Key Insights

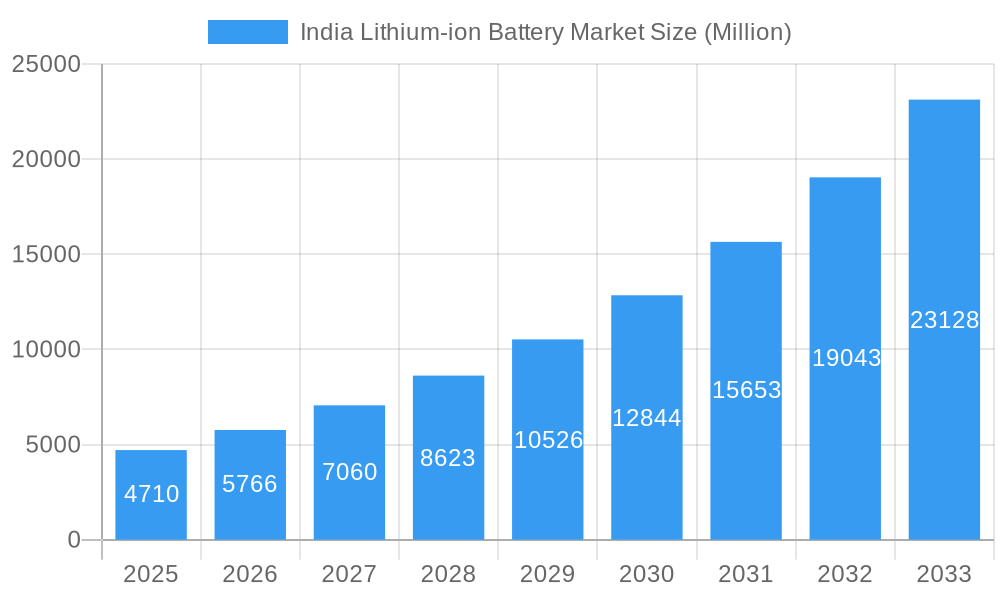

The India lithium-ion battery market is experiencing robust growth, projected to reach a market size of $4.71 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 22.72% from 2025 to 2033. This surge is fueled by the increasing demand for electric vehicles (EVs), portable electronics, and energy storage systems within India's rapidly expanding economy. Government initiatives promoting clean energy and electric mobility are significant drivers, alongside the rising consumer preference for portable devices and the growing need for reliable backup power solutions. However, challenges remain, including the high initial cost of lithium-ion batteries, concerns surrounding battery safety and lifecycle management, and the dependence on raw material imports. The market is segmented by application (portable electronics, automotive, and other applications), with the automotive segment anticipated to witness the most significant growth, driven by the government's push for EV adoption. Key players like Okaya Power Group, Nexcharge, and Toshiba Corporation are actively competing in this dynamic market, investing in research and development to enhance battery technology and improve cost-effectiveness. Regional variations exist, with growth potential distributed across North, South, East, and West India, reflecting varying levels of infrastructure development and EV adoption rates. The market is expected to further consolidate in the coming years as larger players acquire smaller companies and invest in capacity expansion. Opportunities exist for companies focusing on sustainable sourcing of raw materials, innovative battery designs, and efficient recycling solutions.

India Lithium-ion Battery Market Market Size (In Billion)

The forecast period of 2025-2033 will witness continued expansion driven by the increasing penetration of EVs across various segments, including two-wheelers, three-wheelers, and four-wheelers. Furthermore, the burgeoning energy storage sector, encompassing both grid-scale and residential applications, is poised to contribute substantially to market growth. The growing demand for portable devices and the increasing adoption of renewable energy sources will also positively impact market expansion. However, addressing the challenges related to battery lifespan, cost reductions, and environmentally responsible disposal practices will be critical for sustainable and long-term growth of the Indian lithium-ion battery market. The market will likely see increased focus on technological advancements like solid-state batteries and improvements in battery management systems to enhance performance and safety.

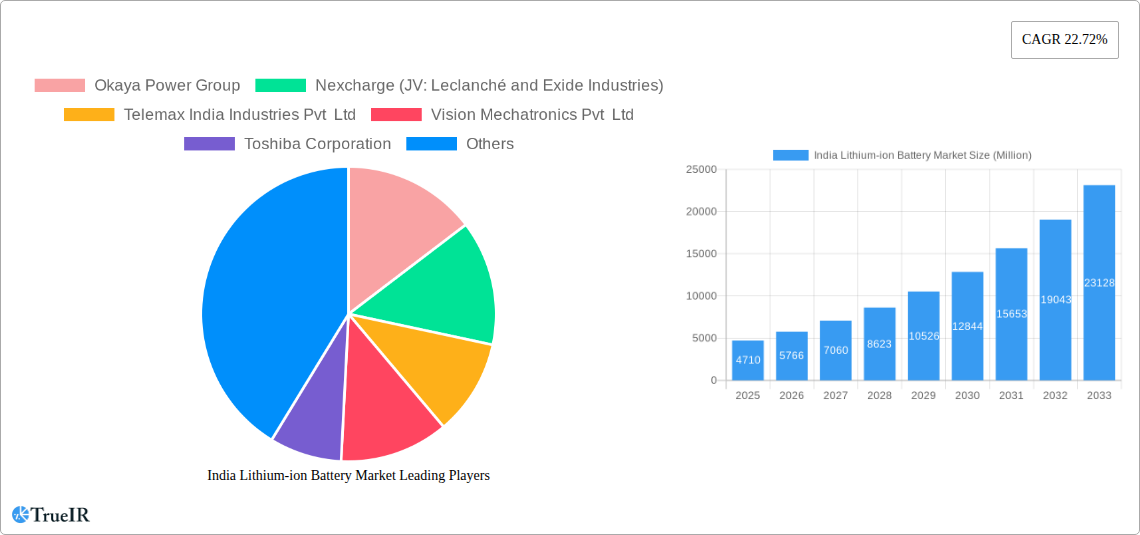

India Lithium-ion Battery Market Company Market Share

This dynamic report provides a deep dive into the burgeoning India lithium-ion battery market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. Analyzing the market from 2019 to 2033 (Study Period), with a base year of 2025 and a forecast period spanning 2025-2033, this report leverages extensive data and expert analysis to illuminate growth trajectories, competitive landscapes, and future potential. We examine key segments, including portable, automotive, and other applications, providing a granular understanding of market dynamics. The report also incorporates critical industry developments and profiles key players such as Okaya Power Group, Nexcharge, and others, helping you navigate this rapidly evolving sector.

India Lithium-ion Battery Market Market Structure & Competitive Landscape

The Indian lithium-ion battery market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the market is witnessing increased competition from both domestic and international companies, driving innovation and investment. The market's dynamics are shaped by several factors:

- Market Concentration: The xx% concentration ratio (CR4) suggests a moderately consolidated market, although this is expected to evolve with new entrants and M&A activity.

- Innovation Drivers: Government incentives for electric vehicles (EVs) and energy storage solutions are driving innovation in battery technology, particularly in areas like energy density and lifespan.

- Regulatory Impacts: Stringent emission norms and government support for domestic manufacturing are creating favorable conditions for market expansion. However, regulatory complexities related to battery safety and disposal remain a challenge.

- Product Substitutes: While lithium-ion batteries dominate, advancements in other battery technologies are expected to introduce some level of substitution in specific niche applications.

- End-User Segmentation: The market is predominantly driven by the portable electronics segment, followed by the rapidly growing automotive and industrial sectors.

- M&A Trends: The past five years have witnessed xx number of mergers and acquisitions, suggesting consolidation within the industry. The value of these transactions reached approximately USD xx Million, further highlighting the attractive investment climate.

The competitive landscape is characterized by both established players and emerging startups. Established players often leverage economies of scale and existing distribution networks, while startups tend to focus on technological innovation and niche applications. The increasing demand for lithium-ion batteries and government support is likely to attract further foreign direct investment, intensifying competition and shaping the market's future trajectory.

India Lithium-ion Battery Market Market Trends & Opportunities

The Indian lithium-ion battery market is experiencing robust growth, driven by the government's push for electric mobility and renewable energy adoption. The market size is projected to reach USD xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is propelled by several key trends:

- Technological Advancements: Significant R&D efforts are focused on improving battery performance, cost reduction, and safety. This includes advancements in battery chemistry, cell design, and manufacturing processes.

- Government Policies & Incentives: Various government initiatives like FAME II and Production-Linked Incentive (PLI) schemes are incentivizing domestic manufacturing and adoption of EVs, creating substantial demand for lithium-ion batteries.

- Expanding EV Market: The rapid expansion of the electric vehicle market is a major driver of lithium-ion battery demand, with a growing adoption of EVs and hybrid vehicles expected to fuel the growth of the battery sector.

- Energy Storage Solutions: The increasing deployment of renewable energy sources necessitates efficient energy storage solutions, creating new avenues for lithium-ion battery applications in grid-scale energy storage and home energy storage systems.

- Infrastructure Development: The development of charging infrastructure and battery swapping stations is supporting the growth of the electric vehicle market, indirectly benefiting the lithium-ion battery sector.

- Consumer Preferences: Growing environmental awareness and rising disposable incomes are fostering consumer preference for eco-friendly electric vehicles, boosting demand for lithium-ion batteries.

The market presents several lucrative opportunities for both established players and new entrants. These opportunities include the development of advanced battery chemistries, expansion into new market segments, establishing strategic partnerships, and capitalizing on the increasing demand from the rapidly growing e-mobility market.

Dominant Markets & Segments in India Lithium-ion Battery Market

The Indian lithium-ion battery market demonstrates strong growth across various segments. However, the automotive sector is positioned as the most dominant segment, exhibiting significant potential for future expansion.

Automotive Segment: This segment is experiencing remarkable growth owing to the escalating adoption of electric and hybrid vehicles across the country. Several factors contribute to its dominance:

- Government Regulations: Stringent emission norms and incentives for electric vehicle adoption are strongly encouraging the growth of this segment.

- Infrastructure Development: Investment in charging stations and battery swapping infrastructure is supporting the growth of the EV industry.

- Technological Advancements: Improvements in battery technology, including enhanced energy density and lifespan, are making EVs more appealing to consumers.

Portable Segment: While still significant, the portable segment's growth rate is anticipated to moderate compared to the automotive sector. Factors influencing this growth include:

- Maturity of the Market: The market for portable devices is already relatively mature, leading to slower growth compared to emerging segments.

- Technological Saturation: Innovation in portable electronics has slowed down, impacting the demand for advanced battery technologies.

Other Applications: The segment encompasses industrial applications, energy storage systems, and other emerging use cases. Its growth is expected to be substantial, driven by factors like:

- Renewable Energy Integration: This segment is benefitting from the rising demand for energy storage solutions to facilitate the wider adoption of renewable energy sources.

- Industrial Automation: Increasing adoption of automation in various industries is driving demand for reliable power sources.

While geographically dispersed, major metropolitan areas and industrial hubs serve as key markets, with significant opportunities emerging in less developed regions as EV adoption expands.

India Lithium-ion Battery Market Product Analysis

The Indian lithium-ion battery market features a diverse range of products, categorized by battery chemistry (e.g., lithium iron phosphate (LFP), nickel manganese cobalt (NMC)), form factor (e.g., cylindrical, prismatic, pouch), and application. Key product innovations focus on improving energy density, reducing costs, enhancing safety features, and extending lifespan. Competitive advantages stem from technological advancements, efficient manufacturing processes, and strong supply chain management. The market is witnessing increasing adoption of LFP batteries due to their cost-effectiveness and safety features, while NMC batteries retain a strong presence in high-performance applications. The market fit for these products largely depends on the application; cost-sensitive applications favour LFP, whereas high-power demands prefer NMC.

Key Drivers, Barriers & Challenges in India Lithium-ion Battery Market

Key Drivers: The Indian lithium-ion battery market is propelled by the government's strong push for electric vehicles, increasing renewable energy integration, advancements in battery technology leading to higher energy density and lower costs, and a growing awareness of environmental concerns among consumers. The FAME II scheme and PLI schemes have significantly boosted domestic manufacturing.

Challenges: Key challenges include the dependence on imported raw materials (like lithium and cobalt), infrastructural limitations in battery recycling and waste management, and the need to address concerns around battery safety and standardization. Supply chain vulnerabilities due to geopolitical factors also pose a significant threat, potentially impacting cost and availability. Regulatory complexities surrounding battery safety and environmental standards add to the challenges.

Growth Drivers in the India Lithium-ion Battery Market Market

The Indian lithium-ion battery market's growth is fueled by several key drivers: government incentives like the FAME II scheme and PLI schemes, the booming EV market, increasing demand for energy storage solutions for renewable energy integration, technological advancements leading to better battery performance and reduced costs, and rising consumer preference for eco-friendly transportation options.

Challenges Impacting India Lithium-ion Battery Market Growth

Challenges include reliance on imported raw materials, lack of robust recycling infrastructure, safety concerns, and regulatory complexities in obtaining approvals and certifications for manufacturing and deployment. Supply chain disruptions and geopolitical factors further impact costs and availability of crucial materials.

Key Players Shaping the India Lithium-ion Battery Market Market

- Okaya Power Group

- Nexcharge (JV: Leclanché and Exide Industries)

- Telemax India Industries Pvt Ltd

- Vision Mechatronics Pvt Ltd

- Toshiba Corporation

- Amperex Technology Limited

- Future Hi-Tech Batteries

- Exicom Tele-Systems Limited

- iPower Batteries Pvt Ltd

- Trontek Group

- TDS Lithium-Ion Battery Gujarat Private Limited (TDSG)

- Inverted Energy Private Limited

- Bharat Electronics Limited (BEL)

Significant India Lithium-ion Battery Market Industry Milestones

- December 2023: Himadri Speciality Chemical Ltd announced a INR 48.00 billion (USD 576 Million) investment in a lithium iron phosphate (LFP) production plant, strengthening the domestic supply chain.

- January 2024: Amara Raja Batteries Ltd announced plans for a gigafactory by 2025, aiming to produce up to 16 GWh of lithium cells and 5 GWh of battery packs. This represents a substantial capacity addition to the market.

- March 2024: Panasonic Energy Co Ltd and Indian Oil Corporation Ltd formed a joint venture to manufacture cylindrical lithium-ion batteries, signifying a major foreign investment in the Indian battery sector and highlighting the strategic importance of the market.

Future Outlook for India Lithium-ion Battery Market Market

The Indian lithium-ion battery market is poised for significant growth over the next decade, driven by sustained government support, rapid EV adoption, and technological advancements. Strategic opportunities exist for companies focusing on domestic manufacturing, battery recycling, and the development of advanced battery chemistries. The market's potential is immense, with the possibility of becoming a global hub for battery production and technology.

India Lithium-ion Battery Market Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Automotive

- 1.3. Other Applications

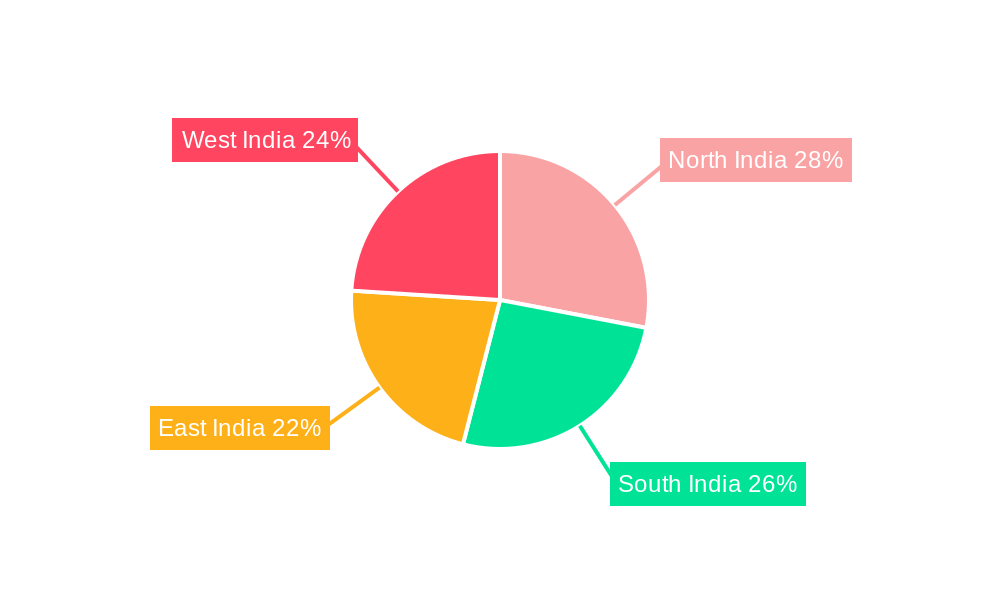

India Lithium-ion Battery Market Segmentation By Geography

- 1. India

India Lithium-ion Battery Market Regional Market Share

Geographic Coverage of India Lithium-ion Battery Market

India Lithium-ion Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Cost Of Lithium-ion Batteries4.; Increasing Adoption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; Demand and Supply of Raw Materials for Battery Manufacturing

- 3.4. Market Trends

- 3.4.1. The Automotive Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Lithium-ion Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Automotive

- 5.1.3. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Okaya Power Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nexcharge (JV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.1 Okaya Power Group

List of Figures

- Figure 1: India Lithium-ion Battery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Lithium-ion Battery Market Share (%) by Company 2025

List of Tables

- Table 1: India Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: India Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 3: India Lithium-ion Battery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Lithium-ion Battery Market Volume K Units Forecast, by Region 2020 & 2033

- Table 5: India Lithium-ion Battery Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: India Lithium-ion Battery Market Volume K Units Forecast, by Application 2020 & 2033

- Table 7: India Lithium-ion Battery Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: India Lithium-ion Battery Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Lithium-ion Battery Market?

The projected CAGR is approximately 22.72%.

2. Which companies are prominent players in the India Lithium-ion Battery Market?

Key companies in the market include Okaya Power Group, Nexcharge (JV: Leclanché and Exide Industries), Telemax India Industries Pvt Ltd, Vision Mechatronics Pvt Ltd, Toshiba Corporation, Amperex Technology Limited, Future Hi-Tech Batteries, Exicom Tele-Systems Limited, iPower Batteries Pvt Ltd *List Not Exhaustive 6 4 Market Ranking Analysi, Trontek Group, TDS Lithium-Ion Battery Gujarat Private Limited (TDSG), Inverted Energy Private Limited, Bharat Electronics Limited (BEL).

3. What are the main segments of the India Lithium-ion Battery Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.71 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Cost Of Lithium-ion Batteries4.; Increasing Adoption of Electric Vehicles.

6. What are the notable trends driving market growth?

The Automotive Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Demand and Supply of Raw Materials for Battery Manufacturing.

8. Can you provide examples of recent developments in the market?

March 2024: Panasonic Energy Co Ltd, a subsidiary of Panasonic Group, a Japan-based multinational electronics company, will form a joint venture with Maharatna PSU Indian Oil Corporation Ltd, the nation's biggest oil firm, to manufacture cylindrical lithium-ion batteries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Lithium-ion Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Lithium-ion Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Lithium-ion Battery Market?

To stay informed about further developments, trends, and reports in the India Lithium-ion Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence