Key Insights

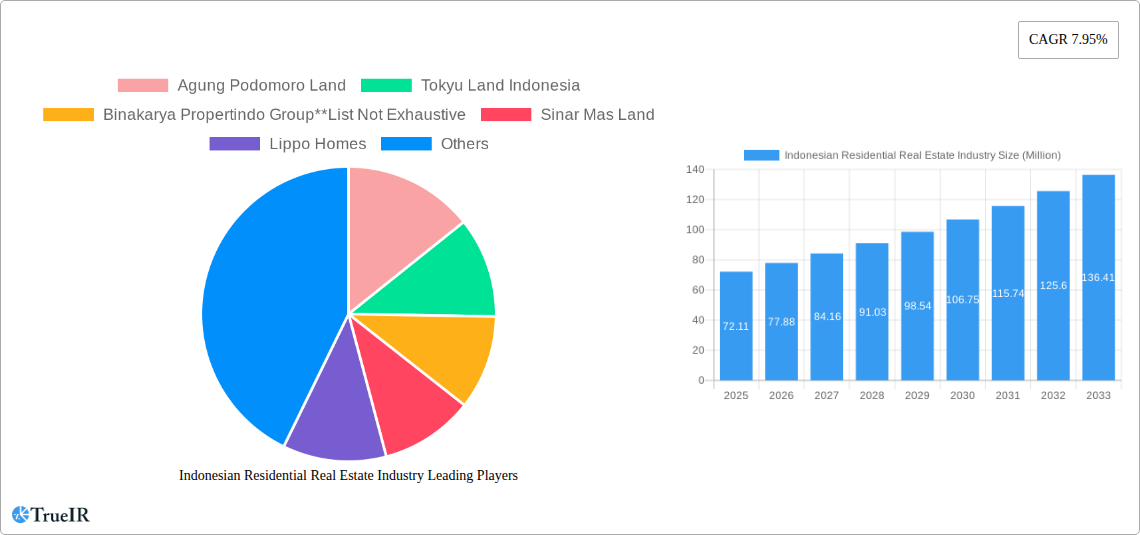

The Indonesian residential real estate market, valued at $72.11 million in 2025, is projected to experience robust growth, driven by a burgeoning population, increasing urbanization, and a rising middle class with enhanced purchasing power. The 7.95% CAGR (Compound Annual Growth Rate) indicates significant expansion over the forecast period (2025-2033). Key market segments include condominiums and apartments, catering to urban dwellers, and villas and landed houses, appealing to those seeking more space and privacy. Jakarta, Greater Surabaya, and Semarang represent the most significant urban centers driving demand, though growth is expected across the country. Strong economic fundamentals, government infrastructure development initiatives, and a growing preference for modern housing are contributing positively to market expansion. However, challenges such as fluctuating land prices, regulatory complexities, and potential interest rate adjustments could act as restraints on growth. Major players like Agung Podomoro Land, Tokyu Land Indonesia, and Sinar Mas Land are actively shaping the market landscape through innovative projects and strategic acquisitions. The market's performance will hinge on continued economic stability, effective government policies, and the adaptability of developers to evolving consumer preferences.

The projected growth trajectory necessitates strategic planning for developers and investors. Understanding the nuances of each segment, including preferences for property types across different cities, is crucial. Continuous monitoring of economic indicators, regulatory changes, and competition will be critical for navigating the complexities of this dynamic market. Furthermore, the increasing emphasis on sustainability and technologically advanced housing solutions presents both challenges and opportunities for companies in this sector. Developers that successfully integrate these factors into their offerings will be well-positioned to thrive in the Indonesian residential real estate market over the coming years.

Indonesian Residential Real Estate Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Indonesian residential real estate market, offering invaluable insights for investors, developers, and industry professionals. Covering the period 2019-2033, with a base year of 2025, this report projects robust growth, driven by dynamic market trends and significant investment opportunities. We examine key segments, dominant players, and emerging challenges, offering a clear roadmap for navigating this thriving market.

Indonesian Residential Real Estate Industry Market Structure & Competitive Landscape

The Indonesian residential real estate market exhibits a moderately concentrated structure, with a few large players commanding significant market share. Agung Podomoro Land, Sinar Mas Land, and Lippo Homes, among others, are key players. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately concentrated market. Innovation is driven by technological advancements in construction, design, and marketing, while regulatory changes, such as building codes and land acquisition policies, significantly impact market dynamics. Product substitutes, such as renting versus owning, also play a role. End-user segmentation is diverse, encompassing various income groups and preferences. Mergers and acquisitions (M&A) activity has been moderate in recent years, with an estimated xx Million USD in transaction volume during 2019-2024. Future M&A activity is projected to increase due to consolidation amongst major players.

- Market Concentration: Moderately concentrated, with a HHI of xx in 2025.

- Innovation Drivers: Technological advancements in construction, design, and marketing.

- Regulatory Impacts: Building codes, land acquisition policies, and environmental regulations.

- Product Substitutes: Renting, shared ownership models.

- End-User Segmentation: Diverse income groups, lifestyle preferences, and family sizes.

- M&A Trends: Moderate activity (xx Million USD, 2019-2024), projected increase in future years.

Indonesian Residential Real Estate Industry Market Trends & Opportunities

The Indonesian residential real estate market is experiencing strong growth, fueled by a burgeoning population, rising urbanization, and increasing disposable incomes. The market size is projected to reach xx Million USD in 2025, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Technological shifts, such as the adoption of Building Information Modeling (BIM) and smart home technologies, are transforming the industry. Consumer preferences are shifting towards sustainable, technologically advanced, and aesthetically pleasing properties. Intense competition necessitates innovative marketing strategies and a focus on customer experience. Market penetration rates for various property types vary significantly across different regions and income segments. Opportunities abound in affordable housing, sustainable developments, and integrated townships.

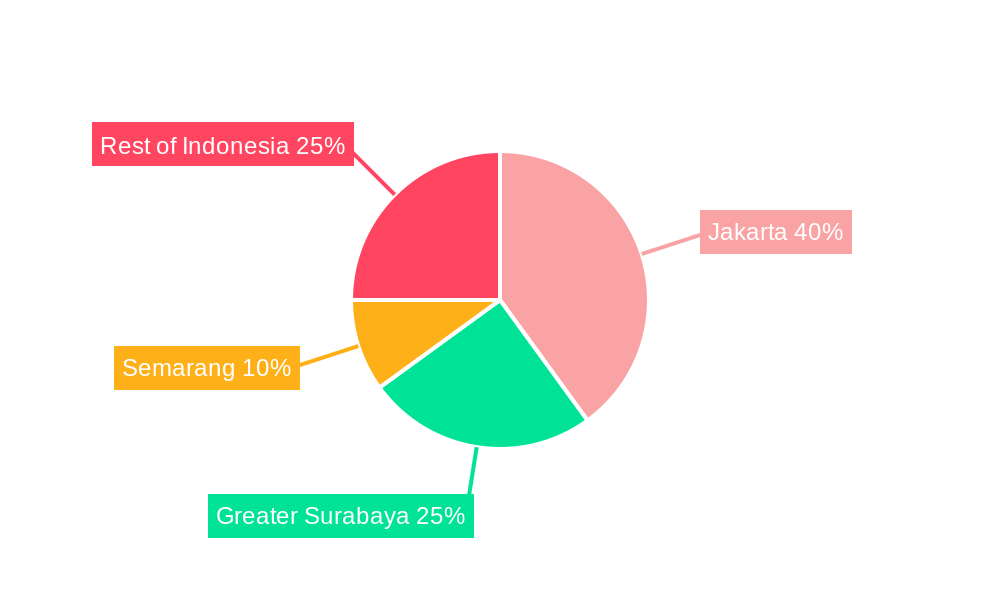

Dominant Markets & Segments in Indonesian Residential Real Estate Industry

Jakarta remains the dominant market, followed by Greater Surabaya. The condominium and apartment segment is experiencing the fastest growth, driven by urbanization and high demand in major cities.

- By Type:

- Condominiums and Apartments: High demand in urban centers, driven by urbanization and limited land availability. Key growth drivers include improved infrastructure, government incentives, and a growing young population.

- Villas and Landed Houses: Strong demand in suburban and rural areas, driven by preferences for larger living spaces and proximity to nature.

- By Key Cities:

- Jakarta: Highest demand, driven by economic activity and population density. Growth is fueled by infrastructural developments and government initiatives.

- Greater Surabaya: Significant growth potential, driven by industrial development and population growth. However, limitations on land availability present challenges.

- Semarang: Moderate growth, driven by regional development and rising middle class.

- Rest of Indonesia: Significant growth potential in secondary cities, driven by expanding infrastructure and improving accessibility.

Indonesian Residential Real Estate Industry Product Analysis

Product innovation is focused on enhancing sustainability, incorporating smart home technologies, and improving design aesthetics to cater to evolving consumer preferences. The use of prefabricated components and modular construction is gaining traction, improving efficiency and reducing costs. Competitive advantages stem from superior design, location, amenities, and brand reputation.

Key Drivers, Barriers & Challenges in Indonesian Residential Real Estate Industry

Key Drivers: Rapid urbanization, rising middle class, government support for infrastructure development, and technological advancements are propelling market growth. For example, the government's focus on infrastructure development, particularly in transportation and utilities, greatly enhances the attractiveness of residential areas.

Challenges: Regulatory complexities, including land acquisition processes and building permits, pose significant hurdles. Supply chain disruptions, particularly in the procurement of building materials, can impact project timelines and costs. Furthermore, intense competition necessitates continuous innovation and efficient cost management.

Growth Drivers in the Indonesian Residential Real Estate Industry Market

Strong economic growth, population increase, and government initiatives supporting infrastructure development are key drivers of growth. Technological innovation and increased foreign investment are also fueling the expansion of the market.

Challenges Impacting Indonesian Residential Real Estate Industry Growth

Regulatory hurdles, particularly land acquisition and permitting processes, create significant delays and increase costs. Supply chain vulnerabilities and labor shortages further constrain growth. The need for affordable housing alongside high-end properties presents a complex balancing act for developers.

Key Players Shaping the Indonesian Residential Real Estate Industry Market

- Agung Podomoro Land

- Tokyu Land Indonesia

- Binakarya Propertindo Group

- Sinar Mas Land

- Lippo Homes

- JABABEKA

- PT Pakuwon Jati

- Ciputra Group

- PP Properti

- Duta Anggada Realty

Significant Indonesian Residential Real Estate Industry Industry Milestones

- 2020: Government launches a new affordable housing program.

- 2022: Several major developers announce significant investments in sustainable building technologies.

- 2023: A large-scale M&A transaction takes place in the Jakarta market.

- 2024: New regulations implemented impacting construction timelines.

Future Outlook for Indonesian Residential Real Estate Industry Market

The Indonesian residential real estate market is poised for continued strong growth, driven by sustained economic expansion, population growth, and ongoing urbanization. Strategic opportunities exist in developing affordable housing, sustainable communities, and technologically advanced properties. The market's future success hinges on overcoming regulatory challenges, enhancing supply chain resilience, and adapting to evolving consumer preferences.

Indonesian Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and landed houses

-

2. Key Cities

- 2.1. Jakarta

- 2.2. Greater Surabaya

- 2.3. Semarang

- 2.4. Rest of Indonesia

Indonesian Residential Real Estate Industry Segmentation By Geography

- 1. Indonesia

Indonesian Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw material prices

- 3.4. Market Trends

- 3.4.1. Jakarta Emerging as a Prime Rental Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesian Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and landed houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Jakarta

- 5.2.2. Greater Surabaya

- 5.2.3. Semarang

- 5.2.4. Rest of Indonesia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Agung Podomoro Land

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tokyu Land Indonesia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Binakarya Propertindo Group**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinar Mas Land

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lippo Homes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JABABEKA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Pakuwon Jati

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ciputra Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PP Properti

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Duta Anggada Realty

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Agung Podomoro Land

List of Figures

- Figure 1: Indonesian Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesian Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Indonesian Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesian Residential Real Estate Industry?

The projected CAGR is approximately 7.95%.

2. Which companies are prominent players in the Indonesian Residential Real Estate Industry?

Key companies in the market include Agung Podomoro Land, Tokyu Land Indonesia, Binakarya Propertindo Group**List Not Exhaustive, Sinar Mas Land, Lippo Homes, JABABEKA, PT Pakuwon Jati, Ciputra Group, PP Properti, Duta Anggada Realty.

3. What are the main segments of the Indonesian Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investment in Infrastructure Projects; The rising popularity of sustainable architecture.

6. What are the notable trends driving market growth?

Jakarta Emerging as a Prime Rental Market.

7. Are there any restraints impacting market growth?

Volatility in Raw material prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesian Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesian Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesian Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Indonesian Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence