Key Insights

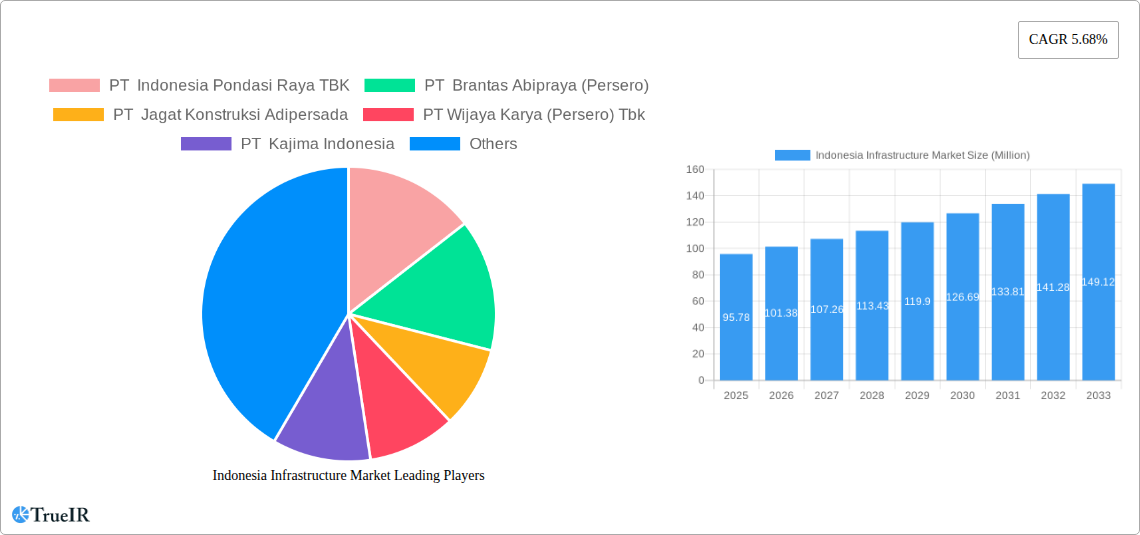

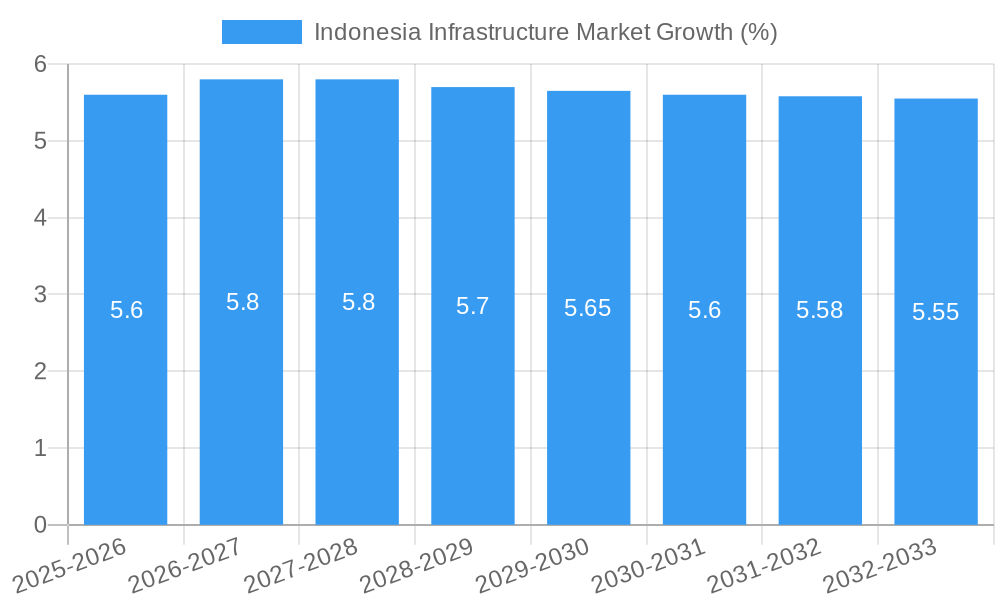

The Indonesian infrastructure market presents a compelling investment opportunity, exhibiting robust growth potential. With a 2025 market size of US$95.78 million and a projected Compound Annual Growth Rate (CAGR) of 5.68% from 2025 to 2033, the market is poised for significant expansion. This growth is fueled by substantial government investment in key infrastructure projects aimed at improving connectivity, supporting economic development, and enhancing the quality of life for citizens. Drivers include increasing urbanization, rising tourism, and the government's focus on developing strategic sectors such as transportation (roads, railways, ports, airports), energy (power generation and distribution), and digital infrastructure (broadband expansion). The market is segmented into social infrastructure (hospitals, schools), transportation, extraction (mining, oil & gas), manufacturing, and utilities, each contributing to the overall expansion. Leading players like PT Indonesia Pondasi Raya TBK, PT Brantas Abipraya (Persero), and PT Wijaya Karya (Persero) Tbk are well-positioned to capitalize on this growth, though competition is likely to intensify. While challenges like regulatory hurdles and potential labor shortages exist, the long-term outlook remains positive, driven by Indonesia's burgeoning economy and commitment to infrastructure development.

The forecast period (2025-2033) anticipates continued growth, with the market size projected to surpass US$150 million by 2033. This projection considers factors such as ongoing government initiatives, private sector participation, and the anticipated increase in foreign direct investment in infrastructure projects. Specific segment performance will vary, with transportation and social infrastructure likely to experience the most significant growth, driven by population growth and the need to modernize existing infrastructure. However, the market's success is contingent upon effective project management, sustainable financing models, and the efficient mitigation of potential risks, ensuring the timely and cost-effective completion of projects. The consistent growth projection makes Indonesia’s infrastructure market an attractive area for both domestic and international businesses.

Indonesia Infrastructure Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Indonesia Infrastructure Market, offering invaluable insights for investors, industry professionals, and policymakers. With a focus on market size, growth drivers, competitive landscape, and future projections, this report covers the period from 2019 to 2033, utilizing 2025 as the base and estimated year. The report leverages rigorous data analysis and expert commentary to present a clear and actionable overview of this dynamic market.

Indonesia Infrastructure Market Structure & Competitive Landscape

The Indonesian infrastructure market is characterized by a moderately concentrated structure, with a few large players dominating certain segments. Concentration ratios, while varying across sectors, indicate a tendency towards oligopolistic competition. The market is experiencing significant innovation, driven by government initiatives promoting sustainable and technologically advanced infrastructure development. Regulatory changes, including those related to environmental protection and public-private partnerships (PPPs), significantly influence market dynamics. Product substitution is a factor, particularly in areas like renewable energy and smart city technologies. End-user segmentation is primarily driven by government agencies, private companies, and individual consumers, with the government playing a crucial role as a major investor. Mergers and acquisitions (M&A) activity has been notable, with a total M&A volume estimated at xx Million in the period 2019-2024, reflecting consolidation efforts and strategic expansion plans by major players.

- Market Concentration: Moderate to high, varying by infrastructure segment.

- Innovation Drivers: Government initiatives, technological advancements, sustainable development goals.

- Regulatory Impacts: Significant influence through PPPs, environmental regulations, and licensing processes.

- Product Substitutes: Renewable energy sources, smart technologies, alternative construction materials.

- End-User Segmentation: Government agencies (national, regional), private companies, individual consumers.

- M&A Trends: Increasing consolidation, strategic acquisitions, expansion into new markets.

Indonesia Infrastructure Market Market Trends & Opportunities

The Indonesian infrastructure market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by significant government investments in infrastructure development, driven by increasing urbanization, economic development, and the need to improve connectivity. Technological advancements, such as the adoption of Building Information Modeling (BIM) and digital construction technologies, are transforming industry practices, improving efficiency, and reducing costs. Consumer preferences are shifting towards sustainable and resilient infrastructure, prompting the market to adapt and innovate to meet these demands. The competitive landscape is dynamic, with both domestic and international companies vying for market share. Market penetration rates for new technologies and materials are steadily increasing.

Dominant Markets & Segments in Indonesia Infrastructure Market

The transportation infrastructure segment is currently the dominant sector within the Indonesian infrastructure market. Its substantial size and consistent growth are attributed to government policies focusing on improving connectivity across the archipelago and supporting economic development. The social infrastructure segment is experiencing significant growth driven by increased urbanization and population growth. Utilities infrastructure is also showing strong growth due to ongoing electrification and water management projects.

- Transportation Infrastructure: High growth potential driven by government investments in roads, railways, airports, and ports. Key factors include expanding urbanization, tourism, and inter-island connectivity.

- Social Infrastructure: Rapid growth fueled by increasing urbanization, rising population, and government initiatives in education and healthcare. Demand for improved housing, schools, and hospitals continues to escalate.

- Utilities Infrastructure: Steady growth is driven by increasing energy demands, modernization of power grids, and water management projects across the nation.

- Extraction Infrastructure: This sector is experiencing moderate growth, linked to the country's natural resource extraction activities.

- Manufacturing Infrastructure: Growth is contingent on both domestic and foreign investments in manufacturing sectors.

Indonesia Infrastructure Market Product Analysis

The Indonesian infrastructure market is characterized by the adoption of advanced building materials, smart technologies, and sustainable construction methods. Innovations in areas such as prefabricated construction, modular buildings, and digital twin technology are improving efficiency and minimizing environmental impact. These innovations are enhancing the overall quality, durability, and sustainability of infrastructure projects while enhancing project management and reducing costs.

Key Drivers, Barriers & Challenges in Indonesia Infrastructure Market

Key Drivers:

- Significant government investment in infrastructure development.

- Rapid urbanization and population growth.

- Increased demand for improved connectivity and infrastructure services.

- Technological advancements in construction and infrastructure management.

Challenges:

- Bureaucratic hurdles and regulatory complexities can lead to project delays and increased costs (estimated xx Million in project delays annually).

- Supply chain disruptions and material cost fluctuations impact project timelines and profitability.

- Competition from both domestic and international companies intensifies market pressures.

Growth Drivers in the Indonesia Infrastructure Market Market

The key drivers include government initiatives such as the National Strategic Projects (NSPs), economic growth, and technological advancements. Continued investment in sustainable and resilient infrastructure further enhances growth prospects. Supportive regulatory frameworks fostering Public Private Partnerships (PPPs) are also crucial in attracting foreign and domestic investment.

Challenges Impacting Indonesia Infrastructure Market Growth

The primary challenges include infrastructure financing, regulatory hurdles, land acquisition complexities, and environmental concerns. The fluctuation of commodity prices and potential supply chain disruptions pose further challenges.

Key Players Shaping the Indonesia Infrastructure Market Market

- PT Indonesia Pondasi Raya TBK

- PT Brantas Abipraya (Persero)

- PT Jagat Konstruksi Adipersada

- PT Wijaya Karya (Persero) Tbk

- PT Kajima Indonesia

- PT Total Inti Persada

- PT Hutama Karya (Persero)

- PT Nusantara Infrastructure Tbk

- PT Jasa Marga (Persero) TBK

- PT Adhi Karya (Persero) TBK

Significant Indonesia Infrastructure Market Industry Milestones

- December 2022: JBIC's MOU with PT Pupuk Indonesia signals increased interest in hydrogen and ammonia fuel sources, impacting the energy infrastructure sector.

- April 2023: Reservoir Link Energy's agreement with PTUOI highlights growing demand for improved wastewater treatment solutions in industrial settings.

Future Outlook for Indonesia Infrastructure Market Market

The Indonesian infrastructure market is poised for continued strong growth, driven by ongoing government investments, increasing urbanization, and technological advancements. The focus on sustainable and resilient infrastructure development will continue to attract investments and create opportunities for both domestic and international players. Strategic partnerships and PPPs will play a crucial role in shaping the future of the market.

Indonesia Infrastructure Market Segmentation

-

1. Infrastructure Segment

- 1.1. Social Infrastructure

- 1.2. Transportation Infrastructure

- 1.3. Extraction Infrastructure

- 1.4. Manufacturing Infrastructure

- 1.5. Utilities Infrastructure

Indonesia Infrastructure Market Segmentation By Geography

- 1. Indonesia

Indonesia Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water

- 3.2.2 energy

- 3.2.3 transportation

- 3.2.4 and communications

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of quality and quantity of infrastructure

- 3.4. Market Trends

- 3.4.1. Increase in Value of Civil Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Segment

- 5.1.1. Social Infrastructure

- 5.1.2. Transportation Infrastructure

- 5.1.3. Extraction Infrastructure

- 5.1.4. Manufacturing Infrastructure

- 5.1.5. Utilities Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Segment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PT Indonesia Pondasi Raya TBK

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Brantas Abipraya (Persero)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Jagat Konstruksi Adipersada

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Wijaya Karya (Persero) Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Kajima Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Total Inti Persad**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Hutama Karya (Persero)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Nusantara Infrastructure Tbk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Jasa Marga (Persero) TBK

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Adhi Karya (Persero) TBK

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PT Indonesia Pondasi Raya TBK

List of Figures

- Figure 1: Indonesia Infrastructure Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Infrastructure Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Infrastructure Market Revenue Million Forecast, by Infrastructure Segment 2019 & 2032

- Table 3: Indonesia Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Indonesia Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Indonesia Infrastructure Market Revenue Million Forecast, by Infrastructure Segment 2019 & 2032

- Table 6: Indonesia Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Infrastructure Market?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the Indonesia Infrastructure Market?

Key companies in the market include PT Indonesia Pondasi Raya TBK, PT Brantas Abipraya (Persero), PT Jagat Konstruksi Adipersada, PT Wijaya Karya (Persero) Tbk, PT Kajima Indonesia, PT Total Inti Persad**List Not Exhaustive, PT Hutama Karya (Persero), PT Nusantara Infrastructure Tbk, PT Jasa Marga (Persero) TBK, PT Adhi Karya (Persero) TBK.

3. What are the main segments of the Indonesia Infrastructure Market?

The market segments include Infrastructure Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 95.78 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water. energy. transportation. and communications.

6. What are the notable trends driving market growth?

Increase in Value of Civil Construction.

7. Are there any restraints impacting market growth?

4.; Lack of quality and quantity of infrastructure.

8. Can you provide examples of recent developments in the market?

December 2022: The Japan Bank for International Cooperation (JBIC) signed a memorandum of understanding (MOU) with PT Pupuk Indonesia (Persero). The objectives of the MOU include promoting cooperation in sectors that use hydrogen and ammonia as fuel sources. JBIC aims to accelerate the structuring of projects for developing the supply chain of hydrogen and ammonia as a fuel source. The signing of the MOU will also promote multiple initiatives, including the Asia Zero Emissions Community (AZEC) Concept, through, for example, securing the production bases and supply chain of hydrogen and ammonia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Infrastructure Market?

To stay informed about further developments, trends, and reports in the Indonesia Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence