies, and marketing campaigns focused on differentiating features and user experience. The market displays strong growth across all segments, with smartphones leading the charge. Smartphones are predicted to hold the largest market share, valued at xx Million in 2025, and are anticipated to grow at a CAGR of xx% in the forecast period.

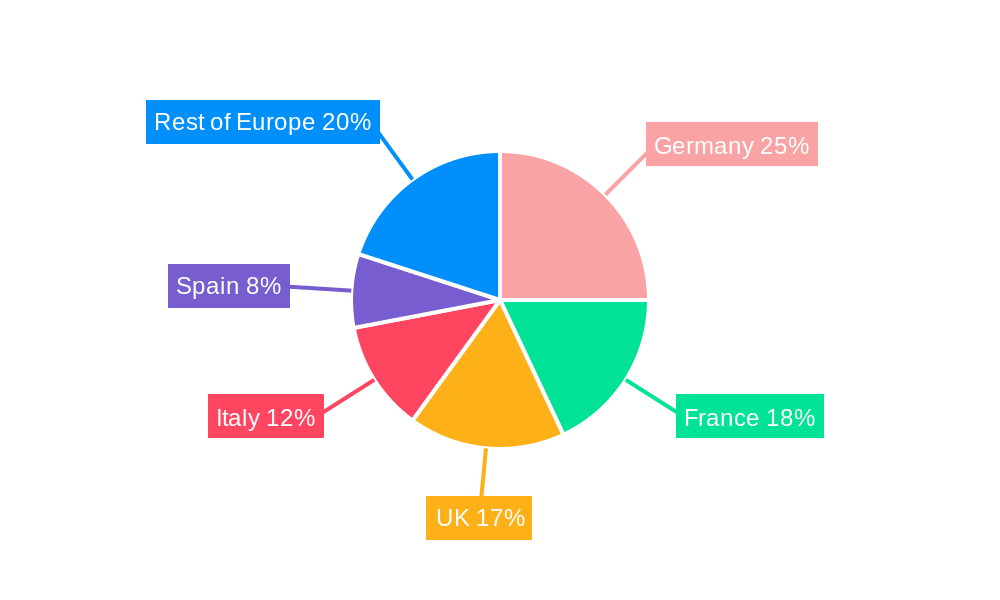

Dominant Markets & Segments in Europe IT Device Market

The Western European region dominates the Europe IT Device Market, accounting for xx% of the total market value in 2025. Within this region, Germany, the United Kingdom, and France represent the largest national markets.

- Germany: Strong economic base, high technology adoption rates.

- United Kingdom: Large consumer base, high disposable incomes.

- France: Growing demand for smart devices and advanced technology.

- Segment Dominance: Smartphones continue to lead, followed by PCs, with Tablets exhibiting steady growth.

The smartphone segment is the largest, driven by strong consumer demand and technological advancements. PCs maintain a significant market share due to their importance in professional settings and gaming. The tablet segment is exhibiting steady growth, fueled by its versatility and affordability.

Europe IT Device Market Product Analysis

The IT device market is marked by constant innovation, with manufacturers launching new products incorporating advanced features such as improved processors, enhanced camera systems, faster internet speeds, and improved battery life. These advancements cater to a wide range of user needs and preferences, from basic communication to high-end professional applications and gaming. The success of new products hinges on their ability to meet evolving consumer expectations while remaining competitive on price and functionality.

Key Drivers, Barriers & Challenges in Europe IT Device Market

Key Drivers: Rising disposable incomes, increasing smartphone penetration, technological advancements like 5G and AI integration, and government initiatives promoting digitalization are key drivers of market growth. The growing demand for remote work and online education further accelerates the demand for IT devices.

Challenges: Supply chain disruptions, particularly concerning component shortages, pose a significant challenge. Fluctuations in currency exchange rates can impact pricing and profitability, as evidenced by Apple's recent price adjustments. Intense competition among manufacturers necessitates continuous innovation and cost optimization.

Growth Drivers in the Europe IT Device Market Market

Technological advancements, including the rollout of 5G networks and the integration of AI capabilities into devices, are significantly boosting market growth. Economic factors such as increasing disposable incomes and a growing middle class drive higher demand for IT devices. Favorable regulatory policies that encourage technological adoption, combined with the transition towards a digital economy, are significant catalysts for market expansion.

Challenges Impacting Europe IT Device Market Growth

Supply chain vulnerabilities, including component shortages and geopolitical uncertainties, create significant obstacles to market growth. Regulatory hurdles and ever-changing data privacy laws impose compliance costs on manufacturers. Fierce competition from numerous established and emerging players intensifies pressure on profit margins and necessitates constant innovation to stay ahead.

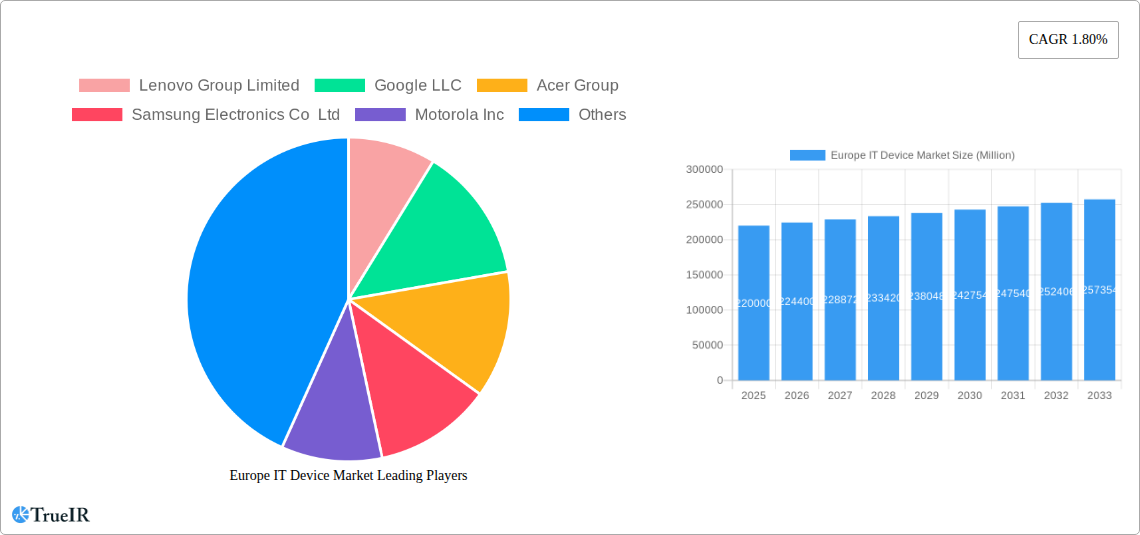

Key Players Shaping the Europe IT Device Market Market

- Lenovo Group Limited

- Google LLC

- Acer Group

- Samsung Electronics Co Ltd

- Motorola Inc

- HP Inc

- Microsoft Corporation

- Xiaomi Corporation

- Huawei Technologies Co Ltd

- Nokia Corporation

- ASUSTek Computer Inc

- Guangdong Oppo Mobile Telecommunications Corp Ltd

- Apple Inc

- Sony Corporation

- LG Corporation

- Dell Technologies

Significant Europe IT Device Market Industry Milestones

- September 2022: Apple announced price increases for in-app purchases and apps across Europe and Asia in response to currency fluctuations.

- October 2022: Nokia launched the X30 5G in the UK and other European markets, priced at EUR 519 (USD 548) and GBP 399 (USD 489).

Future Outlook for Europe IT Device Market Market

The Europe IT Device Market is poised for sustained growth, driven by continuous technological innovation, increasing demand from diverse sectors, and supportive government policies. The market presents significant opportunities for players who can adapt to evolving consumer preferences, manage supply chain challenges effectively, and navigate the competitive landscape successfully. Growth is expected to be particularly strong in the areas of 5G-enabled devices and AI-powered applications.

Europe IT Device Market Segmentation

-

1. Type

-

1.1. PC's

- 1.1.1. Laptops

- 1.1.2. Desktop PCs

- 1.1.3. Tablets

-

1.2. Phones

- 1.2.1. Landline Phones

- 1.2.2. Smartphones

- 1.2.3. Feature Phones

-

1.1. PC's

Europe IT Device Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe IT Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand for Smart Phones; Rapid Roll-Out of 5G Across the Region

- 3.3. Market Restrains

- 3.3.1. Rising Inflation Reducing the Purchasing Power

- 3.4. Market Trends

- 3.4.1. Smartphone Demand Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. PC's

- 5.1.1.1. Laptops

- 5.1.1.2. Desktop PCs

- 5.1.1.3. Tablets

- 5.1.2. Phones

- 5.1.2.1. Landline Phones

- 5.1.2.2. Smartphones

- 5.1.2.3. Feature Phones

- 5.1.1. PC's

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe IT Device Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lenovo Group Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Google LLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Acer Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Samsung Electronics Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Motorola Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 HP Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Microsoft Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Xiaomi Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Huawei Technologies Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nokia Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 ASUSTek Computer Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Guangdong Oppo Mobile Telecommunications Corp Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Apple Inc

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Sony Corporation

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 LG Corporation

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Dell Technologies

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Lenovo Group Limited

List of Figures

- Figure 1: Europe IT Device Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe IT Device Market Share (%) by Company 2024

List of Tables

- Table 1: Europe IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe IT Device Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe IT Device Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Europe IT Device Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe IT Device Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Europe IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Europe IT Device Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Germany Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 11: France Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Italy Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Kingdom Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Netherlands Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherlands Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Sweden Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sweden Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Europe IT Device Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Europe IT Device Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 25: Europe IT Device Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe IT Device Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Germany Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Germany Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: United Kingdom Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Kingdom Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: France Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Italy Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Italy Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Spain Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Europe IT Device Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Europe IT Device Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe IT Device Market?

The projected CAGR is approximately 1.80%.

2. Which companies are prominent players in the Europe IT Device Market?

Key companies in the market include Lenovo Group Limited, Google LLC, Acer Group, Samsung Electronics Co Ltd, Motorola Inc, HP Inc, Microsoft Corporation, Xiaomi Corporation, Huawei Technologies Co Ltd, Nokia Corporation, ASUSTek Computer Inc, Guangdong Oppo Mobile Telecommunications Corp Ltd, Apple Inc, Sony Corporation, LG Corporation, Dell Technologies.

3. What are the main segments of the Europe IT Device Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand for Smart Phones; Rapid Roll-Out of 5G Across the Region.

6. What are the notable trends driving market growth?

Smartphone Demand Boosting the Market.

7. Are there any restraints impacting market growth?

Rising Inflation Reducing the Purchasing Power.

8. Can you provide examples of recent developments in the market?

September 2022: Apple announced its decision to implement significant pricing hikes for its in-app purchases and apps from Europe to Asia, safeguarding its profits when key currencies fell against the US dollar. Apple has been more cautious as it deals with a stuttering economy, even if it is doing better than some of its industry counterparts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe IT Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe IT Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe IT Device Market?

To stay informed about further developments, trends, and reports in the Europe IT Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence