Key Insights

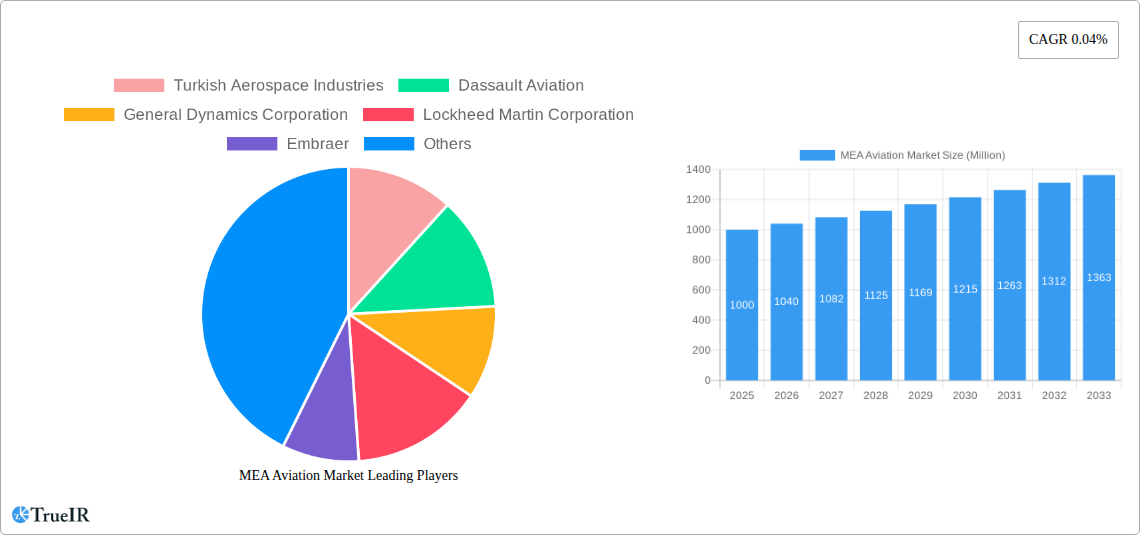

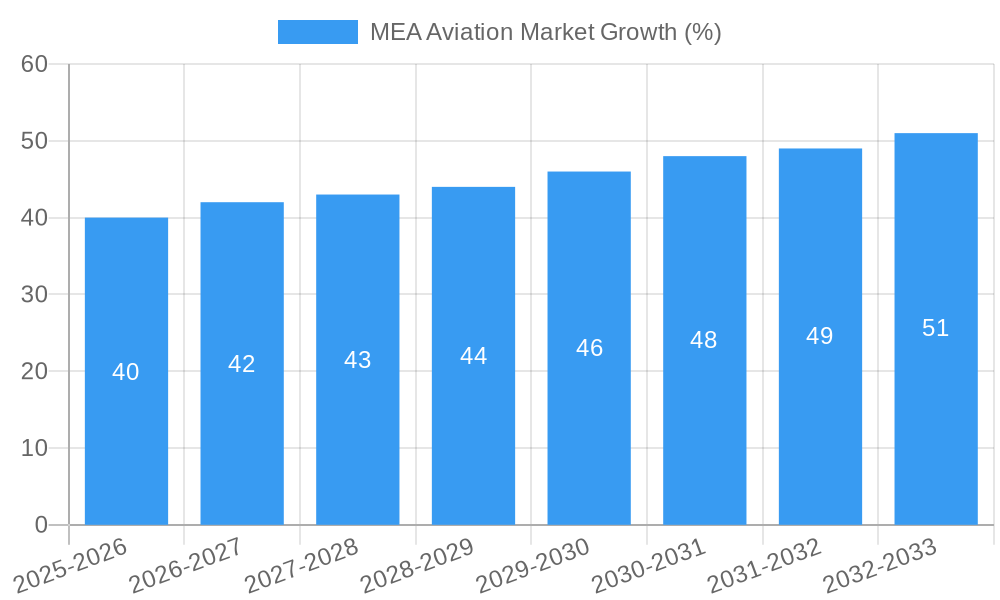

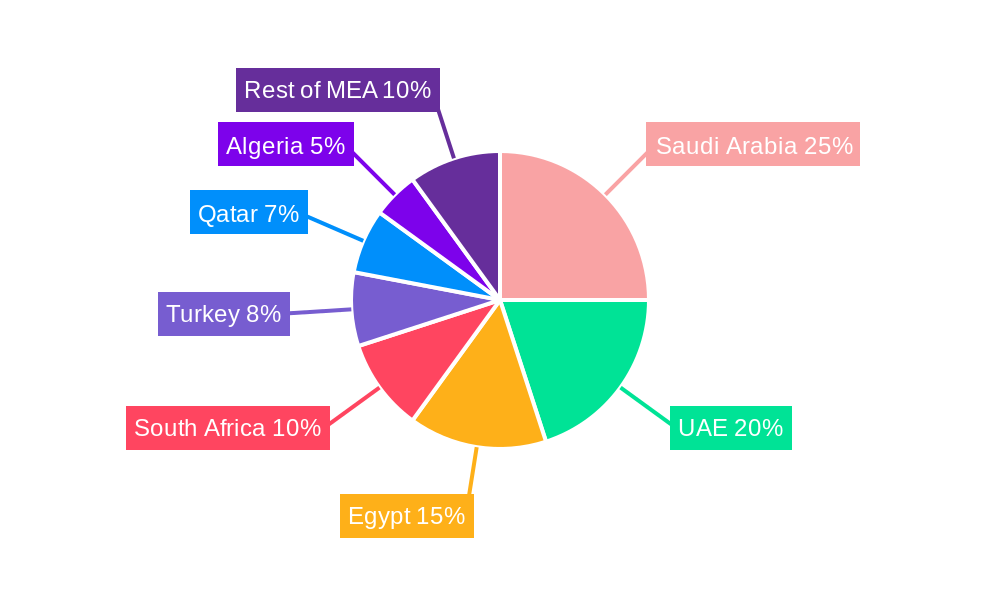

The Middle East and Africa (MEA) aviation market, valued at approximately $XX million in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 4%. This growth is fueled by several key factors. Increasing air passenger traffic, driven by economic development and tourism across the region, particularly in countries like Saudi Arabia, the UAE, and Egypt, is a significant driver. Furthermore, governmental investments in infrastructure development, including airport expansions and upgrades, are creating a more supportive environment for aviation growth. The burgeoning e-commerce sector also contributes, increasing the demand for air freight services. However, the market faces challenges such as fluctuating oil prices, which impact operational costs for airlines, and geopolitical instability in certain regions, potentially disrupting air travel. The market is segmented by aircraft type (commercial aviation being the dominant segment), country (with Saudi Arabia, UAE, and Egypt representing significant shares), and other factors influencing market dynamics.

The competitive landscape is shaped by a mix of global and regional players, including Boeing, Airbus, Lockheed Martin, and Turkish Aerospace Industries. These companies are vying for market share through advancements in aircraft technology, such as fuel-efficient designs and enhanced safety features, and through strategic partnerships with regional airlines. The forecast period (2025-2033) suggests continued expansion, with potential acceleration in growth depending on regional economic conditions and successful implementation of infrastructure projects. The market's future performance will heavily depend on the ability of stakeholders to manage economic risks, navigate geopolitical uncertainties, and adapt to evolving technological advancements within the aviation industry. The continued expansion of low-cost carriers and the increasing adoption of sustainable aviation practices are also set to shape future market trends.

MEA Aviation Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Middle East and Africa (MEA) aviation market, offering invaluable insights for industry professionals, investors, and stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, growth drivers, challenges, and future outlook. The report leverages high-volume keywords to ensure optimal search engine visibility and engagement.

MEA Aviation Market Market Structure & Competitive Landscape

The MEA aviation market exhibits a moderately concentrated structure, with key players like The Boeing Company, Airbus SE, and Embraer holding significant market share. However, the presence of regional players such as Turkish Aerospace Industries and others contributes to a dynamic competitive landscape. The market's concentration ratio (CR4) is estimated at xx%, indicating a moderate level of market dominance.

Innovation Drivers: Technological advancements in aircraft manufacturing, sustainable aviation fuels, and air traffic management systems are driving significant market growth.

Regulatory Impacts: Stringent safety regulations and evolving airworthiness standards influence operational costs and investment decisions. Varying regulatory frameworks across MEA nations also pose a challenge for market participants.

Product Substitutes: The lack of readily available substitutes for air travel within the MEA region limits substitutability. High-speed rail projects in certain areas are emerging as partial alternatives for shorter distances.

End-User Segmentation: The market comprises commercial aviation and other segments (e.g., general aviation, military aviation). Commercial aviation currently dominates the market, accounting for approximately xx% of the total market value.

M&A Trends: The MEA aviation sector has witnessed xx M&A deals in the historical period (2019-2024), with a focus on consolidation among regional players and strategic partnerships with international giants. This trend is expected to continue during the forecast period (2025-2033), driven by synergies and expansion strategies.

MEA Aviation Market Market Trends & Opportunities

The MEA aviation market is experiencing robust growth, with an estimated market size of USD xx Million in 2025. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching USD xx Million by 2033. This growth is fuelled by several factors: rising disposable incomes, increasing tourism, expanding business travel, and substantial investments in airport infrastructure across the region.

Technological shifts towards more fuel-efficient aircraft, advanced air traffic management systems, and the adoption of sustainable aviation fuels are creating significant opportunities for market players. Consumer preferences are shifting towards enhanced passenger experiences, including in-flight connectivity and personalized services. Furthermore, the competitive dynamics are shaping the market through price wars and service differentiation strategies amongst the key players. Market penetration rates for new technologies and services vary significantly across the region, depending on the level of economic development and regulatory support.

Dominant Markets & Segments in MEA Aviation Market

Leading Regions/Countries: The United Arab Emirates (UAE), Saudi Arabia, and Turkey currently dominate the MEA aviation market, driven by robust economic growth, significant investments in infrastructure, and supportive government policies.

Key Growth Drivers:

- Robust Economic Growth: The UAE, Saudi Arabia, and Turkey are experiencing strong economic growth, leading to increased demand for air travel.

- Tourism Expansion: These countries are actively promoting tourism, leading to higher passenger numbers.

- Infrastructure Development: Substantial investments in airport infrastructure are enhancing operational efficiency and passenger handling capacity.

- Government Support: Supportive government policies and initiatives are fostering the growth of the aviation sector.

Aircraft Type: The commercial aviation segment constitutes the largest portion of the MEA aviation market. This segment is propelled by the rising demand for air travel and the growth of low-cost carriers.

MEA Aviation Market Product Analysis

The MEA aviation market showcases a range of aircraft, from regional jets to wide-body airliners. Technological advancements focus on fuel efficiency, reduced emissions, and enhanced passenger comfort. Competition is fierce, with manufacturers striving for differentiation through technological superiority, superior operational efficiency, and after-sales service. The market fit for new products depends heavily on operational requirements, regulatory compliance, and economic considerations.

Key Drivers, Barriers & Challenges in MEA Aviation Market

Key Drivers:

- Economic Growth: Rising disposable incomes and expanding tourism are key drivers.

- Infrastructure Development: Investments in new airports and upgrades to existing ones are boosting capacity.

- Government Initiatives: Supportive policies and initiatives are facilitating market expansion.

- Technological Advancements: Fuel-efficient aircraft and advanced technologies are creating cost efficiencies.

Challenges & Restraints:

Geopolitical instability in some parts of the region is a major challenge, leading to uncertainty and impacting air travel demand. Furthermore, fuel price volatility significantly impacts operational costs. Supply chain disruptions, exacerbated by global events, create delays and cost overruns. Stringent regulatory requirements and bureaucratic processes can add complexities to operations. Finally, intense competition amongst established and emerging players limits profitability margins.

Growth Drivers in the MEA Aviation Market Market

The MEA aviation market’s growth is propelled by several factors, including rising disposable incomes across the region, a boom in tourism and business travel, and significant infrastructure investments in airports and air traffic management systems. Furthermore, supportive government policies and initiatives aimed at boosting the aviation sector, coupled with advancements in aircraft technology focusing on fuel efficiency and sustainability, are contributing to market expansion.

Challenges Impacting MEA Aviation Market Growth

Challenges facing the MEA aviation market include geopolitical instability, fluctuating oil prices, and supply chain disruptions that affect aircraft deliveries and maintenance. Additionally, stringent regulations, varying across different countries in the region, can complicate operations and increase compliance costs. Intense competition between established airlines and new entrants puts downward pressure on prices.

Key Players Shaping the MEA Aviation Market Market

- Turkish Aerospace Industries

- Dassault Aviation

- General Dynamics Corporation

- Lockheed Martin Corporation

- Embraer

- Airbus SE

- United Aircraft Corporation

- Pilatus Aircraft Ltd

- Leonardo S.p.A

- The Boeing Company

Significant MEA Aviation Market Industry Milestones

- July 2022: EmbraerX established a presence in the Netherlands, focusing on innovative and sustainable aviation technology. This highlights a growing focus on sustainability within the industry.

- July 2022: Alaska Air Group's order of eight new E175 planes from Embraer signifies continued demand for regional aircraft.

- August 2022: Boeing's USD 5 Million investment in a St. Louis facility for advanced manufacturing innovation underscores the commitment to technological advancement within the sector.

Future Outlook for MEA Aviation Market Market

The MEA aviation market presents significant growth opportunities driven by sustained economic expansion, tourism growth, and continued investments in infrastructure. Strategic partnerships and technological innovation will be crucial for players to navigate the competitive landscape and capitalize on emerging market segments. The focus on sustainability and the adoption of greener technologies will further shape the market's future trajectory. The market is poised for substantial growth, driven by a confluence of factors outlined within this report.

MEA Aviation Market Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

MEA Aviation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Aviation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Aviation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America MEA Aviation Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America MEA Aviation Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe MEA Aviation Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa MEA Aviation Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific MEA Aviation Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Turkish Aerospace Industries

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dassault Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Embraer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Airbus SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 United Aircraft Corporatio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pilatus Aircraft Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Leonardo S p A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Boeing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Turkish Aerospace Industries

List of Figures

- Figure 1: Global MEA Aviation Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America MEA Aviation Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 3: North America MEA Aviation Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 4: North America MEA Aviation Market Revenue (Million), by Country 2024 & 2032

- Figure 5: North America MEA Aviation Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: South America MEA Aviation Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 7: South America MEA Aviation Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 8: South America MEA Aviation Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America MEA Aviation Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe MEA Aviation Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 11: Europe MEA Aviation Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 12: Europe MEA Aviation Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe MEA Aviation Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Middle East & Africa MEA Aviation Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 15: Middle East & Africa MEA Aviation Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 16: Middle East & Africa MEA Aviation Market Revenue (Million), by Country 2024 & 2032

- Figure 17: Middle East & Africa MEA Aviation Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific MEA Aviation Market Revenue (Million), by Aircraft Type 2024 & 2032

- Figure 19: Asia Pacific MEA Aviation Market Revenue Share (%), by Aircraft Type 2024 & 2032

- Figure 20: Asia Pacific MEA Aviation Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific MEA Aviation Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global MEA Aviation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global MEA Aviation Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 3: Global MEA Aviation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global MEA Aviation Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 5: Global MEA Aviation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global MEA Aviation Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 10: Global MEA Aviation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Brazil MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Argentina MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of South America MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global MEA Aviation Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 15: Global MEA Aviation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Russia MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Benelux MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Nordics MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global MEA Aviation Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 26: Global MEA Aviation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Turkey MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Israel MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: GCC MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: North Africa MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: South Africa MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East & Africa MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global MEA Aviation Market Revenue Million Forecast, by Aircraft Type 2019 & 2032

- Table 34: Global MEA Aviation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: China MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: India MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Japan MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: South Korea MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: ASEAN MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Oceania MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Asia Pacific MEA Aviation Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Aviation Market?

The projected CAGR is approximately 0.04%.

2. Which companies are prominent players in the MEA Aviation Market?

Key companies in the market include Turkish Aerospace Industries, Dassault Aviation, General Dynamics Corporation, Lockheed Martin Corporation, Embraer, Airbus SE, United Aircraft Corporatio, Pilatus Aircraft Ltd, Leonardo S p A, The Boeing Company.

3. What are the main segments of the MEA Aviation Market?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022: Boeing invested USD 5 million in a St. Louis facility for advanced manufacturing innovation.July 2022: Alaska Air Group announced plans to expand its regional fleet by ordering eight new E175 planes from Embraer.July 2022: EmbraerX established a presence in the Netherlands to further the development of innovative and sustainable aviation technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Aviation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Aviation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Aviation Market?

To stay informed about further developments, trends, and reports in the MEA Aviation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence