Key Insights

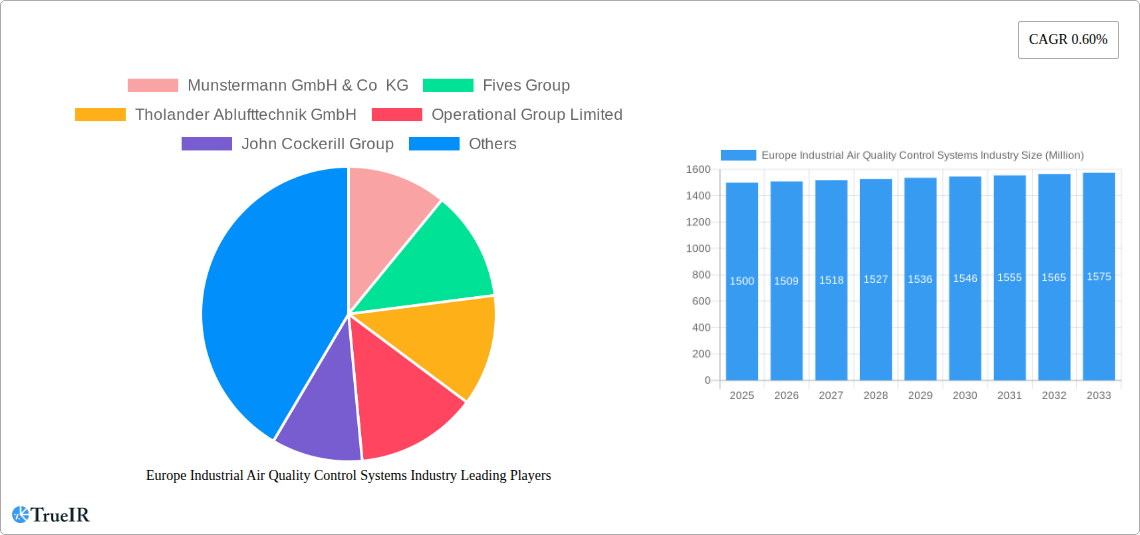

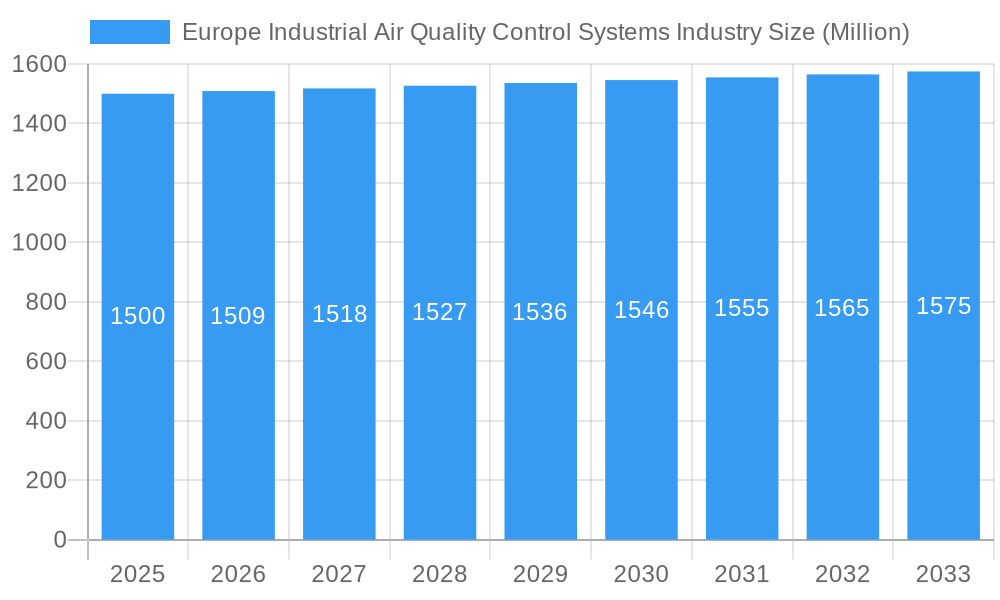

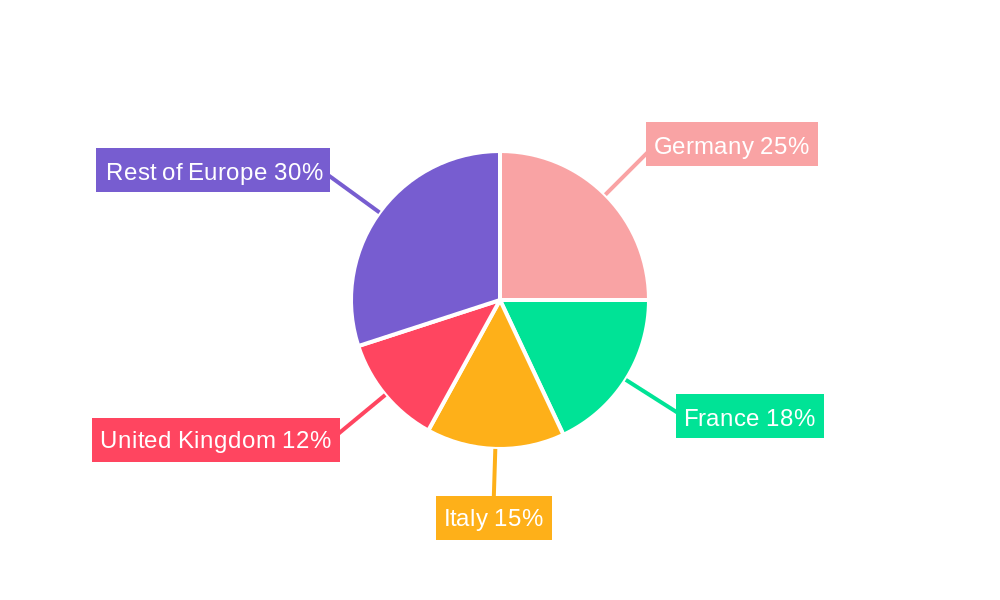

The European industrial air quality control systems market, estimated at $97.9 billion in 2025, is poised for modest expansion. Driven by stringent environmental regulations and robust industrial activity in key sectors, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 0.6% from 2025 to 2033. Dominant industries fueling this growth include power generation, cement, and chemicals & fertilizers. Key technologies like Electrostatic Precipitators (ESPs), Flue Gas Desulfurization (FGD) systems, and Selective Catalytic Reduction (SCR) will continue to be crucial for controlling emissions of Nitrogen Oxides (NOx), Sulphur Oxides (SO2), and Particulate Matter (PM). Challenges such as high initial investment costs and economic volatility are balanced by a persistent focus on sustainability and air quality improvement. Germany, France, Italy, and the United Kingdom are expected to lead market revenue due to their strong industrial bases and stringent environmental policies. Future market dynamics will be shaped by the escalating demand for advanced and efficient air quality control solutions, particularly in sectors facing tighter emission standards.

Europe Industrial Air Quality Control Systems Industry Market Size (In Billion)

Technological advancements in air pollution control will drive the development of more efficient and cost-effective solutions. Furthermore, the adoption of circular economy principles and a heightened focus on reducing carbon footprints will accelerate the integration of these systems, especially within energy-intensive industries. The competitive landscape features both established market leaders and niche specialists, indicating a market influenced by a combination of proven technologies and innovative approaches. Strategic collaborations and market consolidation are anticipated to address growing demand and overcome technological hurdles. This dynamic, supported by robust regulatory frameworks, is expected to sustain consistent, albeit moderate, market growth.

Europe Industrial Air Quality Control Systems Industry Company Market Share

Europe Industrial Air Quality Control Systems Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European industrial air quality control systems market, offering invaluable insights for stakeholders across the value chain. With a focus on market trends, competitive dynamics, and future growth projections, this report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by type (Electrostatic Precipitators (ESP), Flue Gas Desulfurization (FGD) and Scrubbers, Selective Catalytic Reduction (SCR), Fabric Filters, Others), application (Power Generation, Cement, Chemicals & Fertilizers, Iron & Steel, Automotive, Oil & Gas, Other), and key emissions (Nitrogen Oxides (NOx), Sulphur Oxides (SO2), Particulate Matter (PM)). Key players analyzed include Munstermann GmbH & Co KG, Fives Group, Tholander Ablufttechnik GmbH, Operational Group Limited, John Cockerill Group, John Wood Group PLC, Exeon Ltd, Chemisch Thermische Prozesstechnik GmbH, Andritz AG, and Anguil Environmental Systems Inc. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Industrial Air Quality Control Systems Industry Market Structure & Competitive Landscape

The European industrial air quality control systems market exhibits a moderately concentrated structure. While a few large multinational players dominate, several smaller, specialized firms cater to niche segments. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be around xx, suggesting a moderately competitive landscape. Innovation is a key driver, with continuous advancements in ESP, SCR, and fabric filter technologies. Stringent environmental regulations, particularly post-2022, are major influencers, compelling adoption of more efficient and effective systems. Product substitutes are limited, but economic considerations and technological advancements can influence switching costs and market penetration.

- Market Concentration: The market shows a moderately concentrated structure, with the top 5 players holding approximately xx% of the market share.

- Innovation Drivers: R&D investments in cleaner technologies, improved energy efficiency, and advanced monitoring systems are crucial.

- Regulatory Impacts: The European Green Deal and stricter emission standards significantly influence market growth and adoption of advanced systems.

- Product Substitutes: Limited substitutes exist; however, economic factors and alternative technologies could influence future market shifts.

- End-User Segmentation: The power generation, cement, and chemicals & fertilizers industries are major end-users.

- M&A Trends: Consolidation is expected to continue, driven by the need to achieve economies of scale and access new technologies. The total value of M&A transactions in the last five years is estimated at xx Million.

Europe Industrial Air Quality Control Systems Industry Market Trends & Opportunities

The European industrial air quality control systems market is experiencing substantial growth driven by increasingly stringent environmental regulations, the growing need to reduce emissions from industrial sources, and advancements in control system technologies. The market is expected to witness significant growth over the forecast period, fueled by various factors including substantial investments in renewable energy infrastructure. The rising awareness of the harmful effects of air pollution is also driving the demand for efficient control systems across multiple industrial sectors. The market penetration rate for advanced emission control technologies is steadily increasing, with a notable rise in the adoption of SCR and FGD systems. The power generation sector is a leading adopter of these systems to meet the increasingly stringent regulations and reduce their environmental impact. The CAGR for the overall market is projected at xx% for the period 2025-2033. The increasing demand for these systems in other sectors like cement and chemicals also signifies significant growth opportunities for the industry. Technological advancements in developing more energy-efficient and cost-effective solutions are also enhancing the overall growth trend. The increasing focus on digitalization and the integration of smart technologies further enhance market development. Competitive dynamics are marked by innovation, strategic partnerships, and a focus on providing customized solutions to specific industry needs.

Dominant Markets & Segments in Europe Industrial Air Quality Control Systems Industry

Germany, France, and the UK represent the dominant markets in Europe for industrial air quality control systems, driven by robust industrial bases and stringent environmental regulations. Within the segments:

Type: Electrostatic Precipitators (ESPs) hold the largest market share, due to their established presence and cost-effectiveness for certain applications. However, SCR and FGD systems are showing significant growth driven by stricter NOx and SO2 emission regulations. Fabric filters are experiencing steady demand, especially in industries with high particulate matter emissions.

Application: The Power Generation industry remains the largest application segment, owing to extensive regulatory pressure. The Chemicals & Fertilizers industry shows significant growth potential due to increasing environmental concerns. The Cement industry remains a considerable user of these systems.

Emissions: Control systems targeting Particulate Matter (PM) are the most prevalent, followed by NOx and SO2 control systems.

Key Growth Drivers:

- Stringent Environmental Regulations: The European Green Deal and other emission reduction initiatives are accelerating market growth.

- Expanding Industrial Base: Growth in industrial production across Europe fuels demand for efficient emission control systems.

- Government Incentives and Funding: Financial incentives and grants for the adoption of cleaner technologies further boost market expansion.

Europe Industrial Air Quality Control Systems Industry Product Analysis

The market offers a wide range of products, including ESPs, FGD/scrubbers, SCR, and fabric filters, each with specific applications and advantages. Technological advancements focus on improving efficiency, reducing energy consumption, and enhancing pollutant removal capabilities. Integration of smart sensors and data analytics allows for real-time monitoring and optimization of system performance. Companies are increasingly offering customized solutions to cater to the diverse requirements of various industries and emission profiles.

Key Drivers, Barriers & Challenges in Europe Industrial Air Quality Control Systems Industry

Key Drivers: Stringent environmental regulations, increasing industrial production, government incentives, and technological advancements in emission control technologies are driving significant market growth. The EU's Green Deal significantly accelerates this trend.

Challenges: High initial investment costs, complex installation processes, and the need for skilled labor can hinder market expansion. Supply chain disruptions and competitive pressures from both domestic and international players pose further challenges. The impact of these factors varies greatly depending on individual markets and technologies. For instance, supply chain issues have led to a price increase of approximately xx% for certain components in 2022.

Growth Drivers in the Europe Industrial Air Quality Control Systems Industry Market

Stringent environmental policies like the European Green Deal, coupled with the rising awareness of air pollution's health impact, are major drivers. Further growth is fueled by industrial expansion and increasing investments in renewable energy infrastructure, especially in power generation. Technological advancements in control systems—improving efficiency and lowering operating costs—also contribute significantly.

Challenges Impacting Europe Industrial Air Quality Control Systems Industry Growth

High initial capital expenditure remains a significant barrier to entry for smaller companies. Furthermore, the complexity of integrating advanced systems and maintaining highly skilled operational teams can limit adoption. Supply chain vulnerabilities and fluctuations in raw material prices, as experienced in 2022, cause cost uncertainties and affect project timelines. Intense competition and fluctuating energy costs also pose challenges.

Key Players Shaping the Europe Industrial Air Quality Control Systems Industry Market

- Munstermann GmbH & Co KG

- Fives Group

- Tholander Ablufttechnik GmbH

- Operational Group Limited

- John Cockerill Group

- John Wood Group PLC

- Exeon Ltd

- Chemisch Thermische Prozesstechnik GmbH

- Andritz AG

- Anguil Environmental Systems Inc

Significant Europe Industrial Air Quality Control Systems Industry Industry Milestones

- October 2022: The European Green Deal's recommendation for stricter air quality regulations is expected to significantly boost market growth over the next decade, preventing more than 75% of PM2.5-related deaths.

- September 2022: Breathe Warsaw's initiative to create a comprehensive air quality database using a large sensor network will aid in better pollution source identification and support the implementation of low-emission zones, driving demand for advanced air quality control systems.

Future Outlook for Europe Industrial Air Quality Control Systems Industry Market

The European industrial air quality control systems market is poised for robust growth, driven by sustained regulatory pressure, technological advancements leading to more efficient and cost-effective solutions, and increasing awareness of the harmful effects of air pollution. The market offers attractive opportunities for companies that can provide innovative, sustainable, and cost-competitive solutions. Strategic partnerships and mergers and acquisitions will play a significant role in shaping the competitive landscape in the coming years. Continued investment in R&D and expansion into new markets are anticipated to drive further growth.

Europe Industrial Air Quality Control Systems Industry Segmentation

-

1. Type

- 1.1. Electrostatic Precipitators (ESP)

- 1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 1.3. Selective Catalytic Reduction (SCR)

- 1.4. Fabric Filters

- 1.5. Others

-

2. Application

- 2.1. Power Generation Industry

- 2.2. Cement Industry

- 2.3. Chemicals and Fertilizers

- 2.4. Iron and Steel Industry

- 2.5. Automotive Industry

- 2.6. Oil & Gas Industry

- 2.7. Other Applications

-

3. Emissions (Qualitative Analysis only)

- 3.1. Nitrogen Oxides (NOx)

- 3.2. Sulphur Oxides (SO2)

- 3.3. Particulate Matter (PM)

Europe Industrial Air Quality Control Systems Industry Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Rest of Europe

Europe Industrial Air Quality Control Systems Industry Regional Market Share

Geographic Coverage of Europe Industrial Air Quality Control Systems Industry

Europe Industrial Air Quality Control Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Presence of Stringent Regulation for Air Quality Management

- 3.3. Market Restrains

- 3.3.1. 4.; High Capital is Required for the Installation of an Air Quality Control System

- 3.4. Market Trends

- 3.4.1. Power Generation Industry Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electrostatic Precipitators (ESP)

- 5.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 5.1.3. Selective Catalytic Reduction (SCR)

- 5.1.4. Fabric Filters

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Power Generation Industry

- 5.2.2. Cement Industry

- 5.2.3. Chemicals and Fertilizers

- 5.2.4. Iron and Steel Industry

- 5.2.5. Automotive Industry

- 5.2.6. Oil & Gas Industry

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 5.3.1. Nitrogen Oxides (NOx)

- 5.3.2. Sulphur Oxides (SO2)

- 5.3.3. Particulate Matter (PM)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. France

- 5.4.3. United Kingdom

- 5.4.4. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Electrostatic Precipitators (ESP)

- 6.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 6.1.3. Selective Catalytic Reduction (SCR)

- 6.1.4. Fabric Filters

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Power Generation Industry

- 6.2.2. Cement Industry

- 6.2.3. Chemicals and Fertilizers

- 6.2.4. Iron and Steel Industry

- 6.2.5. Automotive Industry

- 6.2.6. Oil & Gas Industry

- 6.2.7. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 6.3.1. Nitrogen Oxides (NOx)

- 6.3.2. Sulphur Oxides (SO2)

- 6.3.3. Particulate Matter (PM)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. France Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Electrostatic Precipitators (ESP)

- 7.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 7.1.3. Selective Catalytic Reduction (SCR)

- 7.1.4. Fabric Filters

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Power Generation Industry

- 7.2.2. Cement Industry

- 7.2.3. Chemicals and Fertilizers

- 7.2.4. Iron and Steel Industry

- 7.2.5. Automotive Industry

- 7.2.6. Oil & Gas Industry

- 7.2.7. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 7.3.1. Nitrogen Oxides (NOx)

- 7.3.2. Sulphur Oxides (SO2)

- 7.3.3. Particulate Matter (PM)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. United Kingdom Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Electrostatic Precipitators (ESP)

- 8.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 8.1.3. Selective Catalytic Reduction (SCR)

- 8.1.4. Fabric Filters

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Power Generation Industry

- 8.2.2. Cement Industry

- 8.2.3. Chemicals and Fertilizers

- 8.2.4. Iron and Steel Industry

- 8.2.5. Automotive Industry

- 8.2.6. Oil & Gas Industry

- 8.2.7. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 8.3.1. Nitrogen Oxides (NOx)

- 8.3.2. Sulphur Oxides (SO2)

- 8.3.3. Particulate Matter (PM)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Europe Europe Industrial Air Quality Control Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Electrostatic Precipitators (ESP)

- 9.1.2. Flue Gas Desulfurization (FGD) and Scrubbers

- 9.1.3. Selective Catalytic Reduction (SCR)

- 9.1.4. Fabric Filters

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Power Generation Industry

- 9.2.2. Cement Industry

- 9.2.3. Chemicals and Fertilizers

- 9.2.4. Iron and Steel Industry

- 9.2.5. Automotive Industry

- 9.2.6. Oil & Gas Industry

- 9.2.7. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Emissions (Qualitative Analysis only)

- 9.3.1. Nitrogen Oxides (NOx)

- 9.3.2. Sulphur Oxides (SO2)

- 9.3.3. Particulate Matter (PM)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Munstermann GmbH & Co KG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Fives Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tholander Ablufttechnik GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Operational Group Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 John Cockerill Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 John Wood Group PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Exeon Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Chemisch Thermische Prozesstechnik GmbH

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Andritz AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Anguil Environmental Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Munstermann GmbH & Co KG

List of Figures

- Figure 1: Europe Industrial Air Quality Control Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Industrial Air Quality Control Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 4: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 8: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 12: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 16: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Emissions (Qualitative Analysis only) 2020 & 2033

- Table 20: Europe Industrial Air Quality Control Systems Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Industrial Air Quality Control Systems Industry?

The projected CAGR is approximately 0.6%.

2. Which companies are prominent players in the Europe Industrial Air Quality Control Systems Industry?

Key companies in the market include Munstermann GmbH & Co KG, Fives Group, Tholander Ablufttechnik GmbH, Operational Group Limited, John Cockerill Group, John Wood Group PLC, Exeon Ltd, Chemisch Thermische Prozesstechnik GmbH, Andritz AG, Anguil Environmental Systems Inc.

3. What are the main segments of the Europe Industrial Air Quality Control Systems Industry?

The market segments include Type, Application, Emissions (Qualitative Analysis only).

4. Can you provide details about the market size?

The market size is estimated to be USD 97.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Presence of Stringent Regulation for Air Quality Management.

6. What are the notable trends driving market growth?

Power Generation Industry Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Capital is Required for the Installation of an Air Quality Control System.

8. Can you provide examples of recent developments in the market?

October 2022: In the European Green Deal, the Commission recommended stricter regulations for sewage treatment from cities, surface and groundwater pollution, and ambient air quality. In ten years, the new regulations will prevent more than 75% of deaths brought on by levels of the major pollutant PM2.5 above WHO recommendations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Industrial Air Quality Control Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Industrial Air Quality Control Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Industrial Air Quality Control Systems Industry?

To stay informed about further developments, trends, and reports in the Europe Industrial Air Quality Control Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence