Key Insights

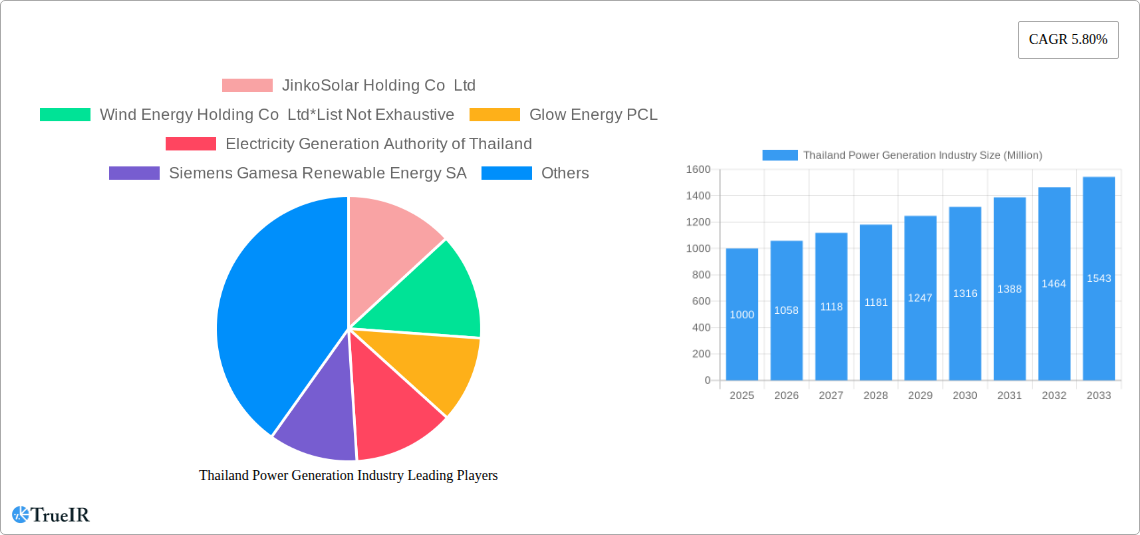

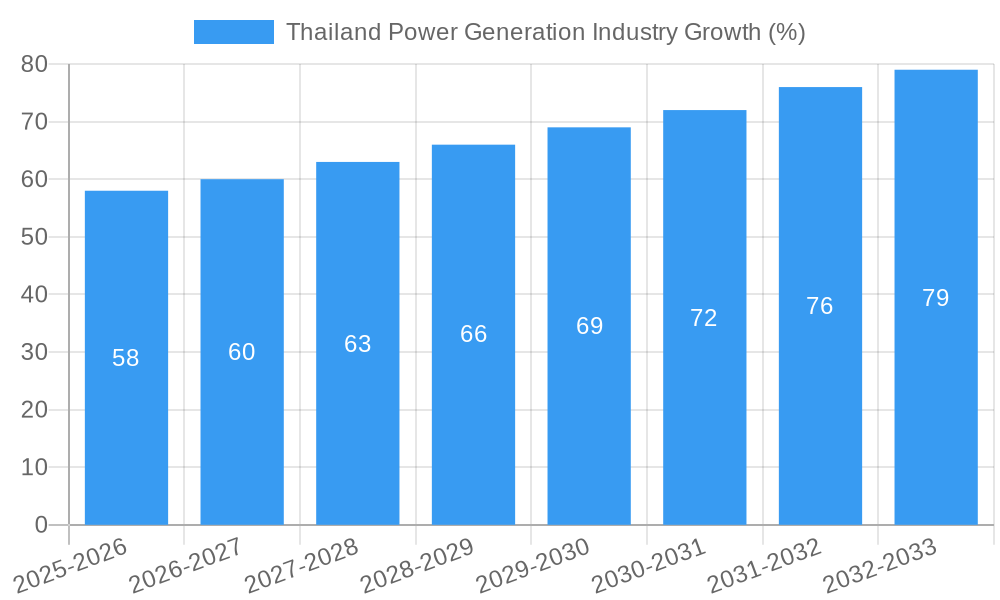

The Thailand power generation market, valued at approximately [Estimate based on market size XX and value unit million; let's assume XX = 1000 for illustration, thus 1000 million in 2025] in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is primarily driven by increasing energy demand fueled by Thailand's economic growth and rising population. Government initiatives promoting renewable energy sources, such as solar and wind power, are significant catalysts, alongside investments in modernizing the existing power grid infrastructure. The conventional power generation segment, while still dominant, is gradually witnessing a shift towards cleaner and more sustainable alternatives due to environmental concerns and global decarbonization efforts. Key players like JinkoSolar, Wind Energy Holding Co Ltd, and Vestas Wind Systems are actively participating in this transition, investing in renewable energy projects and expanding their presence in the Thai market. The strong performance of renewable energy is expected to continue, potentially even outpacing the growth of conventional sources over the forecast period.

However, challenges remain. The intermittent nature of renewable energy sources, requiring robust energy storage solutions and grid management systems, presents a significant hurdle. Furthermore, the upfront capital investment required for renewable energy projects can be substantial, potentially hindering the speed of adoption for some smaller projects. Regulatory frameworks and policy consistency are also crucial for fostering continued investment and confidence in the sector. Despite these constraints, the long-term outlook for the Thai power generation market remains positive, with consistent growth expected due to strong underlying economic and demographic drivers combined with a sustained push towards renewable energy integration.

Thailand Power Generation Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Thailand power generation industry, covering the period 2019-2033, with a focus on market trends, competitive landscape, and future outlook. The report leverages extensive data analysis and expert insights to offer a valuable resource for investors, industry professionals, and strategic decision-makers. Expect in-depth coverage of conventional and renewable power generation segments, key players, and significant milestones shaping the industry's trajectory.

Thailand Power Generation Industry Market Structure & Competitive Landscape

The Thailand power generation market exhibits a moderately concentrated structure, with several large players and a growing number of smaller independent power producers (IPPs). The market is characterized by both state-owned entities like the Electricity Generating Authority of Thailand (EGAT) and private sector participation. The concentration ratio (CR4) for the conventional power generation segment is estimated at 60% in 2025, indicating moderate market concentration. Innovation drivers include government incentives for renewable energy, technological advancements in energy storage solutions, and rising energy demands. Regulatory impacts, including licensing requirements and power purchase agreements (PPAs), significantly influence market dynamics. Product substitutes, such as energy efficiency measures and distributed generation, are increasingly impacting the market share of conventional power generation. End-user segmentation comprises industrial, commercial, and residential sectors, with industrial users accounting for the largest share. M&A activity has been moderate in recent years, with an estimated xx Million USD in deal value in 2024. Significant M&A activity is expected in the renewable energy sector during the forecast period, driven by the growth of renewable energy capacity.

Thailand Power Generation Industry Market Trends & Opportunities

The Thailand power generation market is projected to experience robust growth during the forecast period (2025-2033), driven primarily by increasing electricity demand, rising urbanization, and government initiatives to diversify the energy mix. Market size is estimated at xx Million USD in 2025, projected to reach xx Million USD by 2033, representing a CAGR of xx%. A significant shift towards renewable energy sources is underway, fueled by government targets for renewable energy integration and declining costs of solar and wind technologies. This trend is visible in the increasing market penetration of renewable energy, expected to reach xx% by 2033 from xx% in 2025. Consumer preferences are shifting towards cleaner and more sustainable energy solutions, influencing demand for renewable energy-based power generation. The competitive landscape remains dynamic, with both domestic and international players vying for market share.

Dominant Markets & Segments in Thailand Power Generation Industry

The dominant segment within the Thailand power generation industry is conventional power generation, primarily driven by coal and natural gas. However, the renewable energy segment is witnessing rapid expansion, fuelled by government support for solar, wind, and biomass power. Key growth drivers in the renewable energy sector include:

- Favorable government policies: Incentives, feed-in tariffs, and renewable portfolio standards (RPS) are driving investments in renewable energy projects.

- Declining technology costs: The decreasing cost of renewable energy technologies, such as solar photovoltaic (PV) and wind turbines, is making them increasingly competitive.

- Growing environmental awareness: Rising concerns about climate change and air pollution are driving demand for cleaner energy sources.

The Central and Eastern regions of Thailand dominate the power generation market due to their higher population density, industrial activity, and existing infrastructure.

Thailand Power Generation Industry Product Analysis

Technological advancements in renewable energy technologies, particularly solar PV and wind turbines, are driving product innovation in the Thai power generation market. Higher efficiency modules, advanced energy storage systems, and smart grid technologies are enhancing the competitiveness and market fit of renewable energy solutions. The integration of these technologies enhances grid stability, improves energy efficiency, and reduces reliance on fossil fuel-based generation.

Key Drivers, Barriers & Challenges in Thailand Power Generation Industry

Key Drivers:

- Rising electricity demand due to economic growth and urbanization.

- Government support for renewable energy development through policies and incentives.

- Technological advancements leading to cost reductions in renewable energy technologies.

Key Challenges:

- Grid infrastructure limitations hinder the integration of renewable energy sources.

- Regulatory complexities and bureaucratic hurdles can delay project development.

- Competition from established conventional power generation players poses a challenge to new entrants in the renewable energy sector. This competition impacts pricing and market share, reducing the rate of renewable energy adoption.

Growth Drivers in the Thailand Power Generation Industry Market

The growth of the Thailand power generation market is largely propelled by rising energy demand fueled by economic expansion and increasing urbanization. Government initiatives supporting renewable energy deployment, including feed-in tariffs and renewable energy targets, significantly bolster growth. Furthermore, technological advancements continually reduce the cost of renewable energy generation, driving its wider adoption.

Challenges Impacting Thailand Power Generation Industry Growth

Significant hurdles to growth include limited grid infrastructure to handle the integration of intermittent renewable energy sources. Complex and sometimes inconsistent regulatory frameworks can impede project development and investment. Competition within the sector, especially from established players, creates pricing pressure and restricts market access for new entrants, particularly in the renewable energy space.

Key Players Shaping the Thailand Power Generation Industry Market

- JinkoSolar Holding Co Ltd

- Wind Energy Holding Co Ltd

- Glow Energy PCL

- Electricity Generation Authority of Thailand

- Siemens Gamesa Renewable Energy SA

- Schneider Electric SE

- SGS SA

- BCPG PCL

- SIAM SOLAR

- Vestas Wind Systems AS

- General Electric Company

Significant Thailand Power Generation Industry Industry Milestones

- May 2023: Mae Hing Son province launched a solar power plant and battery energy storage project, showcasing the growing adoption of renewable energy and storage solutions.

- May 2023: Acciona Energia and Blue Circle signed a 25-year PPA for five wind farms (436 MW total capacity), signifying significant investment in wind energy and long-term commitment to renewable energy sources. This also underscores the success of Thailand's bidding process for renewable energy projects via the Energy Regulatory Commission (ERC).

Future Outlook for Thailand Power Generation Industry Market

The future of the Thailand power generation industry is bright, driven by continued economic growth, government support for renewable energy, and technological innovations. Strategic opportunities exist for players focused on renewable energy integration, energy storage solutions, and smart grid technologies. The market presents significant potential for growth, particularly in the renewable energy sector, as Thailand strives to diversify its energy mix and reduce its carbon footprint. The anticipated growth is expected to attract further investment and propel technological advancements.

Thailand Power Generation Industry Segmentation

-

1. Power Generation

- 1.1. Conventional

- 1.2. Renewables

- 2. Power Transmission and Distribution

Thailand Power Generation Industry Segmentation By Geography

- 1. Thailand

Thailand Power Generation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Renewables Capacity in Thailand4.; Rising Modernization of Existing Transmission and Distribution Infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Huge Capital Expenditure Required for Carrying out Modernization of Existing Facilities

- 3.4. Market Trends

- 3.4.1. Renewable Power Generation to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Power Generation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Conventional

- 5.1.2. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JinkoSolar Holding Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wind Energy Holding Co Ltd*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Glow Energy PCL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electricity Generation Authority of Thailand

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Gamesa Renewable Energy SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SGS SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BCPG PCL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SIAM SOLAR

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vestas Wind Systems AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 General Electric Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 JinkoSolar Holding Co Ltd

List of Figures

- Figure 1: Thailand Power Generation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Power Generation Industry Share (%) by Company 2024

List of Tables

- Table 1: Thailand Power Generation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Power Generation Industry Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 3: Thailand Power Generation Industry Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 4: Thailand Power Generation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Thailand Power Generation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Thailand Power Generation Industry Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 7: Thailand Power Generation Industry Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 8: Thailand Power Generation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Power Generation Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Thailand Power Generation Industry?

Key companies in the market include JinkoSolar Holding Co Ltd, Wind Energy Holding Co Ltd*List Not Exhaustive, Glow Energy PCL, Electricity Generation Authority of Thailand, Siemens Gamesa Renewable Energy SA, Schneider Electric SE, SGS SA, BCPG PCL, SIAM SOLAR, Vestas Wind Systems AS, General Electric Company.

3. What are the main segments of the Thailand Power Generation Industry?

The market segments include Power Generation, Power Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Renewables Capacity in Thailand4.; Rising Modernization of Existing Transmission and Distribution Infrastructure.

6. What are the notable trends driving market growth?

Renewable Power Generation to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Huge Capital Expenditure Required for Carrying out Modernization of Existing Facilities.

8. Can you provide examples of recent developments in the market?

May 2023: Mae Hing Son province launched a solar power plant and battery energy storage project. The Electricity Generating Authority of Thailand (EGAT) held a commercial operation date (COD) ceremony for a 3 MW solar power plant and 4 MW battery energy storage system project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Power Generation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Power Generation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Power Generation Industry?

To stay informed about further developments, trends, and reports in the Thailand Power Generation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence