Key Insights

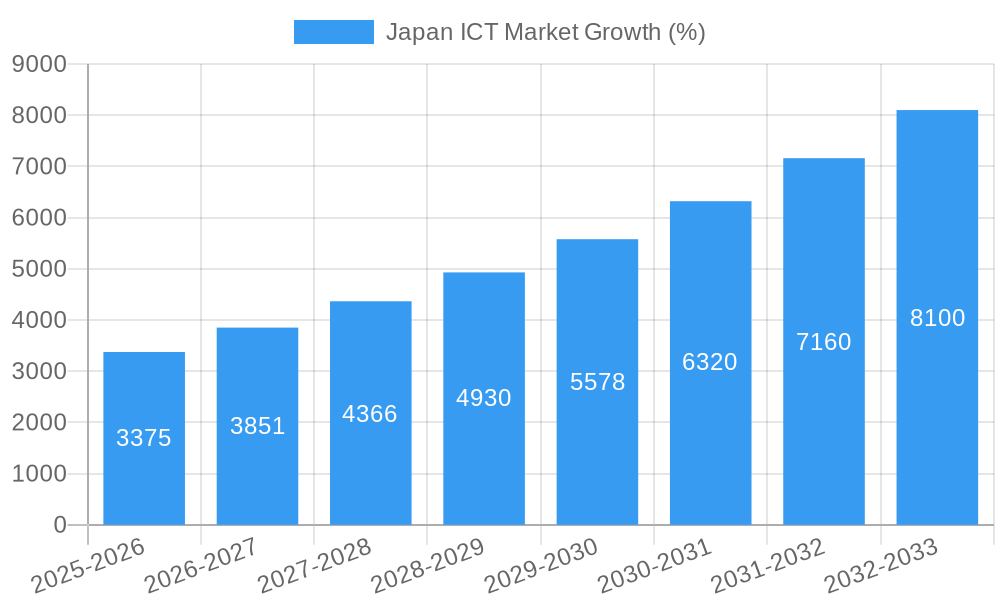

The Japan ICT market, valued at approximately ¥30 trillion (assuming a reasonable market size based on a mature economy and 11.25% CAGR) in 2025, is poised for robust growth, projected to reach ¥60 trillion by 2033, driven by a compound annual growth rate (CAGR) of 11.25%. This expansion is fueled by several key factors. Firstly, increasing digitalization across all sectors, particularly in BFSI, IT & Telecom, and Government, is driving demand for advanced technologies like cloud computing, AI, and IoT. Secondly, the Japanese government's initiatives promoting digital transformation and infrastructure development are further stimulating market growth. The rising adoption of 5G networks and the expanding use of smart devices are also contributing significantly to this trend. Finally, a growing focus on cybersecurity and data privacy within enterprises of all sizes (SMEs and large enterprises) is creating a substantial market for security solutions and services. Competition within the market is fierce, with major players like IBM Japan, ITOCHU Techno-Solutions, and Hitachi vying for market share alongside global giants such as Salesforce.

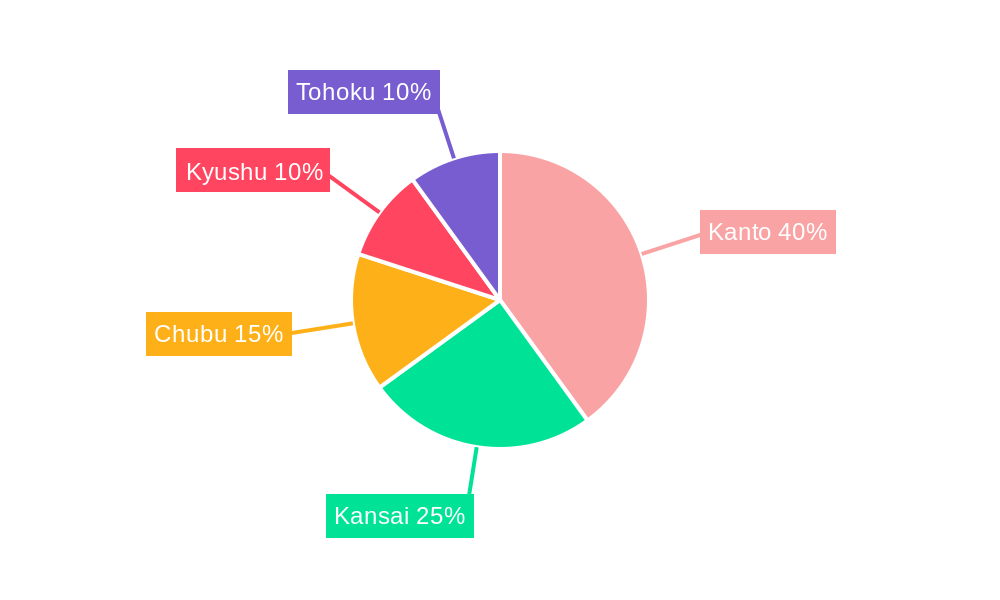

However, certain restraints could impede market growth. These include the relatively high cost of implementing new technologies, a potential skills gap in the ICT workforce, and the need for regulatory adjustments to keep pace with technological advancements. Market segmentation reveals that the software and IT services segments are the largest contributors to market revenue. The Kanto region, being the economic hub of Japan, holds the most significant market share. The forecast period (2025-2033) promises continued expansion, with significant opportunities for businesses focusing on cloud-based solutions, AI-powered services, and robust cybersecurity measures. The diverse industry verticals, along with the regional variations in adoption rates, present distinct market niches for players to capitalize on. Analyzing the historical period (2019-2024) and extrapolating trends into the forecast period helps predict future market performance with a high degree of accuracy.

Japan ICT Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Japan ICT market, offering invaluable insights for investors, businesses, and industry professionals. With a comprehensive study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report leverages extensive market research and data analysis to deliver actionable intelligence. The report covers key market segments, competitive landscapes, growth drivers, and challenges, painting a clear picture of the future of ICT in Japan. Projected market value for 2025 is estimated at xx Million.

Japan ICT Market Structure & Competitive Landscape

The Japanese ICT market exhibits a moderately concentrated structure, with a handful of dominant players alongside a vibrant ecosystem of smaller firms. The market concentration ratio (CR4) for 2024 is estimated at 40%, indicating significant influence from the top four players. Innovation is a key driver, spurred by increasing digitalization across various sectors, coupled with government initiatives promoting technological advancement. Regulatory frameworks, while supportive of technological progress, impose certain compliance requirements. Product substitution is a factor, particularly with cloud-based solutions gaining traction. The market is segmented by enterprise size (SMEs and large enterprises) and industry vertical (BFSI, IT & Telecom, Government, Retail & E-commerce, Manufacturing, Energy & Utilities, and Other). Mergers and acquisitions (M&A) activity has been relatively steady, with a noticeable increase in cross-border deals. The total M&A volume in 2024 reached approximately xx Million.

- Key Players: IBM Japan Ltd, ITOCHU Techno-Solutions Corporation (ITOCHU Corporation), Hitachi Ltd, Fujitsu Limited, SCSK Corporation (Sumitomo Corporation), NEC Corporation, TIS Inc, Salesforce, Panasonic Corporation, Sony Corporation.

- Market Concentration: CR4 estimated at 40% in 2024.

- M&A Activity: Total M&A volume in 2024: xx Million.

- Innovation Drivers: Government initiatives, digital transformation across sectors.

- Regulatory Impact: Compliance requirements balancing innovation.

Japan ICT Market Market Trends & Opportunities

The Japan ICT market is experiencing robust growth, driven by rising digital adoption, increasing government spending on digital infrastructure, and the escalating demand for advanced technologies. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%, signifying significant market expansion. Technological shifts, including the widespread adoption of 5G, AI, and IoT, are reshaping market dynamics. Consumer preferences are shifting towards cloud-based services, personalized experiences, and seamless connectivity. Competitive dynamics are characterized by both fierce competition and strategic partnerships. Market penetration rates for various technologies are increasing, especially in urban areas. The market size is expected to reach xx Million by 2033.

Dominant Markets & Segments in Japan ICT Market

The Japanese ICT market demonstrates robust growth across various segments. The IT Services segment is projected to maintain its leading position throughout the forecast period, fueled by rising demand for cloud computing, cybersecurity solutions, and digital transformation initiatives. The Large Enterprises segment is currently dominating in terms of market share due to their higher investment capacity in ICT infrastructure. The BFSI and IT & Telecom verticals exhibit the highest growth rates, driven by their heavy reliance on advanced technologies.

- Leading Segment (By Type): IT Services

- Leading Segment (By Enterprise Size): Large Enterprises

- Leading Segments (By Industry Vertical): BFSI and IT & Telecom

- Growth Drivers:

- BFSI: Increased adoption of digital banking and fintech solutions.

- IT & Telecom: 5G rollout and expansion of network infrastructure.

- Government: Initiatives to improve digital governance and public services.

- Retail & E-commerce: Growth of online shopping and omnichannel strategies.

Japan ICT Market Product Analysis

The Japanese ICT market showcases a dynamic landscape of product innovations, encompassing advanced hardware, intelligent software, comprehensive IT services, and high-speed telecommunication services. These offerings cater to the evolving needs of businesses and consumers, driving market growth. Key areas of innovation include advancements in AI, cloud computing, cybersecurity, and IoT technologies, resulting in enhanced efficiency, productivity, and connectivity across industries. The emphasis on user-friendly interfaces and robust security features is further shaping product development.

Key Drivers, Barriers & Challenges in Japan ICT Market

Key Drivers: The Japanese ICT market is propelled by factors like escalating government investments in digital infrastructure, a growing emphasis on digital transformation across industries, and a rapidly expanding adoption of cloud-based services. The increasing penetration of smartphones and the rising prevalence of IoT devices also contribute significantly to market growth.

Key Challenges: Significant barriers to growth include the high cost of implementing advanced technologies, concerns around data privacy and cybersecurity, and the need for skilled IT professionals. Regulatory complexities and a potentially fragmented supply chain pose further challenges. These factors could potentially restrict the market's expansion trajectory.

Growth Drivers in the Japan ICT Market Market

Significant growth is fueled by substantial government investments in digital infrastructure, the ongoing adoption of advanced technologies like AI and IoT across industries, and the rising demand for cloud-based solutions. Furthermore, a strong emphasis on digital transformation within the Japanese business landscape is also a significant contributor.

Challenges Impacting Japan ICT Market Growth

Challenges include the high initial investment costs associated with adopting new technologies, concerns over data privacy and cybersecurity, and the need for a skilled IT workforce. Additionally, regulatory complexities and potential supply chain disruptions pose significant hurdles to market expansion.

Key Players Shaping the Japan ICT Market Market

- IBM Japan Ltd

- ITOCHU Techno-Solutions Corporation (ITOCHU Corporation)

- Hitachi Ltd

- Fujitsu Limited

- SCSK Corporation (Sumitomo Corporation)

- NEC Corporation

- TIS Inc

- Salesforce

- Panasonic Corporation

- Sony Corporation

Significant Japan ICT Market Industry Milestones

- October 2022: Google announces the launch of its first data center in Japan by 2023, boosting connectivity and economic activity.

- February 2022: KDDI deploys the world's first commercial 5G standalone Open RAN, accelerating 5G adoption nationwide.

Future Outlook for Japan ICT Market Market

The Japan ICT market is poised for sustained growth, driven by continued digital transformation across various sectors, increasing government support for technological advancement, and the burgeoning adoption of emerging technologies such as AI and IoT. Strategic opportunities abound for businesses focused on cloud computing, cybersecurity, and digital transformation services. The market's potential for expansion is substantial, promising significant returns for investors and stakeholders alike.

Japan ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Japan ICT Market Segmentation By Geography

- 1. Japan

Japan ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising need to explore and adopt digital technologies and initiatives

- 3.3. Market Restrains

- 3.3.1. High CaPex for Building Data Center Along With Security Challenges

- 3.4. Market Trends

- 3.4.1. Rising need to explore and adopt digital technologies and initiatives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kanto Japan ICT Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan ICT Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan ICT Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan ICT Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan ICT Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IBM Japan Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ITOCHU Techno-Solutions Corporation (ITOCHU Corporation)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hitachi Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujitsu Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SCSK Corporation (Sumitomo Corporation)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NEC Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TIS Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Salesforce

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Panasonic Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sony Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IBM Japan Ltd

List of Figures

- Figure 1: Japan ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Japan ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Japan ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Japan ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Japan ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Kanto Japan ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kansai Japan ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Chubu Japan ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kyushu Japan ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Tohoku Japan ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Japan ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 14: Japan ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 15: Japan ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan ICT Market?

The projected CAGR is approximately 11.25%.

2. Which companies are prominent players in the Japan ICT Market?

Key companies in the market include IBM Japan Ltd, ITOCHU Techno-Solutions Corporation (ITOCHU Corporation), Hitachi Ltd, Fujitsu Limited, SCSK Corporation (Sumitomo Corporation), NEC Corporation, TIS Inc, Salesforce, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Japan ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising need to explore and adopt digital technologies and initiatives.

6. What are the notable trends driving market growth?

Rising need to explore and adopt digital technologies and initiatives.

7. Are there any restraints impacting market growth?

High CaPex for Building Data Center Along With Security Challenges.

8. Can you provide examples of recent developments in the market?

October 2022: Google announced that it will launch its first data center in Japan by 2023. The data center would provide more reliable, faster access to the company's products and services, support employment and economic activity, and connect Japan to the rest of the global digital economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan ICT Market?

To stay informed about further developments, trends, and reports in the Japan ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence