Key Insights

The Japan travel retail market is projected to reach $19.9 billion by 2025, driven by a CAGR of 5.7%. This robust growth is underpinned by several key factors: the strong rebound in international tourism post-pandemic, Japan's unique cultural allure, and a rising demand for experiential travel. These trends are significantly increasing sales across major travel hubs such as airports and train stations. Additionally, growing disposable incomes among both domestic and international travelers are boosting spending on premium goods and souvenirs. Innovative retail strategies, including personalized experiences and technological integration by leading operators like Lagardere, Shiseido, and DFS, further enhance the sector's attractiveness.

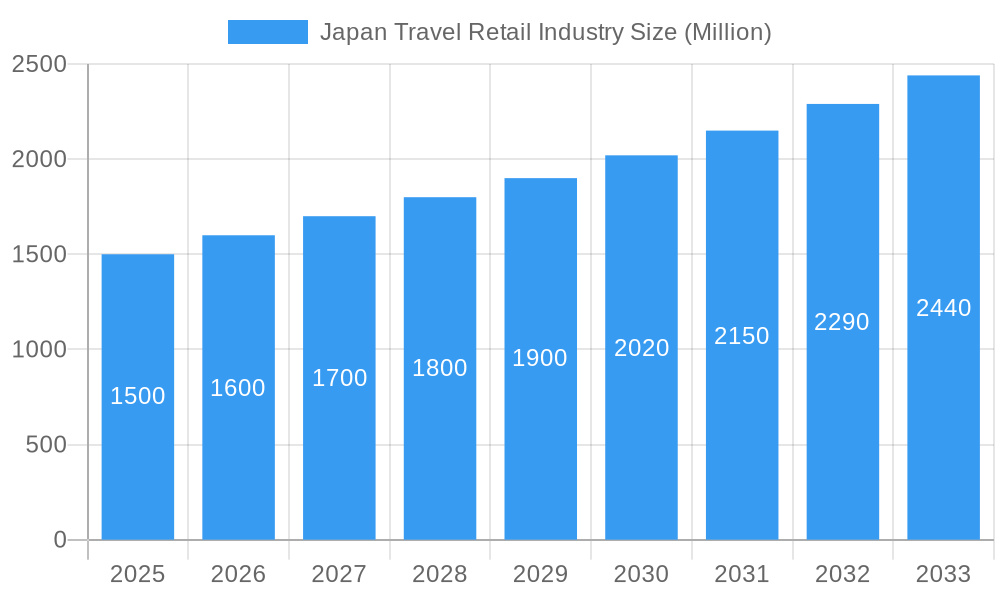

Japan Travel Retail Industry Market Size (In Billion)

Key challenges confronting the industry include currency exchange rate volatility, which can affect tourist spending power, and potential impacts from government regulations on duty-free allowances and import taxes. Intense competition from established and emerging players also demands strategic agility. The market's segmentation across diverse categories like cosmetics, liquor, confectionery, and luxury goods necessitates tailored marketing and product strategies. Despite these hurdles, the long-term outlook for the Japan travel retail industry remains highly positive, with sustained expansion anticipated through 2033, presenting significant opportunities for investors and businesses.

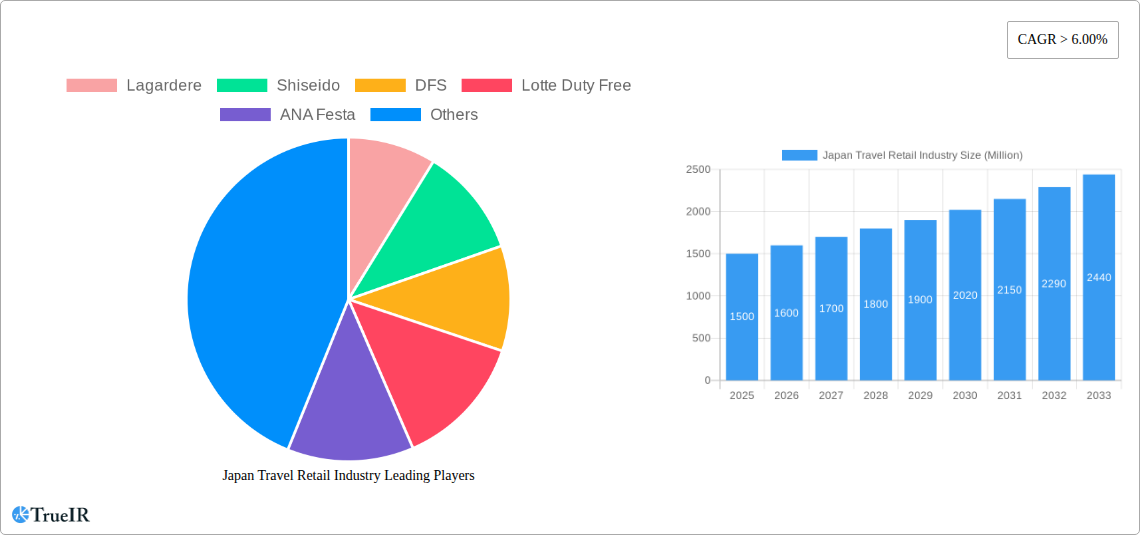

Japan Travel Retail Industry Company Market Share

Japan Travel Retail Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Japan Travel Retail industry, offering invaluable insights for investors, businesses, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report delves into market structure, competitive dynamics, growth drivers, and future outlook. Expect in-depth analysis of market size, CAGR, and key segments, empowering you to make informed strategic decisions. The report projects a market value exceeding xx Million by 2033.

Japan Travel Retail Industry Market Structure & Competitive Landscape

This section analyzes the competitive landscape of the Japan travel retail market, exploring market concentration, innovation, regulatory influence, and M&A activity. The industry displays a moderately concentrated structure, with key players like Lagardere, Shiseido, DFS, Lotte Duty Free, ANA Festa, LOFT, HIS Group, Daiso, Jalux, Fa-So-La, TIAT Duty Free, and Donki holding significant market share. However, the presence of numerous smaller players indicates a competitive environment.

The concentration ratio (CR4) is estimated at xx%, reflecting moderate market consolidation. Innovation is driven primarily by product diversification, enhanced customer experience through technology integration (e.g., mobile payment systems, personalized recommendations), and the development of exclusive travel retail product lines. Regulatory changes, such as those affecting duty-free allowances and import regulations, significantly impact market dynamics. M&A activity has been relatively moderate in recent years, with an estimated xx Million in deal value during the historical period (2019-2024). The market witnesses significant substitution from online retailers and domestic markets, particularly for less price-sensitive products. The end-user segmentation is largely defined by demographics (age, income), nationalities, and travel purpose (leisure vs. business).

Japan Travel Retail Industry Market Trends & Opportunities

The Japan travel retail market is experiencing robust growth, fueled by a rebound in international tourism post-pandemic and a growing preference for premium and experiential retail offerings. The market size is projected to reach xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further bolstered by technological advancements, such as the increased adoption of e-commerce platforms and mobile payment systems. Consumer preferences are shifting towards personalized experiences, sustainable products, and unique offerings catering to the local culture. Intense competition necessitates continuous innovation, strategic partnerships, and customer-centric strategies to secure a larger market share. Market penetration rates show xx% penetration in luxury goods and xx% in general merchandise, indicative of considerable room for expansion.

Dominant Markets & Segments in Japan Travel Retail Industry

The dominant segments are premium beauty and cosmetics, followed by luxury goods, spirits and tobacco, and confectioneries. Tokyo’s Narita and Haneda airports dominate the market, attributed to their high passenger traffic and well-established infrastructure.

- Key Growth Drivers for Dominant Segments:

- High tourist spending on luxury goods and beauty products.

- Growing demand for unique and authentic Japanese products.

- Investments in airport infrastructure and retail spaces.

- Supportive government policies promoting tourism.

The dominance of these airports and product categories is driven by high tourist volume, strategic partnerships with major brands, and a focus on premium retail experiences. Further growth is likely through expanding product offerings, improving customer engagement, and capitalizing on the rising demand for personalized retail experiences.

Japan Travel Retail Industry Product Analysis

Product innovation focuses on exclusive travel retail product lines, premium offerings, personalized experiences, and technologically driven solutions that improve customer convenience. Companies are leveraging technology for personalized shopping experiences, enhancing product discovery, and streamlining checkout processes. This improved convenience is a key competitive advantage, differentiating players in a crowded market. The alignment of products with consumer preferences for quality, uniqueness, and convenience is crucial for successful market penetration.

Key Drivers, Barriers & Challenges in Japan Travel Retail Industry

Key Drivers:

- Resurgence of International Tourism: Post-pandemic recovery in inbound tourism significantly boosts sales.

- Technological Advancements: Mobile payment, personalized recommendations, and omnichannel strategies enhance customer experience.

- Government Initiatives: Policies supporting tourism and easing visa processes further fuel market growth.

Challenges:

- Supply Chain Disruptions: Global supply chain volatility affects product availability and pricing. This has resulted in an estimated xx% increase in product costs during 2022-2023, impacting profitability.

- Economic Uncertainty: Global economic slowdown reduces consumer spending, impacting sales of non-essential products.

- Intense Competition: The market's highly competitive nature necessitates innovation and robust strategies for maintaining market share.

Growth Drivers in the Japan Travel Retail Industry Market

Key drivers include the resurgence of international tourism, driven by Japan's reopening to international visitors and increased travel demand. Technological advancements, offering personalized shopping experiences and streamlining operations, contribute significantly. Furthermore, government policies promoting tourism and supporting the growth of travel retail sector provide a favorable environment for market expansion.

Challenges Impacting Japan Travel Retail Industry Growth

Challenges include the lingering effects of the global economic slowdown, impacting consumer spending. Supply chain disruptions continue to affect product availability and increase costs. The intensely competitive market demands continuous innovation and strategic adaptations to maintain a competitive edge.

Key Players Shaping the Japan Travel Retail Industry Market

- Lagardere

- Shiseido

- DFS

- Lotte Duty Free

- ANA Festa

- LOFT

- HIS Group

- Daiso

- Jalux

- Fa-So-La

- TIAT Duty Free

- Donki

Significant Japan Travel Retail Industry Industry Milestones

- October 2022: Lotte Duty-Free Retail boosted South Korean operations due to Japan's visa-free travel policy, creating cross-market sales opportunities.

- February 2023: Shiseido Travel Retail launched its Baum brand in travel retail, enhancing its premium product portfolio.

Future Outlook for Japan Travel Retail Industry Market

The Japan travel retail industry is poised for continued growth, driven by the sustained recovery in international tourism and the ongoing adoption of innovative technologies. Strategic partnerships, diversification of product offerings, and focus on creating enhanced customer experiences will be key to success. The market presents significant opportunities for businesses willing to adapt to evolving consumer preferences and market dynamics, particularly in the premium and experience-driven segments.

Japan Travel Retail Industry Segmentation

-

1. Product Type

- 1.1. Fashion and Accessories

- 1.2. Wine and Spirits

- 1.3. Tobacco

- 1.4. Food and Confectionary

- 1.5. Fragrances and Cosmetics

- 1.6. Other Pr

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Distribution Channels

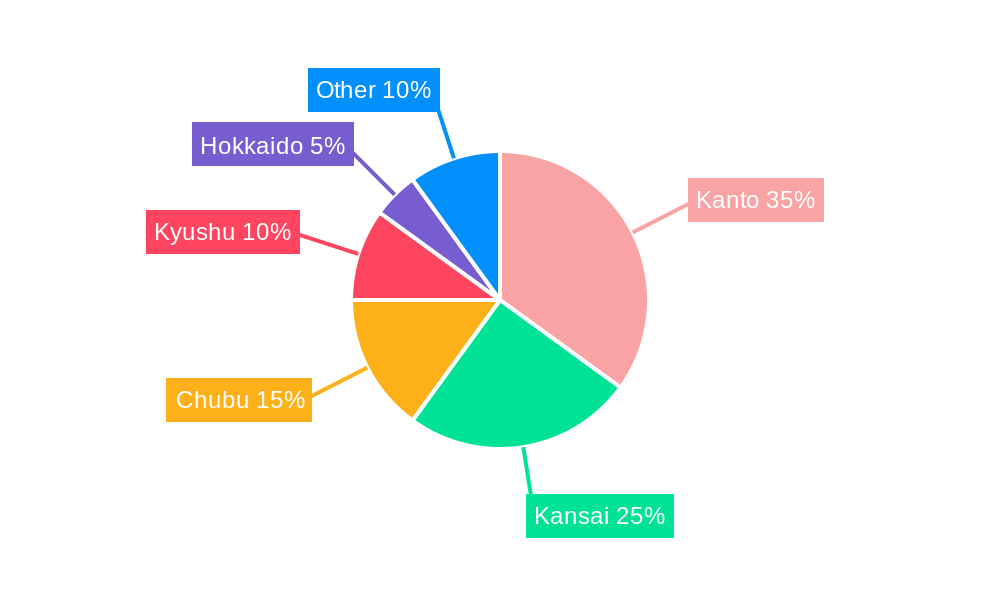

Japan Travel Retail Industry Segmentation By Geography

- 1. Japan

Japan Travel Retail Industry Regional Market Share

Geographic Coverage of Japan Travel Retail Industry

Japan Travel Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tourism Growth is Driving the Market; Airport Expansions is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Tourism Growth is Driving the Market; Airport Expansions is Driving the Market

- 3.4. Market Trends

- 3.4.1. Rising International Tourist Arrivals to Japan is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Wine and Spirits

- 5.1.3. Tobacco

- 5.1.4. Food and Confectionary

- 5.1.5. Fragrances and Cosmetics

- 5.1.6. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lagardere

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shiseido

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DFS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lotte Duty Free

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ANA Festa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LOFT

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HIS Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daiso

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jalux

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fa-So-La

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TIAT Duty Free

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Donki**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Lagardere

List of Figures

- Figure 1: Japan Travel Retail Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Travel Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Japan Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Japan Travel Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Japan Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Japan Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Travel Retail Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Japan Travel Retail Industry?

Key companies in the market include Lagardere, Shiseido, DFS, Lotte Duty Free, ANA Festa, LOFT, HIS Group, Daiso, Jalux, Fa-So-La, TIAT Duty Free, Donki**List Not Exhaustive.

3. What are the main segments of the Japan Travel Retail Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Tourism Growth is Driving the Market; Airport Expansions is Driving the Market.

6. What are the notable trends driving market growth?

Rising International Tourist Arrivals to Japan is Driving the Market.

7. Are there any restraints impacting market growth?

Tourism Growth is Driving the Market; Airport Expansions is Driving the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Shiseido Travel Retail has launched the Japanese skin and mind brand, Baum, in travel retail with the opening of its first counter with Japan Duty-Free Ginza at Mitsukoshi Ginza Department Store in downtown Tokyo.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Travel Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Travel Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Travel Retail Industry?

To stay informed about further developments, trends, and reports in the Japan Travel Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence