Key Insights

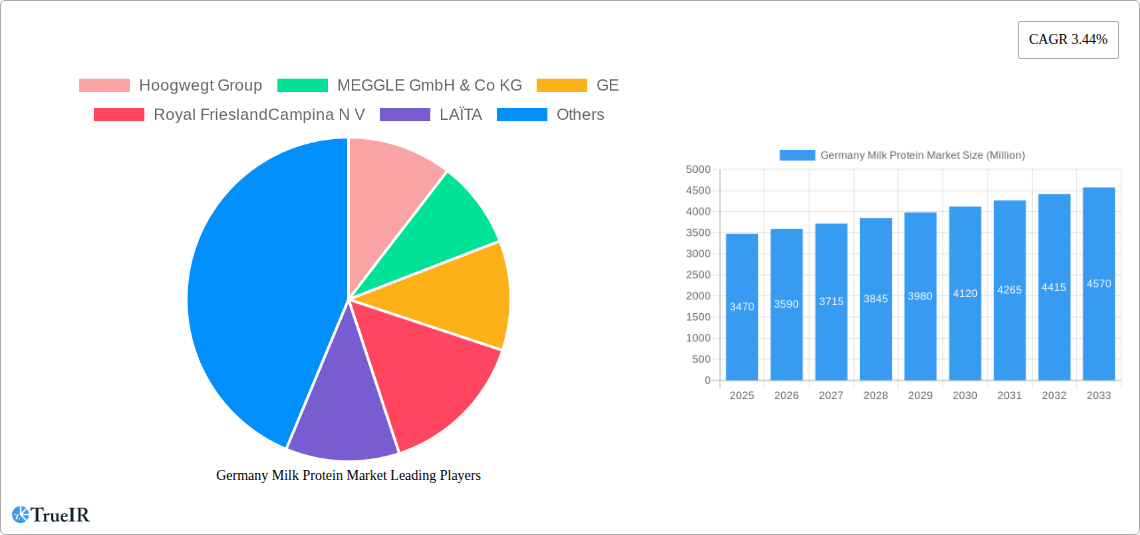

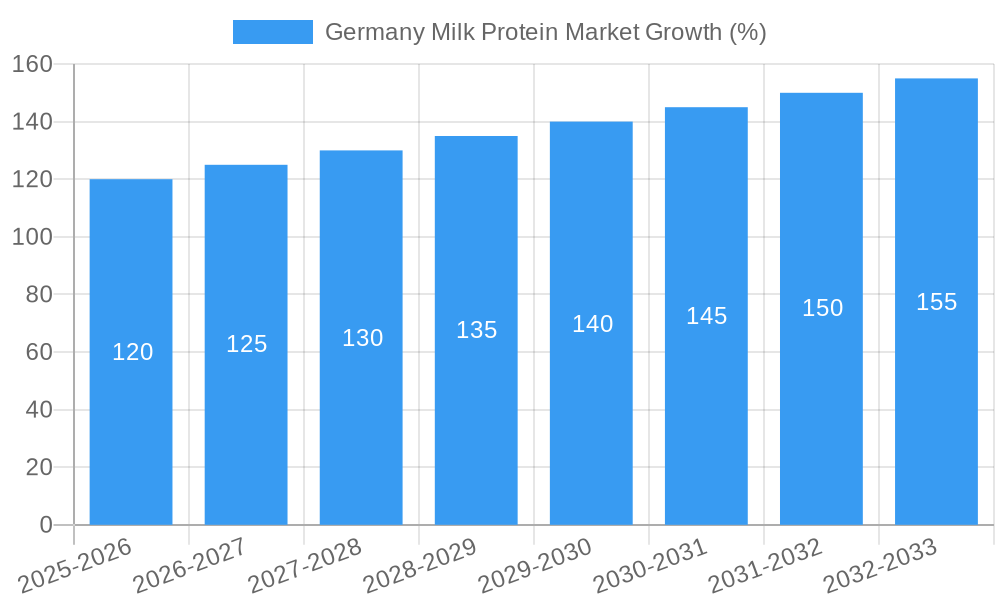

The German milk protein market, valued at approximately €3.47 billion in 2025, is projected to experience steady growth, driven by increasing demand from the food and beverage and animal feed sectors. The rising popularity of protein-rich diets and functional foods fuels the demand for milk protein concentrates and isolates. Germany's robust dairy industry, coupled with advancements in milk protein processing technologies, further contribute to market expansion. The market is segmented by end-user (animal feed holding the largest share followed by food and beverage) and form (concentrates and isolates, with concentrates dominating due to cost-effectiveness). Key players like Hoogwegt Group, MEGGLE GmbH & Co KG, and FrieslandCampina are leveraging their established distribution networks and product innovation to maintain market leadership. However, fluctuating milk prices and increasing competition from plant-based protein alternatives pose challenges to sustained growth. Growth in the coming years is anticipated to be slightly above the European average, reflecting a healthy demand for high-quality dairy ingredients within the German market. This growth will be further spurred by government initiatives supporting sustainable and efficient dairy production practices. The forecast period of 2025-2033 anticipates a continuation of this positive trend, with a gradual increase in market value driven by ongoing product diversification and expanding consumer preferences for protein-enriched products.

The competitive landscape is characterized by both large multinational corporations and specialized regional players. Strategic partnerships, acquisitions, and product innovation are common strategies employed by market participants to gain market share and expand their product portfolios. The market is expected to witness significant innovation in the development of novel milk protein-based products, including those with enhanced functionalities and improved nutritional profiles. Focus on sustainability, traceability, and animal welfare within the dairy supply chain are becoming increasingly important aspects influencing consumer choice and driving demand for premium milk protein products. Regulations related to food safety and labeling are expected to continue to shape the market's trajectory over the forecast period, promoting transparency and enhancing consumer trust.

Germany Milk Protein Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Germany milk protein market, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. With a detailed study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report leverages extensive data analysis and expert insights to paint a comprehensive picture of market trends, competitive dynamics, and future growth potential. The market is estimated at xx Million in 2025 and is projected to experience significant growth over the forecast period. This report covers key segments (animal feed, food & beverages), forms (concentrates, isolates), and identifies leading players such as Hoogwegt Group, MEGGLE GmbH & Co KG, GE, Royal FrieslandCampina N.V., and more.

Germany Milk Protein Market Market Structure & Competitive Landscape

The German milk protein market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation in processing technologies (e.g., microfiltration, ultrafiltration) and the development of functional milk proteins are key drivers of competition. Regulatory frameworks concerning food safety and labeling significantly impact market operations. Product substitutes, such as plant-based protein alternatives, pose a growing challenge, though milk protein’s nutritional advantages retain its position.

- End-user Segmentation: Animal feed constitutes the largest segment, driven by the increasing demand for high-protein animal feed. The food and beverage segment showcases steady growth, fueled by the use of milk proteins in dairy and non-dairy products.

- M&A Activity: The market has witnessed moderate M&A activity in recent years, with xx transactions recorded between 2019 and 2024. These transactions primarily involve consolidation among smaller players and strategic acquisitions by larger multinational corporations. Examples include Royal FrieslandCampina N.V.'s planned divestment of certain German assets (June 2022). This trend is expected to continue, further shaping the competitive landscape.

Germany Milk Protein Market Market Trends & Opportunities

The Germany milk protein market is experiencing robust growth, driven by several factors. The market size expanded from xx Million in 2019 to xx Million in 2024, registering a CAGR of xx% during this period. This growth trajectory is expected to continue, with a projected CAGR of xx% from 2025 to 2033. Technological advancements in processing and purification are leading to higher-quality milk proteins with improved functional properties. Consumer preferences are shifting towards healthier and more functional foods, fueling demand for milk proteins in various applications. Increased investments in R&D by key players are enhancing product innovation and strengthening their market position. Furthermore, expanding applications in niche areas, such as sports nutrition and infant formula, create new market opportunities. Market penetration rates for specific applications, such as whey protein isolate in sports nutrition, are witnessing significant growth, adding to the overall market expansion.

Dominant Markets & Segments in Germany Milk Protein Market

Dominant Segment: The animal feed segment dominates the Germany milk protein market, representing approximately xx% of the total market share in 2024. This dominance is attributed to the high protein requirement of livestock feed and the cost-effectiveness of milk protein as a protein source. The food and beverage segment is the second-largest segment, expected to exhibit a strong growth rate in the forecast period.

Growth Drivers:

- Expanding livestock industry: The continued growth of the livestock farming sector in Germany drives demand for high-quality protein sources in animal feed.

- Government support for agriculture: Various government initiatives and subsidies for the agriculture sector support the growth of the animal feed industry.

- Increasing consumer awareness: Growing consumer awareness of the nutritional benefits of milk proteins in food and beverages is driving increased demand in this segment.

Concentrates vs. Isolates: While concentrates maintain a larger market share, isolates are witnessing faster growth, driven by their high protein concentration and purity, making them suitable for specialized applications.

Germany Milk Protein Market Product Analysis

The German milk protein market showcases continuous innovation in product development, with advancements in processing techniques leading to improved purity, functionality, and yield. Whey protein isolates and concentrates remain the dominant products, catering to various applications. Technological advancements, such as membrane filtration and enzymatic hydrolysis, enable the production of tailor-made milk protein ingredients for specific functional requirements. The market also sees increasing demand for specialized milk proteins, such as caseinates and micellar casein, due to their unique properties in various applications, including enhanced texture and improved nutritional value.

Key Drivers, Barriers & Challenges in Germany Milk Protein Market

Key Drivers: Technological advancements in milk protein processing, rising consumer demand for protein-rich foods, and supportive government policies contribute significantly to market growth. The growing awareness of the health benefits of milk protein, coupled with increased disposable incomes, further enhances demand.

Challenges: Fluctuations in milk prices, stringent food safety regulations, and increasing competition from plant-based protein alternatives pose significant challenges to market expansion. Supply chain disruptions can also impact the availability and price of milk proteins. The impact of these challenges is estimated to reduce the market growth rate by approximately xx% during the forecast period.

Growth Drivers in the Germany Milk Protein Market Market

Several factors are driving growth within the Germany milk protein market. Technological advancements in milk protein processing, enabling higher yields and enhanced functionality, are a significant contributor. The increasing demand for protein-rich foods among health-conscious consumers is another key driver. Furthermore, supportive government policies aimed at promoting the dairy industry and sustainable agricultural practices provide a positive impetus for growth.

Challenges Impacting Germany Milk Protein Market Growth

The German milk protein market faces certain obstacles that could hinder its growth. Stringent regulations and quality control standards necessitate significant investment for compliance. Fluctuations in raw material prices (milk) can impact profitability and create price volatility. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization strategies to maintain market share.

Key Players Shaping the Germany Milk Protein Market Market

- Hoogwegt Group

- MEGGLE GmbH & Co KG

- GE (GEA)

- Royal FrieslandCampina N.V. (Royal FrieslandCampina)

- LAÏTA

- GNC Holdings LLC (GNC)

- Savencia Fromage & Dairy

- Lactoprot Deutschland GmbH

- Fonterra Co-operative Group Limited (Fonterra)

- Agrial Group

- Morinaga Milk Industry Co Ltd (Morinaga Milk)

Significant Germany Milk Protein Market Industry Milestones

- June 2023: GEA inaugurated its New Food Application and Technology Centre of Excellence (ATC) in Hildesheim, signifying increased investment in advanced milk protein processing technologies and alternative protein research.

- June 2022: Royal FrieslandCampina N.V.'s planned divestment of assets to Theo Müller signifies ongoing consolidation within the German dairy sector and potential shifts in market share.

Future Outlook for Germany Milk Protein Market Market

The future of the Germany milk protein market appears promising. Continued technological innovation, growing health consciousness, and expanding applications across diverse sectors present significant growth opportunities. Strategic partnerships and collaborations among key players are expected to further propel market development. The market's strong fundamentals, coupled with favorable industry trends, suggest substantial growth potential in the years to come.

Germany Milk Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

-

2. End-User

- 2.1. Animal Feed

-

2.2. Food and Beverages

- 2.2.1. Bakery

- 2.2.2. Breakfast Cereals

- 2.2.3. Condiments/Sauces

- 2.2.4. Dairy and Dairy Alternative Products

- 2.2.5. RTE/RTC Food Products

- 2.2.6. Snacks

-

2.3. Supplements

- 2.3.1. Baby Food and Infant Formula

- 2.3.2. Elderly Nutrition and Medical Nutrition

- 2.3.3. Sport/Performance Nutrition

Germany Milk Protein Market Segmentation By Geography

- 1. Germany

Germany Milk Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional Food and Beverages; Growing Milk Protein Concentrates Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Milk Protein in Food and Beverages Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. Bakery

- 5.2.2.2. Breakfast Cereals

- 5.2.2.3. Condiments/Sauces

- 5.2.2.4. Dairy and Dairy Alternative Products

- 5.2.2.5. RTE/RTC Food Products

- 5.2.2.6. Snacks

- 5.2.3. Supplements

- 5.2.3.1. Baby Food and Infant Formula

- 5.2.3.2. Elderly Nutrition and Medical Nutrition

- 5.2.3.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Germany Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. France Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Germany Milk Protein Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Hoogwegt Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 MEGGLE GmbH & Co KG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 GE

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Royal FrieslandCampina N V

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 LAÏTA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 GNC Holdings LLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Savencia Fromage & Dairy

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Lactoprot Deutschland GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Fonterra Co-operative Group Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Agrial Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Morinaga Milk Industry Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Hoogwegt Group

List of Figures

- Figure 1: Germany Milk Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Milk Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Milk Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Milk Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Germany Milk Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Germany Milk Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Germany Milk Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Germany Milk Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Germany Milk Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 14: Germany Milk Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: Germany Milk Protein Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Milk Protein Market?

The projected CAGR is approximately 3.44%.

2. Which companies are prominent players in the Germany Milk Protein Market?

Key companies in the market include Hoogwegt Group, MEGGLE GmbH & Co KG, GE, Royal FrieslandCampina N V, LAÏTA, GNC Holdings LLC, Savencia Fromage & Dairy, Lactoprot Deutschland GmbH, Fonterra Co-operative Group Limited, Agrial Group, Morinaga Milk Industry Co Ltd.

3. What are the main segments of the Germany Milk Protein Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional Food and Beverages; Growing Milk Protein Concentrates Application in Processed Food Products.

6. What are the notable trends driving market growth?

Increasing Demand for Milk Protein in Food and Beverages Industry.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

June 2023: GEA unveiled the inauguration of its cutting-edge New Food Application and Technology Centre of Excellence (ATC) in Hildesheim, Germany. Serving as a pivotal hub for pioneering processes and products within the alternative protein sector, the company asserts that its research is dedicated to advancing the field of precision fermentation for milk proteins.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Milk Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Milk Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Milk Protein Market?

To stay informed about further developments, trends, and reports in the Germany Milk Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence