Key Insights

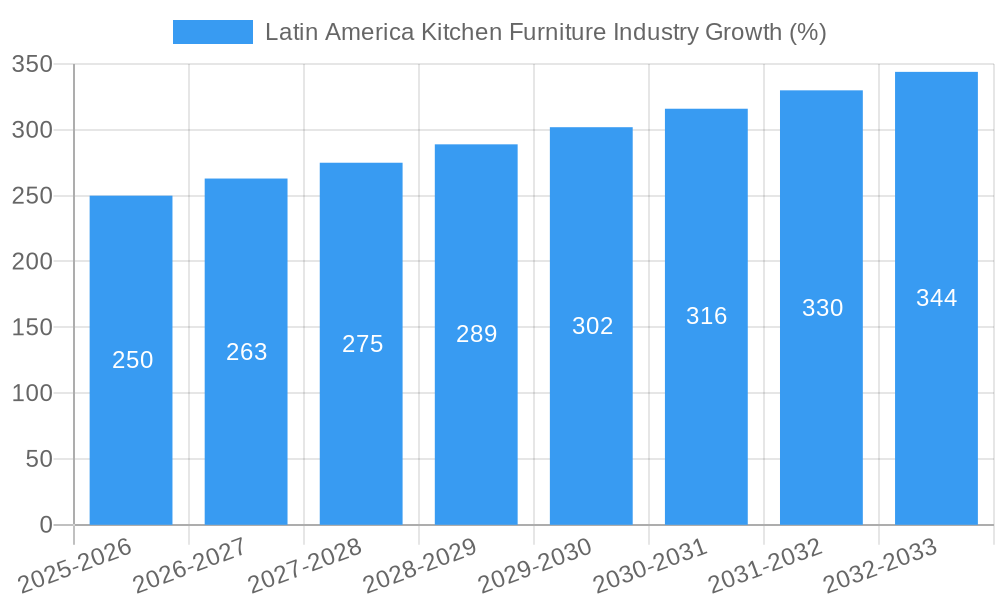

The Latin American kitchen furniture market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for modern, stylish kitchens. The market, estimated at $5 billion in 2025, is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by a burgeoning middle class in major economies like Brazil, Mexico, and Argentina, who are increasingly investing in home improvement projects, including kitchen renovations and new furniture purchases. Furthermore, the influence of Western design trends and the rising adoption of online retail channels are contributing to market expansion. While the historical period (2019-2024) may have witnessed fluctuating growth due to economic uncertainties, the forecast period is expected to exhibit a steadier, positive trajectory, supported by ongoing infrastructural development and a rising demand for durable, high-quality kitchen furniture. Specific segments, such as modular kitchens and customized cabinetry, are anticipated to witness particularly strong growth, reflecting consumer preferences for flexibility and personalized design solutions.

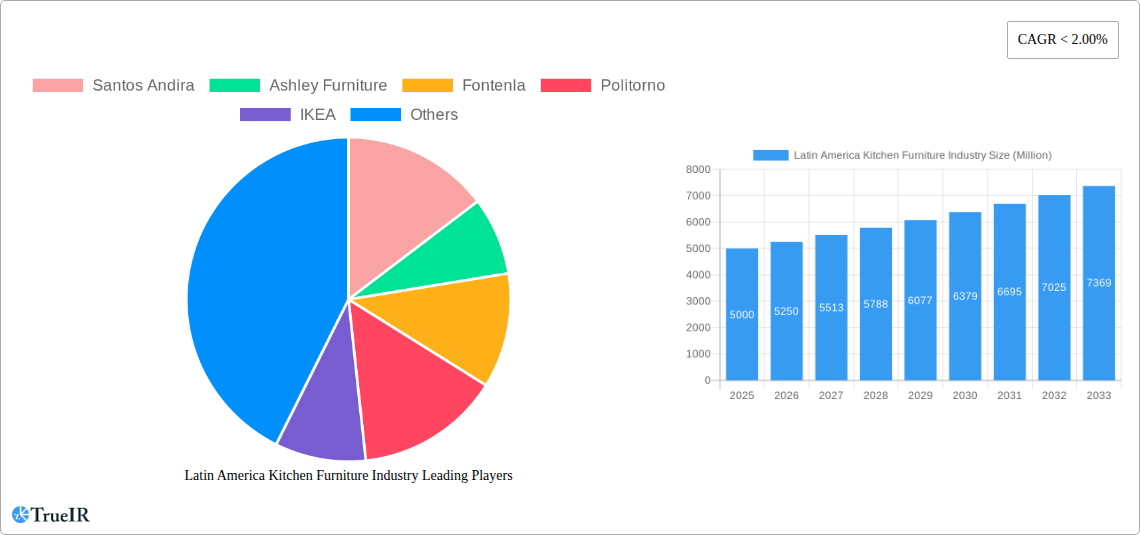

Competition within the market is diverse, ranging from established multinational corporations to local manufacturers. The competitive landscape is characterized by a blend of established brands leveraging strong distribution networks and smaller, agile players focused on niche markets or specific design aesthetics. Strategies for success include offering competitive pricing, focusing on superior product quality, providing excellent customer service, and leveraging digital marketing effectively to reach a wider customer base. The market presents significant opportunities for both domestic and international players, particularly those who can adapt to local consumer preferences and effectively navigate the complexities of regional supply chains. The market is expected to show a compound annual growth rate (CAGR) above 5% during the forecast period, driven primarily by the factors outlined above.

Latin America Kitchen Furniture Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America kitchen furniture industry, covering market size, trends, competitive landscape, and future outlook from 2019 to 2033. The study utilizes data from the historical period (2019-2024), the base year (2025), and projects to the estimated year (2025) and forecast period (2025-2033). Key players such as Santos Andira, Ashley Furniture, Fontenla, Politorno, IKEA, LineaBrasil, Techni Mobili, Dalla Costa, and Arteqiri are analyzed across various segments, including kitchen cabinets, chairs, tables, and other furniture, for both residential and commercial end-users. Distribution channels examined include hypermarkets/supermarkets, specialty stores, and e-commerce. This report is crucial for businesses, investors, and stakeholders seeking to navigate this dynamic market.

Latin America Kitchen Furniture Industry Market Structure & Competitive Landscape

The Latin American kitchen furniture market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a xx level of concentration. Innovation is driven by increasing consumer demand for stylish, functional, and sustainable kitchen furniture. Regulatory impacts, such as import tariffs and environmental regulations, vary across countries and influence pricing and product design. Product substitutes, including modular kitchen systems and ready-to-assemble furniture, exert competitive pressure. The market is segmented into residential and commercial end-users, with the residential segment dominating. M&A activity has been relatively low in recent years (xx deals in the past 5 years with a total value of $xx Million), but the industry is witnessing increased consolidation, especially among retailers adapting to e-commerce.

- Market Concentration: HHI estimated at xx in 2025.

- Innovation Drivers: Consumer demand for sustainable and stylish designs.

- Regulatory Impacts: Varying import tariffs and environmental regulations.

- Product Substitutes: Modular systems and ready-to-assemble furniture.

- End-User Segmentation: Dominance of the residential segment.

- M&A Activity: xx deals in the past 5 years totaling $xx Million.

Latin America Kitchen Furniture Industry Market Trends & Opportunities

The Latin American kitchen furniture market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Market size is estimated at $xx Million in 2025 and is expected to reach $xx Million by 2033. This growth is fueled by rising disposable incomes, urbanization, and a growing preference for modern kitchen designs. Technological advancements such as 3D printing and smart kitchen solutions are creating new opportunities. Consumer preferences are shifting towards customizable, eco-friendly furniture. Competitive dynamics are shaped by the entry of international brands and the increasing adoption of e-commerce. Market penetration rates for e-commerce are growing rapidly, especially among younger demographics. Increasing focus on eco-friendly products and customization are key trends driving market growth. Government initiatives supporting the furniture industry are also expected to contribute to the overall growth in the coming years.

Dominant Markets & Segments in Latin America Kitchen Furniture Industry

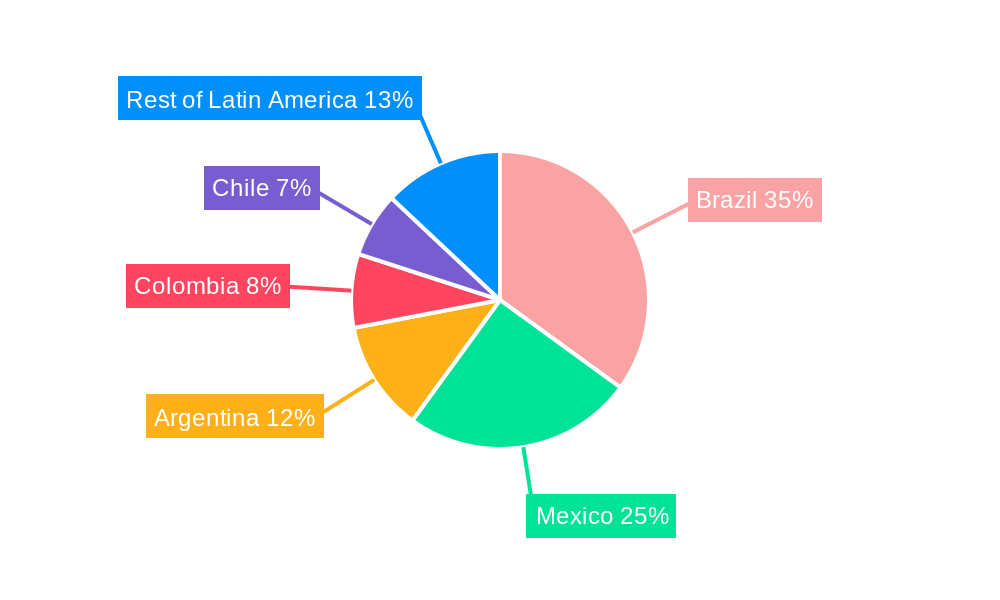

Brazil and Mexico are the dominant markets within Latin America, accounting for approximately xx% of the total market value in 2025. The kitchen cabinet segment holds the largest market share among product types, followed by kitchen tables and chairs. The residential segment dominates the end-user market. Hypermarkets/supermarkets are the leading distribution channel.

- Key Growth Drivers (Brazil): Expanding middle class, robust construction activity.

- Key Growth Drivers (Mexico): Rising disposable incomes, increasing urbanization.

- Dominant Product Segment: Kitchen Cabinets.

- Dominant End-User Segment: Residential.

- Dominant Distribution Channel: Hypermarkets/Supermarkets.

Latin America Kitchen Furniture Industry Product Analysis

The Latin American kitchen furniture market is witnessing innovations in materials, designs, and functionality. Sustainable materials like bamboo and recycled wood are gaining popularity. Smart kitchen features, such as integrated storage and lighting, are being incorporated into high-end products. Manufacturers are focusing on designs that cater to diverse consumer preferences and incorporate ergonomic features. The market favors products that offer a balance of affordability, quality, and style.

Key Drivers, Barriers & Challenges in Latin America Kitchen Furniture Industry

Key Drivers: Rising disposable incomes, urbanization, technological advancements in design and manufacturing, government initiatives promoting the furniture industry, and growing e-commerce adoption.

Challenges: Fluctuating raw material prices, import tariffs, competition from cheaper imports, supply chain disruptions, and the need for skilled labor. These challenges have a quantifiable impact, potentially reducing market growth by xx% annually if not addressed effectively.

Growth Drivers in the Latin America Kitchen Furniture Industry Market

Growth is primarily driven by increasing disposable incomes, particularly in urban areas. Technological advancements, such as smart kitchen solutions, are enhancing product appeal. Government incentives and infrastructure development also contribute to market expansion.

Challenges Impacting Latin America Kitchen Furniture Industry Growth

Significant challenges include supply chain disruptions due to global events, leading to increased material costs. Regulatory hurdles related to environmental standards and import/export regulations also create complexity. Intense competition from both domestic and international players adds pressure on pricing and profitability.

Key Players Shaping the Latin America Kitchen Furniture Industry Market

- Santos Andira

- Ashley Furniture

- Fontenla

- Politorno

- IKEA

- LineaBrasil

- Techni Mobili

- Dalla Costa

- Arteqiri

Significant Latin America Kitchen Furniture Industry Industry Milestones

- 2021: Santos Andira pioneers online sales, demonstrating the growing importance of e-commerce in the sector. This successful transition marked a significant turning point for the company and the broader market by showing the feasibility and efficacy of online sales even for established brick-and-mortar players.

Future Outlook for Latin America Kitchen Furniture Industry Market

The Latin American kitchen furniture market is poised for continued growth, driven by increasing urbanization, rising disposable incomes, and ongoing technological advancements. Strategic opportunities exist in developing sustainable and customized products, leveraging e-commerce channels, and expanding into underserved markets. The market's potential remains significant, presenting attractive prospects for established and new players alike.

Latin America Kitchen Furniture Industry Segmentation

-

1. Product Type

- 1.1. Kitchen Cabinet

- 1.2. Kitchen Chair

- 1.3. Kitchen Table

- 1.4. Others

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Hypermarkets/ Supermarkets

- 3.2. Specialty Stores

- 3.3. e-Commerce

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. Brazil

- 4.2. Peru

- 4.3. Columbia

- 4.4. Rest Latin America

Latin America Kitchen Furniture Industry Segmentation By Geography

- 1. Brazil

- 2. Peru

- 3. Columbia

- 4. Rest Latin America

Latin America Kitchen Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Eco-Friendly Material in Nature is Driving the Market; Increasing Construction and Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. Shorter Life Span is a Restraining Factor the Market

- 3.4. Market Trends

- 3.4.1. Growing Wood Furniture Exports from Brazil is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Kitchen Cabinet

- 5.1.2. Kitchen Chair

- 5.1.3. Kitchen Table

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hypermarkets/ Supermarkets

- 5.3.2. Specialty Stores

- 5.3.3. e-Commerce

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Peru

- 5.4.3. Columbia

- 5.4.4. Rest Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Peru

- 5.5.3. Columbia

- 5.5.4. Rest Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Kitchen Cabinet

- 6.1.2. Kitchen Chair

- 6.1.3. Kitchen Table

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hypermarkets/ Supermarkets

- 6.3.2. Specialty Stores

- 6.3.3. e-Commerce

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Peru

- 6.4.3. Columbia

- 6.4.4. Rest Latin America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Peru Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Kitchen Cabinet

- 7.1.2. Kitchen Chair

- 7.1.3. Kitchen Table

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hypermarkets/ Supermarkets

- 7.3.2. Specialty Stores

- 7.3.3. e-Commerce

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Peru

- 7.4.3. Columbia

- 7.4.4. Rest Latin America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Columbia Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Kitchen Cabinet

- 8.1.2. Kitchen Chair

- 8.1.3. Kitchen Table

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hypermarkets/ Supermarkets

- 8.3.2. Specialty Stores

- 8.3.3. e-Commerce

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Peru

- 8.4.3. Columbia

- 8.4.4. Rest Latin America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest Latin America Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Kitchen Cabinet

- 9.1.2. Kitchen Chair

- 9.1.3. Kitchen Table

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hypermarkets/ Supermarkets

- 9.3.2. Specialty Stores

- 9.3.3. e-Commerce

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Peru

- 9.4.3. Columbia

- 9.4.4. Rest Latin America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Brazil Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 11. Argentina Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 12. Mexico Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 13. Peru Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 14. Chile Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Latin America Latin America Kitchen Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Santos Andira

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Ashley Furniture

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Fontenla

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Politorno

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 IKEA

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 LineaBrasil

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Techni Mobili

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Dalla Costa

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Arteqiri

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Santos Andira

List of Figures

- Figure 1: Latin America Kitchen Furniture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Kitchen Furniture Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: Latin America Kitchen Furniture Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 7: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Kitchen Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Brazil Latin America Kitchen Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Argentina Latin America Kitchen Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America Kitchen Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Kitchen Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Latin America Kitchen Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Peru Latin America Kitchen Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Kitchen Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America Kitchen Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Chile Latin America Kitchen Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Latin America Latin America Kitchen Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Latin America Latin America Kitchen Furniture Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 28: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 29: Latin America Kitchen Furniture Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 33: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 39: Latin America Kitchen Furniture Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 40: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 41: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 42: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 43: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 45: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 47: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 48: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 49: Latin America Kitchen Furniture Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 50: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 51: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 53: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 55: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 57: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 58: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 59: Latin America Kitchen Furniture Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 60: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by End User 2019 & 2032

- Table 61: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 62: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 63: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 64: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 65: Latin America Kitchen Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Latin America Kitchen Furniture Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Kitchen Furniture Industry?

The projected CAGR is approximately < 2.00%.

2. Which companies are prominent players in the Latin America Kitchen Furniture Industry?

Key companies in the market include Santos Andira, Ashley Furniture, Fontenla, Politorno, IKEA, LineaBrasil, Techni Mobili, Dalla Costa, Arteqiri.

3. What are the main segments of the Latin America Kitchen Furniture Industry?

The market segments include Product Type, End User, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Eco-Friendly Material in Nature is Driving the Market; Increasing Construction and Infrastructure Development.

6. What are the notable trends driving market growth?

Growing Wood Furniture Exports from Brazil is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Shorter Life Span is a Restraining Factor the Market.

8. Can you provide examples of recent developments in the market?

In 2021, the Santos Andira Furniture brand made a first-time purchase online platform out of hundreds of Brazilian companies, as a result of the pandemic, a vital new market for the country's biggest retailers. Stores are adapting their strategies - and pursuing merger and acquisition (M&A) to help smooth the transition to internet shopping for inexperienced customers. In four months, Santos made five more online purchases with Via Varejo salesmen's help, generating commissions for the store's agents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Kitchen Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Kitchen Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Kitchen Furniture Industry?

To stay informed about further developments, trends, and reports in the Latin America Kitchen Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence