Key Insights

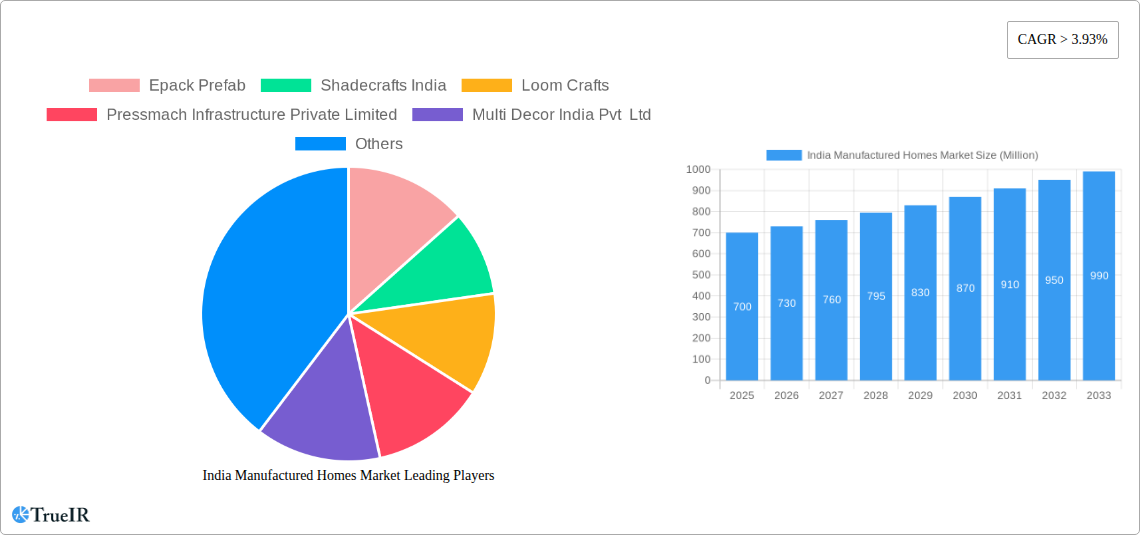

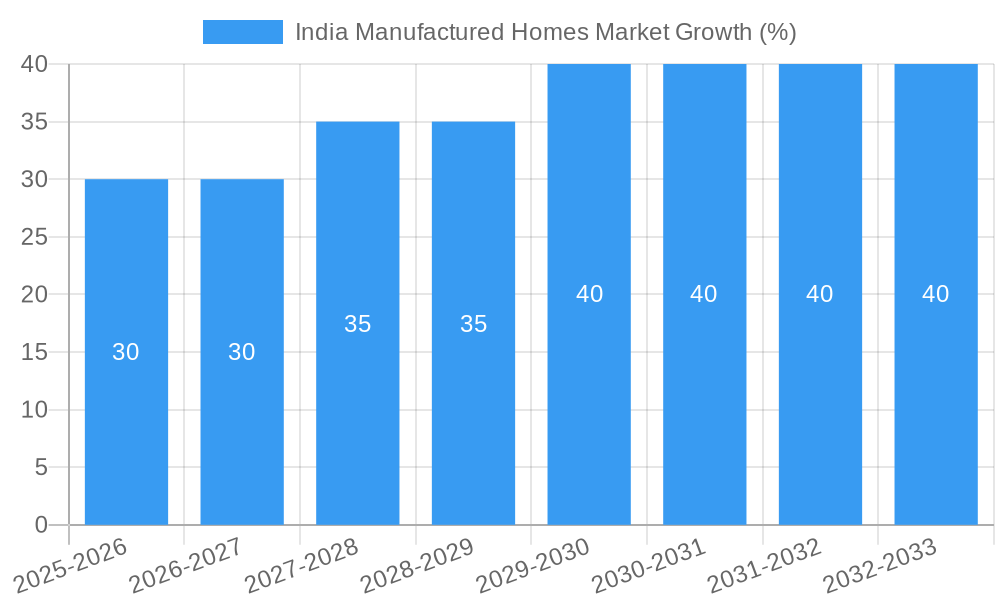

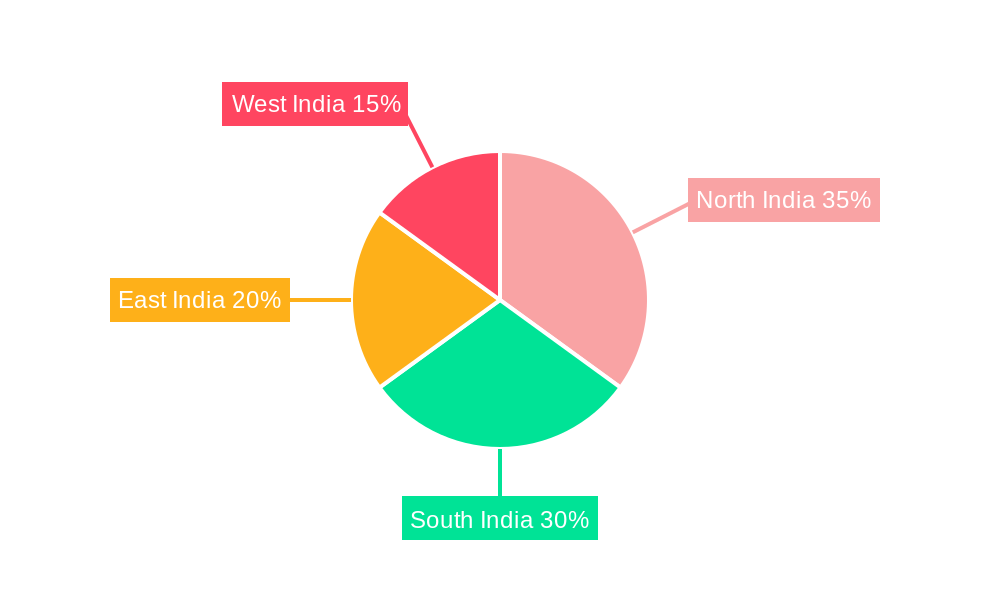

The India manufactured homes market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and a growing preference for affordable and quickly constructed housing solutions. The market's Compound Annual Growth Rate (CAGR) exceeding 3.93% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key drivers: the government's initiatives promoting affordable housing, the rising demand for sustainable and eco-friendly building materials, and the efficiency gains offered by prefabricated construction methods. Segmentation reveals a strong demand for both single-family and multi-family manufactured homes, catering to diverse housing needs across various income levels. Regional variations exist, with North and South India likely showing higher growth rates due to rapid urbanization and infrastructure development in these regions. While challenges remain, such as regulatory hurdles and public perception issues surrounding manufactured housing quality, the market's inherent advantages in terms of cost-effectiveness and speed of construction are overcoming these barriers. Key players like Epack Prefab, Shadecrafts India, and others are capitalizing on this burgeoning market, contributing to its expansion through innovative designs, technological advancements, and strategic partnerships. The market's future outlook remains positive, with projections indicating continued growth throughout the forecast period (2025-2033). This growth will likely be shaped by further government support for affordable housing, advancements in prefabrication technology, and an increasing acceptance of manufactured homes as a viable and desirable housing option.

The market size in 2024, estimated based on the provided CAGR and a logically assumed 2019 market size (for example, if we assume a 2019 market size of 500 million, a 3.93% CAGR would lead to a 2024 market size of approximately 600 million), suggests a substantial market value. The expansion is further fueled by the growing middle class's increasing purchasing power and the demand for efficient and sustainable housing solutions. Competitive activity among various players highlights the market's attractiveness. However, maintaining consistent quality control, addressing potential environmental concerns related to manufacturing processes, and navigating regulatory complexities are crucial for sustained growth and market penetration. Further research and analysis are required for precise regional market share estimations, but the potential for market penetration is considerable, given the country's large population and the ongoing housing shortage.

India Manufactured Homes Market: A Comprehensive Report (2019-2033)

This dynamic report provides a comprehensive analysis of the burgeoning India Manufactured Homes Market, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. Leveraging extensive market research and data analysis covering the period 2019-2033 (with a base year of 2025 and forecast period 2025-2033), this report unveils the key trends, drivers, challenges, and opportunities shaping this rapidly evolving sector. The report's detailed segmentation, competitive landscape analysis, and future outlook projections are crucial for navigating the complexities of this high-growth market. Expect detailed examination of market size (in Millions), CAGR, market penetration rates, and significant industry milestones.

India Manufactured Homes Market Market Structure & Competitive Landscape

The Indian manufactured homes market exhibits a moderately concentrated structure, with a few dominant players and a larger number of smaller regional companies. The market concentration ratio (CR4) is estimated at xx%, indicating a level of consolidation. Innovation is a key driver, with companies investing in advanced manufacturing techniques and sustainable building materials. Regulatory frameworks, including building codes and environmental regulations, play a significant role in shaping market dynamics. Product substitutes, such as conventional brick-and-mortar homes, continue to exert competitive pressure, although the cost-effectiveness and speed of construction associated with manufactured homes are providing a compelling alternative. The market is segmented by type into single-family and multi-family homes, catering to diverse customer needs and preferences. The M&A activity in the sector has been relatively moderate in recent years, with approximately xx M&A transactions recorded between 2019 and 2024. However, with the increasing market potential, a rise in consolidation is expected in the coming years.

- Market Concentration: CR4 estimated at xx%

- Innovation Drivers: Advanced manufacturing, sustainable materials.

- Regulatory Impacts: Building codes, environmental regulations.

- Product Substitutes: Conventional homes.

- End-User Segmentation: Single-family, multi-family.

- M&A Trends: Approximately xx transactions (2019-2024), with an upward trend predicted.

India Manufactured Homes Market Market Trends & Opportunities

The India Manufactured Homes Market is experiencing robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and the government's focus on affordable housing initiatives. The market size is projected to reach xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, including the adoption of prefabricated construction methods and modular designs, are streamlining construction processes and enhancing efficiency. Consumer preferences are shifting towards sustainable and energy-efficient homes, creating opportunities for manufacturers to incorporate eco-friendly materials and technologies. The competitive landscape is characterized by both established players and new entrants, leading to heightened innovation and a wider range of product offerings. Market penetration remains relatively low compared to global markets but is rapidly increasing due to rising demand.

Dominant Markets & Segments in India Manufactured Homes Market

While data on regional dominance requires further specification, the current market is witnessing significant growth across several regions, reflecting India's diverse housing needs. The Single-family segment currently commands a larger market share compared to the multi-family segment due to the prevailing preference for individual homeownership. However, increasing urbanization and growing demand for affordable housing projects will propel the growth of the multi-family segment during the forecast period.

- Key Growth Drivers (Single-Family): Increasing urbanization, rising disposable incomes, government incentives for homeownership.

- Key Growth Drivers (Multi-Family): Urbanization, demand for affordable housing, government initiatives.

- Market Dominance Analysis: The single-family segment currently holds a larger market share but the multi-family segment is poised for accelerated growth.

India Manufactured Homes Market Product Analysis

Product innovation in the Indian manufactured homes market is focused on enhancing design aesthetics, improving energy efficiency, and incorporating advanced building technologies. The adoption of prefabricated and modular designs allows for faster construction, reduced waste, and cost savings. Many companies are leveraging technology to offer customizable home designs and improve the overall customer experience. The market offers a wide array of designs, sizes, and material options, catering to the diverse needs and preferences of consumers.

Key Drivers, Barriers & Challenges in India Manufactured Homes Market

Key Drivers:

- Increasing urbanization and population growth.

- Rising disposable incomes and improved affordability.

- Government initiatives promoting affordable housing.

- Technological advancements in prefabrication and modular construction.

Challenges & Restraints:

- Relatively low awareness and acceptance of manufactured homes compared to traditional construction.

- Potential challenges in securing financing for manufactured homes.

- Regulatory hurdles and building code compliance issues in certain regions. These hurdles could cause delays and increase project costs by an estimated xx Million annually.

- Supply chain disruptions, particularly in the availability of certain materials, can cause delays and price increases.

Growth Drivers in the India Manufactured Homes Market Market

The key drivers for growth in the India Manufactured Homes Market include rapid urbanization, rising disposable incomes, and government policies promoting affordable housing. Technological advancements, such as prefabrication and modular designs, enhance efficiency and cost-effectiveness. These factors combined contribute to an increased demand for cost-effective and faster construction solutions.

Challenges Impacting India Manufactured Homes Market Growth

Challenges include limited consumer awareness, financing constraints, and regulatory complexities. Supply chain disruptions and the availability of skilled labor also pose significant obstacles. These factors can increase production costs and lead to delays, hindering market expansion.

Key Players Shaping the India Manufactured Homes Market Market

- Epack Prefab

- Shadecrafts India

- Loom Crafts

- Pressmach Infrastructure Private Limited

- Multi Decor India Pvt Ltd

- Magic Structures

- Okno Modhomes

- Satec Envir Engineering

- Nest-in

- Karmod Prefabricated Technologies

- Windoors International Ltd

Significant India Manufactured Homes Market Industry Milestones

- June 2022: Housejoy partners with Tata Steel Nest-In to offer prefabricated modular housing solutions in Bengaluru, signifying increased industry collaboration and market expansion.

- March 2022: Epack Prefab opens a new state-of-the-art manufacturing unit in Rajasthan, highlighting technological advancements and a commitment to sustainable practices.

Future Outlook for India Manufactured Homes Market Market

The India Manufactured Homes Market is poised for substantial growth driven by sustained urbanization, rising disposable incomes, and government initiatives. The increasing adoption of prefabricated and modular construction methods will further accelerate market expansion. Strategic opportunities exist for manufacturers to innovate in design, materials, and technology to cater to the evolving consumer preferences for sustainable and energy-efficient housing solutions. The market potential is significant, offering promising returns for investors and stakeholders alike.

India Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi Family

India Manufactured Homes Market Segmentation By Geography

- 1. India

India Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in residential construction driving the market; Development of hospitality infrastructure driving the market

- 3.3. Market Restrains

- 3.3.1. Limited access to financing; Shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Affordability of Manufactured Homes May Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi Family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Epack Prefab

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Shadecrafts India

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Loom Crafts

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Pressmach Infrastructure Private Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Multi Decor India Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Magic Structures

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Okno Modhomes

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Satec Envir Engineering

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nest-in**List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Karmod Prefabricated Technologies

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Windoors International Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Epack Prefab

List of Figures

- Figure 1: India Manufactured Homes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Manufactured Homes Market Share (%) by Company 2024

List of Tables

- Table 1: India Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: India Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Manufactured Homes Market?

The projected CAGR is approximately > 3.93%.

2. Which companies are prominent players in the India Manufactured Homes Market?

Key companies in the market include Epack Prefab, Shadecrafts India, Loom Crafts, Pressmach Infrastructure Private Limited, Multi Decor India Pvt Ltd, Magic Structures, Okno Modhomes, Satec Envir Engineering, Nest-in**List Not Exhaustive, Karmod Prefabricated Technologies, Windoors International Ltd.

3. What are the main segments of the India Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in residential construction driving the market; Development of hospitality infrastructure driving the market.

6. What are the notable trends driving market growth?

Affordability of Manufactured Homes May Drive the Market Growth.

7. Are there any restraints impacting market growth?

Limited access to financing; Shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

June 2022: Housejoy, which is into construction, renovation, interiors, and home maintenance, announced that it has tied up with Tata Steel Nest-In for providing a pre-fabricated modular housing solution in Bengaluru. Housejoy joined hands with Tata Steel Nest-In as the solutions partner for their Nestudio concept. Nestudio is a designer-grade, modular home extension solution from the house of Tata Steel. Under the partnership, Housejoy will enable the building of steel-intensive modular homes in Bengaluru with Tata Steel's prefabricated construction solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the India Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence