Key Insights

The Kuwait retail market is experiencing robust expansion, driven by a youthful demographic, increasing disposable incomes, and growing urbanization. This dynamic sector offers significant opportunities for growth and investment. A diverse range of retail formats, from traditional stores to advanced e-commerce platforms, effectively addresses evolving consumer needs. Major entities like The Sultan Center and Alshaya Group are key contributors to this moderately consolidated market. Projected to reach a market size of $12.5 billion by 2024, the industry is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.5%.

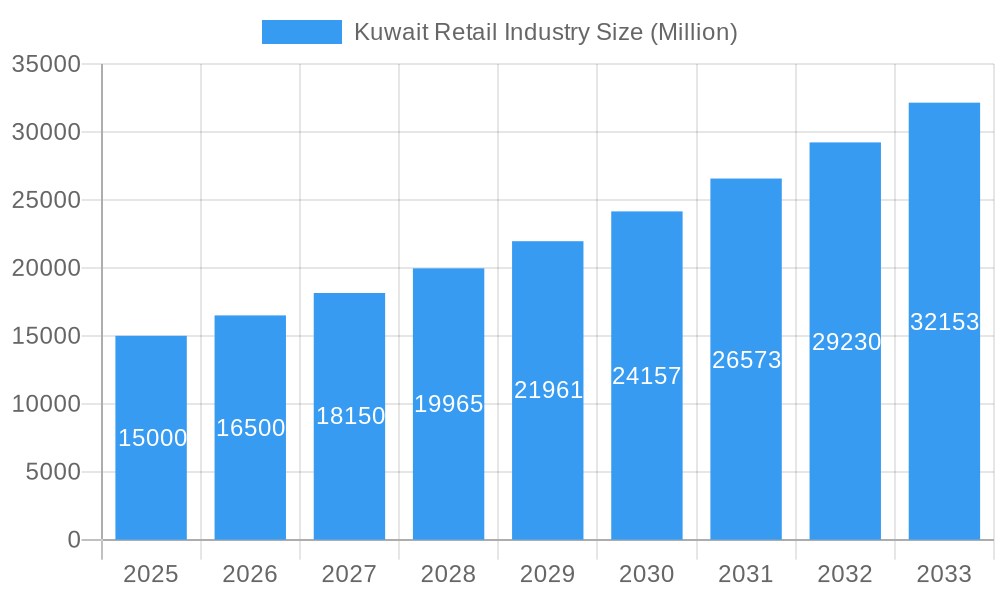

Kuwait Retail Industry Market Size (In Billion)

Looking towards 2033, continued growth is expected, fueled by infrastructure development, new retail spaces, and supportive government policies aimed at improving the business climate. Success in this evolving market hinges on adept supply chain management, a deep understanding of consumer behavior shifts, and strategic e-commerce integration. Differentiation will be achieved through exceptional customer experiences in an increasingly competitive arena.

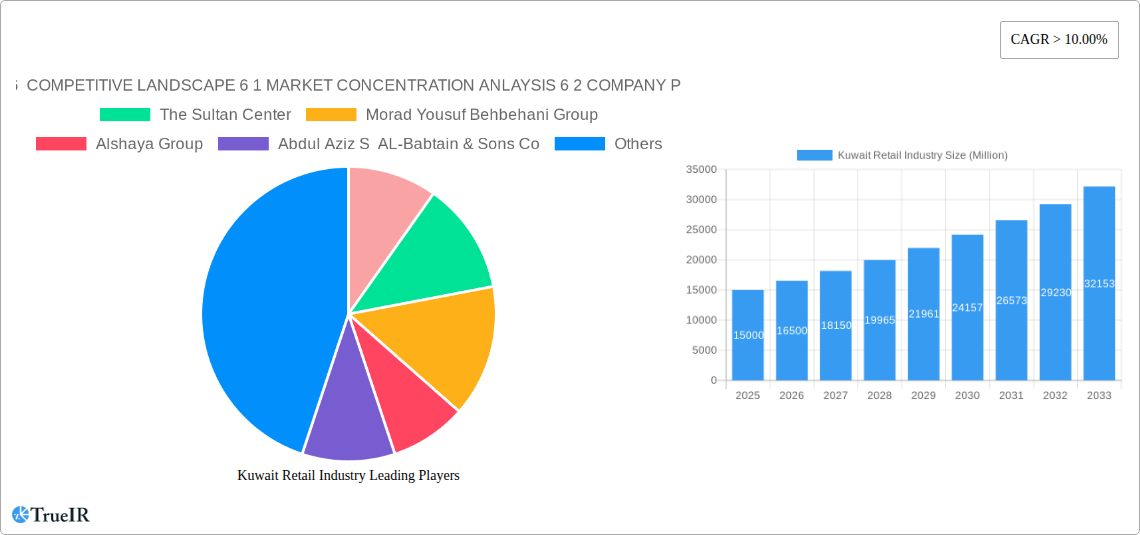

Kuwait Retail Industry Company Market Share

Kuwait Retail Industry Report: 2019-2033 Forecast - Unlocking Growth in a Dynamic Market

This comprehensive report provides an in-depth analysis of the Kuwait retail industry, offering invaluable insights for businesses, investors, and policymakers navigating this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report unveils key trends, opportunities, and challenges shaping the future of retail in Kuwait. With detailed market sizing, competitive landscape analysis, and segment-specific breakdowns, this report is your essential guide to understanding and capitalizing on the evolving Kuwait retail sector. Expect detailed analysis of market concentration, key players, and growth drivers influencing the $XX Million market.

Kuwait Retail Industry Market Structure & Competitive Landscape

The Kuwaiti retail market, valued at $XX Million in 2025, exhibits a moderately concentrated structure. The top 6 players account for approximately XX% of the market share (2025). Market concentration is influenced by several factors including the dominance of large conglomerates, the presence of international retail chains, and the significant influence of family-owned businesses. Innovation in the retail sector is driven by the adoption of e-commerce, omnichannel strategies, and the increasing demand for personalized customer experiences. Regulatory changes concerning import duties and licensing impact market dynamics. Product substitution is observed with the rise of online marketplaces and the increasing availability of imported goods. The end-user segmentation is diverse, catering to various income groups and lifestyle preferences. M&A activity within the sector remains moderate, with approximately XX deals recorded during the 2019-2024 period, primarily involving smaller players consolidating their positions.

- Market Concentration Ratio (CR6, 2025): XX%

- M&A Volume (2019-2024): XX deals

- Key Innovation Drivers: E-commerce, Omnichannel, Personalized Experiences

- Regulatory Impacts: Import Duties, Licensing Regulations

- Major End-User Segments: High-Income Households, Middle-Income Households, Low-Income Households

Kuwait Retail Industry Market Trends & Opportunities

The Kuwait retail market is projected to experience a Compound Annual Growth Rate (CAGR) of XX% during 2025-2033, driven by several key factors. Rising disposable incomes, coupled with a young and growing population, fuels increased consumer spending. Technological advancements, particularly the proliferation of smartphones and internet penetration, contribute to a rapidly expanding e-commerce sector. Consumer preferences are shifting towards convenience, quality, and personalized shopping experiences, impacting retail strategies. The competitive landscape is characterized by both established players and emerging brands vying for market share. Market penetration rates for online retail are projected to reach XX% by 2033, reflecting a significant shift in consumer behavior. The increasing adoption of digital marketing and customer relationship management (CRM) systems is further shaping the competitive dynamics. Opportunities exist in specialized retail segments such as health and wellness, and sustainable products.

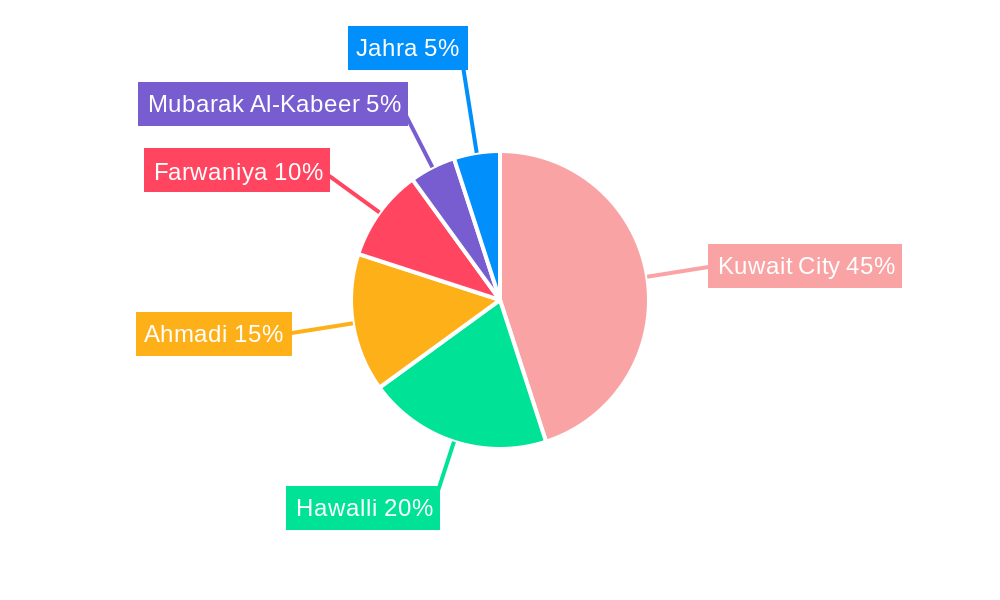

Dominant Markets & Segments in Kuwait Retail Industry

The Kuwait City metropolitan area remains the dominant retail market, accounting for approximately XX% of total retail sales. Key growth drivers for this region include high population density, strong purchasing power, and well-developed infrastructure. Other significant regions include Hawally and Farwaniya. The grocery and food retail segment holds the largest market share, projected to reach $XX Million in 2025, driven by the consistently high demand for essential goods. Other rapidly growing segments include apparel, electronics, and home furnishings. Government initiatives to support the growth of the retail sector, coupled with investments in retail infrastructure, contribute to sustained market expansion.

- Key Growth Drivers (Kuwait City): High Population Density, High Purchasing Power, Developed Infrastructure

- Largest Segment (2025): Grocery and Food Retail ($XX Million)

- Fastest Growing Segments: Apparel, Electronics, Home Furnishings

Kuwait Retail Industry Product Analysis

Product innovation in the Kuwait retail sector is focused on enhancing customer experience and expanding product offerings. This includes the introduction of innovative payment systems, personalized shopping apps, and the integration of technology into the physical retail environment. The increasing demand for premium and imported goods necessitates adaptation of product offerings and supply chains. This also includes the introduction of eco-friendly and ethically sourced products in response to growing consumer awareness.

Key Drivers, Barriers & Challenges in Kuwait Retail Industry

Growth Drivers in the Kuwait Retail Industry Market

Key growth drivers include rising disposable incomes, increasing urbanization, and supportive government policies. Technological advancements like e-commerce and mobile payment systems further fuel market expansion.

Challenges Impacting Kuwait Retail Industry Growth

Challenges include intense competition, regulatory hurdles, and supply chain complexities. Fluctuations in oil prices and economic volatility also impact consumer spending and overall market growth.

Key Players Shaping the Kuwait Retail Industry Market

- The Sultan Center

- Morad Yousuf Behbehani Group

- Alshaya Group

- Abdul Aziz S AL-Babtain & Sons Co

- Gulf Franchising Company

- Future Communication Company Global

- Villa Moda

- Musaed Bader Al Sayer Group

- YIACO Medical Company

- SAFWAN's Pharma

Significant Kuwait Retail Industry Industry Milestones

- 2021: Launch of a major online retail platform by a leading Kuwaiti conglomerate.

- 2022: Introduction of a new government initiative to boost the growth of small and medium-sized enterprises (SMEs) in the retail sector.

- 2023: Several mergers and acquisitions between smaller retailers to enhance market share.

Future Outlook for Kuwait Retail Industry Market

The Kuwait retail market is poised for continued growth, driven by sustained economic expansion, technological advancements, and evolving consumer preferences. Opportunities for growth lie in expanding e-commerce operations, diversifying product offerings, and adopting innovative retail technologies to improve customer experience. The market is projected to show robust growth over the forecast period, presenting substantial investment opportunities.

Kuwait Retail Industry Segmentation

-

1. Product

- 1.1. Food and Beverage and Tobacco Products

- 1.2. Personal and Household Care

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Pharmaceuticals, Luxury Goods, and Other Products

-

2. Distribution Channel

- 2.1. Stored-b

- 2.2. Direct Selling

- 2.3. E-commerce

- 2.4. Other Di

Kuwait Retail Industry Segmentation By Geography

- 1. Kuwait

Kuwait Retail Industry Regional Market Share

Geographic Coverage of Kuwait Retail Industry

Kuwait Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in the population is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverage and Tobacco Products

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Pharmaceuticals, Luxury Goods, and Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Stored-b

- 5.2.2. Direct Selling

- 5.2.3. E-commerce

- 5.2.4. Other Di

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 6 COMPETITIVE LANDSCAPE 6 1 MARKET CONCENTRATION ANLAYSIS 6 2 COMPANY PROFILES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Sultan Center

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Morad Yousuf Behbehani Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alshaya Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Abdul Aziz S AL-Babtain & Sons Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gulf Franchsing Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Future Communication Company Global

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Villa Moda

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Musaed Bader Al Sayer Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 YIACO Medical Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SAFWAN's Pharma*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 6 COMPETITIVE LANDSCAPE 6 1 MARKET CONCENTRATION ANLAYSIS 6 2 COMPANY PROFILES

List of Figures

- Figure 1: Kuwait Retail Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Kuwait Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Kuwait Retail Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Kuwait Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Kuwait Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Kuwait Retail Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Kuwait Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Kuwait Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Retail Industry?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Kuwait Retail Industry?

Key companies in the market include 6 COMPETITIVE LANDSCAPE 6 1 MARKET CONCENTRATION ANLAYSIS 6 2 COMPANY PROFILES, The Sultan Center, Morad Yousuf Behbehani Group, Alshaya Group, Abdul Aziz S AL-Babtain & Sons Co, Gulf Franchsing Company, Future Communication Company Global, Villa Moda, Musaed Bader Al Sayer Group, YIACO Medical Company, SAFWAN's Pharma*List Not Exhaustive.

3. What are the main segments of the Kuwait Retail Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in the population is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Retail Industry?

To stay informed about further developments, trends, and reports in the Kuwait Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence