Key Insights

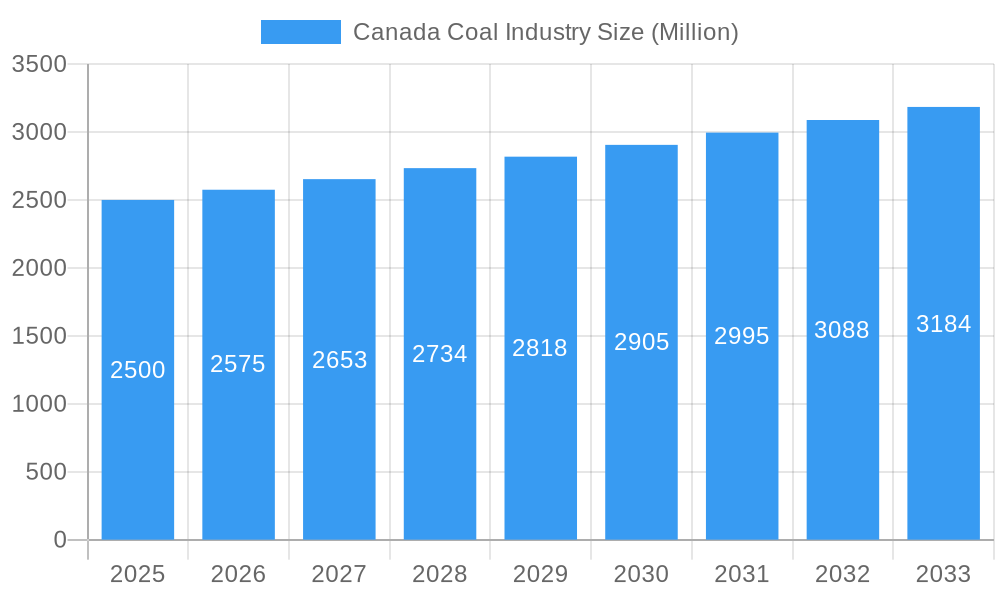

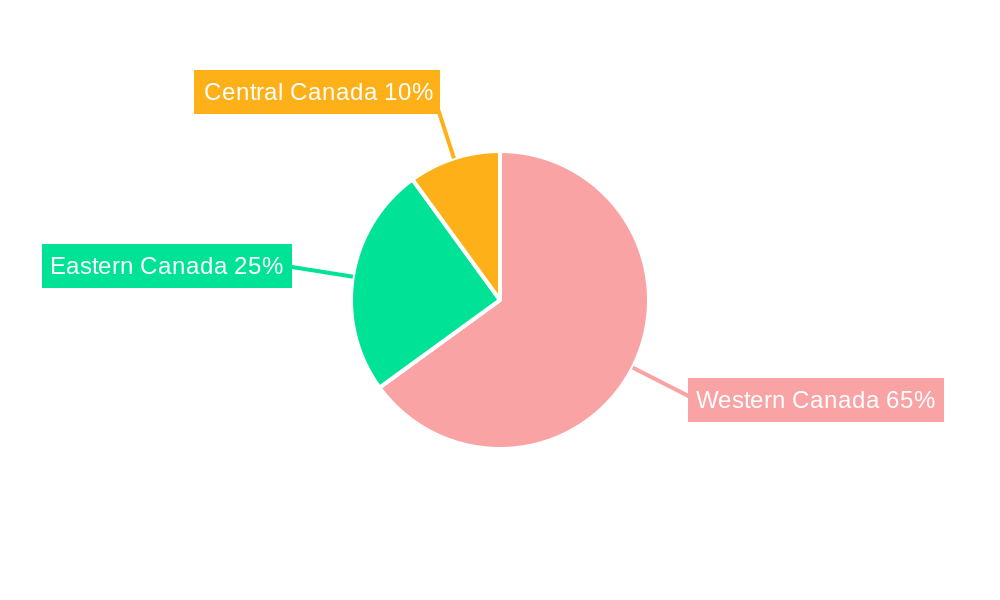

The Canadian coal market, valued at approximately $11 billion in 2024, is projected to grow at a compound annual growth rate (CAGR) of 5.2% through 2033. Despite global decarbonization trends, the industry retains a significant presence, primarily serving the power generation and metallurgical sectors. Key challenges include stringent environmental regulations, the transition to renewable energy, and volatile global coal prices. However, robust domestic demand for metallurgical coal in steel production and ongoing reliance on coal for power generation in specific regions provide market stability. Western Canada is expected to lead market share due to established mining operations.

Canada Coal Industry Market Size (In Billion)

The industry's outlook depends on balancing demand in traditional applications with the rise of cleaner energy. Leading companies such as Teck Resources Limited and Peabody Energy Corp. are anticipated to focus on operational efficiency, carbon capture technologies, and diversification. The competitive landscape is concentrated, with major players likely to pursue strategic initiatives like mergers, acquisitions, and technological advancements to mitigate environmental impacts and improve efficiency. Metallurgical coal usage is expected to be stable, while the power generation segment may decline without significant technological improvements to enhance its environmental performance and competitiveness against renewables. Detailed analysis of regional markets—Eastern, Western, and Central Canada—will illuminate production patterns, supply chain dynamics, and market potential, influenced by infrastructure and government policies.

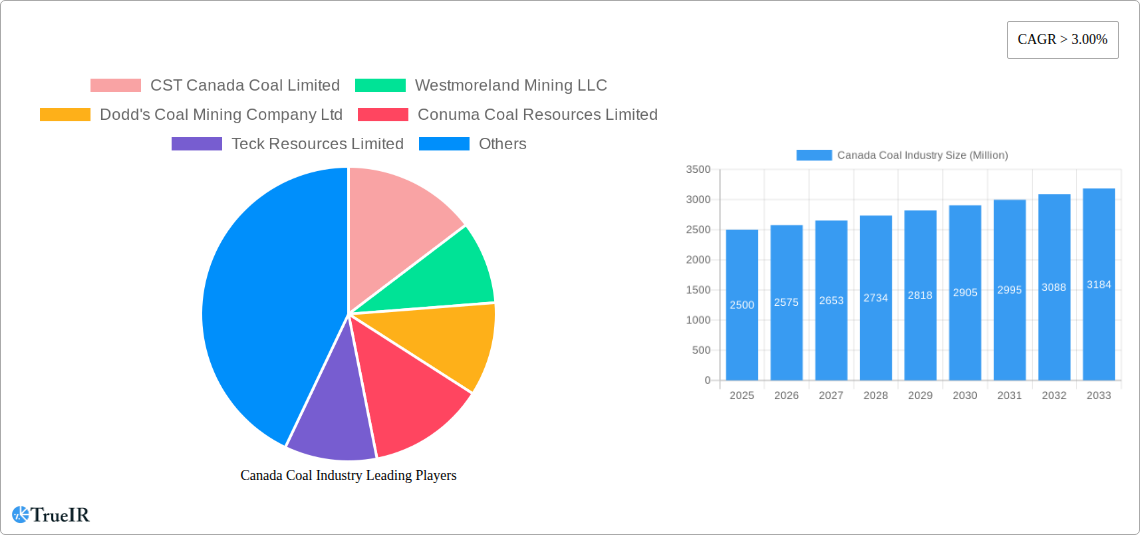

Canada Coal Industry Company Market Share

Canada Coal Industry 2019-2033: Market Analysis, Trends, and Future Outlook

This comprehensive report provides a detailed analysis of the Canadian coal industry, covering market dynamics, competitive landscape, key players, and future growth prospects from 2019 to 2033. The study utilizes a robust methodology incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The report is crucial for investors, industry professionals, and policymakers seeking insights into this evolving sector. High-volume keywords like Canadian Coal Industry, Coal Mining Canada, Coal Market Canada, Canadian Coal Production, Coal Power Generation Canada, and Metallurgical Coal Canada are strategically incorporated to enhance search visibility and engagement.

Canada Coal Industry Market Structure & Competitive Landscape

The Canadian coal industry exhibits a moderately concentrated market structure. The Herfindahl-Hirschman Index (HHI) for 2024 was estimated at xx, indicating a moderately consolidated market. Key players such as Teck Resources Limited, Peabody Energy Corp, Conuma Coal Resources Limited, Westmoreland Mining LLC, Dodd's Coal Mining Company Ltd, and CST Canada Coal Limited, dominate the landscape, though their market shares fluctuate based on production levels and operational changes.

- Innovation Drivers: The industry is witnessing incremental improvements in mining technologies, primarily focused on enhancing safety, efficiency, and reducing environmental impact.

- Regulatory Impacts: Stringent environmental regulations and carbon emission reduction targets significantly influence operational costs and investment decisions. These regulations often drive investments in cleaner coal technologies and carbon capture utilization and storage (CCUS) projects, although the adoption rate remains limited.

- Product Substitutes: Natural gas and renewable energy sources (solar, wind, hydro) represent the primary substitutes for coal in power generation. The increasing competitiveness of these alternatives poses a significant challenge to coal's market share.

- End-User Segmentation: The Canadian coal industry primarily caters to two major segments: power generation and metallurgy. Power generation accounts for approximately xx Million tonnes, while metallurgical coal contributes approximately xx Million tonnes annually (2024 data). The "Others" segment accounts for the remainder.

- M&A Trends: The period from 2019 to 2024 saw a moderate level of mergers and acquisitions (M&A) activity, with xx deals totaling approximately xx Million CAD in value. Consolidation is expected to continue, driven by economies of scale and the need to navigate challenging market conditions.

Canada Coal Industry Market Trends & Opportunities

The Canadian coal industry experienced a decline in production during the historical period (2019-2024), primarily due to reduced demand for thermal coal and increasing regulatory pressures. However, the market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by a combination of factors. The metallurgical coal segment is expected to experience relatively stronger growth compared to thermal coal, fueled by robust steel production. Market penetration rates for metallurgical coal are projected to reach xx% by 2033, while thermal coal penetration will remain relatively stagnant. Technological advancements in coal mining and processing, including automation and improved efficiency, will support growth. However, increasing global pressure to transition to cleaner energy sources presents a significant headwind. The report details the competitive dynamics, highlighting the strategies adopted by major players to maintain market share and profitability in a transforming energy landscape.

Dominant Markets & Segments in Canada Coal Industry

The provinces of British Columbia and Alberta account for the lion's share of coal production in Canada. Within the application segments, metallurgical coal commands a dominant position, driven by its essential role in steel manufacturing.

- Metallurgy: Key growth drivers include steady growth in the global steel industry, particularly in Asia, and the continued need for high-quality metallurgical coal in steel production processes. Existing infrastructure supporting coal transportation and processing is significant.

- Power Generation: This segment faces considerable challenges due to the increasing adoption of renewable energy and stringent emission regulations. Government policies focusing on carbon reduction are negatively impacting this segment.

- Others: This segment encompasses smaller applications, including industrial uses and potentially emerging technologies utilizing coal for carbon-negative applications like CCUS.

The dominance of metallurgical coal and the specific geographic concentrations of mining activities within the provinces of British Columbia and Alberta shape market dynamics.

Canada Coal Industry Product Analysis

Coal products in the Canadian market are differentiated primarily by their application (metallurgical vs. thermal) and quality parameters such as ash content and calorific value. Technological advancements focus on improving extraction techniques and upgrading coal quality to meet specific end-user requirements. The competitive advantage for producers lies in securing long-term contracts with steel mills and power plants, ensuring a stable supply chain, and optimizing production costs amidst regulatory pressures.

Key Drivers, Barriers & Challenges in Canada Coal Industry

Key Drivers: Existing infrastructure for coal mining and transportation, consistent demand for metallurgical coal, and potential opportunities in developing carbon capture technologies are driving market growth.

Challenges: Stringent environmental regulations, increasing competition from renewable energy sources, volatility in global coal prices, and potential for supply chain disruptions due to geopolitical factors represent significant barriers. These hurdles can lead to substantial financial losses for companies with insufficient mitigation strategies. For example, the carbon tax in Canada directly impacts production costs of thermal coal.

Growth Drivers in the Canada Coal Industry Market

Technological advancements, such as automation and improved extraction techniques, are improving efficiency and reducing operating costs. Continued demand for metallurgical coal from the steel industry also provides a significant growth driver. Furthermore, potential for carbon capture and storage (CCS) projects can lead to long-term sustainability for the industry. However, this depends heavily on government incentives and policies.

Challenges Impacting Canada Coal Industry Growth

Stricter environmental regulations are increasing compliance costs. The transition toward renewable energy is reducing the overall demand for coal, particularly thermal coal. Supply chain vulnerabilities and global price volatility present considerable risks to industry stability and profitability. These factors collectively create headwinds impacting market growth and the financial sustainability of some companies within the sector.

Key Players Shaping the Canada Coal Industry Market

- Teck Resources Limited

- Peabody Energy Corp

- Conuma Coal Resources Limited

- Westmoreland Mining LLC

- Dodd's Coal Mining Company Ltd

- CST Canada Coal Limited

Significant Canada Coal Industry Industry Milestones

- 2020: Introduction of stricter environmental regulations impacting coal production in several provinces.

- 2022: Conuma Coal Resources Limited announced investment in efficiency improvement technologies.

- 2023: Peabody Energy Corp reported a significant increase in metallurgical coal exports.

- 2024: Discussions regarding potential investments in CCS technologies gained momentum.

Future Outlook for Canada Coal Industry Market

The future of the Canadian coal industry is intricately linked to global energy transition efforts and domestic policy frameworks. While metallurgical coal is expected to remain a significant commodity, the thermal coal segment will face continued pressure from renewable energy alternatives. Strategic investments in improving operational efficiencies, exploring CCS technologies, and adapting to evolving regulatory environments will be vital for sustained growth and ensuring the long-term viability of Canadian coal producers. The market potential hinges on successful navigation of these challenges and adaptation to a low-carbon economy.

Canada Coal Industry Segmentation

-

1. Application

- 1.1. Metallurgy

- 1.2. Power Generation

- 1.3. Others

Canada Coal Industry Segmentation By Geography

- 1. Canada

Canada Coal Industry Regional Market Share

Geographic Coverage of Canada Coal Industry

Canada Coal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Metallurgy Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Coal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Metallurgy

- 5.1.2. Power Generation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CST Canada Coal Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Westmoreland Mining LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dodd's Coal Mining Company Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conuma Coal Resources Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Teck Resources Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Peabody Energy Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 CST Canada Coal Limited

List of Figures

- Figure 1: Canada Coal Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Coal Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 3: Canada Coal Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Canada Coal Industry Volume Tonnes Forecast, by Region 2020 & 2033

- Table 5: Canada Coal Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Canada Coal Industry Volume Tonnes Forecast, by Application 2020 & 2033

- Table 7: Canada Coal Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Canada Coal Industry Volume Tonnes Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Coal Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Canada Coal Industry?

Key companies in the market include CST Canada Coal Limited, Westmoreland Mining LLC, Dodd's Coal Mining Company Ltd, Conuma Coal Resources Limited, Teck Resources Limited, Peabody Energy Corp.

3. What are the main segments of the Canada Coal Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Metallurgy Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Coal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Coal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Coal Industry?

To stay informed about further developments, trends, and reports in the Canada Coal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence