Key Insights

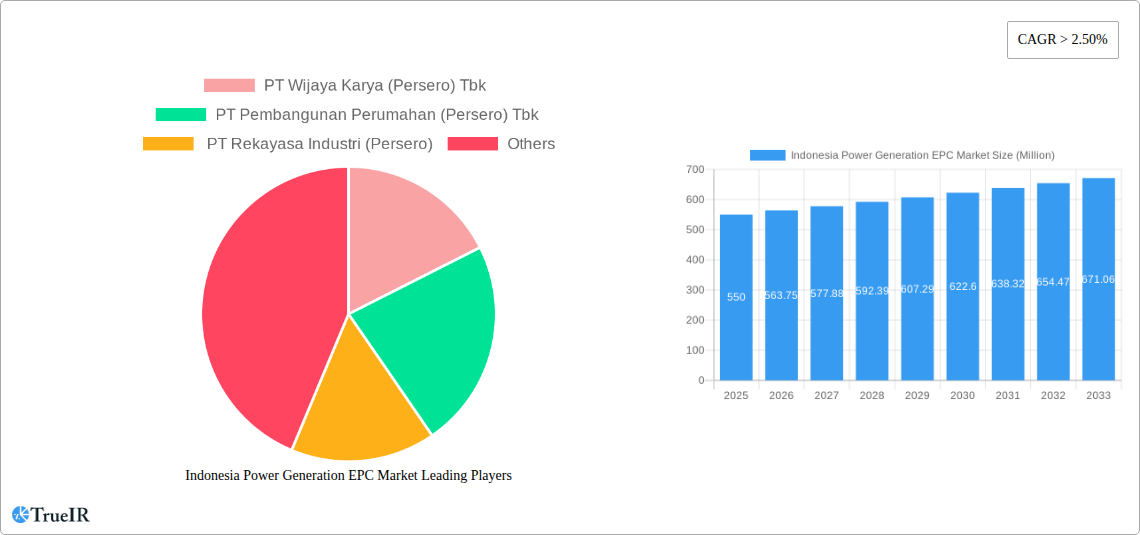

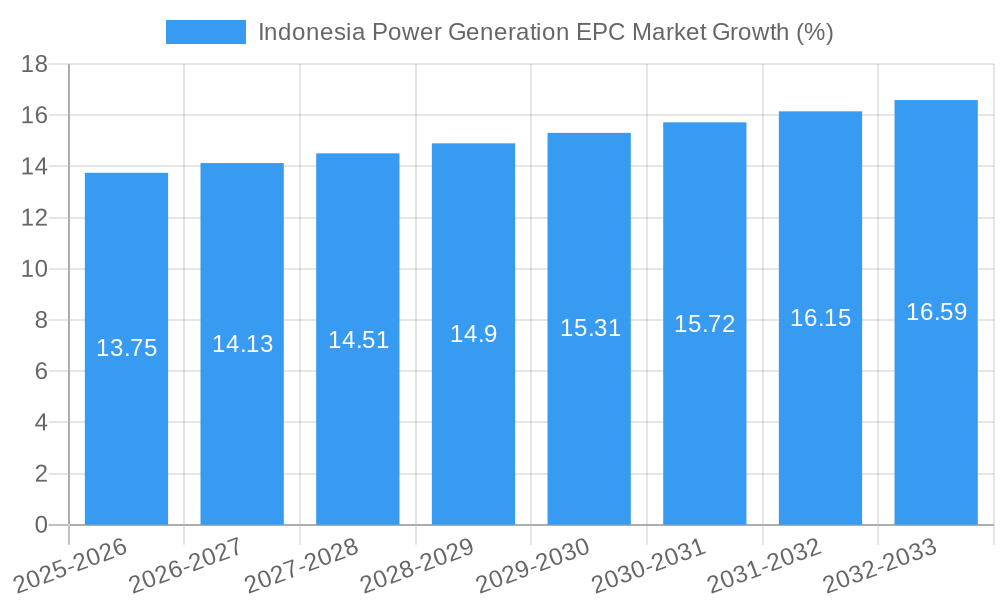

The Indonesia Power Generation Engineering, Procurement, and Construction (EPC) market exhibits robust growth potential, driven by the nation's increasing energy demands and commitment to diversifying its energy sources. With a current market size exceeding $500 million (estimated based on a CAGR of >2.5% and a value unit of millions), the market is projected to experience sustained expansion throughout the forecast period (2025-2033). Key drivers include government initiatives promoting renewable energy integration, such as solar, hydro, and geothermal power, alongside continued investment in thermal power plants to meet immediate energy needs. The market is segmented by technology (Thermal, Renewable – including solar, hydro, and geothermal – and Hydropower) and service (Engineering, Procurement, Construction). This segmentation reflects the diverse approaches to power generation development and the varying levels of involvement from EPC contractors. Major players, including PT Wijaya Karya (Persero) Tbk, PT Pembangunan Perumahan (Persero) Tbk, and PT Rekayasa Industri (Persero), dominate the landscape, leveraging their experience and expertise in large-scale infrastructure projects. The Asia-Pacific region, particularly countries like Indonesia, China, and India, are experiencing significant growth within the broader context, creating favorable conditions for the Indonesian market. While challenges such as regulatory hurdles and infrastructure limitations exist, the overall outlook remains positive, fueled by consistent investment and the government’s focus on energy security and sustainability.

The Indonesian Power Generation EPC market is poised for significant growth over the next decade. The sustained CAGR exceeding 2.5% reflects not only increasing energy consumption but also a strategic shift towards renewable energy integration. This trend creates diverse opportunities for EPC contractors, who can benefit from projects related to solar farms, hydropower plants, and geothermal energy installations. However, the market also faces challenges such as securing financing for large-scale projects and navigating the regulatory landscape. Furthermore, competition among established players remains intense, requiring strategic partnerships and innovative project management to succeed. Continued government support and a focus on infrastructure development will be crucial for sustaining this growth trajectory and realizing the considerable potential within this sector. The focus on regional development within Indonesia, particularly in less developed areas, also presents further expansion opportunities for EPC contractors.

Indonesia Power Generation EPC Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the lucrative Indonesian power generation EPC market, offering invaluable insights for investors, industry professionals, and strategic planners. With a comprehensive analysis spanning the period from 2019 to 2033, this study leverages rigorous data and expert analysis to unveil market trends, opportunities, and challenges. The report meticulously examines market size, growth trajectories, segment performance, and competitive dynamics, providing a 360-degree view of this rapidly evolving sector. Benefit from detailed forecasts, key player profiles, and identification of crucial growth drivers and potential roadblocks.

Indonesia Power Generation EPC Market Market Structure & Competitive Landscape

This section analyzes the Indonesian power generation EPC market's structure, competitive dynamics, and regulatory landscape. The study period covers 2019-2033, with 2025 serving as both the base and estimated year. The forecast period extends from 2025-2033, building upon the historical data from 2019-2024.

The market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. This indicates the presence of both established players and emerging competitors. Key players, including PT Wijaya Karya (Persero) Tbk, PT Pembangunan Perumahan (Persero) Tbk, and PT Rekayasa Industri (Persero), are driving innovation through strategic partnerships and technological advancements. The regulatory environment, characterized by xx, significantly influences market dynamics. The increasing adoption of renewable energy sources presents a notable shift, while the prevalence of thermal power generation remains significant. Substitutes such as distributed generation technologies exert growing pressure.

- Market Concentration: HHI of xx in 2025, indicating a moderately concentrated market.

- Innovation Drivers: Strategic partnerships, technological advancements in renewable energy technologies.

- Regulatory Impacts: Government policies promoting renewable energy integration and grid modernization are major drivers. xx specific policy details.

- Product Substitutes: Increased competition from distributed generation technologies.

- End-User Segmentation: Dominated by utility companies and independent power producers (IPPs).

- M&A Trends: xx number of M&A deals in the last 5 years, indicating a consolidated market. xx Value of these deals in Million USD.

Indonesia Power Generation EPC Market Market Trends & Opportunities

The Indonesian power generation EPC market is experiencing robust growth, driven by increasing energy demand and government initiatives to expand power generation capacity. The market size is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by a rising population, industrialization, and increasing electrification rates across the archipelago. Technological advancements in renewable energy sources, such as solar and wind power, are transforming the market landscape. Consumer preferences are shifting towards cleaner and more sustainable energy solutions. This creates opportunities for EPC companies to specialize in renewable energy projects and offer integrated solutions that encompass engineering, procurement, and construction services. The market displays a high level of competition, with both domestic and international players vying for market share. This competitiveness is further intensified by government policies supporting localization and promoting local EPC companies.

Dominant Markets & Segments in Indonesia Power Generation EPC Market

The thermal power generation segment currently dominates the Indonesian power generation EPC market, accounting for xx% of the total market share in 2025. However, the renewable energy segment, particularly hydropower, is expected to experience the highest growth rate during the forecast period, driven by strong government support for renewable energy development and decreasing costs of renewable energy technologies. Java and Bali region are leading in terms of project development and investments, driven by their high population density and robust economic activity.

By Technology:

- Thermal: Dominant segment in 2025, with xx Million USD market value. Growth is driven by existing infrastructure and continued need for baseload power.

- Renewable: Fastest-growing segment, driven by government incentives and decreasing technology costs. Projected market value of xx Million USD by 2033. Hydropower leading the way.

- Hydropower: Significant potential for growth due to Indonesia's abundant water resources. Projected to account for xx% of the renewable energy segment by 2033.

By Service:

- Engineering, Procurement, Construction (EPC): The dominant service model, offering comprehensive solutions to clients.

Key Growth Drivers:

- Government Policies: Strong support for renewable energy development and infrastructure projects. Specific examples of policies should be inserted here.

- Infrastructure Development: Ongoing investments in power grid expansion and modernization.

- Rising Energy Demand: Driven by economic growth, population increase, and increasing electrification rates.

Indonesia Power Generation EPC Market Product Analysis

The Indonesian power generation EPC market features a diverse range of products and services, from conventional thermal power plants to cutting-edge renewable energy technologies. Technological advancements in areas such as smart grids, energy storage solutions, and digitalization are transforming the industry. The successful adoption of these technologies hinges on their cost-effectiveness, reliability, and ability to meet Indonesia's unique energy needs and environmental goals. This drives the market toward integrated solutions that optimize efficiency and minimize environmental impacts.

Key Drivers, Barriers & Challenges in Indonesia Power Generation EPC Market

Key Drivers:

- Increased energy demand fueled by economic growth and population expansion.

- Government initiatives promoting renewable energy adoption and infrastructure development.

- Technological advancements reducing the cost and improving the efficiency of renewable energy technologies.

Key Challenges & Restraints:

- Regulatory complexities and bureaucratic hurdles can delay project implementation and increase costs. xx% of projects face significant delays due to regulatory issues.

- Supply chain disruptions and logistics challenges in a geographically dispersed archipelago can impact project timelines and budgets. xx% increase in material costs due to supply chain issues.

- Intense competition among domestic and international EPC companies can put downward pressure on pricing.

Growth Drivers in the Indonesia Power Generation EPC Market Market

The market's growth is significantly propelled by Indonesia's rising energy demand, spurred by its expanding population and industrialization. Government policies favoring renewable energy adoption and infrastructure modernization are powerful catalysts. Technological advancements in renewable energy sources and energy storage technologies are further driving market expansion.

Challenges Impacting Indonesia Power Generation EPC Market Growth

Significant challenges include navigating complex regulatory frameworks, managing supply chain complexities across a vast archipelago, and facing intense competition. These factors can lead to project delays, cost overruns, and reduced profit margins for EPC companies.

Key Players Shaping the Indonesia Power Generation EPC Market Market

- PT Wijaya Karya (Persero) Tbk

- PT Pembangunan Perumahan (Persero) Tbk

- PT Rekayasa Industri (Persero)

Significant Indonesia Power Generation EPC Market Industry Milestones

- 2020: Launch of the xx renewable energy initiative by the Indonesian government.

- 2022: Completion of the xx large-scale hydropower project.

- 2023: Significant investment in solar PV projects across multiple islands.

Future Outlook for Indonesia Power Generation EPC Market Market

The Indonesian power generation EPC market holds immense potential for growth. Government support for renewable energy coupled with rising energy demand presents substantial opportunities for EPC companies. Strategic investments in renewable energy projects, grid modernization, and energy storage solutions will shape the market's future. The continued focus on improving energy efficiency and sustainability will drive innovation and attract both domestic and international investment.

Indonesia Power Generation EPC Market Segmentation

-

1. Technology

- 1.1. Thermal

- 1.2. Renewable

- 1.3. Hydropower

-

2. Service

- 2.1. Engineering

- 2.2. Procurement

- 2.3. Construction

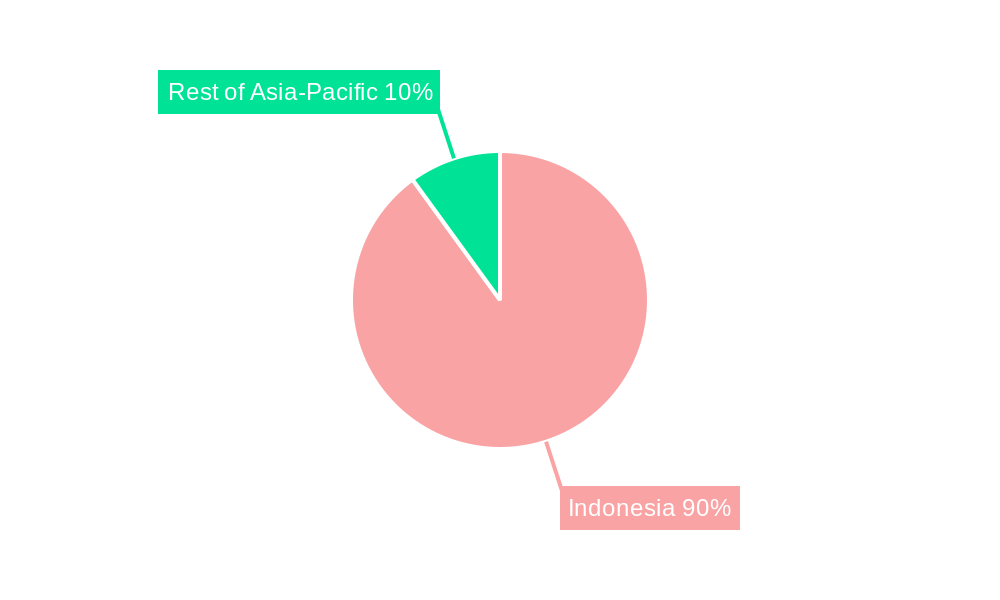

Indonesia Power Generation EPC Market Segmentation By Geography

- 1. Indonesia

Indonesia Power Generation EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices

- 3.3. Market Restrains

- 3.3.1. 4.; The Country's Inefficient Electricity Grid Infrastructure

- 3.4. Market Trends

- 3.4.1. Conventional Thermal Power to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Thermal

- 5.1.2. Renewable

- 5.1.3. Hydropower

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Engineering

- 5.2.2. Procurement

- 5.2.3. Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. China Indonesia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Indonesia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 8. India Indonesia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Indonesia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Indonesia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Indonesia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Indonesia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 PT Wijaya Karya (Persero) Tbk

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PT Pembangunan Perumahan (Persero) Tbk

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PT Rekayasa Industri (Persero)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.1 PT Wijaya Karya (Persero) Tbk

List of Figures

- Figure 1: Indonesia Power Generation EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Power Generation EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Power Generation EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Power Generation EPC Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: Indonesia Power Generation EPC Market Revenue Million Forecast, by Service 2019 & 2032

- Table 4: Indonesia Power Generation EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indonesia Power Generation EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Indonesia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Indonesia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Indonesia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Indonesia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Indonesia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Indonesia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Indonesia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Indonesia Power Generation EPC Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 14: Indonesia Power Generation EPC Market Revenue Million Forecast, by Service 2019 & 2032

- Table 15: Indonesia Power Generation EPC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Power Generation EPC Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Indonesia Power Generation EPC Market?

Key companies in the market include PT Wijaya Karya (Persero) Tbk , PT Pembangunan Perumahan (Persero) Tbk , PT Rekayasa Industri (Persero).

3. What are the main segments of the Indonesia Power Generation EPC Market?

The market segments include Technology, Service .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Growing Demand for Solar Energy-Based Power Generation4.; Declining Photovoltaic System Prices.

6. What are the notable trends driving market growth?

Conventional Thermal Power to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Country's Inefficient Electricity Grid Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Power Generation EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Power Generation EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Power Generation EPC Market?

To stay informed about further developments, trends, and reports in the Indonesia Power Generation EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence