Key Insights

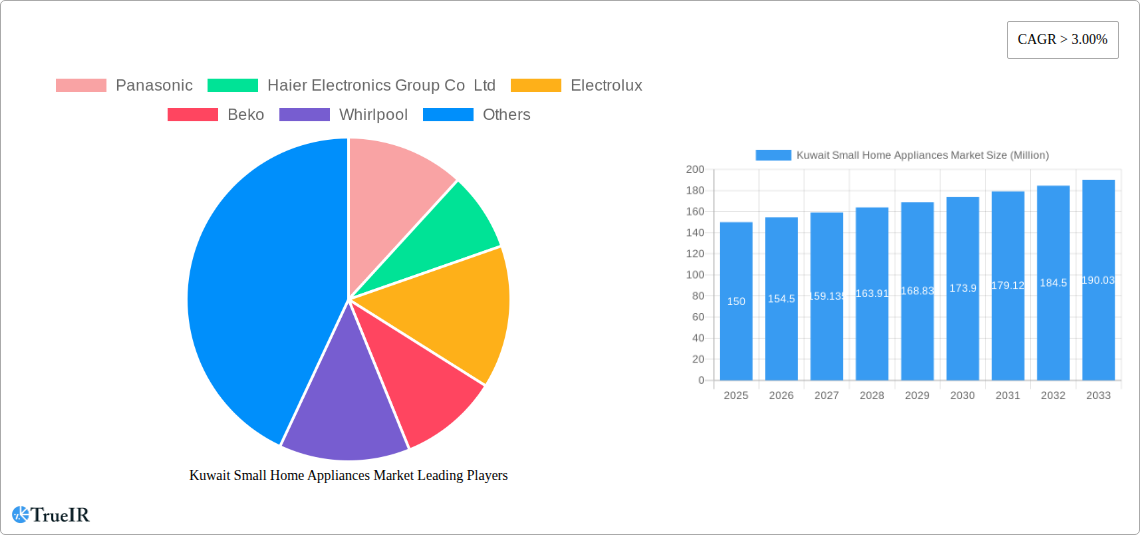

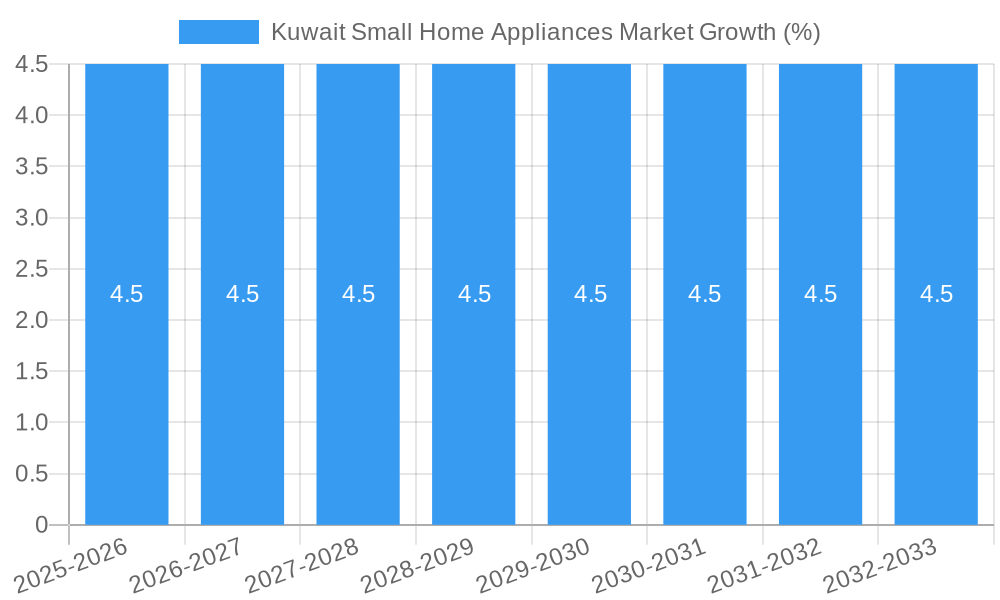

The Kuwait small home appliance market, valued at approximately $150 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. This growth is driven primarily by rising disposable incomes, increasing urbanization, a growing preference for convenience, and the adoption of modern lifestyles among Kuwaiti households. Key product segments include vacuum cleaners, coffee machines, food processors, toasters, grills & roasters, and other smaller appliances. The market is witnessing a shift towards premium, technologically advanced appliances, reflecting consumer demand for enhanced functionality and energy efficiency. Online channels are gaining traction, complementing traditional multi-branded and specialty stores, and representing a significant avenue for future growth. Leading brands like Panasonic, Haier, Electrolux, Beko, Whirlpool, and Samsung dominate the market, leveraging their established brand reputations and extensive distribution networks. However, the market faces certain restraints including price sensitivity among some consumer segments and the potential for economic fluctuations to impact purchasing decisions.

Despite these challenges, the long-term outlook for the Kuwait small home appliance market remains positive. Factors such as the continuing growth of the Kuwaiti population and a consistent demand for efficient and user-friendly home appliances are expected to fuel sustained expansion. Competition among existing players is anticipated to intensify, with a focus on product innovation, improved customer service, and strategic marketing campaigns to attract and retain market share. Furthermore, the increasing penetration of e-commerce presents both opportunities and challenges for market players, requiring adaptability and investment in robust online platforms and logistics infrastructure. The next decade will likely witness a consolidation of brands as smaller players struggle to compete with larger, more established companies.

Kuwait Small Home Appliances Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the Kuwait small home appliances market, offering invaluable insights for businesses, investors, and industry stakeholders. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report leverages robust data and expert analysis to illuminate the market's current state and future trajectory. The market is expected to reach xx Million by 2033, showcasing significant growth potential.

Kuwait Small Home Appliances Market Market Structure & Competitive Landscape

This section dissects the competitive dynamics of the Kuwaiti small home appliance market. We analyze market concentration through concentration ratios, examining the market share held by leading players like Panasonic, Haier Electronics Group Co Ltd, Electrolux, Beko, Whirlpool, Candy Group, Hitachi, Samsung, Arcelik, and BSH Home Appliances Group. The report assesses the influence of innovation drivers, such as technological advancements in energy efficiency and smart features, on market growth. Regulatory impacts, including safety standards and import/export regulations, are also considered. Furthermore, the analysis explores the presence and impact of product substitutes (e.g., traditional cleaning methods) and end-user segmentation based on demographics and lifestyle preferences. Finally, M&A activity within the industry, including volume and impact on market concentration, is evaluated. We predict an increase in M&A activity in the next decade due to heightened competition and the pursuit of synergies in distribution and technological advancements. The overall market concentration is predicted to remain moderately high, with the top 5 players accounting for approximately xx% of the market share by 2033.

Kuwait Small Home Appliances Market Market Trends & Opportunities

This section delves into the evolving landscape of the Kuwait small home appliances market. It examines the market size growth trajectory, illustrating the Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033). We analyze shifts in consumer preferences, including the growing demand for energy-efficient and smart appliances. Technological advancements, such as the integration of IoT capabilities and improved motor technology, are meticulously examined for their impact on market dynamics. The report further dissects the competitive landscape, identifying key strategies employed by major players and exploring emerging opportunities for new entrants. The market penetration rate for smart home appliances is projected to reach xx% by 2033, driven by increasing internet connectivity and consumer adoption of smart home technology. Market size growth is strongly correlated with disposable income and the increasing urbanization rate in Kuwait.

Dominant Markets & Segments in Kuwait Small Home Appliances Market

This section pinpoints the leading segments within the Kuwaiti small home appliances market, both geographically and by product category and distribution channel. We analyze the market share of each product category (Vacuum Cleaners, Coffee Machines, Food Processors, Toasters, Grills & Roasters, Others Small Home Appliances) and distribution channel (Multi-Branded Stores, Specialty Stores, Online, Other Distribution Channels).

Key Growth Drivers:

- Rising Disposable Incomes: Increased purchasing power fuels demand for premium and technologically advanced appliances.

- Urbanization: Growth in urban populations leads to higher demand for convenience-oriented small home appliances.

- Evolving Consumer Lifestyles: The shift towards more convenient and time-saving appliances drives market expansion.

- Government Initiatives: Policies supporting consumer spending and infrastructure development positively impact market growth.

The analysis will detail which specific product category and distribution channel are currently dominating the market and why, providing quantitative data to support these claims. We predict that online sales will experience the highest growth rate among distribution channels during the forecast period.

Kuwait Small Home Appliances Market Product Analysis

The Kuwaiti small home appliances market showcases continuous product innovation. Recent launches include Samsung's Jet™ cordless stick vacuum cleaner (April 2022) with its 200W suction power, marking a significant entry into the vacuum cleaner segment. Panasonic’s March 2022 launch of a premium dry vacuum cleaner with a 2000W motor and 18-liter dust tank emphasizes the growing demand for high-performance, hygienic cleaning solutions. These innovations, coupled with the integration of smart features and improved energy efficiency, cater to evolving consumer preferences for convenience and sustainability.

Key Drivers, Barriers & Challenges in Kuwait Small Home Appliances Market

Key Drivers:

- Technological advancements in energy efficiency, smart features, and improved performance.

- Rising disposable incomes and increasing urbanization within Kuwait.

- Shifting consumer preferences towards convenience and time-saving appliances.

Challenges & Restraints:

- Intense competition from both local and international brands.

- Dependence on imports for certain components, impacting supply chain resilience.

- Fluctuations in oil prices and their impact on consumer spending.

- Potential regulatory changes impacting product standards and import regulations.

Growth Drivers in the Kuwait Small Home Appliances Market Market

The growth of the Kuwait small home appliances market is driven by a confluence of factors. Technological advancements, leading to energy-efficient and smart appliances, are a primary catalyst. Economic growth, reflected in rising disposable incomes and urbanization, further fuels demand. Supportive government policies, fostering consumer spending and infrastructure development, contribute significantly to market expansion. Additionally, changing consumer lifestyles, favoring convenience and time-saving solutions, significantly impact market growth.

Challenges Impacting Kuwait Small Home Appliances Market Growth

Several factors could hinder the market's growth. Intense competition from established international and emerging local brands presents a significant challenge. Supply chain vulnerabilities, particularly dependence on imports for certain components, pose risks. Fluctuations in oil prices could impact consumer spending and demand. Lastly, potential regulatory changes affecting product standards and import regulations may introduce uncertainties.

Key Players Shaping the Kuwait Small Home Appliances Market Market

- Panasonic

- Haier Electronics Group Co Ltd

- Electrolux

- Beko

- Whirlpool

- Candy Group

- Hitachi

- Samsung

- Arcelik

- BSH Home Appliances Group

Significant Kuwait Small Home Appliances Market Industry Milestones

- April 2022: Samsung launched its premium Samsung Jet™ cordless stick vacuum cleaner line-up, significantly impacting the vacuum cleaner segment with its high suction power (up to 200W).

- March 2022: Panasonic launched a premium dry vacuum cleaner with a 2000W motor and 18-liter dust tank, responding to increased hygiene concerns and demand for convenient cleaning.

Future Outlook for Kuwait Small Home Appliances Market Market

The future of the Kuwait small home appliances market appears bright. Continued technological innovation, particularly in smart home appliances and energy efficiency, will drive growth. Rising disposable incomes and urbanization will further enhance market potential. Strategic partnerships and product diversification will become increasingly vital for businesses aiming to thrive in this dynamic environment. The market is poised for robust growth, driven by a favorable economic outlook and evolving consumer preferences.

Kuwait Small Home Appliances Market Segmentation

-

1. Product

- 1.1. Vacuum Cleaners

- 1.2. Coffee Machines

- 1.3. Food Processors

- 1.4. Toasters

- 1.5. Grills & Roasters

- 1.6. Others Small Home Appliances

-

2. Distribution Channel

- 2.1. Multi Branded Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Kuwait Small Home Appliances Market Segmentation By Geography

- 1. Kuwait

Kuwait Small Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Customization and Personalization; Increasing Home Improvement and Renovation Trends

- 3.3. Market Restrains

- 3.3.1. Lack of Expertise Restraining the Market; The Cost of the Materials can be a Significant Restraint

- 3.4. Market Trends

- 3.4.1. Smart Homes are Driving the Growth of Small Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Small Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Vacuum Cleaners

- 5.1.2. Coffee Machines

- 5.1.3. Food Processors

- 5.1.4. Toasters

- 5.1.5. Grills & Roasters

- 5.1.6. Others Small Home Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haier Electronics Group Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Electrolux

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beko

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Whirlpool

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Candy Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hitachi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Samsung

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Arcelik

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BSH Home Appliances Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Small Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Small Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Small Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Small Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Kuwait Small Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Kuwait Small Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Kuwait Small Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Kuwait Small Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Kuwait Small Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Kuwait Small Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Kuwait Small Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Kuwait Small Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Kuwait Small Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: Kuwait Small Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 13: Kuwait Small Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Kuwait Small Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 15: Kuwait Small Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Kuwait Small Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Small Home Appliances Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Kuwait Small Home Appliances Market?

Key companies in the market include Panasonic, Haier Electronics Group Co Ltd, Electrolux, Beko, Whirlpool, Candy Group, Hitachi, Samsung, Arcelik, BSH Home Appliances Group.

3. What are the main segments of the Kuwait Small Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Customization and Personalization; Increasing Home Improvement and Renovation Trends.

6. What are the notable trends driving market growth?

Smart Homes are Driving the Growth of Small Appliances.

7. Are there any restraints impacting market growth?

Lack of Expertise Restraining the Market; The Cost of the Materials can be a Significant Restraint.

8. Can you provide examples of recent developments in the market?

In April 2022: Samsung has launched its premium, highly powerful and intuitive Samsung Jet™ cordless stick vacuum cleaner line-up, delivering the ultimate end-to-end hygienic home cleaning solution to consumers. The launch marks Samsung's foray in the vacuum cleaner segment with a range that can generate up to 200W of industry-leading suction power.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Small Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Small Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Small Home Appliances Market?

To stay informed about further developments, trends, and reports in the Kuwait Small Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence