Key Insights

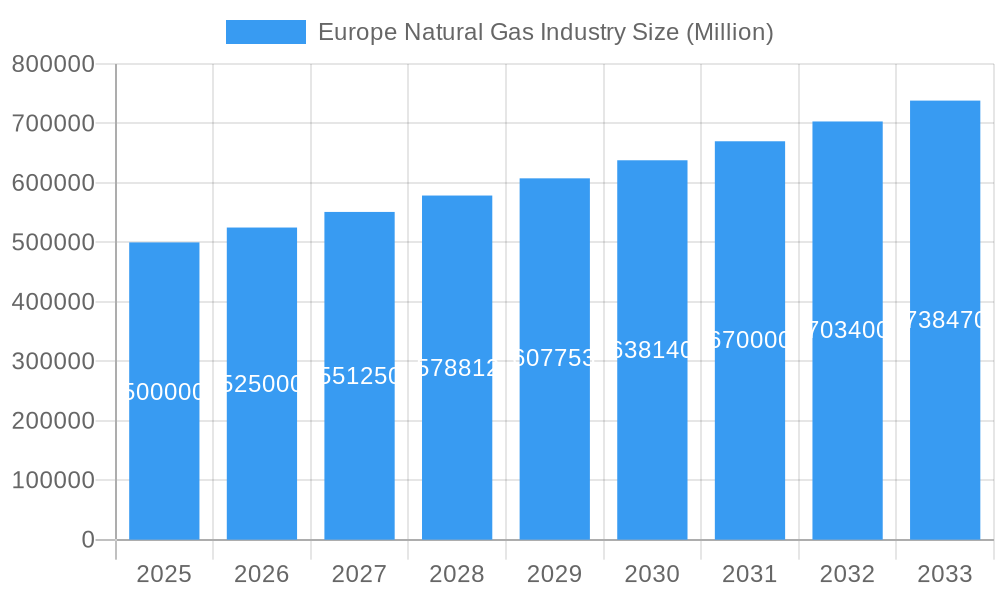

The European natural gas market, valued at $401.9 billion in the 2025 base year, is projected for substantial expansion, with an estimated Compound Annual Growth Rate (CAGR) of 1.4% through 2033. This growth trajectory is primarily fueled by the ongoing energy transition, positioning natural gas as a critical transitional fuel supporting the integration of renewable energy sources. Rising industrial consumption across diverse sectors, alongside persistent power generation needs, are key demand drivers. However, the market is significantly influenced by geopolitical instability and supply chain vulnerabilities, exacerbated by international relations and ongoing conflicts. These factors contribute to price volatility and highlight the strategic imperative for supply source diversification to mitigate inherent risks. The European Union's ambitious target of achieving carbon neutrality by 2050 is also reshaping the market, encouraging investments in advanced gas technologies such as carbon capture and storage (CCS) and the expansion of renewable natural gas (RNG) production. Intense competition among leading entities like Chevron Corporation, BP PLC, and Shell PLC necessitates strategic collaborations, infrastructure advancements, and operational enhancements to sustain competitive advantages.

Europe Natural Gas Industry Market Size (In Billion)

While the European natural gas market exhibits robust growth potential, it confronts notable challenges. These include inherent price volatility, persistent energy supply security concerns, and escalating regulatory pressures focused on environmental stewardship. The accelerating adoption of renewable alternatives, though crucial for long-term sustainability, may pose a constraint on natural gas demand in the latter stages of the forecast period. To leverage emerging opportunities, market participants are prioritizing investments in liquefied natural gas (LNG) infrastructure, exploring novel exploration and production frontiers, and enhancing energy efficiency while integrating renewable energy solutions. Successfully addressing these challenges will be instrumental in defining the European natural gas market's long-term trajectory.

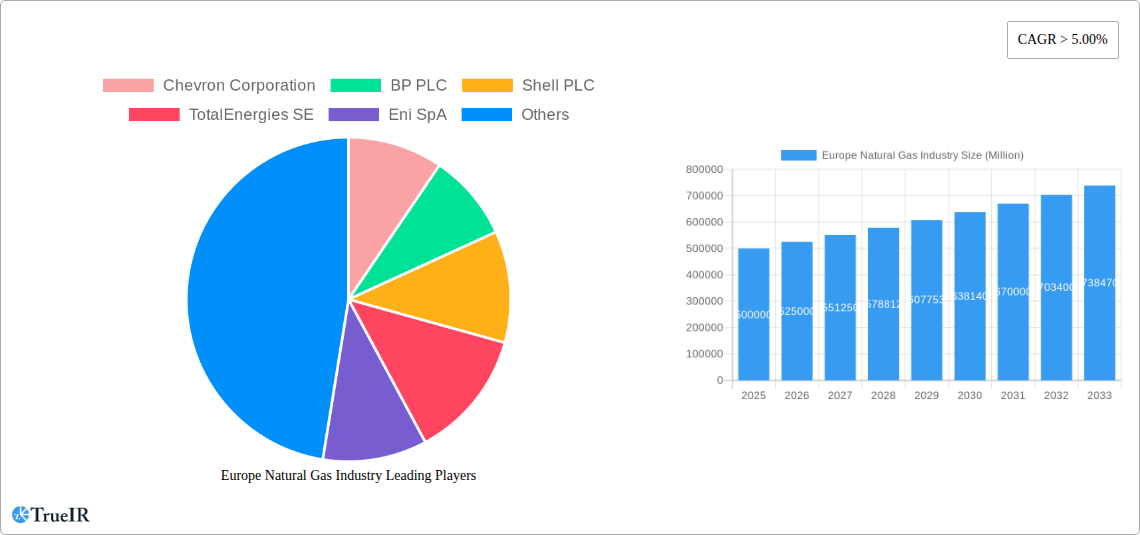

Europe Natural Gas Industry Company Market Share

Europe Natural Gas Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Europe natural gas industry, encompassing market size, competitive landscape, growth drivers, challenges, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for investors, industry professionals, and strategic decision-makers. The forecast period extends from 2025 to 2033, covering historical data from 2019 to 2024. This report quantifies the market in Millions, offering precise figures for informed decision-making.

Europe Natural Gas Industry Market Structure & Competitive Landscape

The European natural gas market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation in extraction technologies, such as shale gas extraction and improved pipeline infrastructure, is a key driver. Stringent environmental regulations, particularly concerning methane emissions and carbon capture, significantly impact industry operations. LNG imports serve as a crucial substitute, particularly in diversifying supply sources.

The end-user segmentation is dominated by the power generation sector (xx Million), followed by industrial applications (xx Million) and residential consumption (xx Million). Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total deal value of approximately xx Million in 2024. Key M&A trends include consolidation among mid-sized players and strategic alliances to secure gas supply and infrastructure.

- Market Concentration: HHI estimated at xx in 2024.

- Innovation Drivers: Shale gas extraction, pipeline infrastructure upgrades.

- Regulatory Impacts: Stringent environmental regulations on methane emissions.

- Product Substitutes: LNG imports.

- End-User Segmentation: Power generation (xx Million), Industrial (xx Million), Residential (xx Million).

- M&A Trends: Consolidation, strategic alliances for supply security.

Europe Natural Gas Industry Market Trends & Opportunities

The European natural gas market is projected to experience significant growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is driven by increasing energy demand, particularly in developing economies, and the transition towards a cleaner energy mix. Technological advancements, such as improved gas storage and distribution technologies, further enhance market growth. However, consumer preferences are shifting towards renewable energy sources, presenting both opportunities and challenges. The intensified competition among energy providers fuels innovation and efficiency improvements. Market penetration rates for natural gas in various sectors are projected to increase gradually.

Dominant Markets & Segments in Europe Natural Gas Industry

The largest markets within Europe are Germany (xx Million), the United Kingdom (xx Million), and France (xx Million). The power generation segment exhibits the highest growth potential, driven by sustained electricity demand and the role of natural gas as a transition fuel.

- Key Growth Drivers in Germany: Robust industrial base, well-established infrastructure.

- Key Growth Drivers in UK: Offshore gas production, LNG import terminals.

- Key Growth Drivers in France: Nuclear power complementarity, strategic diversification efforts.

- Power Generation Segment: Highest growth potential due to sustained electricity demand.

Germany's dominance stems from its large industrial base and extensive pipeline network. The UK benefits from significant offshore gas production and multiple LNG import terminals. France leverages natural gas's complementary role to nuclear power and its focus on energy diversification strategies.

Europe Natural Gas Industry Product Analysis

Technological advancements in natural gas extraction, processing, and transportation are improving efficiency and reducing environmental impact. New applications are emerging in areas like transportation (LNG-fueled vehicles) and industrial processes, requiring specialized gas blends and delivery systems. This expands market opportunities for players offering innovative solutions that cater to diverse application needs and meet stricter environmental standards.

Key Drivers, Barriers & Challenges in Europe Natural Gas Industry

Key Drivers: Growing energy demand, increasing industrialization, the strategic role of gas as a transition fuel, and investments in gas infrastructure projects are primary forces propelling growth.

Challenges: Supply chain disruptions due to geopolitical instability significantly impact gas availability. Regulatory hurdles related to environmental protection and licensing add to the complexity. Intense competition from renewable energy sources and the high price volatility of natural gas pose ongoing challenges.

Growth Drivers in the Europe Natural Gas Industry Market

Technological advancements, economic growth, and supportive government policies drive the European natural gas industry's growth. Specifically, innovations in extraction and processing techniques, industrial expansion, and investments in infrastructure all contribute to market expansion. Moreover, government support for gas infrastructure and initiatives aimed at energy security reinforce the industry's positive momentum.

Challenges Impacting Europe Natural Gas Industry Growth

Geopolitical instability, particularly the Ukraine war and its impact on Russian gas supplies, is a major challenge. Environmental regulations and the push for renewable energy sources pose significant hurdles. Fluctuating prices and the competitiveness of renewable energy further complicate the industry's growth trajectory.

Key Players Shaping the Europe Natural Gas Industry Market

Significant Europe Natural Gas Industry Industry Milestones

- September 2022: The German government announced a USD 65 billion plan to mitigate soaring energy prices, highlighting the urgency of the energy crisis and the importance of energy security.

- March 2022: Equinor's plan to increase gas supply to meet European demands, driven by increased production permits, underscores the industry's responsiveness to evolving needs during times of crisis.

These milestones reflect the industry's adaptation to geopolitical events and the efforts to ensure stable gas supply in Europe.

Future Outlook for Europe Natural Gas Industry Market

The European natural gas market is poised for continued growth, driven by ongoing demand, infrastructure investments, and strategic efforts to enhance energy security. While renewable energy sources continue to gain prominence, natural gas is expected to maintain a significant role as a transition fuel, especially in the power generation and industrial sectors. Strategic opportunities exist in optimizing existing infrastructure, developing new technologies, and forming strategic partnerships to ensure long-term sustainability and profitability.

Europe Natural Gas Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

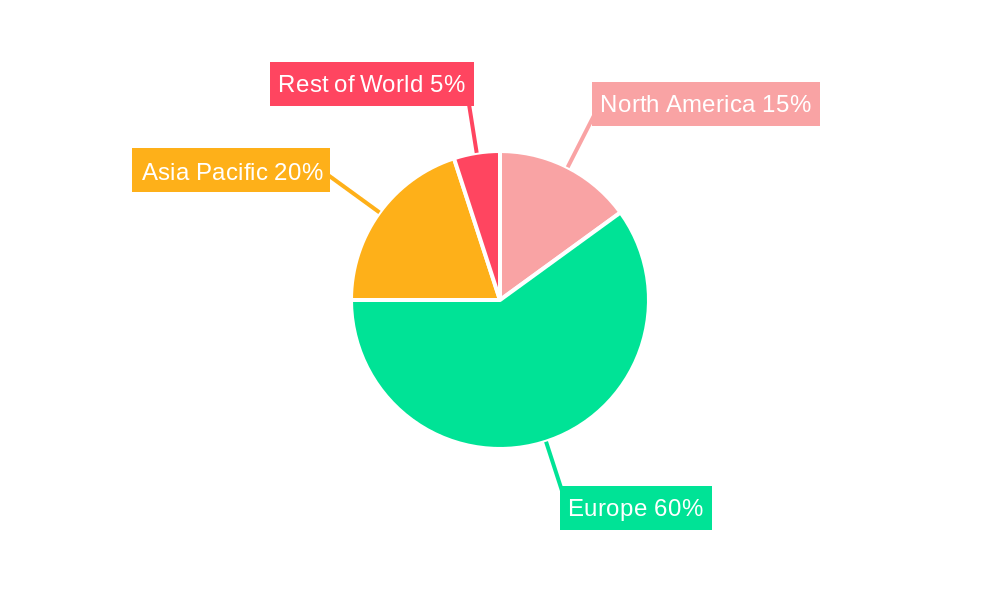

Europe Natural Gas Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Natural Gas Industry Regional Market Share

Geographic Coverage of Europe Natural Gas Industry

Europe Natural Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Natural Gas Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chevron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BP PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shell PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eni SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ConocoPhillips

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Exxon Mobil Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Norwegian Energy Company ASA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Engie SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Electricite de France SA*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chevron Corporation

List of Figures

- Figure 1: Europe Natural Gas Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Natural Gas Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Natural Gas Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Natural Gas Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Natural Gas Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Natural Gas Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Natural Gas Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Natural Gas Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Natural Gas Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Natural Gas Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Natural Gas Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Natural Gas Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Natural Gas Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Natural Gas Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Natural Gas Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Natural Gas Industry?

The projected CAGR is approximately 1.4%.

2. Which companies are prominent players in the Europe Natural Gas Industry?

Key companies in the market include Chevron Corporation, BP PLC, Shell PLC, TotalEnergies SE, Eni SpA, ConocoPhillips, Exxon Mobil Corporation, Norwegian Energy Company ASA, Engie SA, Electricite de France SA*List Not Exhaustive.

3. What are the main segments of the Europe Natural Gas Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 401.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Upstream Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In September 2022, the German government announced a USD 65 billion plan to help people and businesses cope with soaring prices. Several European nations introduce emergency measures to prepare for a long winter in the wake of disruption in Russian gas supplies to Europe following the Ukraine war.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Natural Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Natural Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Natural Gas Industry?

To stay informed about further developments, trends, and reports in the Europe Natural Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence