Key Insights

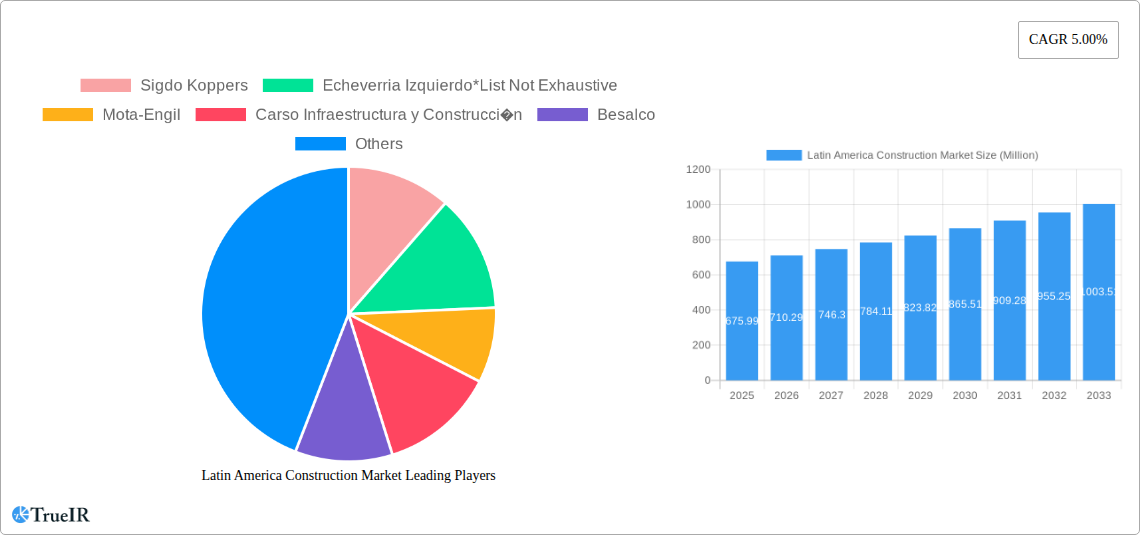

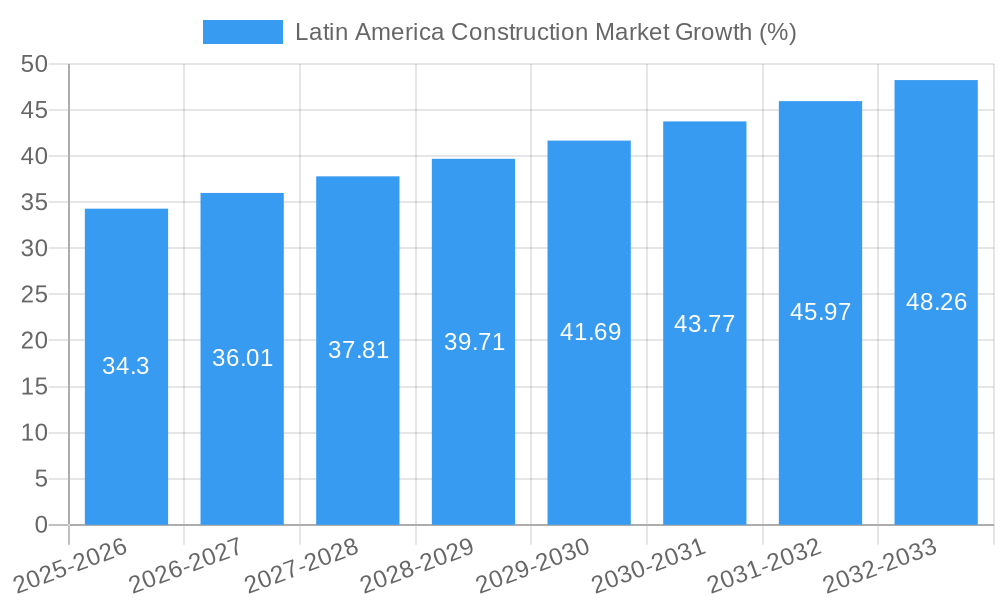

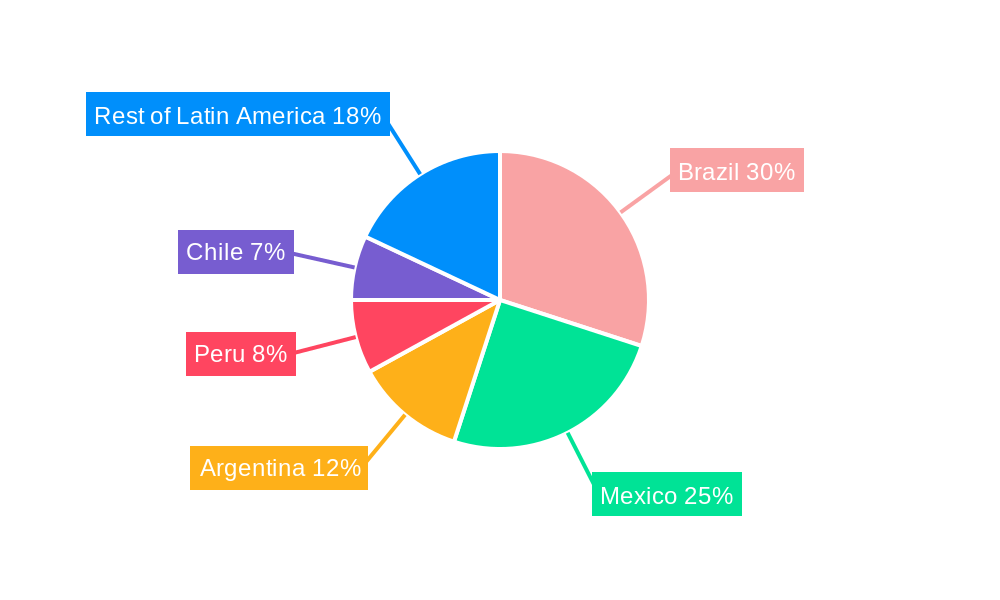

The Latin American construction market, valued at $675.99 million in 2025, is projected to experience robust growth, driven by significant infrastructure development initiatives across the region. Governments in Brazil, Mexico, and other key nations are investing heavily in projects encompassing transportation networks, energy infrastructure, and housing developments, fueling this expansion. The increasing urbanization rate within Latin America, coupled with a growing middle class demanding improved housing and living standards, further strengthens market demand. Specific segments like residential construction and infrastructure projects are anticipated to be particularly lucrative, given the persistent housing shortage and the critical need to upgrade aging infrastructure. While economic fluctuations and potential material cost increases pose challenges, the long-term outlook remains positive, particularly considering ongoing government support for large-scale construction projects. This positive trajectory is further supported by the consistent 5% Compound Annual Growth Rate (CAGR) projected through 2033.

The market's segmentation across residential, commercial, industrial, infrastructure, and energy & utilities sectors reveals varied growth potential. Residential construction will likely dominate due to population growth and urbanization, while infrastructure development will experience significant expansion due to governmental investment. Key players like Sigdo Koppers, Echeverria Izquierdo, Mota-Engil, and others are strategically positioned to capitalize on these opportunities. However, companies must navigate regional economic variations and ensure effective risk management to successfully navigate the market. Competition is expected to remain intense, pushing companies to innovate in construction technologies and project management to secure market share and profitability. The success of companies will depend on their capacity to adapt to changing regulations, secure financing, and efficiently manage large-scale projects.

This dynamic report provides an in-depth analysis of the Latin America construction market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a comprehensive study period spanning 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, trends, and future projections. Leveraging extensive data and expert analysis, this report is your key to understanding the complexities and opportunities within this dynamic market.

Latin America Construction Market Structure & Competitive Landscape

This section delves into the competitive dynamics of the Latin American construction market, analyzing market concentration, innovation drivers, regulatory influences, and M&A trends. The report utilizes a combination of quantitative data (e.g., concentration ratios, M&A volumes) and qualitative insights to paint a comprehensive picture. We examine the influence of key players like Sigdo Koppers, Echeverria Izquierdo, Mota-Engil, Carso Infraestructura y Construcción, Besalco, Techint Ingeniería y construcción, MRV Engenharia, Aenza (Graña y Montero), Sacyr, and SalfaCorp, noting that this list is not exhaustive. The analysis considers the impact of substitution effects from alternative building materials and the evolving preferences of end-users across various segments. The report quantifies market concentration using appropriate metrics (e.g., CR4, CR8) and assesses the frequency and impact of mergers and acquisitions, offering a detailed perspective on how these activities shape the competitive landscape. The influence of regulatory frameworks across different Latin American countries on market structure is also analyzed, highlighting potential barriers to entry and the strategic implications for market participants. The report further explores the innovation drivers within the industry and the role they play in shaping the competitive dynamics.

Latin America Construction Market Market Trends & Opportunities

This section provides a detailed examination of market size growth, technological advancements, shifting consumer preferences, and competitive dynamics within the Latin American construction sector. The analysis is supported by robust quantitative metrics, including compound annual growth rates (CAGR) and market penetration rates for key segments. This comprehensive overview explores emerging trends such as the increasing adoption of sustainable building practices, the integration of Building Information Modeling (BIM), and the growing demand for prefabricated construction methods. The report analyzes the impact of these trends on market growth and identifies key opportunities for businesses to capitalize on this evolving landscape. Detailed forecasts are provided across all major segments, offering valuable guidance for strategic planning and investment decisions. The analysis also takes into account macroeconomic factors, such as economic growth rates in individual countries, and their influence on the construction market's trajectory. We forecast a total market value of xx Million for 2025, with an estimated CAGR of xx% between 2025 and 2033.

Dominant Markets & Segments in Latin America Construction Market

This section identifies the leading regions, countries, and segments within the Latin American construction market based on residential, commercial, industrial, infrastructure, energy and utilities sectors. The analysis leverages a mixed-methods approach, using both quantitative data and qualitative insights to pinpoint the factors driving market dominance.

- Key Growth Drivers: The report identifies and analyzes key growth drivers for each dominant segment, including but not limited to:

- Robust infrastructure development programs.

- Government policies and incentives promoting construction activity.

- Rapid urbanization and population growth.

- Increasing demand for affordable housing.

The dominant market segment analysis will include a detailed explanation of why particular segments, regions, and countries are outperforming others, considering factors such as economic growth, infrastructure investment, government policy, and technological advancements. Quantitative data, such as market share and growth rates, will be used to support these findings. We estimate that the xx segment will dominate the market with a xx% market share in 2025.

Latin America Construction Market Product Analysis

This section offers a concise summary of product innovations, applications, and competitive advantages within the Latin American construction market. The focus is on technological advancements and their impact on market fit. The analysis examines new materials, construction techniques, and technologies that are gaining traction, highlighting their key features, benefits, and potential market disruption. The report will also assess the competitive landscape of products, focusing on factors such as cost-effectiveness, durability, and sustainability.

Key Drivers, Barriers & Challenges in Latin America Construction Market

Key Drivers: The Latin American construction market is propelled by several key factors: robust infrastructure development initiatives across many nations; government incentives and policies aimed at stimulating construction; rapid urbanization and population growth fueling demand for residential and commercial space; and the increasing adoption of sustainable building practices.

Challenges and Restraints: Significant challenges exist, including supply chain disruptions impacting material availability and costs (estimated impact of xx Million in 2024); regulatory complexities and bureaucratic hurdles delaying projects; and intense competition among established players and new entrants. These challenges significantly affect project timelines and budgets.

Growth Drivers in the Latin America Construction Market Market

Growth in the Latin American construction market is driven by factors including significant government investment in infrastructure projects, rapid urbanization and population growth increasing demand for housing and commercial spaces, and a growing adoption of sustainable and innovative building technologies.

Challenges Impacting Latin America Construction Market Growth

Challenges hindering growth include fluctuating commodity prices impacting construction costs, bureaucratic complexities and lengthy permitting processes, and a shortage of skilled labor in certain regions, causing delays and cost overruns.

Key Players Shaping the Latin America Construction Market Market

- Sigdo Koppers

- Echeverria Izquierdo

- Mota-Engil

- Carso Infraestructura y Construcción

- Besalco

- Techint Ingeniería y construcción

- MRV Engenharia

- Aenza (Graña y Montero)

- Sacyr

- SalfaCorp

Significant Latin America Construction Market Industry Milestones

- May 2023: Holcim acquires PASA®, a leading roofing and waterproofing solutions producer in Mexico and Central America, with pro forma net sales of USD 38 Million. This acquisition expands Holcim’s product portfolio and strengthens its regional presence.

- May 2023: Sika acquires the MBCC Group, a leading global supplier of construction chemicals, creating a combined entity with net sales exceeding USD 13.21 Billion. This merger significantly alters the competitive landscape.

Future Outlook for Latin America Construction Market Market

The Latin American construction market is poised for continued growth, driven by sustained infrastructure investment, ongoing urbanization, and the increasing adoption of innovative construction technologies. Strategic opportunities exist for companies to capitalize on this growth by focusing on sustainable construction practices, leveraging technology to improve efficiency and productivity, and navigating the regulatory landscape effectively. The market's long-term potential is significant, with ongoing expansion anticipated across various segments and geographies.

Latin America Construction Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Commercial

- 1.3. Industrial

- 1.4. Infrastructure

- 1.5. Energy and Utilities

Latin America Construction Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in residential construction driving the market; Development of hospitality infrastructure driving the market

- 3.3. Market Restrains

- 3.3.1. Limited access to financing; Shortage of skilled labor

- 3.4. Market Trends

- 3.4.1. Increase in residential construction driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Industrial

- 5.1.4. Infrastructure

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Sigdo Koppers

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Echeverria Izquierdo*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Mota-Engil

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Carso Infraestructura y Construcci�n

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Besalco

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Techint Ingenier�a y construcci�n

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MRV Engenharia

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Aenza (Gra�a y Montero)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sacyr

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 SalfaCorp

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Sigdo Koppers

List of Figures

- Figure 1: Latin America Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Latin America Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Brazil Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Argentina Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Peru Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Chile Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Latin America Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Latin America Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Latin America Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Brazil Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Chile Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Colombia Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Peru Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Venezuela Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Ecuador Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bolivia Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Paraguay Latin America Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Construction Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Latin America Construction Market?

Key companies in the market include Sigdo Koppers, Echeverria Izquierdo*List Not Exhaustive, Mota-Engil, Carso Infraestructura y Construcci�n, Besalco, Techint Ingenier�a y construcci�n, MRV Engenharia, Aenza (Gra�a y Montero), Sacyr, SalfaCorp.

3. What are the main segments of the Latin America Construction Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 675.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in residential construction driving the market; Development of hospitality infrastructure driving the market.

6. What are the notable trends driving market growth?

Increase in residential construction driving the market.

7. Are there any restraints impacting market growth?

Limited access to financing; Shortage of skilled labor.

8. Can you provide examples of recent developments in the market?

May 2023: Holcim acquires PASA®, a leading roofing and waterproofing solutions producer in Mexico and Central America, with pro forma net sales of USD 38 million. As a leader in innovation, sustainability, and quality, PASA® expands Holcim’s roofing and waterproofing offer and strengthens its regional business footprint. By integrating the existing PASA® distribution network with waterproofing solutions from its GacoFlex product range, Holcim will deliver more customer value with an enhanced supply chain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Construction Market?

To stay informed about further developments, trends, and reports in the Latin America Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence