Key Insights

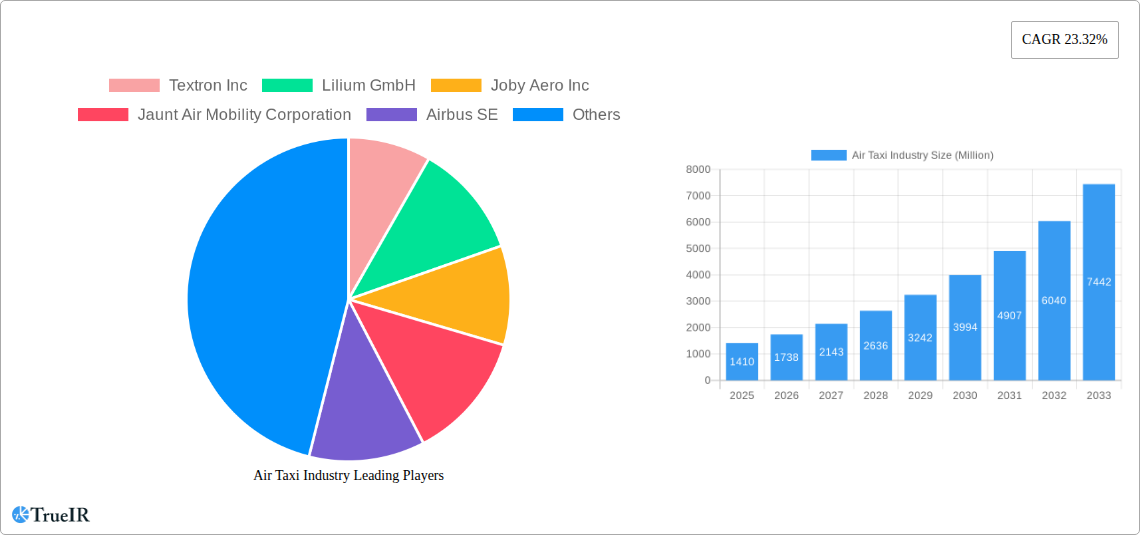

The air taxi industry is poised for explosive growth, projected to reach a market size of $1.41 billion in 2025 and experience a remarkable Compound Annual Growth Rate (CAGR) of 23.32% from 2025 to 2033. This rapid expansion is fueled by several key drivers. Increasing urbanization and traffic congestion in major metropolitan areas are creating a compelling demand for faster, more efficient urban transportation solutions. Technological advancements in electric vertical takeoff and landing (eVTOL) aircraft, coupled with the development of sophisticated autonomous flight systems, are making air taxis a viable and increasingly attractive alternative to traditional ground transportation. Furthermore, growing investments from both established aerospace companies like Boeing and Textron and innovative startups like Lilium and Joby Aero are accelerating the industry's maturation and infrastructure development. The market is segmented primarily by mode of operation, with piloted and autonomous air taxis representing distinct but interconnected market segments. Initially, piloted vehicles will likely dominate, paving the way for the eventual wider adoption of fully autonomous systems. Regulatory hurdles and safety concerns remain significant challenges, but ongoing collaborations between industry players and regulatory bodies are actively addressing these issues.

Air Taxi Industry Market Size (In Billion)

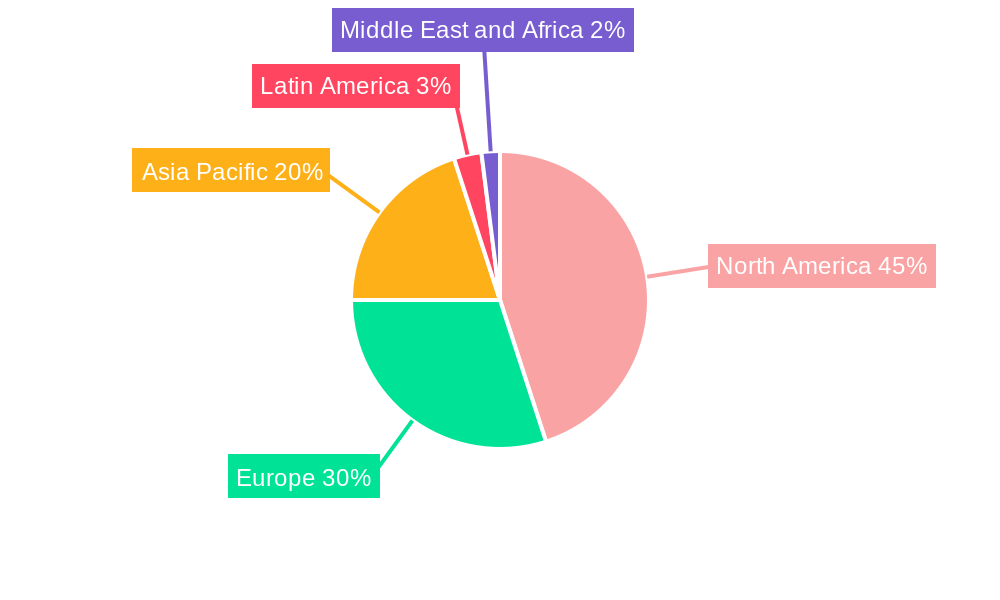

The geographical distribution of the market is expected to be heavily influenced by the early adoption in developed regions. North America, particularly the United States, and Europe are anticipated to lead the market initially due to existing robust infrastructure and supportive regulatory environments. However, rapid technological advancements and increasing disposable incomes in regions like Asia-Pacific (particularly China and India) are projected to drive substantial growth in these markets in the later forecast period. The successful integration of air taxi services will depend critically on the development of efficient and scalable air traffic management systems, along with the creation of dedicated vertiports and appropriate safety regulations. The next decade will witness a crucial transition, as the industry moves from demonstration projects and pilot programs towards widespread commercial deployment and integration into existing transportation networks. Competitive dynamics will intensify as established players and new entrants vie for market share, creating a dynamic and evolving market landscape.

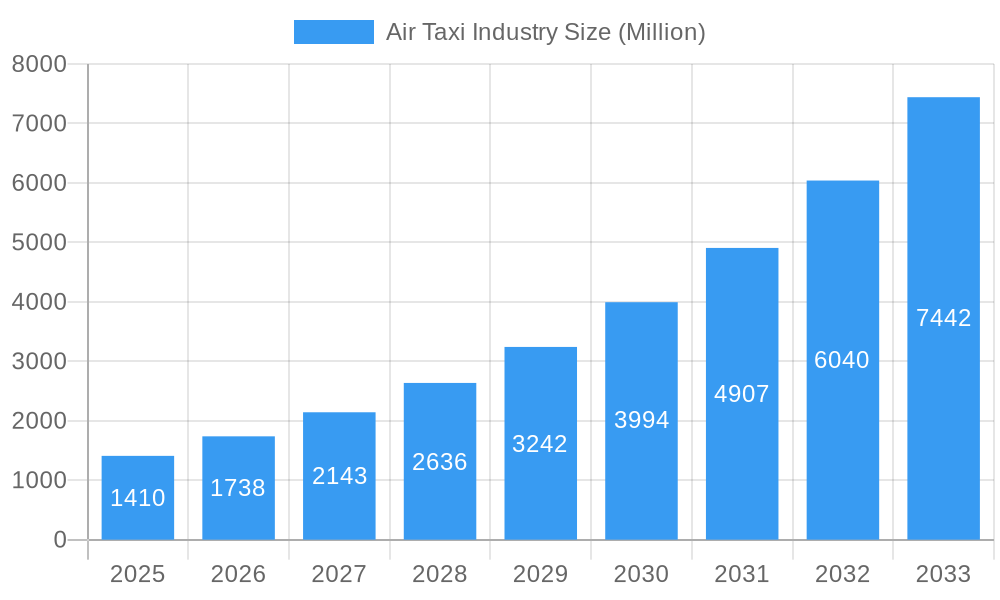

Air Taxi Industry Company Market Share

Air Taxi Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic air taxi industry, projecting a market valuation of $XXX Million by 2033. Leveraging extensive research covering the period 2019-2033 (base year 2025, estimated year 2025, forecast period 2025-2033), this report offers invaluable insights for investors, industry stakeholders, and strategic decision-makers. The report analyzes key market segments, competitive landscapes, and future trends, incorporating data on leading players like Textron Inc, Lilium GmbH, Joby Aero Inc, and more.

Air Taxi Industry Market Structure & Competitive Landscape

The air taxi market is characterized by intense competition among established aerospace giants and innovative startups. Market concentration is currently low, with no single dominant player, reflecting a fragmented landscape. However, consolidation is anticipated through mergers and acquisitions (M&A). The historical period (2019-2024) witnessed approximately $XX Million in M&A activity, with a projected increase to $XXX Million during the forecast period (2025-2033). Innovation, primarily driven by advancements in electric vertical takeoff and landing (eVTOL) technology and autonomous flight systems, is a key competitive differentiator. Regulatory frameworks, varying significantly across jurisdictions, pose a significant challenge and influence market structure. Product substitutes, such as traditional helicopters and ride-sharing services, present indirect competition. The end-user segmentation primarily comprises affluent individuals, businesses seeking efficient transportation solutions, and potentially, public transport systems in the future.

- Market Concentration: Low (currently); expected to increase slightly by 2033.

- Innovation Drivers: eVTOL technology, autonomous flight systems, advanced battery technology.

- Regulatory Impacts: Significant; varying regulations across regions impact market entry and operations.

- Product Substitutes: Helicopters, ride-sharing services.

- End-User Segmentation: High-net-worth individuals, businesses, potential integration into public transport.

- M&A Trends: Increasing activity, driven by consolidation and technology acquisition; projected $XXX Million in M&A activity between 2025 and 2033.

Air Taxi Industry Market Trends & Opportunities

The global air taxi market is poised for substantial growth, fueled by technological advancements and increasing demand for faster, more efficient urban transportation. The market size is projected to reach $XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth is driven by several factors, including the development of quieter and more environmentally friendly eVTOL aircraft, falling battery costs, and increasing consumer acceptance of autonomous flight technology. Technological shifts towards fully autonomous operation will significantly impact market dynamics, increasing efficiency and reducing operational costs. Consumer preferences are evolving towards personalized, on-demand air transportation solutions, particularly in congested urban areas. Competitive dynamics are intensifying, with companies vying for market share through technological innovation, strategic partnerships, and aggressive marketing campaigns. Market penetration remains relatively low but is expected to accelerate significantly over the coming decade, driven by successful pilot programs and wider regulatory approvals.

Dominant Markets & Segments in Air Taxi Industry

While the air taxi market is still nascent, initial indications suggest significant growth potential in several regions and segments. Currently, North America and Europe are leading in terms of investment and regulatory progress, driving early market dominance. Within the mode of operation, the piloted segment currently dominates due to safety and regulatory considerations. However, the autonomous segment is anticipated to experience explosive growth in the latter half of the forecast period.

- Key Growth Drivers (Piloted): Well-established aviation infrastructure in North America and Europe, early adoption by businesses and high-net-worth individuals.

- Key Growth Drivers (Autonomous): Technological advancements in autonomous flight systems, potential for reduced operational costs and increased efficiency.

- Market Dominance: North America and Europe currently lead, with Asia-Pacific poised for significant growth in the latter part of the forecast period.

Air Taxi Industry Product Analysis

The air taxi industry is defined by rapid technological advancements in eVTOL aircraft design, manufacturing, and operational systems. Current innovations focus on enhancing safety, efficiency, range, and passenger comfort. Key product differentiators include noise reduction technologies, advanced battery systems, and sophisticated autonomous flight capabilities. The market fit is primarily focused on urban air mobility (UAM) solutions, addressing the challenges of traffic congestion and limited ground transportation options in densely populated areas.

Key Drivers, Barriers & Challenges in Air Taxi Industry

Key Drivers:

- Technological advancements in eVTOL aircraft and autonomous flight systems.

- Increasing demand for faster and more efficient urban transportation.

- Government support and investment in UAM infrastructure.

Challenges & Restraints:

- High initial investment costs associated with aircraft development and infrastructure development. The overall cost is estimated to impact market penetration by XX% in 2025.

- Regulatory hurdles and safety concerns regarding autonomous flight operations. This represents a XX% barrier to market entry for several smaller firms.

- Intense competition among established aerospace companies and emerging startups. The competitive landscape is expected to limit profit margins by XX% over the forecast period.

Growth Drivers in the Air Taxi Industry Market

Technological advancements, specifically in eVTOL aircraft and battery technology, are pivotal growth drivers. Furthermore, government initiatives supporting UAM infrastructure and regulations are accelerating market adoption. Rising demand for faster urban transit and a growing preference for personalized transportation also fuel the market's expansion.

Challenges Impacting Air Taxi Industry Growth

Regulatory hurdles and safety concerns present significant challenges. High initial investment costs and the need for extensive infrastructure development act as barriers to entry. Intense competition further complicates the landscape, impacting profitability and market share.

Key Players Shaping the Air Taxi Industry Market

- Textron Inc

- Lilium GmbH

- Joby Aero Inc

- Jaunt Air Mobility Corporation

- Airbus SE

- Hyundai Motor Company

- Volocopter GmbH

- Wisk Aero LL

- Guangzhou EHang Intelligent Technology Co Ltd

- The Boeing Company

Significant Air Taxi Industry Industry Milestones

- 2020-06: Joby Aero receives FAA G-1 certification for its eVTOL aircraft.

- 2021-10: Lilium completes its first successful flight test of a five-seater eVTOL.

- 2022-03: Volocopter successfully completes a crewed autonomous flight.

- 2023-05: Airbus showcases its CityAirbus NextGen eVTOL prototype.

- (Add further milestones as available)

Future Outlook for Air Taxi Industry Market

The air taxi market is poised for significant growth, driven by continuous technological innovation, supportive government policies, and increasing consumer demand. Strategic partnerships and investments in infrastructure are key to unlocking the market's full potential. The emergence of autonomous flight will be a pivotal driver of market expansion, creating new opportunities and transforming urban transportation. The market is expected to reach $XXX Million by 2033, representing substantial growth and investment opportunities.

Air Taxi Industry Segmentation

-

1. Mode of Operation

- 1.1. Piloted

- 1.2. Autonomous

Air Taxi Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Egypt

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Air Taxi Industry Regional Market Share

Geographic Coverage of Air Taxi Industry

Air Taxi Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Piloted Segment to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.1.1. Piloted

- 5.1.2. Autonomous

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 6. North America Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 6.1.1. Piloted

- 6.1.2. Autonomous

- 6.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 7. Europe Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 7.1.1. Piloted

- 7.1.2. Autonomous

- 7.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 8. Asia Pacific Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 8.1.1. Piloted

- 8.1.2. Autonomous

- 8.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 9. Latin America Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 9.1.1. Piloted

- 9.1.2. Autonomous

- 9.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 10. Middle East and Africa Air Taxi Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 10.1.1. Piloted

- 10.1.2. Autonomous

- 10.1. Market Analysis, Insights and Forecast - by Mode of Operation

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lilium GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Joby Aero Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jaunt Air Mobility Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hyundai Motor Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Volocopter GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wisk Aero LL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Guangzhou EHang Intelligent Technology Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Boeing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Air Taxi Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 3: North America Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 4: North America Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 7: Europe Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 8: Europe Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 11: Asia Pacific Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 12: Asia Pacific Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 15: Latin America Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 16: Latin America Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Air Taxi Industry Revenue (Million), by Mode of Operation 2025 & 2033

- Figure 19: Middle East and Africa Air Taxi Industry Revenue Share (%), by Mode of Operation 2025 & 2033

- Figure 20: Middle East and Africa Air Taxi Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Air Taxi Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 2: Global Air Taxi Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 4: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 8: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 15: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: China Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Australia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 23: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Mexico Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Latin America Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Air Taxi Industry Revenue Million Forecast, by Mode of Operation 2020 & 2033

- Table 28: Global Air Taxi Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Egypt Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Israel Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa Air Taxi Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Taxi Industry?

The projected CAGR is approximately 23.32%.

2. Which companies are prominent players in the Air Taxi Industry?

Key companies in the market include Textron Inc, Lilium GmbH, Joby Aero Inc, Jaunt Air Mobility Corporation, Airbus SE, Hyundai Motor Company, Volocopter GmbH, Wisk Aero LL, Guangzhou EHang Intelligent Technology Co Ltd, The Boeing Company.

3. What are the main segments of the Air Taxi Industry?

The market segments include Mode of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.41 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Piloted Segment to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Taxi Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Taxi Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Taxi Industry?

To stay informed about further developments, trends, and reports in the Air Taxi Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence