Key Insights

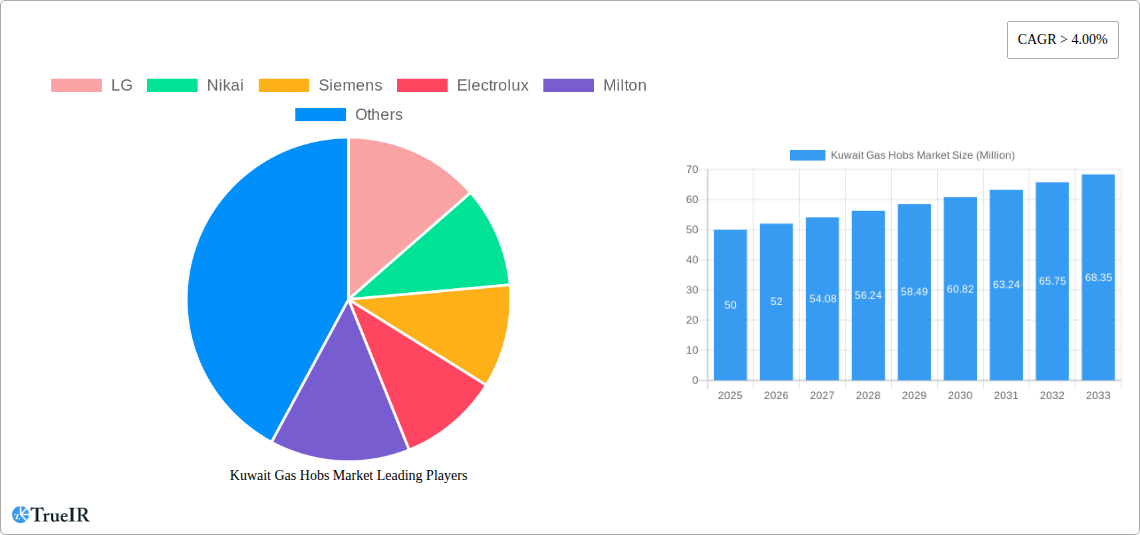

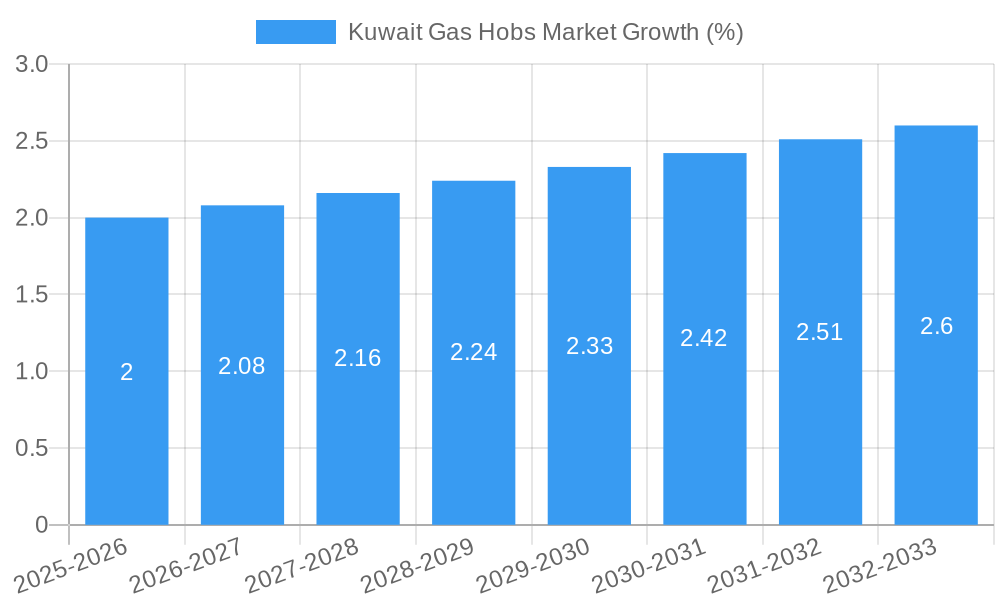

The Kuwait gas hob market, valued at approximately $50 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes among Kuwaiti households are fueling increased demand for modern kitchen appliances, including gas hobs. A preference for gas cooking, deeply ingrained in Kuwaiti culinary culture, continues to support market growth. Furthermore, the burgeoning hospitality sector and the expansion of restaurants and hotels are contributing to the demand for commercial gas hobs. The market is segmented by product type (desktop and embedded gas hobs) and application type (household and commercial). Embedded gas hobs are gaining traction due to their sleek design and space-saving features, while the household segment remains dominant, reflecting the widespread use of gas hobs in Kuwaiti homes. Leading brands such as LG, Nikai, Siemens, Electrolux, Milton, Haier, Sonashi, Better Life, Bosch, and Whirlpool are actively competing in this market, offering a diverse range of features and price points.

However, the market faces some challenges. Fluctuations in global gas prices can impact the affordability of gas hobs, potentially affecting consumer demand. Furthermore, increasing competition from electric and induction cooktops presents a significant challenge, especially among consumers seeking energy efficiency and modern features. The government's focus on energy conservation initiatives might also influence consumer preference towards more energy-efficient alternatives in the longer term. Despite these challenges, the strong preference for gas cooking and consistent growth in the hospitality sector are expected to propel the Kuwait gas hob market towards sustained expansion in the forecast period. Strategic pricing, innovative product features, and targeted marketing campaigns are crucial for brands aiming to capitalize on this growth opportunity.

Kuwait Gas Hobs Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Kuwait Gas Hobs market, offering invaluable insights for businesses and investors seeking to navigate this evolving landscape. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to illuminate key trends, opportunities, and challenges. The market is segmented by product type (Desktop Gas Hobs, Embedded Gas Hobs) and application type (Household, Commercial), and key players such as LG, Nikai, Siemens, Electrolux, Milton, Haier, Sonashi, Better Life, Bosch, and Whirlpool are thoroughly examined. The report projects a market size of xx Million by 2033, presenting a robust CAGR of xx%.

Kuwait Gas Hobs Market Market Structure & Competitive Landscape

The Kuwait Gas Hobs market exhibits a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2024. Innovation is a key driver, with companies constantly introducing new features like improved burner technology and smart connectivity. Regulatory compliance regarding safety and energy efficiency plays a significant role. The market also faces competition from alternative cooking methods, such as induction hobs. End-user segmentation is primarily driven by household and commercial needs, with household applications dominating the market. M&A activity has been relatively low in recent years, with only xx significant transactions recorded between 2019 and 2024. This suggests a focus on organic growth and product differentiation rather than consolidation.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Smart features, energy efficiency, improved burner technology.

- Regulatory Impacts: Safety standards, energy efficiency regulations.

- Product Substitutes: Induction hobs, electric cooktops.

- End-User Segmentation: Household (xx%), Commercial (xx%).

- M&A Trends: Low activity (xx transactions between 2019-2024).

Kuwait Gas Hobs Market Market Trends & Opportunities

The Kuwait Gas Hobs market is experiencing steady growth, driven by rising disposable incomes, urbanization, and a preference for modern kitchen appliances. Technological advancements, such as the integration of smart features and improved burner designs, are shaping consumer preferences. The market is witnessing increased penetration of embedded gas hobs in new constructions, boosting segment growth. Competitive dynamics are characterized by a mix of established players and emerging brands vying for market share. The report projects a CAGR of xx% from 2025 to 2033, with the market size reaching xx Million by 2033. The increasing demand for energy-efficient and technologically advanced gas hobs presents significant opportunities for market players. This includes expansion into smart home integration and offering higher-end models with advanced features.

Dominant Markets & Segments in Kuwait Gas Hobs Market

The Household segment dominates the Kuwait Gas Hobs market, accounting for xx% of the total market revenue in 2024. The growth is primarily fueled by rising urbanization, increasing disposable incomes, and a growing preference for modern kitchens. Desktop gas hobs currently hold a larger market share compared to embedded gas hobs, but the embedded segment is expected to witness significant growth in the forecast period driven by new construction and renovations.

- Key Growth Drivers (Household Segment):

- Rising disposable incomes

- Urbanization and new housing construction

- Preference for modern kitchen appliances

- Key Growth Drivers (Embedded Gas Hobs Segment):

- New construction and renovation projects

- Increasing preference for built-in appliances

- Enhanced aesthetic appeal in modern kitchens

Kuwait Gas Hobs Market Product Analysis

Product innovation in the Kuwait Gas Hobs market focuses on improved burner technology for efficient cooking, enhanced safety features, and the integration of smart functionalities. Competition is fierce, with manufacturers constantly striving to offer superior designs, energy efficiency, and ease of use. The market is seeing a shift towards embedded gas hobs due to their sleek aesthetics and integration with modern kitchen designs. The introduction of smart features, such as connectivity to smartphones, allows users to control and monitor cooking remotely.

Key Drivers, Barriers & Challenges in Kuwait Gas Hobs Market

Key Drivers: Rising disposable incomes, increasing urbanization, and a growing preference for modern kitchens are the primary drivers of the Kuwait Gas Hobs market. Government initiatives promoting energy efficiency are also contributing to market growth.

Key Challenges: Supply chain disruptions, fluctuating raw material prices, and intense competition among manufacturers pose significant challenges. Stricter safety and environmental regulations add to the complexity of operating in this market. The market faces challenges from the increasing popularity of induction cooktops, which offer faster heating and greater energy efficiency.

Growth Drivers in the Kuwait Gas Hobs Market Market

Technological advancements, such as the development of smart gas hobs, and favorable government policies promoting energy efficiency are key growth drivers. The increasing demand for modern and stylish kitchen appliances further fuels the market’s expansion.

Challenges Impacting Kuwait Gas Hobs Market Growth

Fluctuating raw material prices and supply chain vulnerabilities are major challenges. Intense competition and the emergence of alternative cooking technologies also pose a threat to market growth.

Key Players Shaping the Kuwait Gas Hobs Market Market

Significant Kuwait Gas Hobs Market Industry Milestones

- September 2021: Electrolux introduced a range of gas hobs (26" to 36") with two brass power burners and backlit knobs.

- December 2021: LG Electronics launched its LG InstaView Double Oven Gas Slide-in Range and Over-the-Range Microwave Oven at CES 2022, featuring integration with the LG ThinQ™ Recipe feature (18,000+ interactive recipes).

Future Outlook for Kuwait Gas Hobs Market Market

The Kuwait Gas Hobs market is poised for continued growth, driven by technological innovation, rising disposable incomes, and increasing urbanization. Strategic partnerships, product diversification, and expansion into new market segments present significant opportunities for market players. The market is expected to maintain its growth trajectory, driven by the ongoing demand for convenient and efficient cooking solutions.

Kuwait Gas Hobs Market Segmentation

-

1. Product Type

- 1.1. Desktop Gas Hobs

- 1.2. Embedded Gas Hobs

-

2. Application Type

- 2.1. Household

- 2.2. Commercial

Kuwait Gas Hobs Market Segmentation By Geography

- 1. Kuwait

Kuwait Gas Hobs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes

- 3.3. Market Restrains

- 3.3.1. Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges

- 3.4. Market Trends

- 3.4.1. Kuwait's Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Desktop Gas Hobs

- 5.1.2. Embedded Gas Hobs

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Household

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nikai

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Milton

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sonashi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Better Life

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bosch

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Whirpool

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: Kuwait Gas Hobs Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Gas Hobs Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Gas Hobs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Gas Hobs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Kuwait Gas Hobs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Kuwait Gas Hobs Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Kuwait Gas Hobs Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 6: Kuwait Gas Hobs Market Volume K Unit Forecast, by Application Type 2019 & 2032

- Table 7: Kuwait Gas Hobs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Kuwait Gas Hobs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Kuwait Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Kuwait Gas Hobs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Kuwait Gas Hobs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Kuwait Gas Hobs Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 13: Kuwait Gas Hobs Market Revenue Million Forecast, by Application Type 2019 & 2032

- Table 14: Kuwait Gas Hobs Market Volume K Unit Forecast, by Application Type 2019 & 2032

- Table 15: Kuwait Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Kuwait Gas Hobs Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Gas Hobs Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Kuwait Gas Hobs Market?

Key companies in the market include LG, Nikai, Siemens, Electrolux, Milton, Haier, Sonashi, Better Life, Bosch, Whirpool.

3. What are the main segments of the Kuwait Gas Hobs Market?

The market segments include Product Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Tech-Savvy Millennial Population; Increasing Purchasing Power and Rising Disposable Incomes.

6. What are the notable trends driving market growth?

Kuwait's Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

Risk of Malware Attacks; Higher Cost of Maintenance4.3.2.1; Market Opportunities4.; Technological Advancements in Smart Fridges.

8. Can you provide examples of recent developments in the market?

On September 2021, Electrolux introduced range of gas hobs varying from 26" to 36". These gas hobs comes with two bras power burners and also feature backlit knobs that turns on once burner is lit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Gas Hobs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Gas Hobs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Gas Hobs Market?

To stay informed about further developments, trends, and reports in the Kuwait Gas Hobs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence